by Iain McIlwee | Apr 2, 2024 | Contractual and Legal, Transformation

A new stricter procurement regime is being introduced to support the Government’s 2019 Manifesto commitment to ‘..support start-ups and small businesses via government procurement, and commit to paying them on time…. <and> clamp down on late payment more broadly…’.

The Public Procurement Notice PPN 10/23 comes into force on the 1st April and demands historic payment performance is taken into account when awarding new Central Government contracts with a value in excess of £5 million per annum.

Contracting authorities must verify that the successful bidder meets the selection criterion prior to award of the contract or appointment to a framework agreement or dynamic purchasing system. The criterion is based on:

- Whether the bidder has paid its suppliers in accordance with the contractual terms that it applies to its supply chain; and

- Whether, overall, the bidder has paid its suppliers promptly by:

- paying at least 95% (at least 90% if an action plan is provided) of invoices within 60 days, which is considered an appropriate measure of overall payment promptness, and;

- meeting the average payment days threshold of at least 55 days for all invoices.

Reporting on this requirement will take into account a twelve month period and the bidder must demonstrate that they meet the required standard in at least one of the two previous six month periods – intercompany payments should not be included.

Where the bidder has reported payment data every six months in accordance with the Reporting on Payment Practices and Performance Regulations 2017, the two most recent reports can be submitted. If the bidder has recent data for the previous three or more months which has not yet been reported under the regulations, then this can also be submitted as a reporting period.

Where bidders are not required to publish their data in accordance with the regulations, they should still submit the previous twelve months’ worth of available data in two (six month) periods in line with the Department for Business and Trade Guidance to Reporting Payment Practices and Performance.

The criteria for applying the rules is summarised as:

|

Bidder pays ≥95% of all supply chain invoices in 60 days and the bidders average payment days are also ≤55.

Both metrics are hit concurrently in at least one of the previous two six month reporting periods.

|

Bidder meets the required standard. |

Pass |

|

Bidder pays ≥90% < 95% of all supply chain invoices in 60 days and the bidder’s average payment days are also ≤55.

Both metrics are hit concurrently in at least one of the previous two six month reporting periods.

|

Bidder demonstrates action plan that includes (as a minimum) the following:

1. Identification of the primary causes of failure to pay:

(a.) 95% of all supply chain invoices within 60 days; and

(b) (if relevant) all supply chain invoices within agreed terms.

2. Actions to address each of these causes.

3. Regular reporting on progress to the bidder’s audit committee (or equivalent).

4. Plan signed off by a director.

5. Plan published on its website. (This can be a shorter, summary plan) |

Pass |

|

Bidder pays ≥90% < 95% of all supply chain invoices in 60 days and the bidder’s average payment days are also ≤55.

Both metrics are hit concurrently in at least one of the previous two six month reporting periods.

|

No action plan or action plan does not include all of the above features. |

Fail |

| Bidder pays <90% of all supply chain invoices in 60 days in both of the previous six month reporting periods after removing intercompany payments (if relevant). |

Bidder’s payment performance falls substantially below the required standard. |

Fail |

| Bidder’s average payment days are >55 in both of the previous six month reporting periods after removing intercompany payments (if relevant). |

|

|

Exemptions should only be considered:

- where the market for a contract of this type is distorted/narrowed/struggling to such a significant extent that delivery of public services is likely put at risk, or value for money is likely to be severely compromised;

- where there is a civil emergency.

FIS CEO Iain McIlwee commented:

“Whilst this another positive step, we are still talking about lengthy payment periods in an industry where up-front costs have increased substantially in recent years. It is also narrow in application, the requirement to comply with this notice only binds Central Government Departments, their Executive Agencies and Non Departmental Public Bodies where the contract value exceeds £5 million. It does not apply to NHS trusts, local or devolved authorities and there is also a fair bit of wiggle room provided in the exemptions. All this means in real terms the impact will limited for the vast majority of those working in the finishes and interiors sector. That said it is further recognition of the importance of an issue which remains a cancer at the core of construction and our hope is that as procuring authorities look to the new Regulatory Requirements and concerns about the resilience of the supply chain that they look to exceed the expectation set down in this PPN.

With increased Government support it is more important than ever that we call-out poor practice. If you have payment concerns FIS is able to take these foward anonymously both directly and working with the Small Business Commission (who has sanctions via the Prompt Payment Code). Through FIS you also have access to QS, Legal and specialist credit checking services that can help to expedite payment – nothing changes if we do or say nothing and we will always look to act in your best interests”.

A full copy of the PPN is available here

by Iain McIlwee | Feb 7, 2024 | Market data, Material Shortages

The FIS Wage Rate Survey H2 2023 conducted in January 2024 revealed that, across the trades, FIS members have continued to experience wage rate increases averaging around 4% in key trade occupations (the full index is available to contributors only.

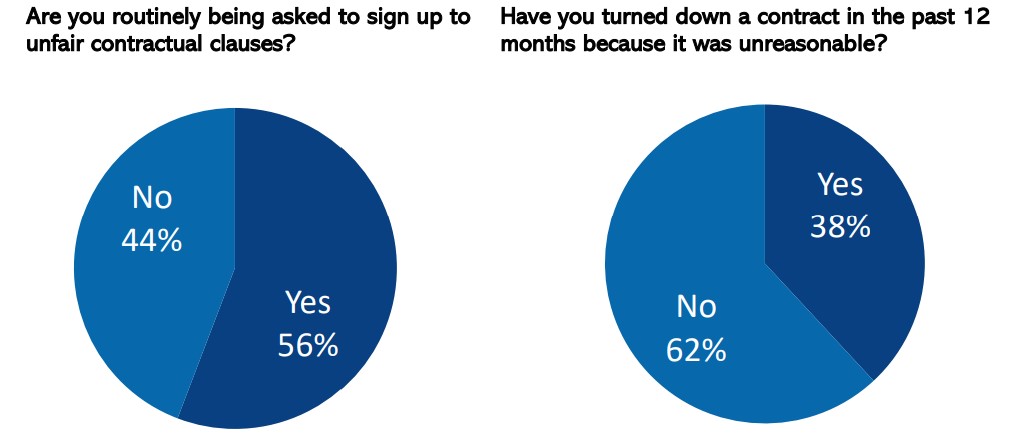

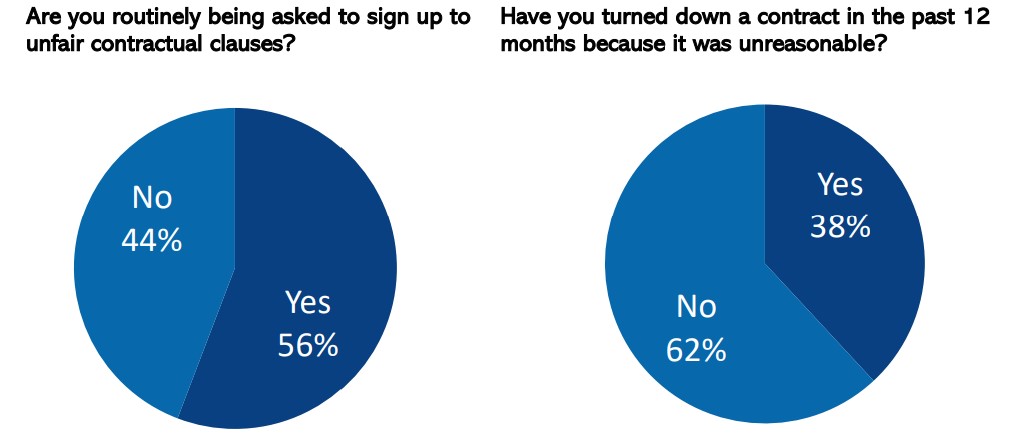

The survey also explored some of the concerns that are currently being experienced related to risk dumping through the supply chain.

Commenting on the data FIS CEO Iain McIlwee stated:

“The numbers clearly shows that the supply chain continues to be hit by inflationary pressures. Some of the contractual issues are also a worry, close to 60% of our specialist members are being asked to sign unfair contracts. Encouragingly there is evidence here that the Responsible No is being exercised, but the numbers are still out of balance. There is also evidence that design, programme and compliance risk are increased with over 70% stating that they routinely being asked to take more risk in terms of Design and close to 90% stating the same for programme. These numbers are not surprising, but they are concerning, especially against the backdrop of rising cost and more limited insurance cover available“.

In 2024 FIS launched the Responsible No Campaign to help bring attention to the pressures that specialists are under and the indiscriminate risk dumping that is evident in parts of the supply chain.

IF you wish to participate in future wage rate surveys, please contact the FIS on info@thefis.org and we will make sure you recieve appropriate updates.

by Iain McIlwee | Dec 14, 2023 | Market data

To help monitor wage rate inflation (and other contractual issues), FIS launched in 2021 The FIS Wage Rate Index. The aim of this work is to support contract negotiations and to help track the impact of labour shortage on the cost breakdown of projects.

The survey is conducted every six months and FIS is asking all contractor members to take part. Data is published as a price index to allow for regional rate variations and all company specific data is managed in the strictest of confidence. The survey covers core trade roles, labourers, apprentices and construction and site managers.

THE DETAILED RESULTS OF THE SURVEY WILL BE MADE AVAILABLE EXCLUSIVELY TO CONTRIBUTORS.

You can complete the survey via the link here. The survey will close early in the New Year. If you cannot complete, please share the link with the person in your business who can.

Your support is, as ever, appreciated.

by Iain McIlwee | Nov 8, 2023 | Market data, Material Shortages

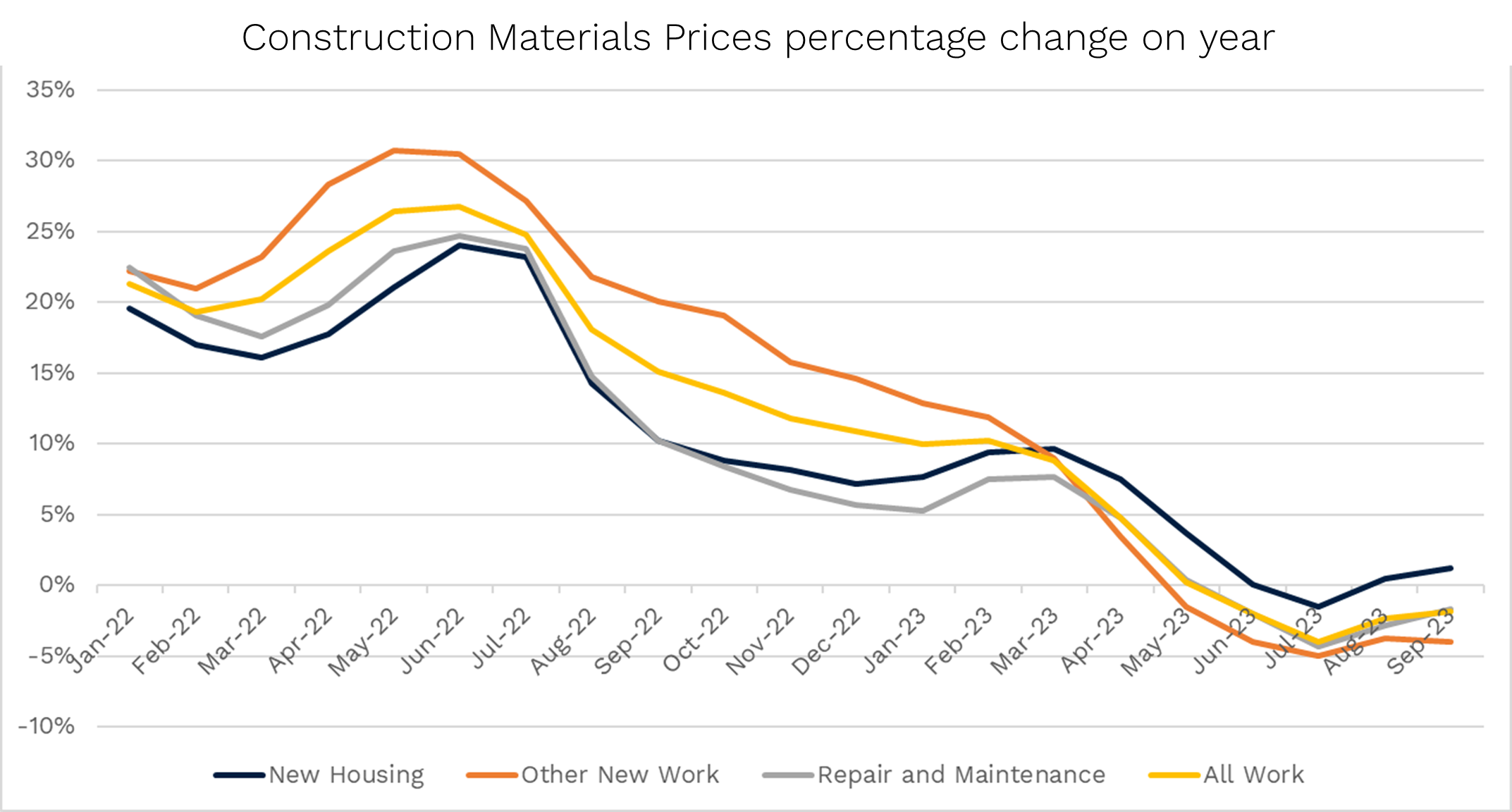

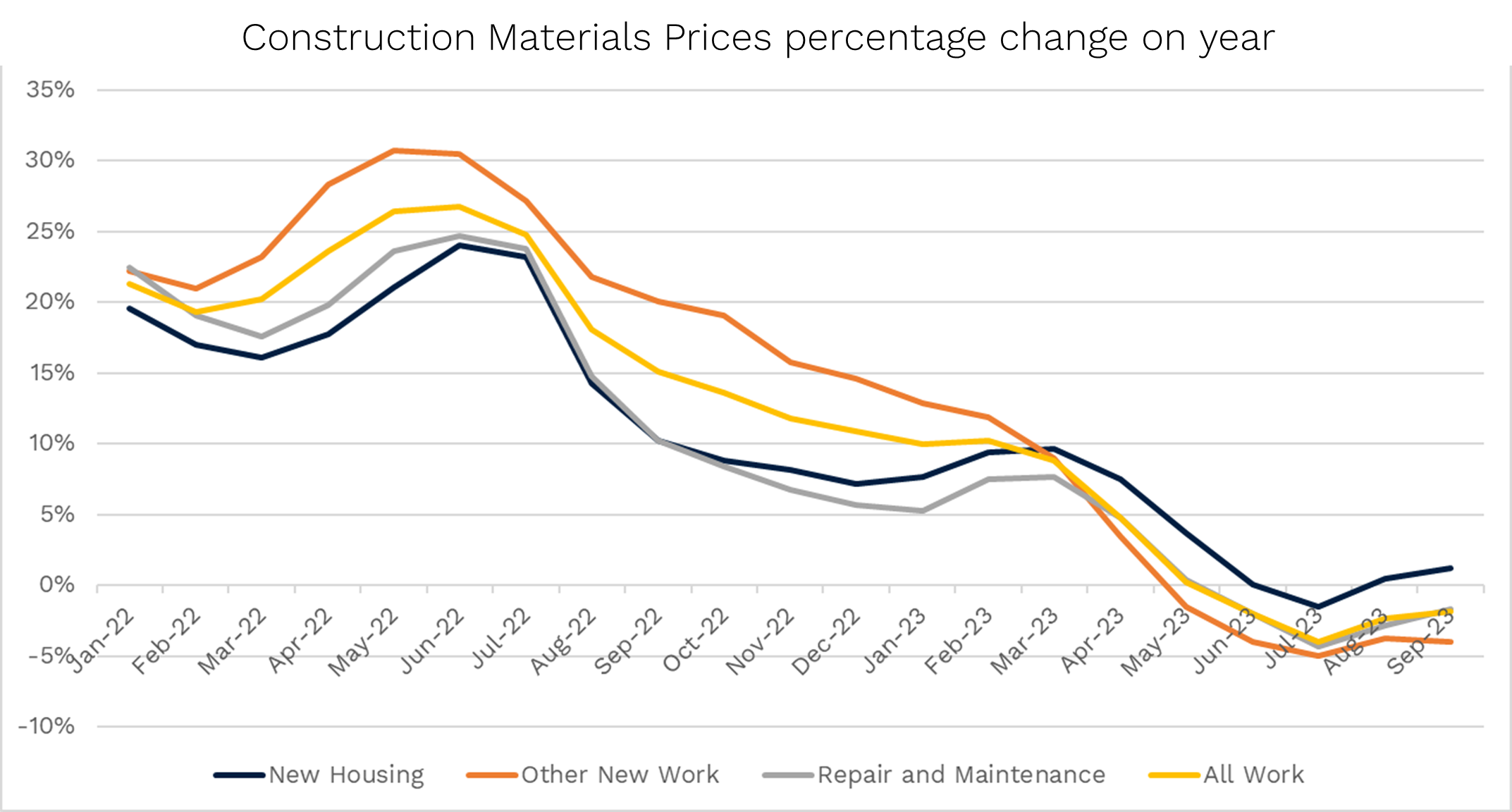

Commenting on the data FIS CEO, Iain McIlwee stated:

“Whilst it is encouraging to see the rate of inflation coming down, this index does not necessarily reflect what individual contractors are experiencing on the ground. Whilst generic data is helpful, the index is broad and there are fairly large differences between the different material types and the headline may not align to the specific products specialists are procuring or deals they may be locked into.

“Beyond this it is important to remember that materials only typically reflect around 30-40% of the cost of construction and we have continued to see wage rate inflation trending high – the FIS Wage Rate and Productivity Survey published this week pointed to continued day rate inflation across all the key trades in our sector.

“The final cost to factor in, is that new regulation is putting pressure on all in the supply chain and the cost of compliance is impacting prelims.

“Looking ahead, the signs seem to be that the period of hyperinflation has passed, but this doesn’t mean real world prices are falling and we cannot be complacent. The full impact of recent events in the Middle East on energy and material prices remains unknown and just because work may be slowing down in some areas it does not necessarily follow that prices will drop.”

Source: Department for Business & Trade – Monthly Bulletin of Building Materials and Components, Table 1

If you are interested in participating in the FIS Wage Rate Survey and receiving a copy of the data, email iainmcilwee@thefis.org (data goes back to 2020, but is only available to contributing companies).

by Iain McIlwee | Aug 17, 2023 | Building Safety Act

With the October deadline looming, the much anticipated Secondary Regulations under the Building Safety Act 2022 have been published today by the Department for Levelling Up, Housing and Communities. The five key pieces of regulation laid today are:

- The Building Regulations etc. (Amendment) (England) Regulations 2023,

- The Building Regulations (Higher-Risk Building Procedures) (England) 2023

- The Building (Approved Inspectors etc. And Review of Decisions) (England) Regulations 2023

- The Higher-Risk Buildings (Management of Safety Risks etc) (England) Regulations 2023

- The Building Safety Act 2022 (Consequential Amendments etc.) Regulations 2023

The regulations aim to deliver the recommendations of Dame Judith Hackitt in her report Building A Safer Future and cover the technical detail underpinning the new, more stringent regime for the design and construction of higher-risk buildings, wider changes to the building regulations for all buildings and the details of the new in-occupation safety regime for higher-risk buildings.

The regulations can be found here: The Building Safety Act: secondary legislation – GOV.UK (www.gov.uk)

Alongside the regulations, they have published the responses to the consultations on them which were held last summer. The government response to the consultations can be found here:

These Regulations will fundamentally reform the way buildings are designed, built and managed to ensure safety of those who live in them. These Regulations introduce significant reform to building control for all buildings and a new bespoke approach to building control for blocks of flats, hospitals and care homes of 18m or more or seven stories or more under the new Building Safety Regulator.

The Regulations also introduce the new in occupation regime where dutyholders must demonstrate they are proactively engaging with residents on building safety and demonstrate to the building safety regulator that they are managing the building safety risks in their building – fire spread and structural collapse – appropriately.

The next sets of regulations related to the new regime will be laid shortly. The Higher-Risk Buildings (Keeping and Provision of Information etc) (England) Regulations and the Charges Regulations are due to be laid next month. The former regulations will cover the information that accountable persons for occupied higher-risk buildings need to keep as golden thread information and what information they need to share with residents and other people who are involved in ensuring the safety of the building. The latter will set out the approach to charging by the Building Safety Regulator.

FIS will be reviewing in detail and provide summary as soon as practical. In the meantime, you find out more about the Building Safety Act via our Building Safety Act Hub here.

by Iain McIlwee | Aug 16, 2023 | Health and Safety

From September – HSE site inspections across Great Britain to focus on moving and handling materials

Starting in early September 2023, HSE will be undertaking construction site inspections, focusing on moving and handling construction materials. The inspections will be checking employers and workers know the risks, plan their work and are using sensible control measures to protect workers from injuries and aches, as well as pain and discomfort in joints, muscles and bones known as musculoskeletal disorders (MSDs).

These injuries can have a serious impact on workers’ ability to perform tasks; their quality of life; and in some cases, their ability to stay in work and earn a living.

This latest health inspection initiative is supported by the ‘Work Right Construction: Your Health Your Future’ campaign to improve the long-term health of those working in construction.

Find out more about the campaign by visiting:

The supporting resources from HSE includes a range of posters and site signage and guidance in the form of:

Commenting on this campaign FIS CEO Iain McIlwee stated:

“The concept of Occupational Health is an area that there has been growing understanding of in recent times. We have a responsiblity, not just in terms of safety, but looking after the long term health of our workers and limiting the potential damage that can result from lifting heavy items. There is more work to be done here to support a more inclusive workforce too as well as helping to extend careers in the sector and ensure that we optmise productivity and attack the labour shortage from all angles.”

Specialist advice is available from FIS to support activities including a free helpline and Health and Safety Working Group that convenes to review accidents and exchange best practice where necessary, latest guidance includes:

FIS Manual Handling Guide: Safe handling of plasterboard (which is relevant for all moving board type material) and Recommendations for the safe ingress of plasterboard (which looks at how material should be moved through the site). Members also have access to AWCI: Safe Work Practices for Wall and Ceiling Industry Construction Workers, a guide developed for the US market, but has been made available to FIS members through our partnership with AWCI).

The FIS Health and Safety Toolkit is available here

by Iain McIlwee | Aug 1, 2023 | Main News Feed

It has been confirmed that the next edition of JCT (JCT 2024) is anticipated to be issued in the early part of next year. The final decision on the release date will be determined by when the secondary legislation necessary to implement many of the provisions of the Building Safety Act 2022 has been published (expected to be finalised by October 2023).

What are the key changes:

Modernising and streamlining: changes will include the adoption of gender-neutral language, provision for execution by electronic signature and the facility for notices to be sent electronically.

Fluctuation provisions: Price uncertainty is set to continue and the JCT has launched a new fluctuations hub to offer guidance on its Fluctuation Options and also plans to move the fluctuation provisions to an online document to increase prominence and accessibility. Currently, fluctuation Options B & C are available online while Option A features in the JCT contracts.

Extensions of Time: There will be new relevant events to cover epidemics, updates to how ‘statutory powers’ are dealt with and ‘Statutory Undertakers’ will be redefined to ‘Statutory Providers’. In addition, the period of time for the Employer to assess an interim extension of time will be reduced from 12 weeks to 8 weeks from receipt of the Contractor’s particulars. The relevant event dealing with antiquities will be extended to deal with UXB’s, contamination and asbestos.

Loss and expense: The Contract Particulars will provide for parties to include optional additional grounds for the contractor to claim loss and expense. These include epidemics and the exercise of statutory powers by the UK Government which directly affects the works. The relevant matter dealing with antiquities will be extended to deal with UXB’s, contamination and asbestos.

Liquidated damages: The JCT is also making amendments to reflect the Supreme Court’s decision in Triple Point Technology Inc (Respondent) v PTT Public Company Ltd (Appellant) (2021). The decision restores the orthodox position that liquidated damages clauses apply up to termination of a contract, but not thereafter. Clear wording must be used if parties want to agree a different approach. The planned updates to the JCT will provide that where works are not complete at termination, LDs can be levied up to termination and only general damages for delay can be claimed thereafter.

Resolving disputes, arbitration and adjudication: Parties will be able to choose a nominating body or appointer of their choice, as opposed to the original short list. However, it is anticipated that the particulars will still include a list of bodies, as the AICA is being removed (due to it now being defunct). The notification and negotiation of disputes, set out at Supplemental Provision 10, will no longer be an optional provision. Subject to the parties right to refer a dispute to adjudication, this provision deals with the avoidance or early resolution of disputes or differences by requiring each party to promptly notify the other of a matter that is likely to give rise to a dispute or difference. It also requires senior executives to meet “as soon as practicable, for direct, good faith negotiations to resolve the matter”.

Allocation of risk: There will be a new provision added to the contract to deal with unexploded ordnance, contaminated materials and asbestos.

Legislative changes: There will be updates to reflect recent legislation including the Building Safety Act and its secondary legislation (once this has been finalised) and the two new insolvency grounds that were introduced under the Corporate Insolvency and Governance Act 2020 will be added.

Construction Act: There will be revisions to termination accounting provisions to reflect the requirements of the Construction Act, in particular a due date for the final payment after termination will be added.

Future proofing: The contract has been drafted with consideration to the Construction Playbook, sustainable development, collaborative working and environmental considerations.

In addition, a new set of contracts will be added to the suite. The Target Cost Contract, the Target Cost Sub-Contract and the Target Cost guide will be published alongside the updated suite.

While the final amendments are not released yet, the above is understood to be a good guide for the changes that are being implemented.

Commenting on the changes, FIS CEO Iain McIlwee stated:

“Changes to JCT are long overdue, there has been a lot of water under the bridge since 2016! But, whilst the changes are welcome, recent research by Reading University points to the fact that the very concept of a standard form of contract is to all extent and purposes almost dead.

It is vital that these changes are heralded with some real leadership making it clear that the contracts are designed to be used in an unamended format. Where amends are deemed necessary the users should be cautioned against “risk dumping” and the contracts should be deemed invalid unless changes are clearly marked up in the body of the contract instead of included in an unwieldy schedule of amends.

The new Building Safety Regulations emphasise that risk should be dealt with by the person most able to manage it – there is a huge opportunity for JCT to get behind this principle and champion the import of standard and unamended contracts.”

This summary of the changes is based on content in the latest edition of JCT News

by Iain McIlwee | Aug 1, 2023 | Technical

The Department for Business and Trade announces an indefinite extension to the use of CE marking for UK businesses, but DLUHC (who regulate Construction Products) have indicated that this extension will not apply to construction products.

The Department for Business and Trade (DBT) has announced today a package of smarter regulations designed to “ease business burden” that includes recognition of the CE mark in the UK beyond the 2024 deadline. This means British firms will be able to continue the use of CE marking alongside UKCA in perpetuity. But, FIS have been informed that this easement relates only to the 18 sectors that fall under DBT – it does not apply to construction products.

Announcing the change Business Minister Kevin Hollinrake stated:

“The Government is tackling red tape, cutting burdens for business, and creating certainty for firms – we have listened to industry, and we are taking action to deliver. By extending CE marking use across the UK, firms can focus their time and money on creating jobs and growing the economy.”

DLUHC have indicated to the Construction Products Association (who are leading representation on this matter through the Construction Leadership Council) that recognition for construction products will continue until 30th June 2025 ONLY. The rationale offered is that the Government remains committed to ensuring the testing regime for construction products is effective and inspires public and market confidence. DLIHC have indicated that they will set out their proposals for reform of the construction products regime in due course.

Commenting on this announcement FIS CEO Iain McIlwee stated:

“The logic is hard to follow here. All the arguments about red-tape, business burden, avoiding cliff edges and refocussing on innovation and growth that apply are replicated, even magnified, in the construction sector. The unnecessary re-testing of product that transitioning to UKCA necessitates is a waste of resource and, particularly in the case of fire safety, precious furnace time. The Government talk about pragmatism, but this is not extending to construction and that is disappointing and frustrating in equal measure. I only hope that “due course” considers, but doesn’t conflate the need to focus on product safety, which is a very separate and significantly more important issue to address.”

You can read the full announcement here.

by Iain McIlwee | Jul 27, 2023 | Building Safety Act

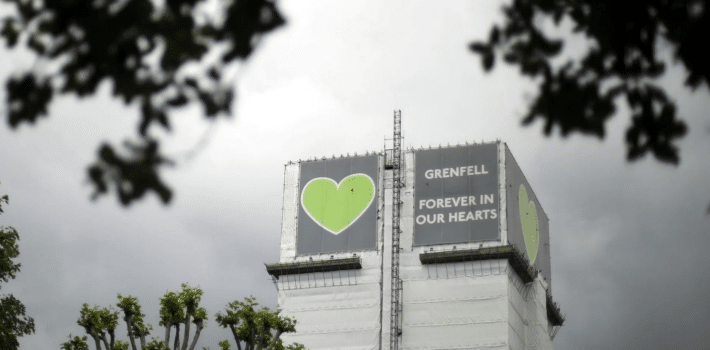

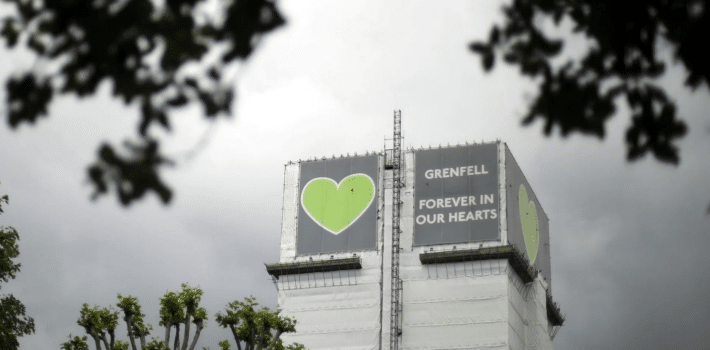

Cladding Safety Scheme opens to give thousands more buildings access to government funding to fix dangerous cladding for the first time.

The government has announced its biggest building safety intervention to date as part of a wider package of measures to help end the building safety crisis across England.

The full opening of the Cladding Safety Scheme (CSS), announced in a speech by Housing Secretary Michael Gove, means that costs associated with removing unsafe cladding in mid-rise buildings will now be covered by government funding, protecting leaseholders from costs where the responsible developer cannot be made to pay. It is estimated that thousands more mid-rise buildings will qualify, giving tens of thousands of residents across England a pathway to a safe home, with no cost whatsoever to leaseholders in the building.

The CSS will be funded by both the £5.1 billion allocated by government to fix the most dangerous buildings and through revenue from the Building Safety Levy on new development.

The scheme will be available to all medium-rise buildings between 11 and 18 metres across England and high-rise buildings over 18 metres outside of London where fire safety professionals have recommended that works must take place. The scheme will also be available to the social housing sector.

All building owners who believe they are eligible for funding need to apply through Homes England Cladding Safety Scheme application portal.

Any leaseholders or residents living in a building they think is eligible for funding will be able to provide further information about their building using Homes England’s ‘Tell Us tool’.

Peter Denton, Chief Executive of Homes England, said:

The Cladding Safety Scheme pilot was an important step in removing the cost burden on leaseholders trapped in unsafe homes and built on the progress made on building safety.

The full rollout of the programme allows us to go even further. Our team is ready to go, and we expect thousands of buildings to benefit over the next decade.

We will continue to work with DLUHC to ensure the pace we’re working at is maintained, so we can bring peace of mind and protection to the millions of people whose lives have been affected by unsafe cladding.

The opening of the CSS means that costs of fixing dangerous cladding for all buildings in England over 11 metres will now be covered either by government funding or by developers who built them.

Earlier this year, the Secretary of State secured the signatures of 49 of the country’s biggest housebuilders on his developer remediation contract – a major step toward ending the building safety crisis.

The developers all put pen to paper on the legally binding document and committed themselves to fix unsafe buildings they developed or refurbished in England over the 30 years to 5 April 2022. The government has now written to eligible developers to invite them to join the Responsible Actors Scheme giving them 60 days to respond. Eligible developers who choose not to join, or who join the Scheme but then renege on their commitments, will be prohibited from carrying out major development or obtaining building control approvals.

While funding is a major part of solving the crisis, it is also important that residents see swift progress once work has been deemed necessary. The government has been clear that there is no excuse for unsafe cladding to be left unmanaged. Building owners must meet their legal obligations to fix fire safety defects in their buildings and make homes safe quickly.

The Department for Levelling Up, Housing and Communities, the Building Safety Regulator, the Local Government Association, and the National Fire Chiefs Council have today published a joint statement committing to work together to enforce the remediation of fire safety defects, underlining their commitment to see buildings made safe faster. Building owners who continue to stall can expect to face robust enforcement action from regulators, with the full support of government behind them.

The Greater London Authority will continue to deliver remediation to London-based 18m+ buildings through the Building Safety Fund.

Buildings in England already progressing through the Building Safety Fund will not be transferred into the new CSS but their progress will remain unaffected.

by Iain McIlwee | Jul 27, 2023 | Market data

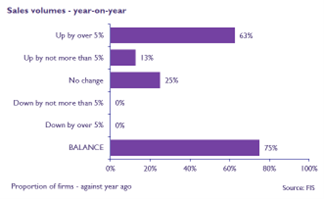

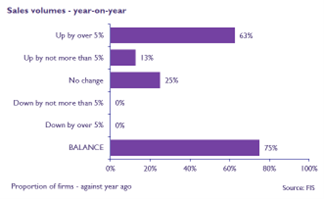

Workloads reported by members in the FIS Q2 State of Trade Survey have continued to trend positively with a higher balance (18% up from 5% in Q1) reporting Growth. Within this, 35% of members have experienced growth greater than 5% and just 29% reported a decline for the quarter. The balance (-7%) of respondents did, however, report a decline in sales in Q2 2023 with those reporting a growth in sales dropping from 75% to 43% quarter on quarter. This is the first time the net balance has been negative since Q3 2020.

This trend is consistent with data from Barbour ABI which has highlighted that most sectors have seen falls in terms of contract awards compared to Q1, with notably industrial reducing by 45% and healthcare by 50%. Conversely, awards over Q2 in education continued on a positive trend and the commercial sector remained relatively positive albeit volatile. NHBC has reported that Q2 new house building registrations fell in the UK by 42% compared with a year ago according. It should, however, be noted that was from a base almost double the long-term average. The numbers in 2022 were distorted as house builders worked to get ahead of the new building regulations.

Looking ahead to the next quarter, both sales and workload for the next quarter are trending positively, but the balance is lower than the past couple of quarters. There are still reports of work slipping with rising interest rates and concerns over compliance (particularly linked to staircases) impacting viability of projects. It is also worth noting that, whilst overall trend remains positive, 20% of members are expecting workload to slip by in excess of 5% in Q3.

Members can access the full FIS State of Trade Survey Q2 2023 here

by Iain McIlwee | May 25, 2023 | Market data

Uncertainty surrounded the start of 2023 in the finishes and interiors sector with concerns (particularly in the housing sector) resulting in 32% of respondents seeing a reduction in workloads. Whilst there remain underlying concerns related to ongoing inflation and a rising cost of capital impacting viability and delaying starts, 37% did experience increases and confidence has built through the quarter.

Commenting on the release, FIS CEO Iain McIlwee said:

“The data here was timely as we met wiith Bank of England representatives this week along with a small delgation of construction organisatons led by BuildUK. The overall situation remains that things are more positive for most than many had anticipated. There remain some clear risks and uncertainty that will mean growth overall in the economy is likely to remain subdued and this will have an impact on construction. Interest rates will be key, with inflation reports this week slightly higher than anticipated and consequently the 5.0% peak anticipated rates is already being talked up and we have seen a reaction from certain high street banks increasing mortage rates. The cost of mortgages and finance for large commercial projects will remain a key risk.

The election will also have a distorting effect, with Autumn 2024 a probable date. How policy adapts to drive home ownership and construction and encourages investment from business will again be key. The long term need to get building homes and hospitals as well as redeveloping commercial space to meet modern requirements and sustainable goals is all positive, but how policy drives this may be limited by political motivations.

Resiliance in the supply chain too remains a concern with higher levels of insolvency in construction driven by aggressive procurement and cash/credit issues that are being cascaded through the supply chain and leaving SMEs vulnerable. The full impact of the Building Safety Act and legacy are still to be fully understood.”

Read the full state of FIS State of Trade Survey Here – FIS State of Trade Survey Q1 2023

See Also – CPA survey reveals a cautious improvement in Q1

After the uncertainty-filled end to 2022, conditions have become more settled in Q1 with product manufacturers’ sales and contractors’ workloads indicating an improvement in conditions for construction.

by Iain McIlwee | Apr 28, 2023 | Building Safety Act

Last week saw the publication of The Independent Review of the Construction Product Testing Regime which was announced by government in April 2021 and was led by Paul Morrell OBE and Anneliese Day KC.

The purpose of the Review was to

- to identify any potential weaknesses in the system and

- to make recommendations for improvement.

It undertook a critical assessment of the system for testing and certifying construction products and how the system could be strengthened to provide confidence that construction products are safe and perform as labelled and marked.

It is a wide ranging report and recognises contributions from FIS. Key points to draw out include:

- Concerns remain over fragmentation and there is a greater focus required on how products work within systems and understanding responsibility

- Recommendatons around the definition of “safety critical products”, to include; Fire resisting construction (eg in compartment walls), including glazing, Class A1 material for shaft construction, Fire doors and doorsets, door closers, Cavity barriers, Fire resisting ceilings, Fire-stopping

- Regulations to be tightened to ensure all products have a “general safety requirement” and are embraced by the Construction Products Regulation, requiring them to report consistently on essential characteristics through adoption of the Declaration of Performance process.

- The need to strengthen enforcement and importance of getting behind the Code for Construction Products Information

- The call for a Standard to support assessment of performance to augment testing and scope

The report also touches on the suggestion of licensing for main contractors to help improve the safety culture. We are not expecting a formal response from Government to the recommendations, but they will inform the Building Safety Regulator as they develop the regulatory and enforcement landscape over the coming months.

You can view all the documents relating to the independent review led by Paul Morrell OBE and Anneliese Day KC here. FIS is currently working on an executive summary for members.

For all information related to helping members comply with the new regulatory requirements and the Building Safety Act here

by Iain McIlwee | Apr 28, 2023 | Transformation

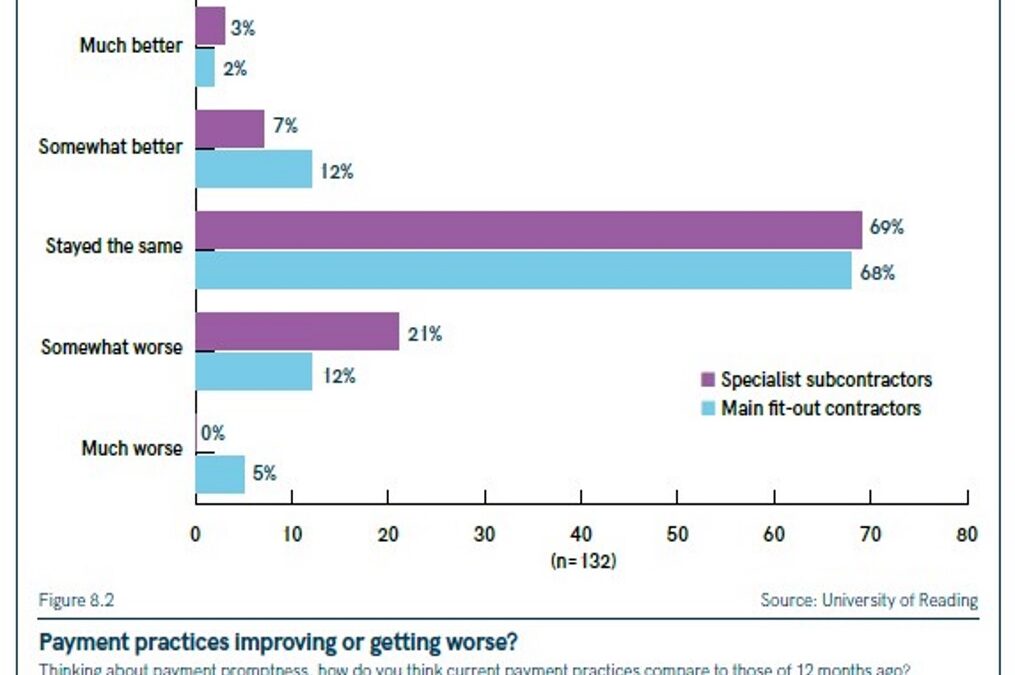

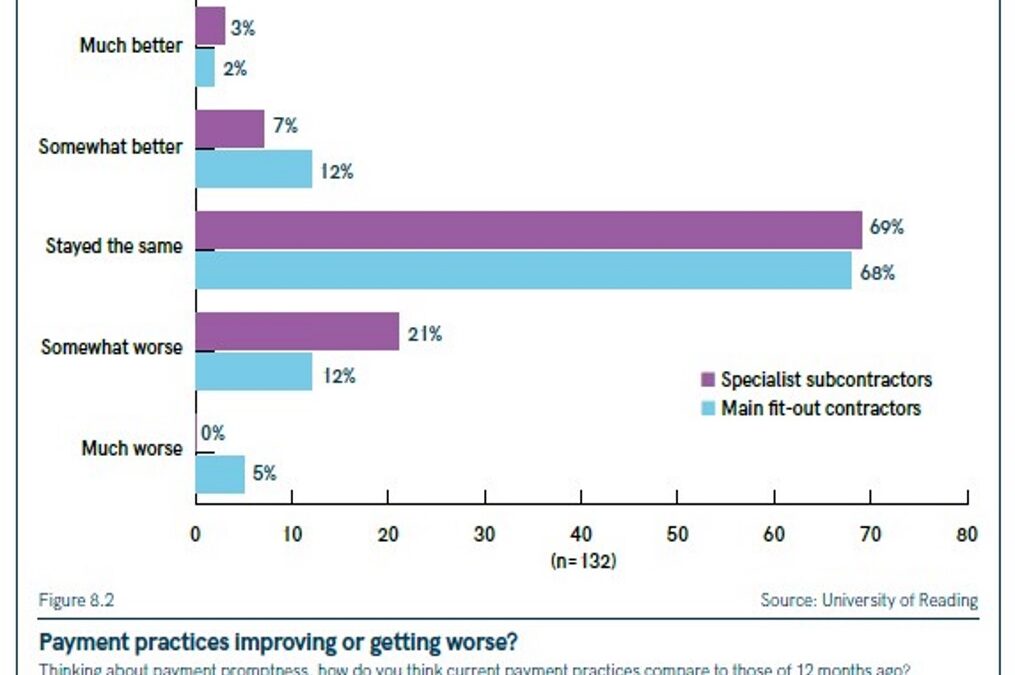

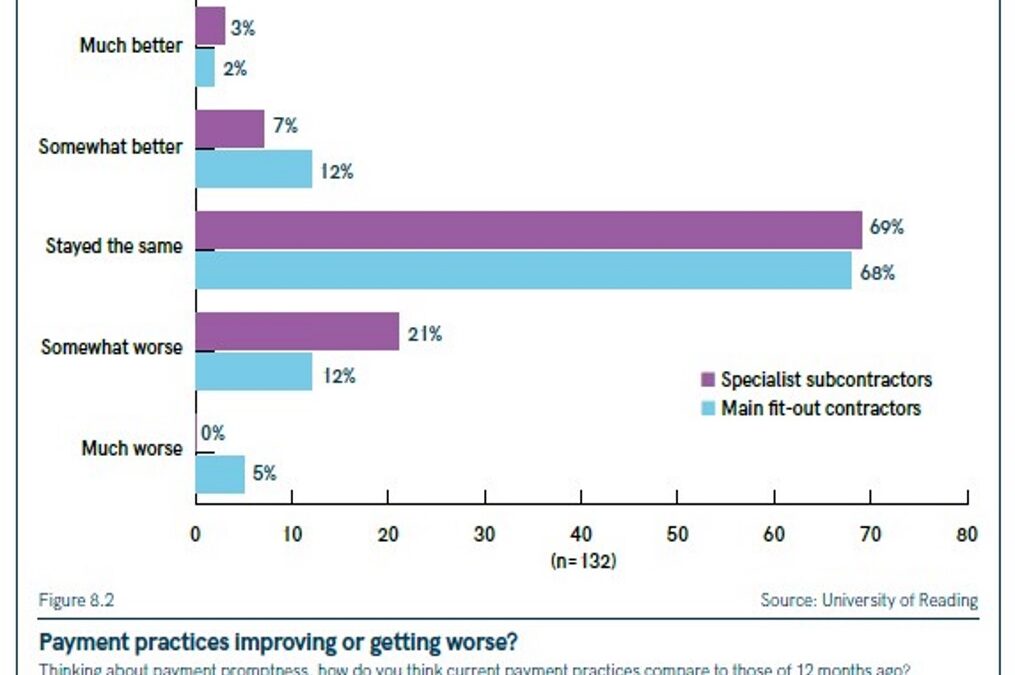

FIS had today responded to the Amendments to the Payment Practices and Performance Regulations consultaton calling for an overhaul that will better support SMEs in the sector.

The FIS response draws on recent research conducted by the University of Reading into procurement, contractual and payment practices in the sector. It challenges headlines indicating that payment in construction was improving, on the basis of flawed data that fails to measure the value of invoices paid and is opened to being gamed. As it stands companies only need to report on the percentage of invoices paid, but does not measure value. Whilst the guidance does make clear that invoice in construction should mean application, this is not regulated and there is little to no enforcement of how companies are reporting. This misleading dataset masks a cancer at the core of construction that is killing businesses and ruining lives.

In the response FIS makes it clear that whilst metrics on the average percentage of volume of payments made are useful but fail to give us a true picture of payment performance. As it stands efficient payment of small invoices for e.g. business facilities or stationary could mask differing practices within the construction sector, typified by larger payments. The FIS also recommends that Duty to Report obligations should be incorporated into annual Audit requirements to ensure that there is third party scrutiny of auditing practices.

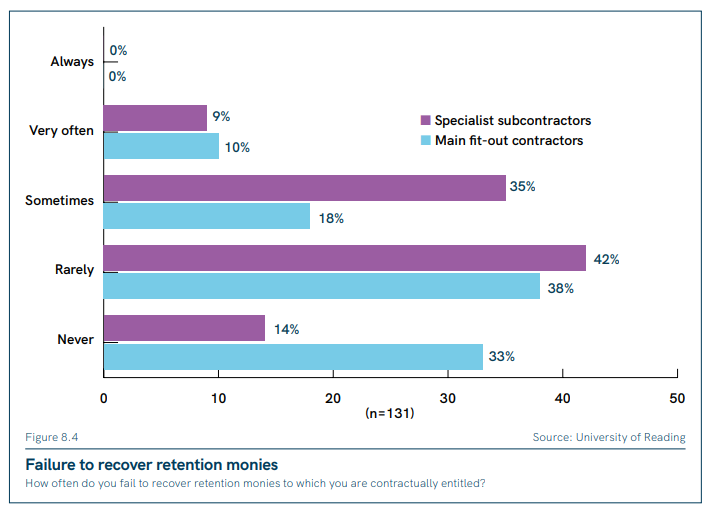

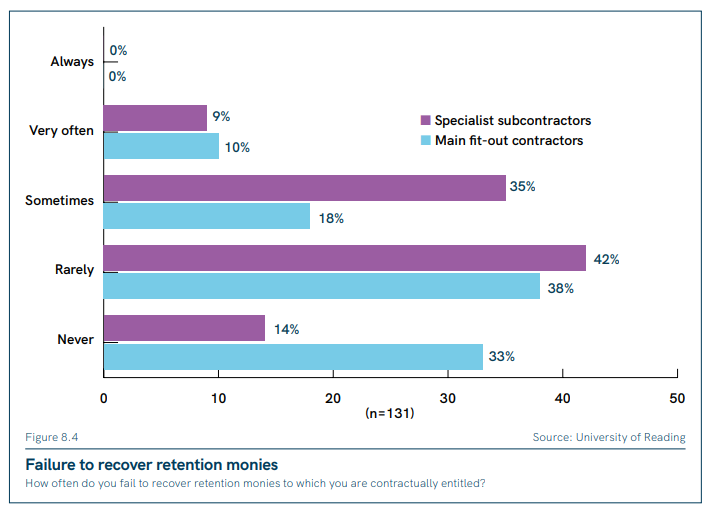

The FIS is also calling for a clampdown on retention practices. FIS Research dentifies 33% of main contractors always secure retention, compared to 14% of specialists. This concern here is that a significant proportion of retention that should cascade through the supply chain is actually realised as profit. FIS continue to advocate for the ultimate abolition of retention, but in the interim, to ensure that retentions are protected, associated only with the work packages undertaken and AUTOMATICALLY RELEASED based on a defined date (rather than abstract event). This should be Regulated and monitored to prevent nefarious practices.

In a seperate consulation the FIS has applauded the efforts of the Small Business Commissioner recommending that the Office is strengthened, responsibility in the construction sector is extended and that the office is given more resource and greater powers to support SMEs in the supply chain.

You can read the full FIS Payment and Retentions Submission 2023 here and response to the Small Business Commissioners Consultation here.

The consultation closes at 11:45pm tonight and FIS has also prepared a template response to encourage members to feed their views in here.

by Iain McIlwee | Mar 31, 2023 | Transformation

In March FIS attended a round table with CLC and Government officials to look into payment practices, retention and support available through regulation via the Duty to Report. I think there is a desire from Government to beef things up a bit to support SMEs, but we need to ensure that they see votes in change and that small businesses feel strongly about it – so to get change over the line we need your help. We will, but we also need you to respond to the consultation.

What is the aim in all this?

Recent headlines that payment practices in construction are improving are, at best, misleading. Our own research with the University of Reading (shown in the chart at the top of this page) tells us that, for most in our sector, it is no better and, for nearly a quarter of specialists, it is worsening. The improvement headlines ring particularly hollow when we see the human impact of poor practice and you know and care for the people that our QS helpine has been working with – it is not just cashflow and the cost of money that concerns us, the stress and human toil of poor payment is literally sickening.

Where the market fails to correct we need regulation to drive better behaviour. Effective Regulation needs three things, a clear and proportionate set of rules and scope, an mechanism to measure and impactful enforcement.

Why does official data suggest it is getting better, but I am not seeing any (positive) change?

The old addage… lies, damned lies and statistics comes to play here. The headlines are based on information extracted from the Duty to Report. The concept of the Duty to Report is it exposes payment practices – it compells larger businesses (those that satisfy two of the following £36 million in turnover, £18 million on its balance sheet and 250 employees) to formally report on payment times against an agrreed criteria. This means Government can make procurement decisions based on it, have a formal measure to support initiative like the Prompt Payment Code and equally SMEs can check theoretically check a company’s payment history (here) to help decide if you want to work with them. It is a good concept in that it highlights a problem, but the issue is that it is poorly delivered.

The underlying problem is that companies only report on volume of invoices, not value. Ten tiny invoices (for e.g. stationary) can drown out one huge invoice for construction. She system can be gamed by selecting what invoices to pay early to mask that you are paying the big ones late. Thus you can still continue to use the supply chain as a free line of credit and still look good on paper!

The other big issue for construction is that it measures invoice payment, but in the complex world of applications, valuations, pay less notices and certification the invoice is not . The guidance is actually fairly cut and dry:

- For construction contracts in scope of the Housing Grants, Construction and Regeneration Act 1996 or the Construction Contracts (Northern Ireland) Order 1996, businesses must use the earliest point at which they have notice of an amount for payment.

- This would generally be the date they receive an application for payment or, in cases where there is no application for payment, the date on which they receive a payment notice (or default payment notice) or on which they issue a payment notice – whichever is earliest. Day 1 of the time taken to pay will be the day after the day on which the business has this notice.

but, guidance is not regulation and frankly there are no meaningful checks and balances on how people are reporting. In fact in our digging, it was identified that there have been only 18 investigations and no prosecutions. Without proper checks and balances and strong enforcement, regulation is about as useful as a chocolate teapot!

Aren’t we supposed to be getting rid of retention by 2025?

The CLC roadmap to zero retentions does say that they should be phased out no later than 2025, but like so many ‘Roadmaps’ we seem to have lost the road!! I remain concerned that retention debate often gets derailed by trying to solve two problems at once. For me there are two distinct parts to this debate:

1. the underlying concept of retention – how we work, as a sector, manage trust and quality with clients to evolve away from retention and ultimately how our Standard form Contracts support this evolution.

2. how they are fairly and consistently deployed within the supply chain – a key conclusion from our research is that they aren’t and the further down the supply chain, the less likely you are to actually get your retention.

I know it is more nuanced than that in terms of why and whether people have claimed, but for whatever reason the retention isn’t cascading smoothly (certainly not automatically). If you think of certain parts of our market, the low margin means that the tier one is making around 3% profit on average – the value of retention effectively sit at their approximate profit. Whilst there is a cash concern that more might be held against than they hold, the motivation for the less scrupulous in the supply chain, the difference between the 33% of main contractors and 14% of specialists always securing retention is about 19% of profit. For this reason FIS can continue to advocate for the ultimate abolition of retention, but in the interim, to ensure that retentions are protected and AUTOMATICALLY RELEASED based on a defined date (rather than abstract event).

So what do we need you to do?

The purpose of this post is not to rant about things we all know, but to emphasise that FIS reserach is helping to inform a debate which is happening and there does now seem geniune interest from Government in addressing some of these issues and appreciation that continued nefarious practices in construction undermine the cultural changes that they want to see. This is where you come in…

Full details of the Payment Practices and Performance Regulations 2017 consultation here

You can respond via the webiste or by copying and adapting (where you feel necessary) below in an email to the consultation questions to responsiblepaymentculture@beis.gov.uk (by 11.45pm 28th April 2023).

We have with colleagues representing specialists set down a template response that you can be downloaded below, but remember this is your response so do feel free to edit/ammend and add any personal comments or experience to help support understanding and change.

You can download the FIS template response here

Please do send us your response so we can factor in any additional points to the core FIS input on this. Thanks for your support – together we are stronger.

Iain McIlwee

CEO, Finishes and Interiors Sector

PS Through this process we are always looking for feedback on our Procurement Research recently completed with the University of Reading that may help you with your response.

PPS For support in managing your contractual responsibility, including the new Best Practice Guide that FIS has helped develop with the CICV in Scotland and standard Terms and Conditions launched in 2023.

by Iain McIlwee | Mar 27, 2023 | Labour, Main News Feed, Material Shortages

FIS Position and Support on Inflation and Material Shortages

The past two years have, without doubt, been some of the hardest times businesses in the finishes and interiors sector have faced. Uncertainty and challenge continues into 2023.

The underlying trend began post COVID with the RICS reporting construction materials costs in the UK had already reached a 40 year high based on the annual growth of the BCIS Materials Cost Index by the end of 2021. According to Joe Martin, BCIS Lead Consultant “The pressure on materials prices and availability is expected to continue at least until the end of 2022. Labour shortages are expected to evolve as the significant driver for overall construction cost increases next year and the construction sector would need to compete for it with other sectors”.

After this rapid inflation in 2021 across all material groups, 2022 started with concerns around the impact of ongoing labour shortages and the escalation of tragic events in Ukraine put further pressure on energy and fuel prices adding to pressure on the supply chain. This has resulted in the announcement of further price increases throughout 2022 and rapid inflation for key materials, fuel and energy. Of particular concern for FIS members are increases in insulation, steel and plasterboard.

The Construction Products Association have prepared for FIS Members an update on the wider impacts of this tragic conflict.

Keeping an eye on your contracts

Where this impacts existing contractual relationships members are reminded to check contractual terms and consider the relevance and application of any fluctuation clauses. If you are unable to rely on standard fluctuation clauses, an early conversation with your client in terms of your ongoing ability to fulfil the contract in the wake of rapid and unexpected price increases is essential.

Where you are currently tendering, consider carefully the impact of the current inflationary environment, look to link any fluctuation to material and product prices rather than general inflation or ensure that quotes are time stamped and limited. Where you cannot negotiate a shared risk approach with your client, you need to seriously consider what could worse case scenario mean to your business if prices drifted?

We encourage all in the construction sector to consider seriously the impact of imposing fixed prices at this time. The sector is working on every tighter margins and this could impact the resilience and ongoing viability of of businesses in the supply chain. Where concerns are raised, a pragmatic, understanding and collaborative approach is essential. It is vital that we work together to avoid conflict and we further encourage all companies to consider signing and adopting the principles set down in the Conflict Avoidance Pledge that has be developed by the Royal Institute of Chartered Surveyors (RICS) and endorsed by the Construction Leadership Council (CLC).

Below we provide some information on the market forces that are resulting in ongoing inflationary pressures and additional advice and guidance related to managing businesses and contracts in a high inflation environment.

The aim is to keep it refreshed so our members are have a clear picture and can have informed decisions up and down the supply chain.

When can we expect an end to all of this?

Whilst the rate of inflation is expected to slow in 2023, the situation remains volatile. With such a perfect storm of complex and cumulative issues it is difficult to know when we will start to notice improvement or how much worse things may get. The old adage hope for the best, but prepare for the worst comes to mind.

The FIS is an active participant in the Construction Leadership Council who continue to monitor the situation through a dedicated working group of subject experts – you can access the latest Construction Leadership Council Product Availability Statement here.

Energy Prices and Other Global Issues

As we step into 2023 the tragic events in Ukraine continues to impact oil and gas prices and hence energy costs across the world into a period or rapid inflation which is now feeding through into the price of construction products and logistics. In the period 1 April 2021, wholesale gas had risen from around of 50p/therm to around £2.80/therm by the end of March 2022.

You can track natural gas prices here.

Whilst the UK in not overly reliant on Russia or Ukraine for construction products (which together account for just 1.2% of imports of construction products, some areas such as flat glass and certain timber products have a more significant share from these markets. Projects could also be impacted by shortages of products such as concrete reinforcing bars or other unrelated shortages (such as bricks) which are still ongoing.

The global situation remains volatile and it is impossible to predict accurately the ongoing impact on material and product prices. Beyond the escalation in Ukraine, tension between the US and China and genuine concerns about UK Conformity Assessment (UKCA).

Logistical and Freight Challenges

Beyond supply and demand, inflation and availability problems has been further compounded by a number of issues related to freight and logistics, in 2021 we had the Suez Canal logjam, Brexit and pandemic uncertainty. An ongoing shortage of lorry drivers has also been reported and has put upward pressure on transport costs. Whilst shipping freight prices did ease in 2022, the invasion of Ukraine has pushed up fuel prices.

Squeezing the supply chain

A key concern is that in the wake of double digit inflation in the price of some materials and increasing labour costs and despite an increasingly healthy pipeline, we are not seeing equivalent inflation in tender prices, which means margins are likely to be squeezed and in extreme cases businesses could be driven into recession.

The latest tender price reports from MACE is showing that current tender price inflation ran at 7.5% in 2021 and were expected to rise by 5.5% in 2022, this is below the rate of inflation.

How can I track and report price movements?

There isn’t currently an index of prices specific to products in the Finishes and Interiors Sector, but you can draw out the main material movements via the Office of National Statistics, note this is lagging and prices are changing fairly rapidly at the moment. It also doesn’t necessarily reflect prices on the ground due to specific grades/distribution buffering etc.

The World Bank commodity price index and London Metals Exchange give a high level picture, but doesn’t get into the detail on products used in the finishes and interiors sector.

The RICS publish the annually the BCIS Material Price Index

Probably the best reference is via the merchant groups, for example :

For the sake of balance, if you publish a similar index, please don’t hesitate to pop a link over by email or in the chat and we’ll include it here.

FIS track labour prices on a half yearly basis with information available to contributors. If interested in learning more email iainmcilwee@thefis.org.

Top tips for contracting in a high inflationary market

FIS have produced a new factsheet for members looking at some standard clauses to include with quotations and top tips for contracting at a time of high inflation.

Build UK have also produced information to inform the entire supply chain on how to manage relationships in an uncertain inflationary environment

Bring your concerns to FIS

If you feel you are being treated unfairly, talk to us, we will do what we can. We can, through our own contacts in the industry, the CLC and contact with the Small Business Commissioners Office and Civil Service shine a light on negative trends and poor behaviour, it can be done anonymously and handled sensitively so as not to damage your relationships.

FIS is urging the supply chain to heed the advice of the Construction Leadership Council and adopt a collaborative approach and ensure that there is ongoing and open communication through the supply chain and we are doing all we can to work together rather than tearing lumps off of each other.

Too often construction get contractual and adopts a siege mentality, parcelling up and firing risk out hoping it sticks elsewhere. The much talked about transformation must start now, rather than pushing risk down the supply chain, we need to be communicating with clients, helping them to understand that these events are beyond the control of individual companies and we need to work together to resolve and manage.

Our supply chain has had an unprecedented and difficult year, we need to nurture it back to health, not return to old and punitive ways that will ultimately drive people out of business to the detriment of all.

Useful links:

FIS Webinar: Managing your business in a time of shortage – Listen again here

You can access the latest Construction Leadership Council Product Availability Statement here (27 July 2022).

by Iain McIlwee | Mar 24, 2023 | Building Safety Act

FIS CEO Iain McIlwee reports on the Building Safety Regulators Conference held on Wednesday 22 March.

This Wednesday I attended a full day conference organised by the Building Safety Regulator, along with around a thousand people from across construction and property management. There was a lot to digest, but the key point is that, whilst there is still much to be done, they are sticking to the original implementation timeline. The Regulator becomes fully active next month with the Registration of occupied High-Risk Buildings becoming mandatory. This is significant as it brings greater and clearer responsibility on individuals to ensue that a building is safe and there is a plan in place to keep it that way and it reminds us all that people are at the heart of building safety.

The next key point and they finished with this to emphasise, is that The Building Safety Act is not just about high-risk buildings. For these there is an enhanced oversight system being put in place by way of Gateways. For all other buildings, the key recommendations set down in the consultation will be carried through in secondary regulation – still a bit of parliamentary scrutiny required, so not set in stone, but basically the alignment of Building Safety with the existing CDM requirements is critical. These changes are focussed on cultural change in and tighter controls for construction. The phrase used was from Shed to Shard

What does it mean if you are working on High Risk Buildings?

Get your head around Gateways. If working on High Risk Buildings, familiarise yourself with the additional information requirements at Gateway 2 (i.e. how are you going to convince the Regulator that you have a workable design and effective delivery/information management plan) and Gateway 3 (prove that you stuck to and built it as per the plan). Photographic evidence will be key – the regulator will want reassurance that the stuff they can’t see was done right – controls and procedures are in place to manage the process, competence and communication. Any changes on the fly will need to be documented, and in many cases, approved by the regulator before progressing. The Regulator will want to see buildability considered to limit the need for change on site.

Buildings will be required to go through these Gateways from October. A cautionary tale was that 50% of Buildings did not meet Gateway 1 (Planning and Fire Plan) requirements. The Regulator is primarily interested in fire and structure, but we were repeatedly reminded that meeting all of the Building Regulations is a requirement. They expect the process to be dynamic between the Gateways to minimise any hold ups, but these are hold points, hard stops.

The key to making it through the Gateways is evidence, evidence, evidence. A number of the discussions centred on what Stage (according to the Plan of Works) the design is expected to be at before you can proceed through Gateway 2. In one of the presentations it was confirmed that design should be completed to Stage 4 (Technical Design) before you can go through the Gateway and Stage 5 (Construction) can begin. There was mention of the series of gateways, but my impression was that whilst the regulations do make allowances for exceptions, exceptions should be that. To emphasise this the impact of design changes on weight was used as an example. If you don’t know how you are building it, how can you fully understand and detail the loadings?

Will it really have much impact on the wider building sector?

Emphatically Yes – in fact this was a big part of the summing up. Effectively this is not a change to the Building Regulations, but a massive change to the regime and processes expected to evidence compliance. Building Control is being subjected to wholesale change, a much more robust competency regime with greater emphasis on process. Greater granularity is to be expected – their focus will be on competence, control and evidence. We can expect more testing questions as Approved Inspectors become Registered Building Control Inspectors and are subjected to more independent scrutiny and tighter controls. The process will be very much aligned to the existing CDM Regulations and “as built”. Within this, the statutory duty holder roles will apply to all projects. The Principal Designer (PD) role got a fair bit of attention and it was clearly news to some that this statutory role relates to all projects – significantly the PD will be accountable and need to provide confirmation that the requirements of the building regulations have been met.

There are still a few things to iron out, one issue discussed was whether CDM and Building Safety could be separated and administered by two PD’s (in theory yes, but the intent seems to be that one PD should be the norm). Another question asked was whether this would mark the end of D&B. It doesn’t, the regulation are being written to allow, but it should be the death knoll for design and dump – with the PD and Designer Roles so closely regulated I simply can’t see how scope of design can be limited in the way we often see it now.

The key for Contractors is to ensure they can demonstrate competence – that is confidence that individuals have the skills, knowledge, experience and behaviours necessary and organisational capability (management policies, procedures, systems and resources) to meet the requirements of the building regulations.

Other key takeaways

It was encouraging to hear the FIS work in helping to establish the Passive Fire Knowledge Group recognised in one of the panel discussions as a good example of taking responsibility and trying to align the supply chain to confront issues before we get to them. It was also good to hear the work we have done on developing competency frameworks acknowledged and the whole super system concept that we have been focussed on getting a mention with the finishes and interiors talked about in this context.

From the perspective of the new building control procedures, all of this will come at a cost – the term “cost recoverable” was used to describe the work of the regulator. If you are planning jobs for the future, do have a think about the additional costs in terms of compliance and potential fees. Significantly if you are working on High Risk Buildings, double check contracts for causes of delay too.

The final and heavily reinforced message was don’t wait, start making changes. The words “ongoing”, “transition”, “looking into that” and “in progress” were all used and there is a realisation that there is still much to be done. All the detail isn’t yet in hand, but this will come in the secondary regulation over the coming months (it will be subject to Parlimentary scrutiny which may change and possibly delay aspects), but Regulator is scaling up and the direction of travel set down in the consultation in October doesn’t seem to have been diverted far so it is time to get cracking!

Useful Links to help you start preparing:

- FIS Summary of response to the October consultation of reforms to the Building Regulations

- FIS Guide to Developing a Competency Management Plan

- BuildUK Guide to the Building Safety Act (Available to FIS Members Only)

- Start looking at your quality management procedures – FIS PPP Quality Risk Management Toolkit

by Iain McIlwee | Mar 17, 2023 | Building Safety Act, Technical

FIS has today responded to the the Department for Levelling Up Housing and Communities (DLUHC) consultation on changes to the guidance in England using Approved Document B (ADB). This consultation includes the recommendation to remove national classes using the BS476 series as a method of demonstrating compliance.

The reason behind the change is that potential flaws in Approved Document B and the use of the national classification standards for Reaction to Fire and Fire Resistance were identified in both the Building A Safer Future work and during the Grenfell Inquiry. As part of this, it was highlighted that the BS476 series standards have not been reviewed by the British Standards Institution (BSI) in detail for some time (typically over 20 years) whereas the European equivalents continue to be updated on a regular basis.

Through an extensive consultation with members concerns have been raised that this approach would be more problematic when looking at Fire Resistance. Here manufacturers have been more heavily reliant on testing to British Standards. This test evidence would all be rendered defunct by the proposed change and a substantial programme of retesting will be required to support the determination of products and systems commonly used today.

Click here for a fully copy of the FIS Position Paper and Response to Consultation on Omitting National standards from ADB March 2023

You can see a full copy of the consultation which closes on the 17th March here. Please do consider adding your own response.

by Iain McIlwee | Mar 17, 2023 | Main News Feed

The Competition and Markets Authority announced that they have launched a market study focused on housebuilding in England, Scotland and Wales. Alongside this, they have also launched a separate project on consumer rights in rented homes. The CMA’s market study into housebuilding will focus on four areas: Housing qualities, land management, local authority oversight, and innovation.

The CMA’s consumer enforcement work in housing will focus on: the end-to-end experience from a tenant’s perspective and identifying the consumer protection issues that may arise. The full announcement with further details can be found here.

FIS Members will note that all meetings start with a clear statement:

Members are reminded they agree to conform to FIS policy to comply with the Competition Act 1998. The meeting is convened and held in accordance with the Memorandum and Articles of Association of FIS and the regulations made by the Association. The Association has in place procedures to ensure compliance with all relevant competition laws and the meeting is subject to those procedures.

New guidance was published for all members through BuildUK in 2022 to help support compliance through your business.

You can download the latest guidance on complying with UK Competition Law here

by Iain McIlwee | Mar 16, 2023 | Labour

FIS welcomes the announcement in the Budget that the MAC has added a number of new construction trades to the Shortage Occupation List and opted to add Dry Lining to the list of occupations in the Skilled Worker List. This is significant as it potentially provides access to a controlled immigration process that will support the sector in managing any existing or upcoming shortages in our workforce. Other trades most relevant to the finishes and interiors sector now included on the Shortage Occupation List are plastering and carpentry and joinery (both of which were already on the Skilled Worker List).

In advance of starting the full SOL review, MAC were, in advance of the Budget expedited review of occupations in the construction and hospitality sectors, recommending the addition of eligible occupations to the SOL and RQF 1-2 occupations to the Skilled Worker (SW) route where appropriate.

To be eligible for the SOL, an occupation must fulfil the eligibility requirements of the SW route. A job must be classified into a Regulated Qualifications Framework (RQF) level 3-5 skill group or above and meet a minimum annual salary threshold. The Government has uprated these thresholds as part of the routine Spring package of Immigration Rules that were laid on 9 March 2023, following which (subject to Parliamentary approval) this minimum threshold will be £26,200. For this review, the Government have asked that we also consider currently ineligible RQF 1-2 occupations for possible inclusion on the SOL. However, the Government have made clear that such inclusion should be rare, and so the bar is high for such occupations to be added.

Table 5.3: Recommendations for occupations in construction

|

SOC |

Description |

Decision |

|

5311 |

Steel erectors |

Do not recommend for addition to the SOL |

|

5312 |

Bricklayers and masons |

Recommend for addition to the SOL |

|

5313 |

Roofers, roof tilers and slaters |

Recommend for addition to the SOL |

|

5315 |

Carpenters and joiners |

Recommend for addition to the SOL |

|

5319 |

Construction and building trades n.e.c. |

Recommend for addition to the SOL |

|

5321 |

Plasterers |

Recommend for addition to the SOL and recommend that ‘Dryliners’ but not ‘Ceiling fixers’ are moved to this SOC code |

|

8141 |

Scaffolders, stagers and riggers |

Do not recommend for addition to the SOL |

|

8142 |

Road construction operatives |

Do not recommend for addition to the SOL |

|

8149 |

Construction operatives n.e.c. |

Do not recommend for addition to the SOL Recommend that ‘Dryliners’ but not ‘Ceiling fixers’ are moved from this SOC code to SOC code 5321 (Plasterers) |

|

8229 |

Mobile machine drivers and operatives n.e.c. |

Do not recommend for addition to the SOL |

|

9120 |

Elementary construction occupations |

Do not recommend for addition to the SOL |

By moving Dry Lining into the Standard Occupation Classification area 5321 (as per FIS recommendation and lobbying work on the SOC), Dry Lining is now also shares skilled worker status with Plastering for the purposes of being a Skilled Worker.

Commenting on the changes, FIS CEO Iain McIlwee stated:

“It is a relief to finally see Dry Lining recognised as both a skilled occupation and also the shortages that we face as a sector. This is something FIS have been campaigning on for a number of years and I am grateful to colleagues from across the Construction Leadership Council for their efforts in helping to effect this exceptional change and thankful that we now have some movement. We now need to respond to the detailed review taking place to identify other areas of concern and revisit the sponsor and visa process to better understand any further blockers and issues”.

by Iain McIlwee | Mar 14, 2023 | Labour, Main News Feed

The Construction Leadership Council has published its report of shortage occupations in construction and its updated guidance to help construction businesses access the Points Based Immigration System.

In February 2023, the CLC submitted stakeholder evidence to the Migration Advisory Committee (MAC), detailing shortage occupations that could be considered for inclusion on the Shortage Occupation List of the UK’s Points Based Immigration System, as well as potential roles to be added to the Skilled Worker route.

The CLC’s Movement of People Working Group compiled a comprehensive report, detailing its recommendations, an evidence base, the actions industry is taking to increase the domestic workforce as well as other ideas to help tackle skills shortages.

The CLC recommended the following occupations for inclusion on the Shortage Occupation List:

- Plasterers, Dry Liners and Ceiling Fixers

- Carpenters and Joiners

- General Labourers

- Bricklayers and Masons

- Ground Workers

- Piling Rig Operatives

- Plant Operatives

- Retrofit Co-ordinators

- Road Construction Operatives

- Roofers, Roof Tilers and Slaters

- Scaffolders, Stagers and Riggers

- Steel Erectors

- Thermal Insulators

The MAC is expected to report on construction shortages in due course.

Commenting, Co-Chair of the CLC and Group Chairman and CEO of MACE, Mark Reynolds said:

“The CLC is committed to building our domestic construction workforce and championing construction as one of the best career choices for new entrants but the fact is we are still currently facing chronic shortages. A dynamic immigration system allows us to bridge gaps in workforce need and meet the people requirement for the sector’s pipeline of work. That’s why we are calling for the inclusion of these occupations in the shortage occupation list, to help make it a little easier to access the right people, at the right time’.

FIS CEO, Iain McIlwee added:

“Data from our recent Skills Pulse Survey underpins that 40% of businesses are still experiencing shortages in skilled labour and this is likely to worsen as volumes pick up constraining potential growth. The training sector is rapidly scaling up, but doesn’t provide a quick fix. We are grateful to colleagues from across the construction sector for pulling together and pooling our resources to help make this detailed submission to Government and the MAC and focussing on how we can add a bit of flexibility to the system”.

Access the full report here.

Access the CLC’s revised 2023 Immigration Guidance ‘Movement of People – What you should know’ here.

Page 1 of 1312345...10...>Last