FIS Statement: Shortages in the finishes and interiors sector, the what, why, when and how?

Latest update 30th March

The year started with concerns around labour, which endure, but it is the material shortages of 2021 are starting to give way to energy related concerns linked to the escalation of tragic events in Ukraine. Key areas impacting FIS members are steel and plasterboard, with major drywall manufacturers now putting metal on allocation and ceiling grids and screws, fixings and fastenings also impacted.

Globally commodities like copper and iron ore (a key constituent in steel) surged to record highs last year (iron ore prices have more than doubled since the beginning of last year) and Aluminium prices are are up by over 20%. We are also seeing challenges with availability and lead times for bagged cement, polymeric based materials (e.g. insulation, plastics, coatings, sealants and adhesives) and composite and wood based products (e.g. timber, plywood and paper).

Due to continued high demand for plasterboard products and challenges on the consistent availability and supply of some key raw materials, some suppliers are now on allocation and price rises for summer and autumn have been announced.

In this report we look at some of the factors that are causing shortages and how companies need to be preparing/reacting to this challenge. The aim is to keep it refreshed so our members are have a clear picture and can have informed decisions up and down the supply chain.

Demand Related Issues

The impact of higher than anticipated demand in key sectors like housing and the domestic refurbishment sector (fuelled by growing household savings) have exceeded expectation. It notes that this is not simply UK demand, but we operate in an increasingly globalised market. A surge in Chinese consumption is linked to faster than expected recovery from the pandemic fuelling property development and investment in infrastructure and notably by global demand for appliances and electronic goods (many of which are manufactured in China).

A similar picture is true for timber, where demand in the US and China has hoovered up material and, according to the Timber Trade Federation, in the UK DIY and Garden projects in the UK and Brexit has added to pressure on availability. This situation has eased in 2022, but prices remain high.

Production & Energy Related Issues

Price and availability are always a balance of supply and demand and in the case of iron ore, shutdowns in Brazil related to the Brumadinho dam disaster and technical issues with plants in Australia constrained production.

For polymeric materials such as plastics and sealants freak cold weather in 2021 and storms in the US wiped out production of crude oil in February of that year crippled production of derivative products. Whilst the majority of plants were back up and running by the first week of April this created an air bubble in supply that is still working its way through the market.

As we step into 2022 the rapid escalation of events has sent oil and gas prices into a period or rapid inflation which is now feeding through into the price of construction products and logistics. Since 1 April 2021, wholesale gas has risen from a weekly average of 52p/therm to £2.10/therm by the end of January.

Logistical and Freight Challenges

Beyond supply and demand availability has been further compounded by a number of issues related to freight and logistics. At the start of the year, Brexit prompted some suppliers opting to avoid shipping to UK whilst things “ironed out” and a few border related challenges (also linked to COVID). This led to a mismatch in import and export levels (containers going back empty) which pushed up prices.

This situation has eased, but the problem has not gone away. The Suez Canal Queue hasn’t helped exacerbating congestion at global ports and messing up vessel scheduling. As we move into the summer, port congestion and acute shortage of containers have combined with crude oil price spikes (linked to US weather issues) has led to freight rates for both bulk vessels and containers souring to record highs. Speaking to one supplier this week they sited an example that a consignment from the East has seen shipping costs quadruple and the shipping cost is now costing more than the product itself! It is widely reported in the press that the container costs have in some circumstances from £1,800 – £16,000!

A shortage of lorry drivers has also been reported by the CLC with building sites struggling to receive deliveries. The Road Haulage Association are citing Brexit as a key reason for this.

Whilst shipping freight prices have started to ease in 2022, the invasion of Ukraine has pushed up fuel and hence logistic costs.

Political Challenges

The fact that US and China are locked in a trade war isn’t helping either. Trade tensions are potentially leading to stocking to build up resilience and reduce reliance on one another. Anything that restricts or disrupts free flow of material tends to drive prices up. Further problems in the Middle East may also end up having an impact.

Closer to home, the European Parliament has finally ratified the post-Brexit EU-UK trade deal which means we are safe in the knowledge that we will be trading tariff and quota free. This doesn’t mean that Brexit negotiations are in the rear-view mirror as we drive towards the land of milk and honey. Many of the potential issues related to Mutuality of Obligation have been kicked into 2022 when the introduction of the UKCA mark could present a number of new issues related to the applicability of testing and assessment for either UKCA or CE marking. Best case, unless this element of the deal is clarified, it is going to mean increased testing costs for manufacturers, in some cases this may mean that materials and products are not imported or exported from the UK – the additional costs simply don’t justify the returns. We had a fairly stark warning from colleagues in the timber sector this week – it is a global market, if it gets too difficult, it will simply be sold elsewhere.

What does all of this mean?

The long and short of it is inflationary pressure on materials and products, lead times are longer and some materials may be difficult to secure. According CPA and reported in the FT, Timber prices have risen by more than 80 per cent in the past six months, while copper and steel have jumped by 40 per cent, according to the Construction Products Association. Costs of paints and varnishes are also up by 30 per cent, while polymers such as polyethylene and polypropylene have risen 60 per cent and we have seen significant upward pressure on plasterboard.

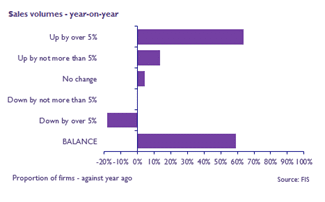

A key concern is that despite inflation in materials and labour and an increasingly healthy pipeline, we are not seeing equivalent inflation in tender prices, which means margins are likely to be squeezed. The latest tender price reports from MACE is showing that current tender price inflation is running at just 1.5% at the moment and expected to rise to a meagre 2.0% next year.

How can I track and report price movements?

There isn’t a great index of specific prices, but you can draw out the main material movements via the Office of National Statistics (next release is summer), note this is lagging and prices are changing fairly rapidly at the moment. It also doesn’t necessarily reflect prices on the ground due to specific grades/distribution buffering etc.

The World Bank commodity price index and London Metals Exchange give a high level picture, but doesn’t get into the detail on products used in the finishes and interiors sector.

The RICS publish the annually the BCIS Material Price Index

Probably the best reference is via the merchant groups, for example :

- CCF publish upcoming (current) prices and have an archive too.

- Encon price changes here

- Galaxy price changes here

- SIG price changes here

For the sake of balance, if you publish a similar index, please don’t hesitate to pop a link over by email or in the chat and we’ll include it here.

When can we expect an end to all of this?

With such a perfect storm of complex and cumulative issues it is difficult to know when we will start to notice improvement or how much worse things may get, but it may take some time with many predicting ongoing problems throughout 2021 and possibly into 2022. The old adage hope for the best, but prepare for the worst comes to mind.

Certainly data from the RICS (published November 2021) construction materials costs in the UK continue to escalate, reaching a 40 year high based on the annual growth of the BCIS Materials Cost Index. According to Joe Martin, BCIS Lead Consultant “The pressure on materials prices and availability is expected to continue at least until the end of 2022. Labour shortages are expected to evolve as the significant driver for overall construction cost increases next year and the construction sector would need to compete for it with other sectors”

How do I need to react?

The advice from the statement CLC shared at the end of this article is spot on. Plan.

Talk to your clients about the challenges in securing material and the importance of early appointment to give you time to prepare.

Be wary of Design Liability: It is also vital to consider the specification, switching elements because you can secure them as an alternative may not necessarily support full certification and warranties as a system, to fulfil programmes. Any change to materials and products installed should be EQUAL AND APPROVED or you may be absorbing risk and design liability. Beyond inadvertent design liability, we are also seeing (for a combination of reasons, not least cost and availability of insurance) pressure on sub-contractors to take on design liability within their contract. Do you fully understand what is the liability and cost of this, does your insurance cover it? We strongly urge you to exercise caution.

Before accepting a contract, make sure you can fulfil it. It is vital to check you can secure the material and at what price, does your supply agreement guarantee a price?

Double Check your Estimates. With pricing erratic, double check your maths – estimations need to be on point and there is literally little margin for error. Make sure you state that the quotation is only valid for a short amount of time, and that it is dependent on material supply (do you need to update statements on estimates, quotes and to issue new advice to your team?). If you are trimming supervision to make the maths work, what could be the risk and cost in terms of quality and safety?

Consider the resilience of your supplier, how long have you worked with them, how well do you know them, how important are you to them, how confident are you they will deliver? There is some support and guidance on this in the FIS Project Risk Assessment Tool.

Consider the resilience of your customer, through the FIS you can get free credit checks. This isn’t a panacea, but we have seen a number of failures in the construction sector and if margins continue to squeeze there will be more. In the wake of the burden of retentions and aggressive tendering meaning profits will be lost and won in variation and change – will you get paid, how much and just how contractual is this job likely to be at that price?

Be realistic. Before signing a contract with potentially onerous delay responsibilities ensure you have checked these carefully are all these risks in your control to manage? If you are already locked into a contract and experiencing delays/inflation then look to your contracts and follow the process – remember it is likely that, regardless of blame and responsibility), you will be obliged to ensure that as soon as it becomes “reasonably apparent” that work is likely to be delayed, notice must be given to the relevant party. If prices are spiralling, talk to your customer, negotiate.

Check for damages. If you are yet to sign, it is well worth ensuring that supply related delays that will in many cases be beyond your control cannot be a factor in determining liquidated damages. Remember force majeure relies on events being unforseeable.

Dust off those fluctuation clauses. Before you sign a contract check the fluctuation clauses too (albeit they typically seem to be scratched out of the standard contracts). If you cannot negotiate a shared risk approach with your client (and we are getting reports that clients are starting to accept fluctuations), you need to seriously consider pricing in risk moving forwards – what could worse case scenario mean to your business if prices drifted?

FIS has updated advice in our Contractual and Legal Toolkit, including advice on fluctuations, managing delays and extensions of time within contracts. It also highlights the role that the RICS developed and CLC endorsed Conflict Avoidance Process and Conflict Avoidance Pledge can play in helping to ensure issues related to shortage and availability doesn’t flair up in unnecessary conflict and exacerbate a difficult situation to a crisis.

Bring your concerns to FIS

If you feel you are being treated unfairly, talk to us, we will do what we can. We can, through our own contacts in the industry, the CLC and contact with the Small Business Commissioners Office and Civil Service shine a light on negative trends and poor behaviour, it can be done anonymously and handled sensitively so as not to damage your relationships.

FIS is urging the supply chain to heed the advice of the Construction Leadership Council and adopt a collaborative approach and ensure that there is ongoing and open communication through the supply chain and we are doing all we can to work together rather than tearing lumps off of each other.

Too often construction get contractual and adopts a siege mentality, parcelling up and firing risk out hoping it sticks elsewhere. The much talked about transformation must start now, rather than pushing risk down the supply chain, we need to be communicating with clients, helping them to understand that these events are beyond the control of individual companies and we need to work together to resolve and manage.

Our supply chain has had an unprecedented and difficult year, we need to nurture it back to health, not return to old and punitive ways that will ultimately drive people out of business to the detriment of all.

Useful links:

FIS Webinar 15th June, Midday – 1pm: Managing your business in a time of shortage – Listen again here

- Materials Supply Report – a detailed BuildUK report on the availability of construction materials (produced in partnership with the Chartered Institute of Purchasing and Supply)

- Latest FIS Trends Survey

- Market Intelligence from the Construction Products Association (if you can’t access, email info@thefis.org and we will arrange for an account to be set up, this service is available to members of FIS)

- Construction Data from the ONS

- FIS Contractual and Legal Toolkit

- Timber Specific information: TTF Statistical Dashboad and Market Statement from the Timber Trade Federation.

- Paint and Coatings Specific information: Market Statement from the British Coatings Federation

- Mineral Products information: Market statement from the Mineral Products Association

- Market Statement from Composites UK

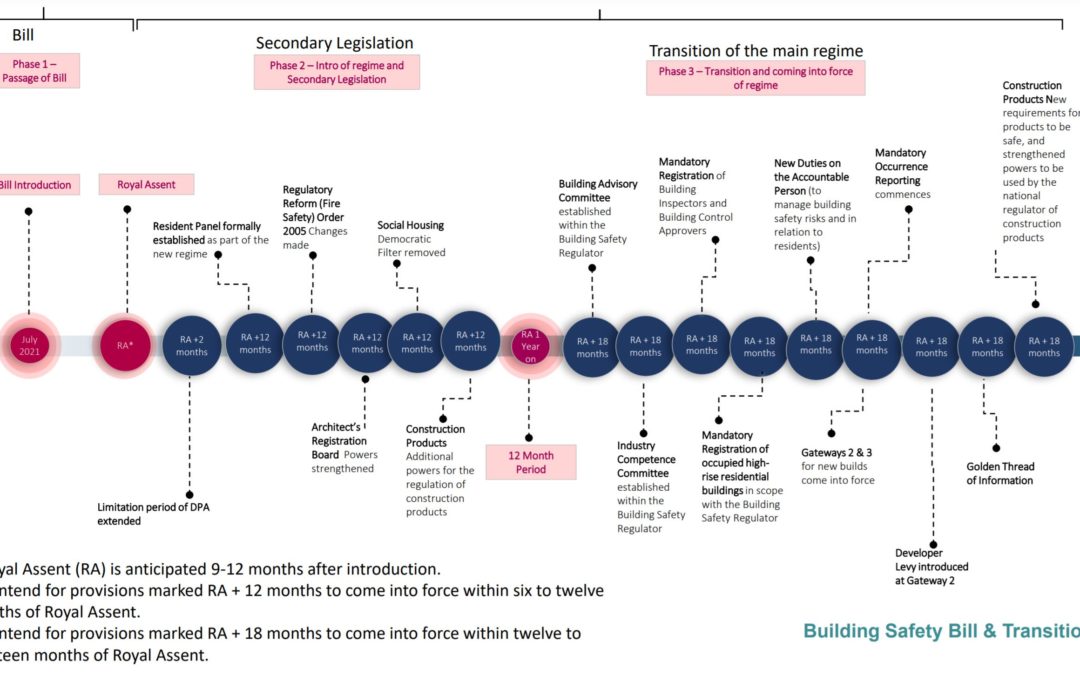

The Roadmap sets out policy recommendations for central and local governments to help drive and enable the transition needed to decarbonise the sector. These go beyond the recently published UK Government Heat & Buildings strategy and cover existing homes, existing non-domestic buildings and new buildings as well as for the infrastructure which connects our buildings and industry.

The Roadmap sets out policy recommendations for central and local governments to help drive and enable the transition needed to decarbonise the sector. These go beyond the recently published UK Government Heat & Buildings strategy and cover existing homes, existing non-domestic buildings and new buildings as well as for the infrastructure which connects our buildings and industry.