by Iain McIlwee | 31 Mar, 2023 | Transformation

In March FIS attended a round table with CLC and Government officials to look into payment practices, retention and support available through regulation via the Duty to Report. I think there is a desire from Government to beef things up a bit to support SMEs, but we need to ensure that they see votes in change and that small businesses feel strongly about it – so to get change over the line we need your help. We will, but we also need you to respond to the consultation.

What is the aim in all this?

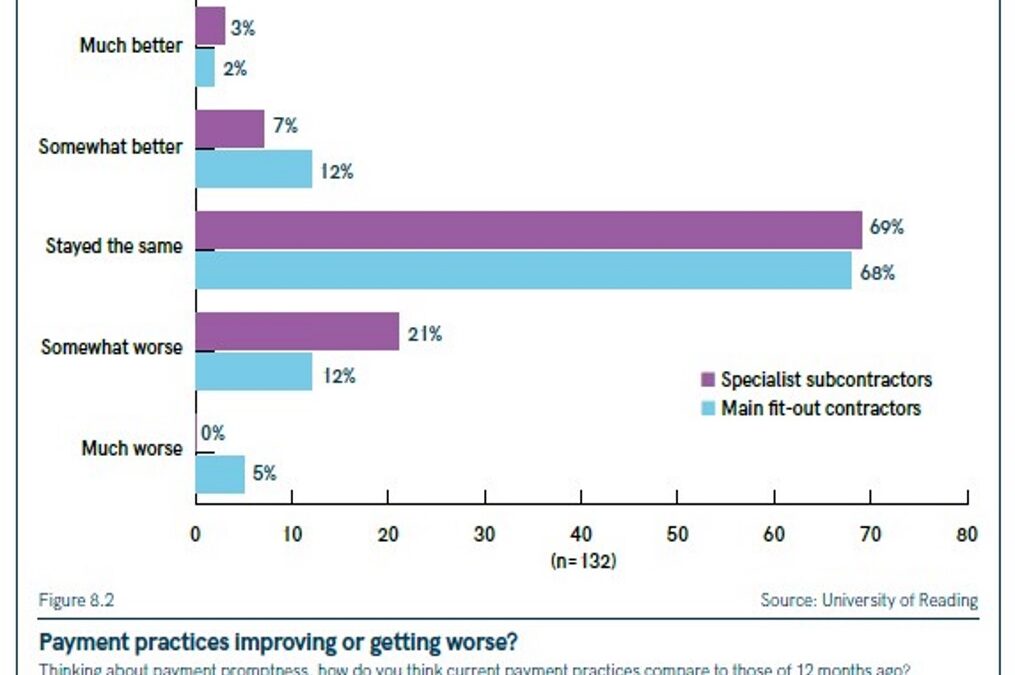

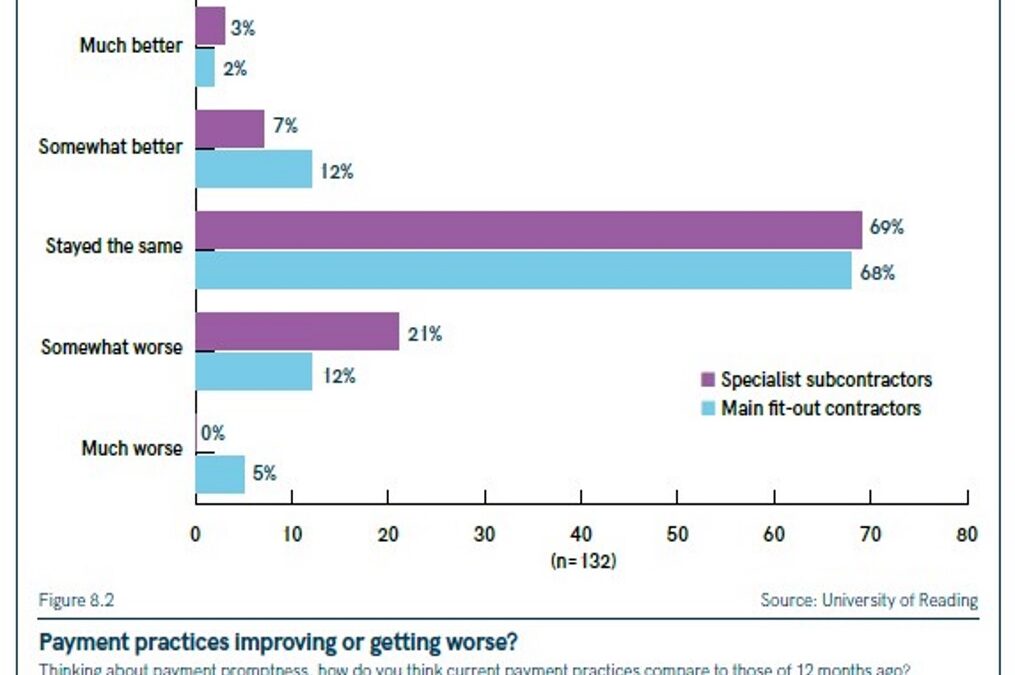

Recent headlines that payment practices in construction are improving are, at best, misleading. Our own research with the University of Reading (shown in the chart at the top of this page) tells us that, for most in our sector, it is no better and, for nearly a quarter of specialists, it is worsening. The improvement headlines ring particularly hollow when we see the human impact of poor practice and you know and care for the people that our QS helpine has been working with – it is not just cashflow and the cost of money that concerns us, the stress and human toil of poor payment is literally sickening.

Where the market fails to correct we need regulation to drive better behaviour. Effective Regulation needs three things, a clear and proportionate set of rules and scope, an mechanism to measure and impactful enforcement.

Why does official data suggest it is getting better, but I am not seeing any (positive) change?

The old addage… lies, damned lies and statistics comes to play here. The headlines are based on information extracted from the Duty to Report. The concept of the Duty to Report is it exposes payment practices – it compells larger businesses (those that satisfy two of the following £36 million in turnover, £18 million on its balance sheet and 250 employees) to formally report on payment times against an agrreed criteria. This means Government can make procurement decisions based on it, have a formal measure to support initiative like the Prompt Payment Code and equally SMEs can check theoretically check a company’s payment history (here) to help decide if you want to work with them. It is a good concept in that it highlights a problem, but the issue is that it is poorly delivered.

The underlying problem is that companies only report on volume of invoices, not value. Ten tiny invoices (for e.g. stationary) can drown out one huge invoice for construction. She system can be gamed by selecting what invoices to pay early to mask that you are paying the big ones late. Thus you can still continue to use the supply chain as a free line of credit and still look good on paper!

The other big issue for construction is that it measures invoice payment, but in the complex world of applications, valuations, pay less notices and certification the invoice is not . The guidance is actually fairly cut and dry:

- For construction contracts in scope of the Housing Grants, Construction and Regeneration Act 1996 or the Construction Contracts (Northern Ireland) Order 1996, businesses must use the earliest point at which they have notice of an amount for payment.

- This would generally be the date they receive an application for payment or, in cases where there is no application for payment, the date on which they receive a payment notice (or default payment notice) or on which they issue a payment notice – whichever is earliest. Day 1 of the time taken to pay will be the day after the day on which the business has this notice.

but, guidance is not regulation and frankly there are no meaningful checks and balances on how people are reporting. In fact in our digging, it was identified that there have been only 18 investigations and no prosecutions. Without proper checks and balances and strong enforcement, regulation is about as useful as a chocolate teapot!

Aren’t we supposed to be getting rid of retention by 2025?

The CLC roadmap to zero retentions does say that they should be phased out no later than 2025, but like so many ‘Roadmaps’ we seem to have lost the road!! I remain concerned that retention debate often gets derailed by trying to solve two problems at once. For me there are two distinct parts to this debate:

1. the underlying concept of retention – how we work, as a sector, manage trust and quality with clients to evolve away from retention and ultimately how our Standard form Contracts support this evolution.

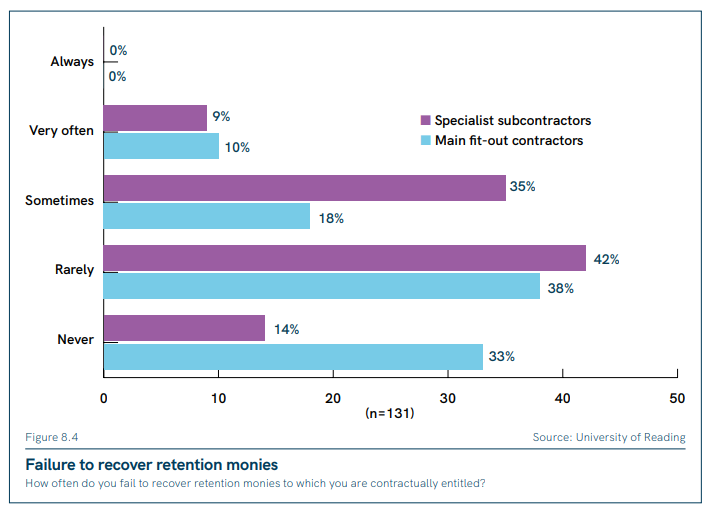

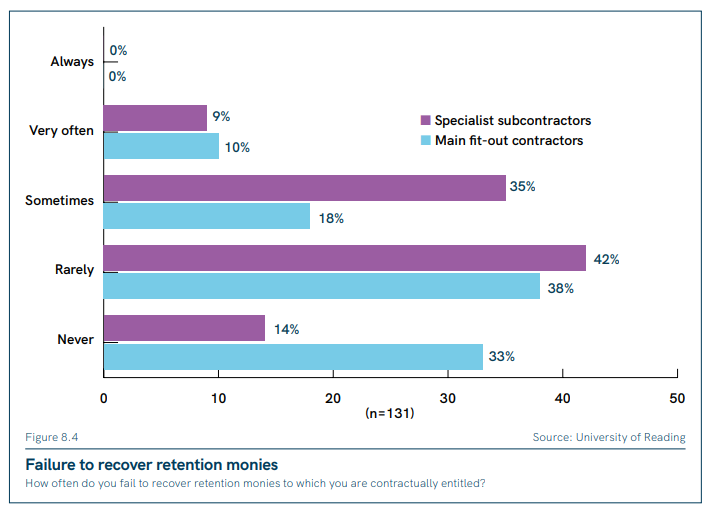

2. how they are fairly and consistently deployed within the supply chain – a key conclusion from our research is that they aren’t and the further down the supply chain, the less likely you are to actually get your retention.

I know it is more nuanced than that in terms of why and whether people have claimed, but for whatever reason the retention isn’t cascading smoothly (certainly not automatically). If you think of certain parts of our market, the low margin means that the tier one is making around 3% profit on average – the value of retention effectively sit at their approximate profit. Whilst there is a cash concern that more might be held against than they hold, the motivation for the less scrupulous in the supply chain, the difference between the 33% of main contractors and 14% of specialists always securing retention is about 19% of profit. For this reason FIS can continue to advocate for the ultimate abolition of retention, but in the interim, to ensure that retentions are protected and AUTOMATICALLY RELEASED based on a defined date (rather than abstract event).

So what do we need you to do?

The purpose of this post is not to rant about things we all know, but to emphasise that FIS reserach is helping to inform a debate which is happening and there does now seem geniune interest from Government in addressing some of these issues and appreciation that continued nefarious practices in construction undermine the cultural changes that they want to see. This is where you come in…

Full details of the Payment Practices and Performance Regulations 2017 consultation here

You can respond via the webiste or by copying and adapting (where you feel necessary) below in an email to the consultation questions to responsiblepaymentculture@beis.gov.uk (by 11.45pm 28th April 2023).

We have with colleagues representing specialists set down a template response that you can be downloaded below, but remember this is your response so do feel free to edit/ammend and add any personal comments or experience to help support understanding and change.

You can download the FIS template response here

Please do send us your response so we can factor in any additional points to the core FIS input on this. Thanks for your support – together we are stronger.

Iain McIlwee

CEO, Finishes and Interiors Sector

PS Through this process we are always looking for feedback on our Procurement Research recently completed with the University of Reading that may help you with your response.

PPS For support in managing your contractual responsibility, including the new Best Practice Guide that FIS has helped develop with the CICV in Scotland and standard Terms and Conditions launched in 2023.

by Iain McIlwee | 27 Mar, 2023 | Labour, Main News Feed, Material Shortages

FIS Position and Support on Inflation and Material Shortages

The past two years have, without doubt, been some of the hardest times businesses in the finishes and interiors sector have faced. Uncertainty and challenge continues into 2023.

The underlying trend began post COVID with the RICS reporting construction materials costs in the UK had already reached a 40 year high based on the annual growth of the BCIS Materials Cost Index by the end of 2021. According to Joe Martin, BCIS Lead Consultant “The pressure on materials prices and availability is expected to continue at least until the end of 2022. Labour shortages are expected to evolve as the significant driver for overall construction cost increases next year and the construction sector would need to compete for it with other sectors”.

After this rapid inflation in 2021 across all material groups, 2022 started with concerns around the impact of ongoing labour shortages and the escalation of tragic events in Ukraine put further pressure on energy and fuel prices adding to pressure on the supply chain. This has resulted in the announcement of further price increases throughout 2022 and rapid inflation for key materials, fuel and energy. Of particular concern for FIS members are increases in insulation, steel and plasterboard.

The Construction Products Association have prepared for FIS Members an update on the wider impacts of this tragic conflict.

Keeping an eye on your contracts

Where this impacts existing contractual relationships members are reminded to check contractual terms and consider the relevance and application of any fluctuation clauses. If you are unable to rely on standard fluctuation clauses, an early conversation with your client in terms of your ongoing ability to fulfil the contract in the wake of rapid and unexpected price increases is essential.

Where you are currently tendering, consider carefully the impact of the current inflationary environment, look to link any fluctuation to material and product prices rather than general inflation or ensure that quotes are time stamped and limited. Where you cannot negotiate a shared risk approach with your client, you need to seriously consider what could worse case scenario mean to your business if prices drifted?

We encourage all in the construction sector to consider seriously the impact of imposing fixed prices at this time. The sector is working on every tighter margins and this could impact the resilience and ongoing viability of of businesses in the supply chain. Where concerns are raised, a pragmatic, understanding and collaborative approach is essential. It is vital that we work together to avoid conflict and we further encourage all companies to consider signing and adopting the principles set down in the Conflict Avoidance Pledge that has be developed by the Royal Institute of Chartered Surveyors (RICS) and endorsed by the Construction Leadership Council (CLC).

Below we provide some information on the market forces that are resulting in ongoing inflationary pressures and additional advice and guidance related to managing businesses and contracts in a high inflation environment.

The aim is to keep it refreshed so our members are have a clear picture and can have informed decisions up and down the supply chain.

When can we expect an end to all of this?

Whilst the rate of inflation is expected to slow in 2023, the situation remains volatile. With such a perfect storm of complex and cumulative issues it is difficult to know when we will start to notice improvement or how much worse things may get. The old adage hope for the best, but prepare for the worst comes to mind.

The FIS is an active participant in the Construction Leadership Council who continue to monitor the situation through a dedicated working group of subject experts – you can access the latest Construction Leadership Council Product Availability Statement here.

Energy Prices and Other Global Issues

As we step into 2023 the tragic events in Ukraine continues to impact oil and gas prices and hence energy costs across the world into a period or rapid inflation which is now feeding through into the price of construction products and logistics. In the period 1 April 2021, wholesale gas had risen from around of 50p/therm to around £2.80/therm by the end of March 2022.

You can track natural gas prices here.

Whilst the UK in not overly reliant on Russia or Ukraine for construction products (which together account for just 1.2% of imports of construction products, some areas such as flat glass and certain timber products have a more significant share from these markets. Projects could also be impacted by shortages of products such as concrete reinforcing bars or other unrelated shortages (such as bricks) which are still ongoing.

The global situation remains volatile and it is impossible to predict accurately the ongoing impact on material and product prices. Beyond the escalation in Ukraine, tension between the US and China and genuine concerns about UK Conformity Assessment (UKCA).

Logistical and Freight Challenges

Beyond supply and demand, inflation and availability problems has been further compounded by a number of issues related to freight and logistics, in 2021 we had the Suez Canal logjam, Brexit and pandemic uncertainty. An ongoing shortage of lorry drivers has also been reported and has put upward pressure on transport costs. Whilst shipping freight prices did ease in 2022, the invasion of Ukraine has pushed up fuel prices.

Squeezing the supply chain

A key concern is that in the wake of double digit inflation in the price of some materials and increasing labour costs and despite an increasingly healthy pipeline, we are not seeing equivalent inflation in tender prices, which means margins are likely to be squeezed and in extreme cases businesses could be driven into recession.

The latest tender price reports from MACE is showing that current tender price inflation ran at 7.5% in 2021 and were expected to rise by 5.5% in 2022, this is below the rate of inflation.

How can I track and report price movements?

There isn’t currently an index of prices specific to products in the Finishes and Interiors Sector, but you can draw out the main material movements via the Office of National Statistics, note this is lagging and prices are changing fairly rapidly at the moment. It also doesn’t necessarily reflect prices on the ground due to specific grades/distribution buffering etc.

The World Bank commodity price index and London Metals Exchange give a high level picture, but doesn’t get into the detail on products used in the finishes and interiors sector.

The RICS publish the annually the BCIS Material Price Index

Probably the best reference is via the merchant groups, for example :

For the sake of balance, if you publish a similar index, please don’t hesitate to pop a link over by email or in the chat and we’ll include it here.

FIS track labour prices on a half yearly basis with information available to contributors. If interested in learning more email iainmcilwee@thefis.org.

Top tips for contracting in a high inflationary market

FIS have produced a new factsheet for members looking at some standard clauses to include with quotations and top tips for contracting at a time of high inflation.

Build UK have also produced information to inform the entire supply chain on how to manage relationships in an uncertain inflationary environment

Bring your concerns to FIS

If you feel you are being treated unfairly, talk to us, we will do what we can. We can, through our own contacts in the industry, the CLC and contact with the Small Business Commissioners Office and Civil Service shine a light on negative trends and poor behaviour, it can be done anonymously and handled sensitively so as not to damage your relationships.

FIS is urging the supply chain to heed the advice of the Construction Leadership Council and adopt a collaborative approach and ensure that there is ongoing and open communication through the supply chain and we are doing all we can to work together rather than tearing lumps off of each other.

Too often construction get contractual and adopts a siege mentality, parcelling up and firing risk out hoping it sticks elsewhere. The much talked about transformation must start now, rather than pushing risk down the supply chain, we need to be communicating with clients, helping them to understand that these events are beyond the control of individual companies and we need to work together to resolve and manage.

Our supply chain has had an unprecedented and difficult year, we need to nurture it back to health, not return to old and punitive ways that will ultimately drive people out of business to the detriment of all.

Useful links:

FIS Webinar: Managing your business in a time of shortage – Listen again here

You can access the latest Construction Leadership Council Product Availability Statement here (27 July 2022).

by Iain McIlwee | 24 Mar, 2023 | Building Safety Act

FIS CEO Iain McIlwee reports on the Building Safety Regulators Conference held on Wednesday 22 March.

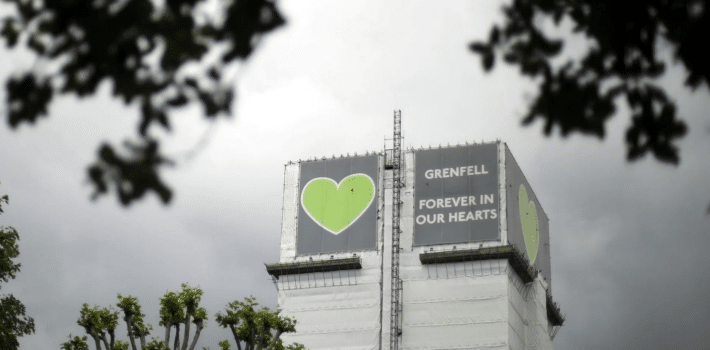

This Wednesday I attended a full day conference organised by the Building Safety Regulator, along with around a thousand people from across construction and property management. There was a lot to digest, but the key point is that, whilst there is still much to be done, they are sticking to the original implementation timeline. The Regulator becomes fully active next month with the Registration of occupied High-Risk Buildings becoming mandatory. This is significant as it brings greater and clearer responsibility on individuals to ensue that a building is safe and there is a plan in place to keep it that way and it reminds us all that people are at the heart of building safety.

The next key point and they finished with this to emphasise, is that The Building Safety Act is not just about high-risk buildings. For these there is an enhanced oversight system being put in place by way of Gateways. For all other buildings, the key recommendations set down in the consultation will be carried through in secondary regulation – still a bit of parliamentary scrutiny required, so not set in stone, but basically the alignment of Building Safety with the existing CDM requirements is critical. These changes are focussed on cultural change in and tighter controls for construction. The phrase used was from Shed to Shard

What does it mean if you are working on High Risk Buildings?

Get your head around Gateways. If working on High Risk Buildings, familiarise yourself with the additional information requirements at Gateway 2 (i.e. how are you going to convince the Regulator that you have a workable design and effective delivery/information management plan) and Gateway 3 (prove that you stuck to and built it as per the plan). Photographic evidence will be key – the regulator will want reassurance that the stuff they can’t see was done right – controls and procedures are in place to manage the process, competence and communication. Any changes on the fly will need to be documented, and in many cases, approved by the regulator before progressing. The Regulator will want to see buildability considered to limit the need for change on site.

Buildings will be required to go through these Gateways from October. A cautionary tale was that 50% of Buildings did not meet Gateway 1 (Planning and Fire Plan) requirements. The Regulator is primarily interested in fire and structure, but we were repeatedly reminded that meeting all of the Building Regulations is a requirement. They expect the process to be dynamic between the Gateways to minimise any hold ups, but these are hold points, hard stops.

The key to making it through the Gateways is evidence, evidence, evidence. A number of the discussions centred on what Stage (according to the Plan of Works) the design is expected to be at before you can proceed through Gateway 2. In one of the presentations it was confirmed that design should be completed to Stage 4 (Technical Design) before you can go through the Gateway and Stage 5 (Construction) can begin. There was mention of the series of gateways, but my impression was that whilst the regulations do make allowances for exceptions, exceptions should be that. To emphasise this the impact of design changes on weight was used as an example. If you don’t know how you are building it, how can you fully understand and detail the loadings?

Will it really have much impact on the wider building sector?

Emphatically Yes – in fact this was a big part of the summing up. Effectively this is not a change to the Building Regulations, but a massive change to the regime and processes expected to evidence compliance. Building Control is being subjected to wholesale change, a much more robust competency regime with greater emphasis on process. Greater granularity is to be expected – their focus will be on competence, control and evidence. We can expect more testing questions as Approved Inspectors become Registered Building Control Inspectors and are subjected to more independent scrutiny and tighter controls. The process will be very much aligned to the existing CDM Regulations and “as built”. Within this, the statutory duty holder roles will apply to all projects. The Principal Designer (PD) role got a fair bit of attention and it was clearly news to some that this statutory role relates to all projects – significantly the PD will be accountable and need to provide confirmation that the requirements of the building regulations have been met.

There are still a few things to iron out, one issue discussed was whether CDM and Building Safety could be separated and administered by two PD’s (in theory yes, but the intent seems to be that one PD should be the norm). Another question asked was whether this would mark the end of D&B. It doesn’t, the regulation are being written to allow, but it should be the death knoll for design and dump – with the PD and Designer Roles so closely regulated I simply can’t see how scope of design can be limited in the way we often see it now.

The key for Contractors is to ensure they can demonstrate competence – that is confidence that individuals have the skills, knowledge, experience and behaviours necessary and organisational capability (management policies, procedures, systems and resources) to meet the requirements of the building regulations.

Other key takeaways

It was encouraging to hear the FIS work in helping to establish the Passive Fire Knowledge Group recognised in one of the panel discussions as a good example of taking responsibility and trying to align the supply chain to confront issues before we get to them. It was also good to hear the work we have done on developing competency frameworks acknowledged and the whole super system concept that we have been focussed on getting a mention with the finishes and interiors talked about in this context.

From the perspective of the new building control procedures, all of this will come at a cost – the term “cost recoverable” was used to describe the work of the regulator. If you are planning jobs for the future, do have a think about the additional costs in terms of compliance and potential fees. Significantly if you are working on High Risk Buildings, double check contracts for causes of delay too.

The final and heavily reinforced message was don’t wait, start making changes. The words “ongoing”, “transition”, “looking into that” and “in progress” were all used and there is a realisation that there is still much to be done. All the detail isn’t yet in hand, but this will come in the secondary regulation over the coming months (it will be subject to Parlimentary scrutiny which may change and possibly delay aspects), but Regulator is scaling up and the direction of travel set down in the consultation in October doesn’t seem to have been diverted far so it is time to get cracking!

Useful Links to help you start preparing:

- FIS Summary of response to the October consultation of reforms to the Building Regulations

- FIS Guide to Developing a Competency Management Plan

- BuildUK Guide to the Building Safety Act (Available to FIS Members Only)

- Start looking at your quality management procedures – FIS PPP Quality Risk Management Toolkit

by Iain McIlwee | 17 Mar, 2023 | Building Safety Act, Technical

FIS has today responded to the the Department for Levelling Up Housing and Communities (DLUHC) consultation on changes to the guidance in England using Approved Document B (ADB). This consultation includes the recommendation to remove national classes using the BS476 series as a method of demonstrating compliance.

The reason behind the change is that potential flaws in Approved Document B and the use of the national classification standards for Reaction to Fire and Fire Resistance were identified in both the Building A Safer Future work and during the Grenfell Inquiry. As part of this, it was highlighted that the BS476 series standards have not been reviewed by the British Standards Institution (BSI) in detail for some time (typically over 20 years) whereas the European equivalents continue to be updated on a regular basis.

Through an extensive consultation with members concerns have been raised that this approach would be more problematic when looking at Fire Resistance. Here manufacturers have been more heavily reliant on testing to British Standards. This test evidence would all be rendered defunct by the proposed change and a substantial programme of retesting will be required to support the determination of products and systems commonly used today.

Click here for a fully copy of the FIS Position Paper and Response to Consultation on Omitting National standards from ADB March 2023

You can see a full copy of the consultation which closes on the 17th March here. Please do consider adding your own response.

by Iain McIlwee | 17 Mar, 2023 | Main News Feed

The Competition and Markets Authority announced that they have launched a market study focused on housebuilding in England, Scotland and Wales. Alongside this, they have also launched a separate project on consumer rights in rented homes. The CMA’s market study into housebuilding will focus on four areas: Housing qualities, land management, local authority oversight, and innovation.

The CMA’s consumer enforcement work in housing will focus on: the end-to-end experience from a tenant’s perspective and identifying the consumer protection issues that may arise. The full announcement with further details can be found here.

FIS Members will note that all meetings start with a clear statement:

Members are reminded they agree to conform to FIS policy to comply with the Competition Act 1998. The meeting is convened and held in accordance with the Memorandum and Articles of Association of FIS and the regulations made by the Association. The Association has in place procedures to ensure compliance with all relevant competition laws and the meeting is subject to those procedures.

New guidance was published for all members through BuildUK in 2022 to help support compliance through your business.

You can download the latest guidance on complying with UK Competition Law here

by Iain McIlwee | 16 Mar, 2023 | Labour

FIS welcomes the announcement in the Budget that the MAC has added a number of new construction trades to the Shortage Occupation List and opted to add Dry Lining to the list of occupations in the Skilled Worker List. This is significant as it potentially provides access to a controlled immigration process that will support the sector in managing any existing or upcoming shortages in our workforce. Other trades most relevant to the finishes and interiors sector now included on the Shortage Occupation List are plastering and carpentry and joinery (both of which were already on the Skilled Worker List).

In advance of starting the full SOL review, MAC were, in advance of the Budget expedited review of occupations in the construction and hospitality sectors, recommending the addition of eligible occupations to the SOL and RQF 1-2 occupations to the Skilled Worker (SW) route where appropriate.

To be eligible for the SOL, an occupation must fulfil the eligibility requirements of the SW route. A job must be classified into a Regulated Qualifications Framework (RQF) level 3-5 skill group or above and meet a minimum annual salary threshold. The Government has uprated these thresholds as part of the routine Spring package of Immigration Rules that were laid on 9 March 2023, following which (subject to Parliamentary approval) this minimum threshold will be £26,200. For this review, the Government have asked that we also consider currently ineligible RQF 1-2 occupations for possible inclusion on the SOL. However, the Government have made clear that such inclusion should be rare, and so the bar is high for such occupations to be added.

Table 5.3: Recommendations for occupations in construction

|

SOC |

Description |

Decision |

|

5311 |

Steel erectors |

Do not recommend for addition to the SOL |

|

5312 |

Bricklayers and masons |

Recommend for addition to the SOL |

|

5313 |

Roofers, roof tilers and slaters |

Recommend for addition to the SOL |

|

5315 |

Carpenters and joiners |

Recommend for addition to the SOL |

|

5319 |

Construction and building trades n.e.c. |

Recommend for addition to the SOL |

|

5321 |

Plasterers |

Recommend for addition to the SOL and recommend that ‘Dryliners’ but not ‘Ceiling fixers’ are moved to this SOC code |

|

8141 |

Scaffolders, stagers and riggers |

Do not recommend for addition to the SOL |

|

8142 |

Road construction operatives |

Do not recommend for addition to the SOL |

|

8149 |

Construction operatives n.e.c. |

Do not recommend for addition to the SOL Recommend that ‘Dryliners’ but not ‘Ceiling fixers’ are moved from this SOC code to SOC code 5321 (Plasterers) |

|

8229 |

Mobile machine drivers and operatives n.e.c. |

Do not recommend for addition to the SOL |

|

9120 |

Elementary construction occupations |

Do not recommend for addition to the SOL |

By moving Dry Lining into the Standard Occupation Classification area 5321 (as per FIS recommendation and lobbying work on the SOC), Dry Lining is now also shares skilled worker status with Plastering for the purposes of being a Skilled Worker.

Commenting on the changes, FIS CEO Iain McIlwee stated:

“It is a relief to finally see Dry Lining recognised as both a skilled occupation and also the shortages that we face as a sector. This is something FIS have been campaigning on for a number of years and I am grateful to colleagues from across the Construction Leadership Council for their efforts in helping to effect this exceptional change and thankful that we now have some movement. We now need to respond to the detailed review taking place to identify other areas of concern and revisit the sponsor and visa process to better understand any further blockers and issues”.

by Iain McIlwee | 14 Mar, 2023 | Labour, Main News Feed

The Construction Leadership Council has published its report of shortage occupations in construction and its updated guidance to help construction businesses access the Points Based Immigration System.

In February 2023, the CLC submitted stakeholder evidence to the Migration Advisory Committee (MAC), detailing shortage occupations that could be considered for inclusion on the Shortage Occupation List of the UK’s Points Based Immigration System, as well as potential roles to be added to the Skilled Worker route.

The CLC’s Movement of People Working Group compiled a comprehensive report, detailing its recommendations, an evidence base, the actions industry is taking to increase the domestic workforce as well as other ideas to help tackle skills shortages.

The CLC recommended the following occupations for inclusion on the Shortage Occupation List:

- Plasterers, Dry Liners and Ceiling Fixers

- Carpenters and Joiners

- General Labourers

- Bricklayers and Masons

- Ground Workers

- Piling Rig Operatives

- Plant Operatives

- Retrofit Co-ordinators

- Road Construction Operatives

- Roofers, Roof Tilers and Slaters

- Scaffolders, Stagers and Riggers

- Steel Erectors

- Thermal Insulators

The MAC is expected to report on construction shortages in due course.

Commenting, Co-Chair of the CLC and Group Chairman and CEO of MACE, Mark Reynolds said:

“The CLC is committed to building our domestic construction workforce and championing construction as one of the best career choices for new entrants but the fact is we are still currently facing chronic shortages. A dynamic immigration system allows us to bridge gaps in workforce need and meet the people requirement for the sector’s pipeline of work. That’s why we are calling for the inclusion of these occupations in the shortage occupation list, to help make it a little easier to access the right people, at the right time’.

FIS CEO, Iain McIlwee added:

“Data from our recent Skills Pulse Survey underpins that 40% of businesses are still experiencing shortages in skilled labour and this is likely to worsen as volumes pick up constraining potential growth. The training sector is rapidly scaling up, but doesn’t provide a quick fix. We are grateful to colleagues from across the construction sector for pulling together and pooling our resources to help make this detailed submission to Government and the MAC and focussing on how we can add a bit of flexibility to the system”.

Access the full report here.

Access the CLC’s revised 2023 Immigration Guidance ‘Movement of People – What you should know’ here.

by Iain McIlwee | 23 Feb, 2023 | Labour

Whilst the future of Government Immigration Policy remains somewhat unclear, through the CLC, FIS was asked to respond to the Migration Advisory Committee’s interim review of the construction occupations in the Shortage Occupations List (SOL).

We have responded directly focussing specifically on the status of shortages in the finishes and interiors sector and supported the response from CLC which has called for 17 new occupations to be added to the SOL carpenters, painters and decorators, piling rig operatives, dry liners, ceiling fixers, plasterers, roofers, and scaffolders. The outcome of this interim review is expected in March, with a full review of the SOL due to be undertaken later this year.

To view the FIS response which includes our underlying data click here this drew on data collected throughout the year including our Skills Pulse Survey, this is survey is still open and if you have a few minutes to complete the more data the better.

by Iain McIlwee | 23 Feb, 2023 | Building Safety Act

The Higher‐Risk Buildings (Key Building Information etc.) (England) Regulations, which introduce the requirement for Principal Accountable Persons to register Higher‐Risk Buildings, will come into force on 6 April 2023. Existing Higher‐Risk Buildings must be registered before October 2023 and the Regulations set out the specific information that will need to be provided to the Building Safety Regulator in an electronic format within 28 days of applying to register a building.

A significant amount of information will be required, including the materials used in the structure, roof and external walls; the number of staircases; the fire and smoke control equipment in the building; and the type of evacuation strategy. Detailed guidance from the Building Safety Regulator is expected to be published shortly with full implementation of the Building Safety Act completed by October 2023.

Commenting on this incoming requirement, FIS CEO, Iain McIlwee stated:

“This is an important development and underpins the need for better information management in the sector. For our members, the critical takeaway is that we need to ensure that we are documenting effectively decisions and recording as built.

This hunt for live information has uncovered problems and we are starting to see a growing number of legacy claims hit the press. Within these Design Development elements in the contract are front and centre and proving critical. For projects moving forward, clarification and qualification of design details needs to be an element of pre-construction that should happen at tender stage, not on the site under time and cost pressure.”

FIS is running a Building Safety Act session at our Conference in London on Monday 27th February where we will be looking at common problems, what the inspector will be looking for and how we deliver the Golden Thread. We also have a detailed introducton to the Building Safety Act here that includes a number of tools designed to support compliance, including our new Guide to Developing a Competency Management Plan and Quality Management Toolkit.

For advice and guidance on spotting traps and understanding design liability issues (including how to avoid being the accidental designer) visit the FIS Contractual and Legal Toolkit.

by Iain McIlwee | 22 Feb, 2023 | Material Shortages

Statement from John Newcomb, CEO of the Builders Merchants Federation and Peter Caplehorn, CEO of the Construction Products Association, co-chairs of the Construction Leadership Council’s Product Availability working group

The past month has seen yet more improvements in the balance of product demand and supply, with good availability for most construction products and prices no longer as volatile.

While demand has slowed in recent months, work in every major construction sector, apart from commercial, remains above pre-pandemic levels.

The slowdown has allowed brick manufacturers to rebuild stocks to their highest levels since May 2021. While there are some exceptions, manufacturers are reporting up to 8 weeks supply for most brick types at current demand levels.

The availability of gas boilers has also improved. With their supply chains returning to normal levels, availability increased by over 20% in January 2023 compared with January 2022.

Wholesalers in the electro-technical sector report their number one operational challenge is still “product availability and price issues” with longer lead times experienced for solar products including inverters, batteries and mounting systems.

In addition, the problems in the supply and pricing of EV chargers linked to regulatory changes, reported in detail in our January statement, remain a major concern. Installers should check the provenance with their wholesalers and request a Statement of Compliance and, if applicable, an Enforcement Undertaking.

Currently, there are large stocks of most grades of timber in the UK. The exceptions being birch plywood and Siberian larch cladding, which come from Russia, but substitute products are available.

As reported last month, price inflation has largely stabilised with some suppliers deferring price increase as demand slows. Gas prices appear to be easing and many larger energy intensive manufacturers have likely hedged a high proportion of their energy costs for the year ahead. Nonetheless, the impact on manufacturers from high energy costs often takes months to feed through to product prices – especially for energy-intensive products and materials – so the volatility from late 2022 may still be felt into the spring. Inflationary pressures on other costs, especially labour, continue and may well impact prices later in the year.

The Product Availability Group is monitoring potential impacts from the earthquake in Turkey that could disrupt supply chains. While nothing major has been reported to date, Turkey is one of the world’s largest exporters of raw iron bars and Turkish ports are key connections for steel rebar and structural steel global trade. There may be longer term ramifications, for both materials and labour, when rebuilding begins.

To take part in the latest FIS Wage Rate and Productivity Survey, click here (results are only shared with participants)

For all the work FIS is doing around inflation and availability, including recommended contractual terms click here

by Iain McIlwee | 7 Feb, 2023 | Market data

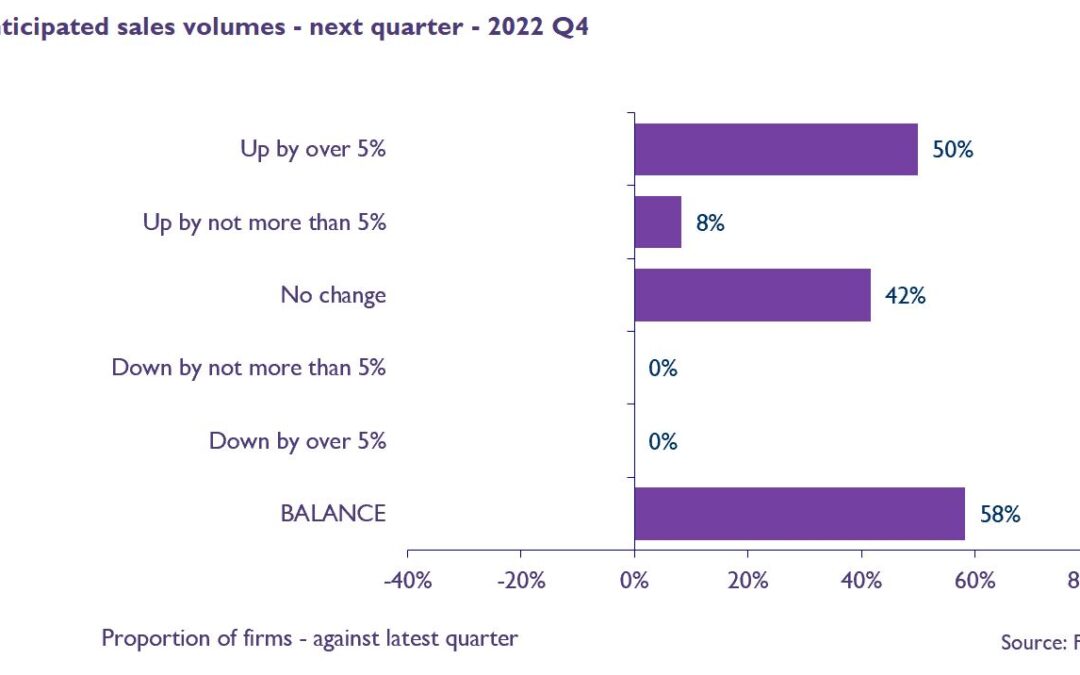

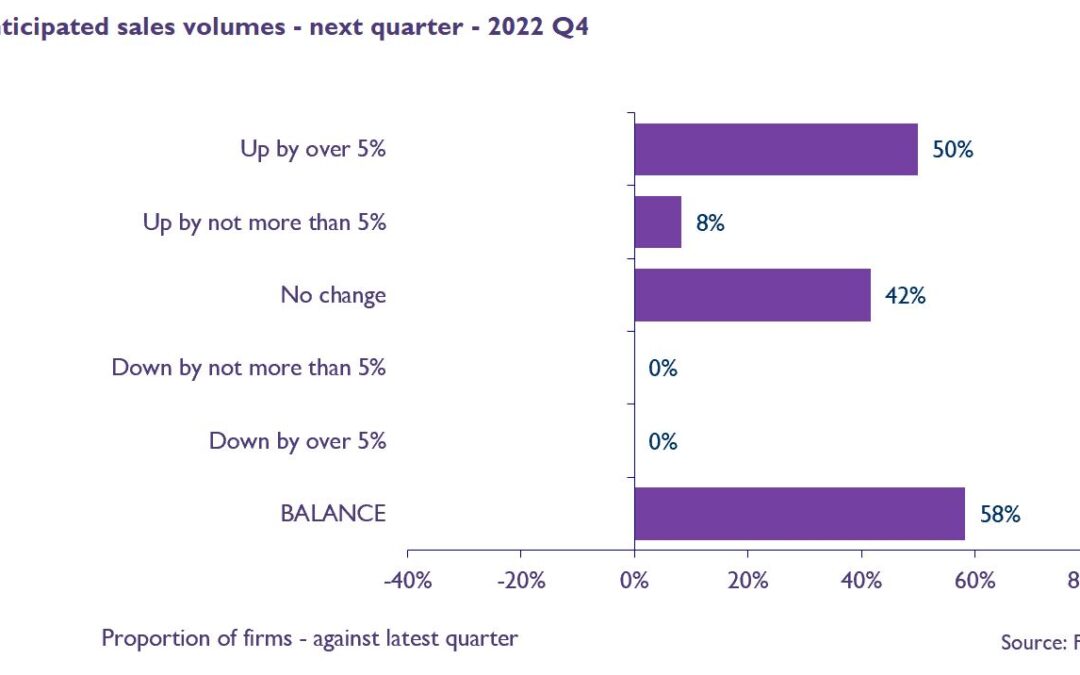

According the the latest FIS State of Trade Survey, the finishes and interiors finished 2022 relatively strongly with a net balance of 42% experienced growth in sales (against 17% in Q3) and 50% of those responding to the FIS State of Trade Survey reporting sales volumes increasing by over 5% (up from 33% reporting the same in Q3).

Looking ahead to 2023, again the picture for sales is more positive than in Q3 with those predicting growth swinging from just 20% to 75%. There is, however, an acceptance that some projects will slip and not all will turn into boots on the ground and the overall impact on anticipated workload is that there is a slight downward trend with just 33% predicting growth (versus 45% in Q3).

The majority anticipate static market conditions for the year ahead, with a small swing in terms of those predicting a decline (up to 26% from 25% last quarter) resulting in a net balance predicting growth of 9%. This is slightly less optimistic than in Q4 2021 when a net balance of 18% were predicting an increase in workloads.

You can read the full findings, including an update on inflation and investment in the FIS State of Trade Survey Q4 2022 here.

FIS data is absorbed into the wider CPA State of Trade Survey – you can see the full results and findings here.

by Iain McIlwee | 1 Feb, 2023 | Transformation

This week Kevin Hollinrake MP, Minister for Enterprise, Markets and Small Business Government opened a consultation into Payment Practices and Performance Regulations 2017. The consultation is looking primarily at whether the Regulations should be extended beyond their current expiry date of 6 April 2024. It also provides an opportunity to consult on other potential amendments and improvements to the Regulations resulting from the views expressed by those who responded to the recent statutory review.

The consultation sets out proposals on:

- amending the expiry date to extend the Regulations beyond 6 April 2024

- including an additional value reporting metric

- referencing payment reporting in a company’s director’s report

- a clarification of how supply chain finance is reported

- including a new metric on disputed invoices

- retention payments in the construction sector

FIS fed into the initial review via the Small Business Commissioner and will be responding to the consultation on behalf of our membership.

FIS continues to speak out on poor practice witnessed in construction (see recent article in Construction News – FIS CEO calls out Payment Practices). We will be also be drawing on research recently conducted with the University of Reading that has highlighted “46% of subcontractors reported waiting for 40-59 days in comparison to only 24% of main contractors. Perhaps most strikingly, only 6% of specialist subcontractors reported being paid within 30 days.”

Specifically on retentions the consultation is exploring:

Question 6: Do you agree that the Regulations should be amended so that payment practice and performance reports should include information on the standard retention payment terms in qualifying construction contracts?

Question 7: Do you agree that the Regulations should be amended so that payment practice and performance reports should include statistical information on retention payments?

But, it should open up an opportunity to raise more broadly concerns over retentions and our response will draw on questions raised in the research conducted with the University of Reading.

If you are interested in feeding directly into the consultation, you can access all the information here. Please do send a copy of any response or thoughts that you would like embraced in the FIS response to iainmcilwee@thefis.org. Equally if you want to talk through your views, don’t hesitate to call Iain on 0121 707 0077.

You can see the current FIS position on retentions here along with our wider approach to concerns over procurement and payment fairness in the sector.

by Iain McIlwee | 30 Jan, 2023 | Building Safety Act

This weekend we heard Rt Hon Michael Gove’s (Secretary of State for Levelling Up, Housing and Communities) candid admission that Building Regulations were “faulty and ambiguous” in the run-up to the Grenfell Tower fire. This was, however, backed up with an assertion that there had been an “active willingness” on the part of developers to endanger lives for profit.

Gove’s mantra remains “polluter pays” and these comments were followed by a letter issued to developers today (30 January 2023) saying that Government expects them to sign a newly published ‘developer remediation contract’ as soon as possible.

Last year, 49 developers signed a public pledge committing to do the right thing to protect leaseholders and residents. Once signed, the contract will make those commitments legally binding., the contract will require developers to:

- Take responsibility for all necessary work to address life-critical fire-safety defects arising from design and construction of buildings 11 metres and over in height that they developed or refurbished over the last 30 years in England.

- Keep residents in those buildings informed on progress towards meeting this commitment.

- Reimburse taxpayers for funding spent on remediating their buildings.

The government has made clear that developers who refuse to sign the contract or fail to comply with its terms face significant consequences.

Commenting on the letter FIS CEO Iain McIlwee stated:

“This letter is a significant moment for construction and, whilst it is positive that the weight has rightly been lifted from the leaseholder, it darkens the shadow that hangs over the construction sector.

The inevitable next step is, for the developers that sign, to start to look to offset their liabilities onto the supply chain. They will engage lawyers to pull out heavily ammended standard form contracts, contracts that even the Government’s own Industrial Strategy recognise “can unfairly transfer legal risk” and that did not reflect the true working practices at the time. Cases like LDC vs GDC vs ESL and Mulallely vs Martley Homes start to give us insight into how this will play out.

The Building Safety Act is undoubtedly a force for long term good, but to truly support transformation in the shorter term it needs to be mirrored by a tightening of the Construction Act and some protection to SMEs in the supply chain. My fear now is that this opens the door to conflict and cost – adversarial behaviours will undermine change and resources that would be better expended on transformation and putting right mistakes of the past will be wasted”.

You can read the full letter from Richard Goodman, Director General, Safer and Greener Buildings Department for Levelling Up, Housing and Communities and view the proposed contract here

Read FIS Overview of the Building Safety Act here

by Iain McIlwee | 24 Jan, 2023 | Material Shortages

The Construction Leadership Council issued the latest Product Availability Statement today:

The new year has started in much the same way as the last one finished, with product availability continuing to improve for almost all products and in all regions. This is, in part, due to a reduced level of activity, with poor weather and a delayed return to sites after the Christmas break contributing to a slow start to 2023.

For some, there remains an ongoing problem in relation to gas boilers and M&E products, where the issue is the global supply chain for semi-conductors rather than the UK supply chain.

In some regions, bricks, blocks and roof tiles remain on allocation, but with manufacturers managing deliveries and builders’ merchants adjusting to the situation and carrying extra stock, the majority of end-users are not experiencing shortages. Brick stocks are also increasing, and a new plant will come on stream in 2024.

Price inflation has also stabilised. Timber prices have continued to fall but are expected to increase in Q2 as European mills are reducing production over winter. The price of some energy intensive products, such as bricks, cement and PIR insulation, increased by around 10% in January due to energy and distribution costs. However, with continuing economic uncertainty, some suppliers have deferred price increases, but with general inflation still above 10%, these are likely to be implemented by Q2.

The electro-technical sector is reporting delays for solar products (including inverters, batteries and mounting systems), and also the supply of EV chargers is an increasingly problematic area. Following regulatory changes in December 2022, manufacturers have updated their products or are granted an Enforcement Undertaking by the Office for Product Safety and Standards (OPSS) which allows them to continue to trade while they work towards product compliance. There is a fear that cheap imports which are not compliant with the latest regulations may reach the market. Installers should check the provenance with their wholesalers and request a Statement of Compliance and, if applicable, an Enforcement Undertaking.

Shipping costs from the Far East have vastly improved, with container costs dropping nearly 80% from last year’s high now nearing pre-Covid levels. However, a surge in Covid in China is affecting all points of the supply chains there. These problems are expected to continue through the Chinese New Year, with most factories closing from 16-29 January.

Looking further ahead there is considerable uncertainty forecasting demand for the coming year particularly for domestic RMI work and increasingly for new housing, where higher mortgage rates and the end of the Help to Buy scheme at the end of March are expected to slow new sales. Other areas, however, continue to see strong demand, particularly for industrial, commercial, infrastructure and government projects.

Statement from John Newcomb, CEO of the Builders Merchants Federation and Peter Caplehorn, CEO of the Construction Products Association, co-chairs of the Construction Leadership Council’s Product Availability working group

Commenting on the statement FIS CEO, Iain McIlwee stated:

“Whilst we are starting to see some hope on the horizon in terms of inflation abating, but we aren’t out of the woods yet. In addition to the problems outlined above, the New Year started in our sector with a new and significant round of price rises for plasterboard and plaster. We need to be careful and realistic in our pricing and continue to work with the supply chain to ensure that this is managed and we don’t just load it onto the specialists who simply cannot just absorb this.”

For all the work FIS is doing around inflation and availability, including recommended contractual terms click here

by Iain McIlwee | 20 Jan, 2023 | Building Safety Act

New Guidance has been published by the Home Office to help conduct routine checks on fire doors and provide information to residents. This guide is aimed at Responsible Persons carrying out simple checks upon a fire door. It is based on the assumption that the fire risk assessment has already assessed the suitability of the fire doors.

This short guide is intended to assist those with duties under the Fire Safety (England) Regulations to comply with regulation 10, which makes requirements about fire doors in all buildings that contain two or more domestic premises and that contain common parts, through which residents would need to evacuate in a fire.

Regulation 10 makes requirements in relation to two matters, namely:

- information about flat entrance doors that the Responsible Person must give to all residents (whether tenants or leaseholders) – this requirement relates to all blocks of flats

- routine checks of fire doors that the Responsible Person must ensure are carried out – these checks are only required in blocks of flats in which the top storey is more than 11m above ground level (typically, a building of more than four storeys)

The guidance includes a simple checklist.

The Fire Safety (England) Regulations 2022 were placed on the statute book on 18 May 2022, and came into force on 23 January 2023.

The full guidance is available here

by Iain McIlwee | 18 Jan, 2023 | Labour, Main News Feed

FIS is working with No Going Back (NGB), an innovative programme of training, support, employment, and housing funded and driven by 35 Livery Companies working collaboratively to reduce re-offending.

With Employment being such a major part of changing people’s lives when people leave prison, helping to dramatically reduce the likelihood of reoffending, between 23 January – 3 of February 2023, New Futures Network are hosting ‘Unlocking Construction’ employment events in prisons across England & Wales. and NGB are delighted to be a part of this in HMP Onley, Brixton, Wandsworth, and Thamesmead.

HMP Wandsworth and HMP Onley would like to invite Employers from the Construction Industry inside to be part of a special employment event on Wed 25 January (Wandsworth) and Wed 1 February (Onley) to support men into sustainable jobs in the construction sector upon release. This could be men with experience or those who are looking to pursue a new career in the sector. As more than 80% of men released from HMP Onley return to London and the Home Counties, many fantastic potential candidates are keen to find out about jobs on release.

For those attending, the events will follow the format:

HMP Wandsworth – Wednesday 25th January at 1:30 pm (likely finish time 4pm)

An interactive session in the Bounce Back Dry Lining workshop for serving prisoners who are interested in working in Dry Lining – some are currently doing the dry lining training course, and others have completed it.

This event is to improve their awareness of, and access to information on further training and employment opportunities available by introducing them directly to specialists and employers in the sector. It would give the men a chance to raise any questions to address challenges or concerns relating to employment or training within the sector. The prison will also pre-select a couple of men who are work-ready and approaching release for employers to speak with individually.

HMP Onley – Wednesday 1st February at 8:30 am (likely finish time is 4pm) POSTPONED DUE TO RAIL STRIKE, BUT IF YOU WANT TO BE KEPT UP-TO-DATE ON THE REVISED DATE, USE THE CONTACT LINKS BELOW

HMP Onley are hosting a Construction Fair on the day, with a cross-section of employers from the industry to support men into sustainable employment upon release. This could be men with experience or those who are new and looking to pursue a career in construction.

They are running a morning and afternoon session to allow more prisoners to take part and fit around the prison regime. More than 80% of men released from HMP Onley return to London and the Home Counties, there are many fantastic potential candidates who are keen to find out about jobs on release. For employers attending, there would also be an opportunity to have a prison tour to visit the Industry Workshops and recently launched Employment Hub. Training programmes running in this facility include Dry Lining, Carpentry and Joinery and Flooring.

NGB are also happy to facilitate visits in other prisons.

If you are interested in attendng one of these prison visits or finding out more about opportunities to engage in a programme in your local area (or arranging a seperate arrangement for these two facilities), please email jokeane@bouncebackproject.com asap (copy beenanana@thefis.org) or call the FIS on 0121 707 0077.

by Iain McIlwee | 13 Jan, 2023 | Transformation

FIS has supported CICV (a collaborative construction trade body in Scotland) in developing a new major new survey to help establish an overview of the current state of payments and cashflow in the Scottish construction industry.

Created by the CICV’s Pipeline & Commercial sub-group, the answers will help us shape a strategy to address ongoing issues, in consultation with the Construction Leadership Forum and The Scottish Government.

Commenting on the survey, FIS CEO Iain McIlwee stated:

“This is another important piece of work that the CICV is doing and it is great to see a genuine focus on collaboration across the wider sector once more being emodied through this group. With the Government’s Payment review announced, we need to be honest about where we are as an industry – this is something we at FIS will really be stepping up the ante on this year. Getting to the real data will help spotlight real concerns and instruct how legislation (and behaviours) need to change. Poor payment practices and process management around payment are a cancer at the core of construction. Please share your data so together we can drive change.”

FIS encourage anyone who works in construction to take part in the survey, which closes on 27 January and can be accessed here.

All answers are confidential.

December 2022 FIS CEO calls out Payment Practices

To fnd out more about FIS Campaigning in this area click here.

by Iain McIlwee | 11 Jan, 2023 | Legal cases, Transformation

The case of LDC (PORTFOLIO ONE) LIMITED vs (1) GEORGE DOWNING CONSTRUCTION LIMITED (GDC) EUROPEAN SHEETING LIMITED (ESL). Starts to give fresh insights into how claims will be heard in the new compliance landscape.

The case related to external wall works carried out by ESL under a sub contract to GMD Developments Ltd (the main contractor). Both contractors were retained on a design and build basis and both issued collateral Deeds of Warranty dated 17 October 2008 in favour of the then employer, GMD. Those Deeds of Warranty were subsequently assigned by GMD to LDC (the employer).

The works related to three blocks, each over 18m high, and each with a different configuration of external wall cladding. In each case, on the inside of the external wall cladding there is a breather membrane and Structural Insulated Panels (“SIPs”). The SIPs were fixed to the structural concrete frame of each block. The case is built on the fact that that following water ingress issues and subsequent investigations into the as-built Property, it was discovered that:

- There are several defects in the external wall construction of the composite cladding elevations which have led to water ingress and deterioration of the SIPs.

- There are fire barrier and fire stopping issues on all elevations; including in relation to the cavity barrier provision between the outer face of the SIPs and the rear face of the cladding panels on the Cor-ten elevations, and between the rear of the SIPs and the concrete slab and between SIPs, on all elevations.

Other material factors were that GMD had already agreed to a settlement of £17,650,000 with LDC, so the judgement being sought was related to LDC’s claim against ESL in the sum of £21,152,198.87 calculated as follows:

- Cost of remedial works: £16,457,825.87; and

- Loss of Income: £4,694,373.00; and

- Downing’s claim for an indemnity and/or contribution against ESL in the sum of£17,650,000 together with Downing’s reasonable costs of defending the claim brought against it by LDC

The Judge found in favour of the Claimant and ESL were required to meet the full costs. The case raises a number of issues.

The first is that it was heard despite the fact ESL are currently in Liquidation. This means that any liability is likely to be met via a Professional Indemnity claim against the collateral warranty. What is not clear is whether cover is commensurate with the claim or whether any subsequent claim could be brought against duty holders associated with ESL to meet any shortfall. The judgement itself is silent on this, but new legal precedence has been created by the Building Liability Order is yet to be tested. On this aspect, this may not be the last we hear from this case.

The second is that it was 15 years ago – remember the Defective Premises Act now allows retrospective claims to go back 30 years (reverting to 15 years on jobs that started after the Building Safety Act was introduced in 2022).

Another important point is that the case rests not on whether the cladding needed to be removed due to the original selection of the SIPS system (it was replaced with SFS), but to address moisture ingress creating structural issues and uncovering fire safety concerns during investigation. Consequently this judgment makes no reference to initial manufacturer claims. Worth dwelling on is that whilst, for the purposes of remediation a new cladding system was selected and the judgment made reference to “post-Grenfell enhanced Regulation”, the premise of the case is that the works themselves fell short of the requirements due to moisture ingress creating structural concerns and residual fire safety concerns related to changes to the specification during the construction process. In her findings the Judge, Ms Buehrlen KV, concurred that it was more cost effective to replace the entire system and SFS was a better alternative in the wake of new guidance. The comments from Technical Witness Mr Fung are interesting in the reference whether the need to replace was proportionate, but the defence seemed to rest on the fact that any remedial encapsulation would not represent a tested solution. The whole case doesn’t really get into the original specification and whether the potential would be a need to replace regardless due to new cladding legislation. It is what we don’t know here that stands out here.

Another and perhaps the most significant aspect of the case is that a design change was pivotal to the judgement and attempts to caveat changes by ESL were not accepted. This judgement centred on design detailing (i.e. missing verticle fire breaks and EPSM Membrane based on the original Architectural Specification) and workmanship (i.e. missing fixings and issues with the horizontal fire breaks) associated with the original cladding specification. Failings and subsequent damage caused by water ingress to the original cladding system meant it was deemed to be structurally unsound and there were concerns about the fire safety raised.

ESL claim that they were instructed to omit the vertical cavity barriers and EPDM included in the Architectural Specification. We are not party to where, how and why the decision was made around removing fire breaks, but ESL did as a result of the claim that they were “instructed to omit” attempt to exclude the provision of fire breaks from their contractual responsibility. The judgement refers to emails and ESL in their original defence maintained that they were not responsible for the design of cavity barriers and they were instructed to omit the EPDM which caused or contributed to the water ingress issues. Much we don’t know, but if there was pressure put on them to value engineer, a buildability issue was uncovered or whether any external advice was provided, it was not recorded and presented in a manner that convinced the judge that ESL were not ultimately responsible. The Judge determined that these elements were intrinsic to the “design of the cladding and rainscreen” to deliver compliance and so regardless of the attempt to exclude and ESL was left with the liability. The balance between these elements and workmanship issues was not discussed.

In conclusion the judge references the details from the Mulalley case in so far as “Building Regulation Compliance” falls under “Reasonable Skill and Care” in design and meetiing “All Statutory Requirements” in the case of the D&B Sub Contract. The judge determined that the attempts to caveat elements of the design doesn’t supersede a contractual obligation to meet “All Statutory Requirements”. It is unclear to me in the judgement how or why these decisions were reached.

Whilst the full implications of this judgement are yet to be determined, it does throw up some concerns for sub-contractors both in terms of the potential for legacy claims, underpins the need to ensure any change to the specification is appropriately signed off and to exercise caution in terms of the assumption that an express caveat releases a party from their core contractual requirements.

This article was prepared by Iain McIlwee and provided in good faith based on initial reading, FIS Lawyers will be looking in more detail at the full implications of this case and potential precedent set.

This judgement has not, at the time of writing been uploaded to the BAILII website, but will appear here imminently, if you are interested to read the full transcript in the interim email iainmcilwee@thefis.org

by Iain McIlwee | 10 Jan, 2023 | Material Shortages

The government announces the new “Energy Bills Discount Scheme” for UK businesses, charities, and the public sector from April.

- Scheme will provide a discount on high energy costs to give businesses certainty while limiting taxpayers’ exposure to volatile energy markets

- Businesses in sectors with particularly high levels of energy use and trade intensity will receive a higher level of support.

A new energy scheme for businesses, charities, and the public sector has been confirmed today (9th January), ahead of the current scheme ending in March. The new scheme will mean all eligible UK businesses and other non-domestic energy users will receive a discount on high energy bills until 31 March 2024.

This will help businesses locked into contracts signed before recent substantial falls in the wholesale price manage their costs and provide others with reassurance against the risk of prices rising again.

The government provided an unprecedented package of support for non-domestic users through this winter, worth £18 billion per the figures certified by the OBR at the Autumn Statement. This is equivalent to the cost of an increase of around three pence on people’s income tax.

The government has been clear that such levels of this support, unprecedented in its nature and huge scale, were time-limited and intended as a bridge to allow businesses to adapt. The latest data shows wholesale gas prices have now fallen to levels just before Putin’s invasion of Ukraine and have almost halved since the current scheme was announced.

The new scheme therefore strikes a balance between supporting businesses over the next 12 months and limiting taxpayer’s exposure to volatile energy markets, with a cap set at £5.5 billion. This provides long term certainty for businesses and reflects how the scale of the challenge has changed since September last year.

The Chancellor of the Exchequer, Jeremy Hunt, said:

My top priority is tackling the rising cost of living – something that both families and businesses are struggling with. That means taking difficult decisions to bring down inflation while giving as much support to families and business as we are able.

Wholesale energy prices are falling and have now gone back to levels just before Putin’s invasion of Ukraine. But to provide reassurance against the risk of prices rising again we are launching the new Energy Bills Discount Scheme, giving businesses the certainty they need to plan ahead.

Even though prices are falling, I am concerned this is not being passed on to businesses, so I’ve written to Ofgem asking for an update on whether further action is action is needed to make sure the market is working for businesses.

From 1 April 2023 to 31 March 2024, eligible non-domestic customers who have a contract with a licensed energy supplier will see a unit discount of up to £6.97/MWh automatically applied to their gas bill and a unit discount of up to £19.61/MWh applied to their electricity bill, except for those benefitting from lower energy prices.

A substantially higher level of support will be provided to businesses in sectors identified as being the most energy and trade intensive – predominately manufacturing industries. A long standing category associated with higher energy usage; these firms are often less able to pass through cost to their customers due to international competition. Businesses in scope will receive a gas and electricity bill discount based on a supported price which will be capped by a maximum unit discount of £40.0/MWh for gas and £89.1/MWh for electricity.

Energy Bill Discount Scheme summary

For eligible non-domestic customers who have a contract with a licensed energy supplier, the government is announcing the following support:

- From 1 April 2023 to 31 March 2024, all eligible non-domestic customers who have a contract with a licensed energy supplier will see a unit discount of up to £6.97/MWh automatically applied to their gas bill and a unit discount of up to £19.61/MWh applied to their electricity bill.

- This will be subject to a wholesale price threshold, set with reference to the support provided for domestic consumers, of £107/MWh for gas and £302/MWh for electricity. This means that businesses experiencing energy costs below this level will not receive support.

- Customers do not need to apply for their discount. As with the current scheme, suppliers will automatically apply reductions to the bills of all eligible non-domestic customers.

For eligible Energy and Trade Intensive Industries, the government is announcing:

- These businesses will receive a discount reflecting the difference between a price threshold and the relevant wholesale price.

- The price threshold for the scheme will be £99/MWh for gas and £185/MWh for electricity.

- This discount will only apply to 70% of energy volumes and will be subject to a ‘maximum discount’ of £40.0/MWh for gas and

Included in the list of energy intensive industries are:

Businesses in England will also benefit from support with their business rates bills worth £13.6 billion over the next five years, a UK-wide £2.4 billion fuel duty cut, a six month extension to the alcohol duty freeze and businesses with profits below £250,000 will be protected from the full corporation rate rise, with those making less than £50,000 – the vast majority of UK companies – not facing any corporation tax increase at all.

A full factsheet on what this means for business is available here.

by Iain McIlwee | 23 Dec, 2022 | Main News Feed, Transformation

FIS CEO Iain McIlwee has called out payment practices in the construction sector in a hard hitting article in Construction News this week.

In the article Iain raises the concern that payment conditions are worsening (reported by 21% of FIS Members), with particular issues occurring at the year end. He points out that, whilst average invoice payment times of main contractors with a Duty to Report are reportedly down to 31 days, this masks what is actually happening the ground and the myriad of issues associated with payment applications, pay less notices, certification and underpaying which are picked up in reporting.

A contributing FIS Member who wished to remain anonymous added:

“I am sick to death of begging for money. It isn’t just Christmas. It goes on all year, but definitely gets worse as we move to reporting periods. I attend meetings all the time where I am told businesses pride themselves in paying on time, but it is the spurious underpayments and unsubstantiated pay less notices that they don’t talk about. It feels like death by a thousand cuts.”.

The full article, which you can read here provides first hand accounts of the way in which contractors are being treated and reflects on the impact on relationships and mental health in the sector as well as wasted time and limiting ability to invest and transform. Further experiences have been shared in online discussions linked back to the article.

In reaction, To address the growing number of issues FIS have drafted in experienced adjudicator Len Bunton as a consultant adviser. He has also contributed to the article, reflecting on his recent experiences of working with FIS:

“I am very concerned about the level of issues we are encountering relating to payment. The industry needs to improve its management of the commercial side of contracts, and this should help greatly to reduce some of the current problems. Project bank accounts will help, as will utilising the Conflict Avoidance Process (CAP). I think the public sector needs to lead by example and take far greater interest in ensuring that payment is getting to the supply chain at the right time and in the right amounts. A shaking of the head and saying, ‘this is nothing to do with us’, does not help the industry.”

FIS, as part of our transformation agenda has committed to stepping up the work they are doing on fair payment in 2023 now that Business Secretary Grant Shapps has announced a formal review into payment practices of larger companies and the impact on the supply chain.

You can read more about how is FIS Campaigning for the sector here

Page 3 of 15«12345...10...>Last