by Iain McIlwee | Jul 13, 2020 | Main News Feed

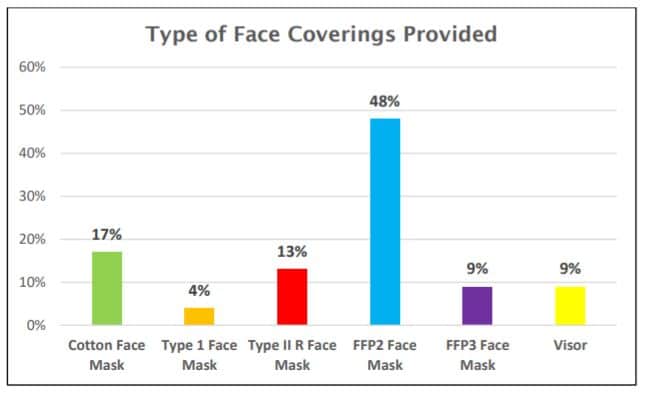

BuildUK carried out a snapshot survey of its Contractor members in June 2020 to understand their current policies on the provision of face coverings to workers in response to coronavirus.

The survey questions were based on the assumption that members:

- had undertaken a risk assessment, implemented the hierarchy of control measures within the Site Operating Procedures, and still had specific tasks that required individuals to work within

two metres of each other

- provide suitable PPE, including face masks or RPE, where identified for particular tasks.

BuildUK received responses from 94% of members and this report summarises the approaches being taken.

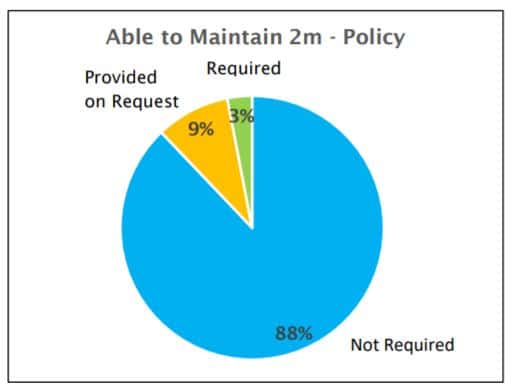

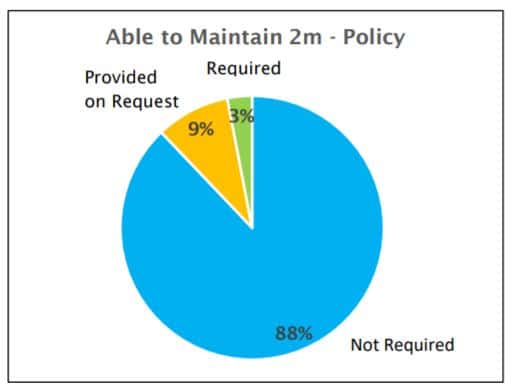

Q1: Where workers are able to maintain social distancing of two metres, what is your policy regarding the provision of face coverings?

- 29 companies do not provide, or require, a face covering

- 3 companies provide either face masks or visors on request

- 1 company requires face masks (Type II R) to be worn for all tasks

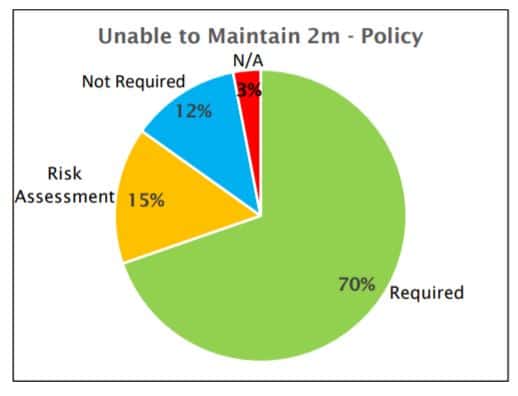

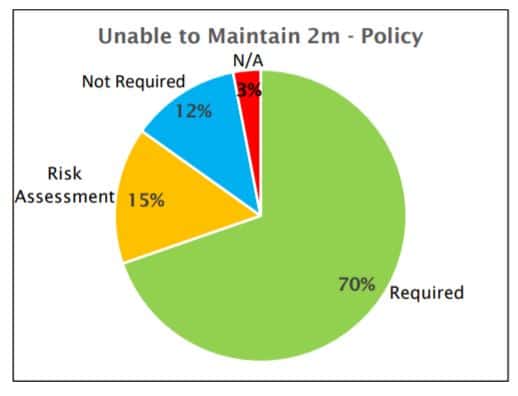

Q2: Where workers are not able to maintain social distancing of two metres, what is your policy regarding the provision of face coverings?

- 23 companies require face coverings to be worn for all tasks undertaken within two metres

- 5 companies undertake a task-specific risk assessment to determine if face coverings are worn

- 4 companies do not require face coverings to be worn

- 1 company does not undertake any activity within 2 metres

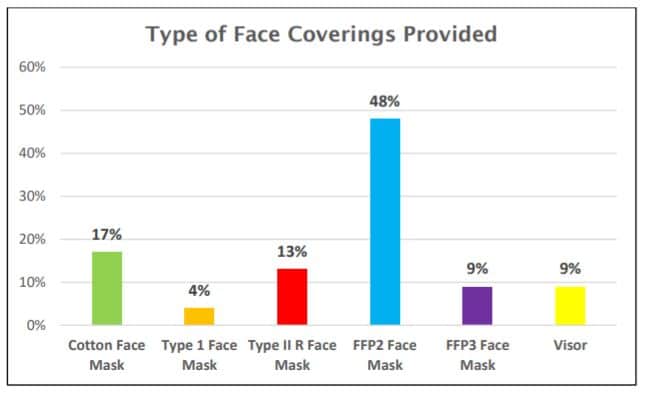

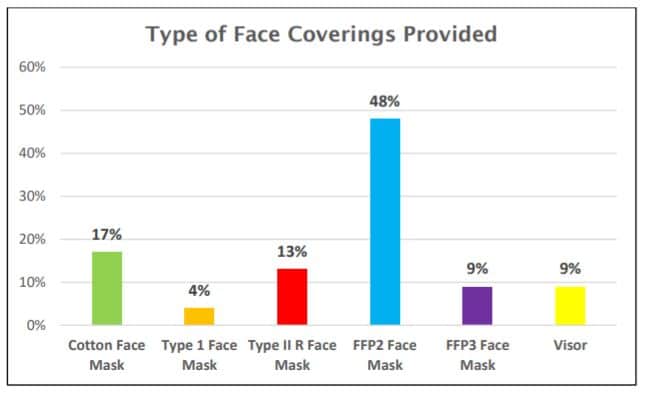

Q3: If you require face coverings within two metres, what type is provided?

Of the 23 companies that require face coverings for all tasks undertaken within two metres:

- 11 provide an FFP2 face mask

- 4 provide a cotton face mask

- 3 provide a Type II R face mask

- 2 provide an FFP3 face mask

- 2 provide a visor

- 1 provides a Type I face mask

Additional Resources:

FIS COVID-19 Health and Safety Toolkit

FIS COVID-19 Guide to the Selection of Personal and Respiratory Protective Equipment

by Iain McIlwee | Jul 8, 2020 | Main News Feed

In his statement today the Chancellor turned his attention to the next wave of support job retention in the UK economy, unveiling a new A Plan for Jobs 2020.

Key announcements likely to impact FIS Members:

Job Retention Bonus

The Chancellor confirmed that the Coronavirus Job Retention Scheme (CJRS) will wind down flexibly and gradually, supporting businesses until October. To further support people who have been furloughed in getting back to work the government is introducing a new Job Retention Bonus to reward and incentivise employers who keep on their furloughed employees.

Full detail to be announced, but the outline is that government will introduce a one-off payment of £1,000 to UK employers for every furloughed employee who remains continuously employed through to the end of January 2021.

Employees must earn above the Lower Earnings Limit (£520 per month) on average between the end of the Coronavirus Job Retention Scheme and the end of January 2021. Payments will be made from February 2021. Further detail about the scheme will be announced by the end of July.

Supporting Young People and Apprentices

High quality traineeships for young people – The government will provide an additional £111 million this year for traineeships in England, to fund high quality work placements and training for 16-24 year olds. This funding is enough to triple participation in traineeships. For the first time ever, the government will fund employers who provide trainees with work experience, at a rate of £1,000 per trainee. The government will improve provision and expand eligibility for traineeships to those with Level 3 qualifications and below, to ensure that more young people have access to high quality training.

Payments for employers who hire new apprentices – The government will introduce a new payment of £2,000 to employers in England for each new apprentice they hire aged under 25, and a £1,500 payment for each new apprentice they hire aged 25 and over, from 1st August 2020 to 31st January 2021. These payments will be in addition to the existing £1,000 payment the government already provides for new 16-18 year-old apprentices, and those aged under 25 with an Education, Health and Care Plan – where that applies.

High value courses for school and college leavers – The government will provide £101 million for the 2020-21 academic year to give all 18-19 year olds in England the opportunity to study targeted high value Level 2 and 3 courses when there are not employment opportunities available to them.

New funding for sector-based work academies – The government will provide an additional £17 million this year to triple the number of sector-based work academy placements in England in order to provide vocational training and guaranteed interviews for more people, helping them gain the skills needed for the jobs available in their local area.

Support targeted at the Construction Sector

The Chancellor recognised that the UK construction sector is vital for the recovery of the UK economy. The sector accounts for 7.6% of GDP and employs over 2.3 million workers spread across every UK region including over 900,000 self-employed workers.

The Chancellor reconfirmed the commitments made by the Prime Minister in his Build Build Build Speech on the 30th June.

Construction Talent Retention Scheme – The government is funding a Construction Talent Retention Scheme to support the redeployment of workers at risk of redundancy. This will help retain construction skills and match talented workers to opportunities across the UK.

Courts sustainability – The government will invest £40 million to improve the environmental sustainability of the courts and tribunals estate in England and Wales, investing in initiatives to reduce energy and water usage.

NHS maintenance and A&E capacity – The government will provide £1.05 billion in 2020-21 to invest in NHS critical maintenance and A&E capacity across England.

Modernising the NHS mental health estate – The government will provide up to £250 million in 2020-21 to make progress on replacing outdated mental health dormitories with 1,300 single bedrooms across 25 mental health providers in England.

Health Infrastructure Plan – The government will provide a further £200 million for the Health Infrastructure Plan39 to accelerate a number of the 40 new hospital building projects across England.

Further Education (FE) estate funding – Building on the £1.5 billion commitment for FE capital funding made at Budget 2020, the government will bring forward £200 million to 2020-21 to support colleges to carry out urgent and essential maintenance projects. This will be the first step in the government’s commitment to bring the facilities of colleges everywhere in England up to a good level.

School estate funding – The government will provide additional funding of £560 million for schools in England to improve the condition of their buildings and estates in 2020-21. This is on top of the £1.4 billion already invested in school maintenance this year.40

School rebuilding programme – The government has announced over £1 billion to fund the first 50 projects of a new, ten-year school rebuilding programme in England. These projects will be confirmed in the autumn, and further detail on future waves will be confirmed at the Comprehensive Spending Review. Construction on the first sites will begin in September 2021.

Court modernisation – The government will invest £102 million to modernise the court estate in England and Wales. This will include £55 million for essential court maintenance, £37 million for technology to fast-track the digitalisation of the courts, and £10 million for local regeneration projects outside London and the South East which will support employment and economic growth.

Prison and probation estate funding – The government will invest £143 million to improve the prison and probation estate in England and Wales. This will include £20 million to accelerate the digitalisation of prisons, £60 million for 1,000 temporary prison units to expand the capacity of the estate, and £63 million in additional maintenance.

Local infrastructure projects – The government will provide £900 million for shovel-ready projects in England in 2020-21 and 2021-22 to drive local growth and jobs. This could include the development and regeneration of key local sites, investment to improve transport and digital connectivity, and innovation and technology centres. Funding will be provided to Mayoral Combined Authorities and Local Enterprise Partnerships.

Towns Fund capital acceleration – The government will accelerate £96 million of investment in town centres and high streets through the Towns Fund this year. This will provide up to 101 towns across England with funding for projects such as improvements to parks, high streets, and transport.

Local road maintenance – The government will invest £100 million to deliver 29 local road maintenance upgrades across England in 2020-21, including eight bridge and viaduct repairs and improving local roads. This is in addition to the government’s plans to spend £1.5 billion in 2020-21 on filling potholes, resurfacing roads and improving local highway infrastructure.

Unblocking Manchester’s railways – The government will provide £10 million to develop plans for improving the reliability and capacity of the Manchester rail network.

World-class laboratories – The government will provide a £300 million investment in 2020-21 to boost equipment and infrastructure across universities and institutes across the UK.

Support targeted at the Housing Sector

The housing market has been severely affected by the pandemic, with activity and construction both slowing sharply. Estimates suggest that UK residential transactions in May 2020 were nearly 50% lower than in May 2019. According to Nationwide, UK house prices fell in the year to June 2020 for the first time in almost 8 years.

To address this the Chancellor has announced two key measures:

Temporary Stamp Duty Land Tax (SDLT) cut – The government will temporarily increase the Nil Rate Band of Residential SDLT, in England and Northern Ireland, from £125,000 to £500,000. This will apply from 8 July 2020 until 31 March 2021 and cut the tax due for everyone who would have paid SDLT. Nearly nine out of ten people getting on or moving up the property ladder will pay no SDLT at all.

Green Homes Grant – The government will introduce a £2 billion Green Homes Grant, providing at least £2 for every £1 homeowners and landlords spend to make their homes more energy efficient, up to £5,000 per household. For those on the lowest incomes, the scheme will fully fund energy efficiency measures of up to £10,000 per household. In total this could support over 100,000 green jobs and help strengthen a supply chain that will be vital for meeting our target of net zero greenhouse gas emissions by 2050. The scheme aims to upgrade over 600,000 homes across England, saving households hundreds of pounds per year on their energy bills.

Social Housing Decarbonisation Fund – The government will establish a new Social Housing Decarbonisation Fund to help social landlords improve the least energy-efficient social rented homes, starting with a £50 million demonstrator project in 2020-21 to decarbonise social housing. This will mean warmer homes and lower annual energy bills for some of the lowest income households.

Affordable Homes Programme – The government has confirmed that the £12.2 billion Affordable Homes Programme announced at Budget will support up to 180,000 new affordable homes for ownership and rent in England. The £12.2 billion will be spent over five years, with the majority of homes built by 2025-26 and the rest by 2028-29. The Affordable Homes Programme will also include a 1,500 unit pilot of First Homes.

Short-Term Home Building Fund extension – The government will support small- and medium-sized housebuilders that are unable to access private finance by boosting the Short-Term Home Building Fund, providing an additional £450 million in development finance to smaller firms. This is expected to support around 7,200 new homes in England, boosting housing supply and adding resilience to the market. A proportion of this fund will be reserved for firms using innovative approaches to housebuilding such as ‘Modern Methods of Construction’.

Brownfield Housing Fund – The government will allocate a £400 million Brownfield Housing Fund to seven Mayoral Combined Authorities to bring forward land for development and unlock 24,000 homes in England. To allow authorities to begin delivering projects quickly, 90% of the fund will be allocated immediately on a per capita basis, with 10% to be allocated through a competitive process.

Planning reform – The government will introduce new legislation in summer 2020 to make it easier to build better homes in the places people want to live. New regulations will make it easier to convert buildings for different uses, including housing, without the need for planning permission. In July 2020, the government will launch a policy paper setting out its plan for comprehensive reforms of England’s planning system to better support the economy and release more land for housing in areas that need it most.

Other Announcements

The Plan also includes a number of announcements designed to stimulate the Hospitality sector through VAT cuts and a Eat Out to Help Out voucher scheme. There is also a range of new funding to support return to work, funded work experience and employ ability training/coaching through the Department of Work and Pensions and the National Careers Service, alongside further support for apprenticeships, which enable people to work while training.

The Policy Paper A Plan for Jobs 2020 with full details and supporting data can be viewed here

A Plan for Jobs 2020 speech as delivered by Chancellor Rishi Sunak

by Iain McIlwee | Jun 25, 2020 | Main News Feed

Build UK has been working with Constructionline to measure the impact of coronavirus on the industry, and have published the results in a new infographic based on data submitted from almost 8,000 suppliers.

The infographic provides some encouraging news with respect to the impact of the CLC’s work on Site Operating Procedures with 99% of respondents making use of this document. The numbers related to whether companies are expecting significant financial difficulties ahead are concerning with 29% of companies in England, 42% in Scotland, 32% in Wales and 47% in Northern Ireland .

The Biggest challenges highlighted was continuity of work, however, the survey points also to the significant challenge the industry has in terms of productivity. The three main things that would help suppliers are outstanding invoices to be paid (38%), a relaxation of project deadlines (28%), and shorter payment terms (24%).

Download the Constructionline-Build-UK Infographic here

by Iain McIlwee | Jun 25, 2020 | Main News Feed

Effectively CITB made three significant announcements today:

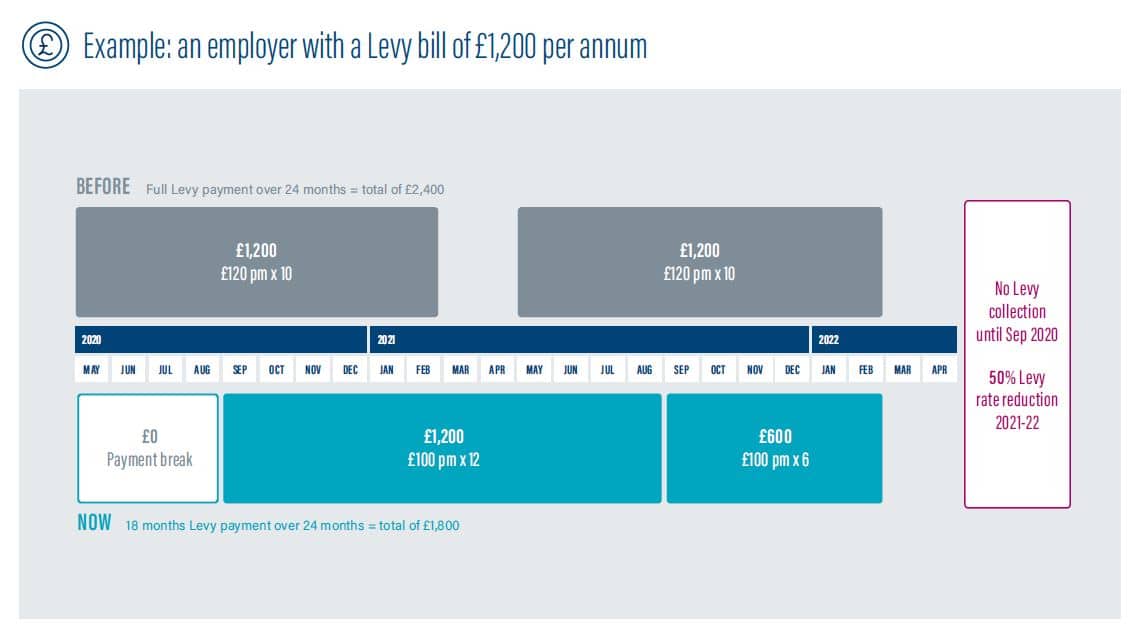

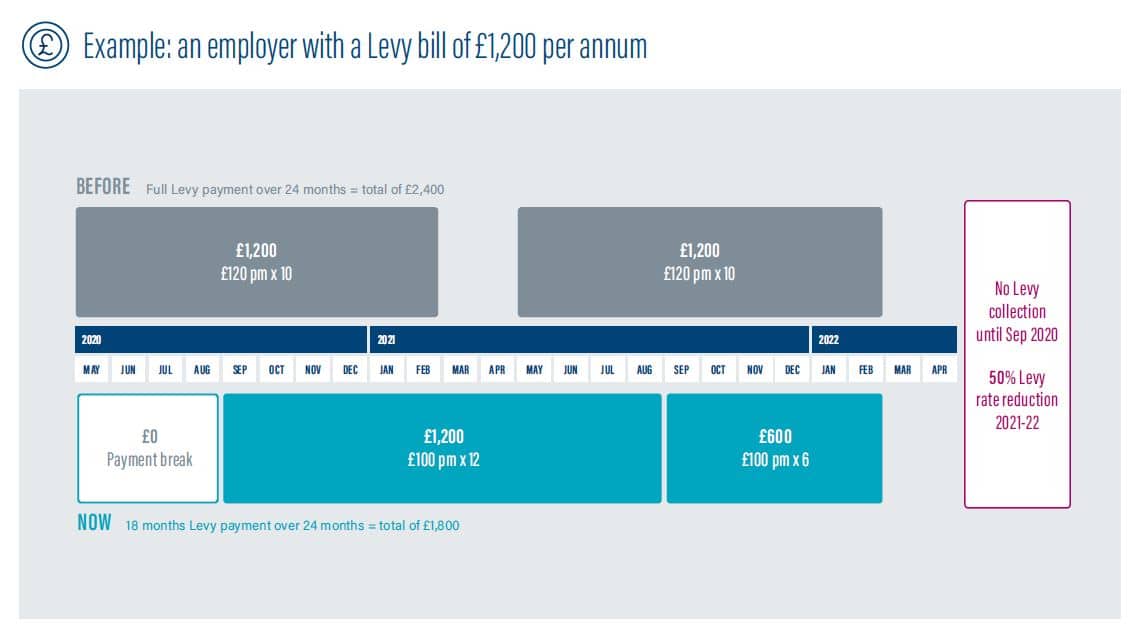

Your levy liability contribution is going to reduce

The CITB are cognisant of cash-flow challenges that industry faces, but by law they must collect the Levy. The workaround is that they will continue the “Levy Holiday” until September (so you have nothing to pay until then). In August you will get your full Levy Bill for 20/21 (remember the CITB tax year is April), but you will have a choice to pay up-front or over a 12 month period to August 2021.

Next year’s Levy bills (21/22) will be delayed and cut by 50%. This bill can also be paid in one go, or spread over 6 months, September 2021 – February 2022.

This means an overall Levy cut of 25% across two years.

It is anticipated that levy collection will then return to ‘normal’ rates and collection periods from March 2022, but this will be dependent on Government’s decisions around the Levy Order and feedback to CITB from the industry.

You will not get a consensus vote this year

In such an uncertain backdrop with so much in the air, CITB are responding to feedback that their focus needs to be on helping the industry meet the challenges posed by COVID. The decision has therefore been taken to suspend the consensus process (that was due to run this summer), this has been agreed with the Department for Education.

To ensure CITB are in tune with industry needs they have been engaging with employers and industry groups to gather views on their plans going forward. We are told this process will continue over the summer, when CITB will be seeking the industry’s views on a skills strategy for 2021-23 and the Levy required to fund it. New Levy Proposals will then be put to the Department for Education to enable it to present a new Levy Order to Parliament.

CITB have published a new Business Plan

This CITB Skills Stability Plan 2020-21 is effectively the CITB business plan for the current financial year (to March 2021). It outlines how, they intend to support construction with the skills it needs, including assistance to recover from the COVID-19 crisis. Emphasis is on reducing the financial call on employers, supporting apprenticeships and direct funding for employers’ skills needs through the Grants scheme and the Skills and Training Funds. In the plan you can see the range financial commitments. CITB is working on the assumption that the effect of the above levy cuts will see levy income fall by £166 million over the two-year period (this is a little over 40% of the roughly £400 million previously forecast). Internal costs and expenditure have been reduced and these will be cut further. CITB currently has around half of its employees furloughed.

Have your say

During the last consensus process FIS was one of the two organisations that did not support the levy proposals during the last round of consensus. Without a formal consensus process, we need to ensure that CITB delivers for our sector and that your views are reflected in our ongoing discussions surrounding this with CITB, the Construction Leadership Council (CLC) and Government.

At this stage we would like to gather your initial views via this simple and short survey here. The proposals will be looked at in more detail by the FIS Skills Board. If you are interested in getting involved, find out more about the work of the FIS Skills Board here.

by Iain McIlwee | Jun 25, 2020 | Main News Feed

The Construction Products Regulation lays down EU-wide rules for marketing construction products. The European Commission has opened a formal review to includes:

- addressing the issues identified in the 2019 evaluation

- improving how the single market for construction products functions.

The aim is to unlock the sector’s growth and jobs potential, promote environmental goals as part of the Green Deal and Circular Economy Action Plan, and possibly promote product safety.

While the UK is currently in the Transition Period which ends on 31st December 2020, we are obliged to follow EU legislation being passed. Even after the end of the Transition Period, the UK will more than likely continue to use the CPR as the governing legislation for the placing of construction products on the UK and EU markets. It should also be remembered that this consultation is against a backdrop that MHCLG made clear its intention to review the current test and evidence methodology for construction products, possibly using a parallel system to the Construction Products Regulation, but independent and UK limited through the Construction Products Standards Committee.

As it stands, FIS will be responding to this consultation through the Construction Products Association and Construction Products Europe.

To support an informed consultation, The European Commission has issued invitations to two online Q&A sessions on:

A summary of concerns with the current iteration of the Construction Products Regulations are provided below:

Summary of the current CPR problem areas

This document provides an overview of the numerous problems surrounding the CPR and hopefully sheds some light on the issues concerned. It does not cover possible solutions at this stage.

- The current CPR acquis

By the CPR acquis we mean published and cited hENs, cited European Assessment Documents (EADs) and delegated and implemented acts published in the OJEU.

Within these documents, formal contradictions to the CPR exist and, therefore, they do not meet the current legal framework. According to the numerous European Court of Justice (ECJ) rulings e.g. James Elliott case, the European Commission is responsible for the correct content of the hENs.

The CPR acquis should be in line with the CPR itself (both the current Regulation and any future revision). The current CPR acquis must continue to be available as the basis for the European single market for construction products. Withdrawing most of the hENs is not viable as it would destroy the existing single market.

2. Backlog of blocked standards

According to the Commission, the vast majority of revised and newly developed hENs have been refused citation because they “formally contradict the CPR or they do not comply with the respective Mandate”. Behind this is the series of rulings by the ECJ making the Commission legally responsible for the content of hENs. This has brought to a standstill the technical progression of standard writing.

It is a necessity that the CPR acquis adapts to enable technical progression of hENs under the existing CPR and any future revision of the Regulation. It is imperative that the existing backlog of citations be successfully overcome ASAP, while still ensuring the hENS remain in line with the CPR.

- Adaptation to technical and regulatory progress

Although a hEN may be regarded as being exhaustive today, as national and European regulations adapt to meet market demands, gaps could well appear in the future. Thus, a procedure is required to adapt hENs to accommodate technical and regulatory progress without creating new barriers to trade. These changes to regulatory requirements need to be covered by harmonised technical specifications in a reasonably short time frame.

- Exhaustiveness and gaps in hENs

Member States have complained that the essential characteristics within a hEN do not always exist enabling compliance with national provisions. Current ECJ rulings prohibit Member States plugging these gaps with supplementary national provisions as this would be against the basic presumption of exhaustiveness.

Member States and the Commission expect hENs to contain all the relevant essential characteristics so that no gaps exist. Similarly, industry expects the hENs to have all the necessary information for the single market to function without any additional national requirements.

- Empowerment of the Commission for correcting errors in harmonised technical specifications.

CEN has been criticised by the Commission for submitting hENs for citation which do not meet the requirements of the respective Mandate or that they contradict the CPR. The Commission goes on to state that it does not have the power to correct such errors and, therefore, the backlog of standards for citation continues to rise.

It is imperative that hENs comply with their respective Mandate/Standardisation Request and the principles of the CPR. Practical procedures must be developed to correct these identified errors, however, the Commission wants to be able to act by itself and not depend on CEN.

While CEN/TCs do not deliberately submit standards that are not compliant with the mandate or the CPR, the remedy for this problem should entail complete and detailed Mandates/Standisation Requests as well as having binding criteria and corresponding guidance for the drafting of hENs.

- Product compliance with National requirements

The CE marking and DoP are not directly linked to the requirements in a certain Member State which gives rise to complaints from industry professionals about the difficulties they have to assess whether they can install a specific CE marked construction product in a building of a specific Member State.

Users of CE marked construction products expect clear and simple information enabling them to decide whether the declared performance complies with the general requirements for its use in a certain country.

With future CE/DoP information becoming available in a structured digital format it is possible to develop compliance tools to automatically compare this information with national requirements in different Member States.

- Implementation of BRCW7+

Basic requirements for construction works (BRCW) are defined in Annex I of the CPR. There are three BRCWs which contain life-cycle / environmental impact / sustainability relevant requirements: BRCWs 3, 6 and 7. Collectively these are known as BRCW7+.

There is an increasing need for the inclusion of life cycle information with harmonised technical specifications. However, BRCW7+ has not yet been implemented in Mandates/Standardisation Requests so harmonised life cycle product information remains non-harmonised.

The alignment of EN 15804 with the PEF methodology has not yet been taken by the Commission as the final decision about assessment according to EN 15804 Amendment 2 and its integration into the CPR or whether PEF construction products need to be developed for this purpose.

- Transitional arrangements

The Commission has estimated that it will take up to 10 years to revise the CPR and to adjust the CPR acquis. This is far too lengthy a period.

During this period it requires that technical progress continues and, therefore, it must be possible to revise/adapt hENs in the meantime.

The current backlog in the citation of hENS must be remedied ASAP so that they can be used under the current CPR.

- Market surveillance

As currently operated by National Authorities, this is not satisfactory. The resources needed are not available, consequently there is insufficient coordination between individual, national market surveillance authorities etc.

Market surveillance is required to work as an incentive to fulfil legal obligations and to act as a tool to protect the market from inadequate practices. The process needs to focus on the non-conformity of products rather than undertaking formal document checks.

- Avoidance of double regulation

There are still issues on the overlap between the CPR and other legislation which must be avoided as they cause the utmost confusion in the market place for manufacturers trying to comply with legislation.

- EOTA

The criteria for the activities of EOTA and the national Technical Assessment Bodies (TABs) are not clear and transparent enough. Currently, EOTA can produce an EAD without a corresponding Mandate from the Commission thus throwing doubt on whether the current activities of EOTA/TABs are still in accordance with the original intention.

A clear separation of the standardisation process and the work of EOTA is required and needs to consider both legal and technical issues.

- Information in DoP and CE marking

Duplication of information appearing in the DoP and the CE marking is an unnecessary obstacle which requires a remedy. With the future implementation of BRCW 3 and 7 the amount of information to be included will become impossible to include in the CE mark.

It must be possible to affix the legally required CE marking (including BRCW 3 and 7 information) to a construction product to ensure a link is provided to the relevant information in a digital format.

- Introduction of product inherent properties

Some in industry see the need to include product properties which are independent from the products intended use in addition to the current building related essential characteristics. These should not be linked to the performance of the product across the lifetime of the construction works.

These independent properties need to be assessed on a case by case basis and where possible integrated into Standardisation Requests when their declaration in the CPR framework is necessary to protect individuals and the environment.

To assist debate and start to gather consensus, Construction Products Europe have prepared a draft reply to the consultation, which can be viewed here if anyone members have differing views email joecilia@thefis.org and we will feed these into the CPA and consider a separate response accordingly. Please feed any information by the close of the first week of August 2020 to enable us to make appropriate representations.

by Iain McIlwee | Jun 25, 2020 | CSCS, Main News Feed

Over recent years the CSCS card design has changed.

If you see a CSCS card that looks slightly different to what you expect, do not assume that it is fake. Instead, use one of these tools to check if the card is valid:

- The free Go Smart app: All CSCS cards are Smart, they contain a chip which allows the card to be scanned electronically. Employers can read the information stored on the card using a smartphone or tablet device with the free Go Smart app installed.

- The Go Smart online card checker.

- The CITB card checker (for cards issued before 9th December 2019 only).

- Access your CSCS Online account: If you already have an account, please login to view the status of your card.

There are three card designs in circulation:

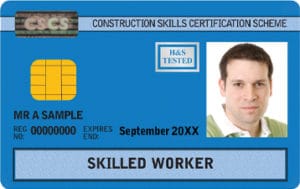

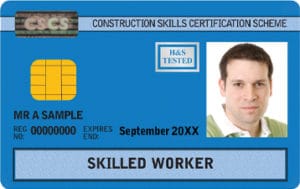

CSCS cards issued before 9th December 2019

All cards issued before 9th December 2019 look like the image below.

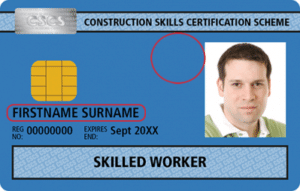

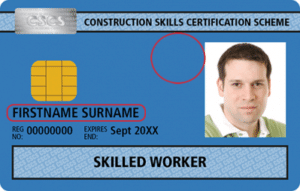

CSCS cards issued between 9th December 2019 and end of May 2020

These cards have 2 key differences.

- The cardholder’s full name appears on the card, instead of just their initials and last name.

- The HS&E tested holofoil no longer appears on the card.

These changes are highlighted on the image below.

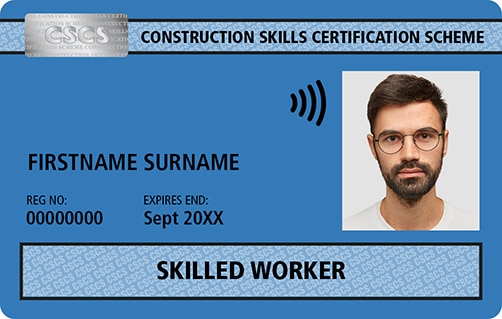

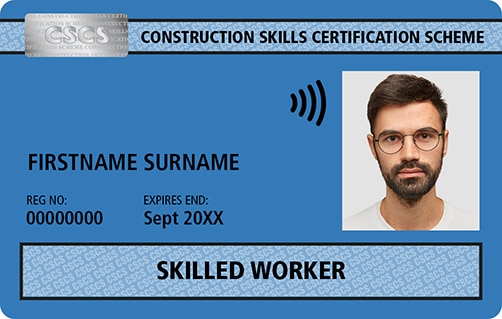

Cards issued since June 2020

A new card design was launched in June 2020. The new design has the following design differences:

- The smart chip embedded in the card is no longer visible

- There is a contactless symbol next to the cardholder’s photograph

by Iain McIlwee | Jun 25, 2020 | Main News Feed

This scheme is for employers. You can claim back up to 2 weeks of SSP if:

- you have already paid your employee’s sick pay (use the SSP calculator to work out how much to pay)

- you’re claiming for an employee who’s eligible for sick pay due to coronavirus

- you have a PAYE payroll scheme that was created and started on or before 28 February 2020

- you had fewer than 250 employees on 28 February 2020 across all your PAYE payroll schemes

Employees do not have to give you a doctor’s fit note for you to make a claim. But you can ask them to give you either:

- an isolation note from NHS 111 – if they are self-isolating and cannot work because of coronavirus (COVID-19)

- the NHS or GP letter telling them to stay at home for at least 12 weeks because they’re at high risk of severe illness from coronavirus

The scheme covers all types of employment contracts, including:

- full-time employees

- part-time employees

- employees on agency contracts

- employees on flexible or zero-hour contracts

- fixed term contracts (until the date their contract ends)

It has been confirmed that you can now claim for employees who are self-isolating because they’ve been notified by the NHS or public health bodies that they’ve come into contact with someone with coronavirus.

Find out how to make your claim here.

For detailed guidance from FIS on what to do if an employee reports sick or is required to self isolate click here

by Iain McIlwee | Jun 25, 2020 | Main News Feed

- No Levy payments before September and then, up to 12 months to pay

- Next year’s Levy bills to be delayed and 50% cut proposed

- Skills Stability Plan protects apprenticeships, Grants Scheme and employer funding

- Consensus will not take place this year to allow focus on recovery

CITB has today announced its plan to help employers recover from the impact of Coronavirus, including a substantial reduction in Levy bills.

The Skills Stability Plan 2020-21 protects apprenticeships and provides direct funding to employers to adopt new ways of working needed in the wake of Covid-19.

Employers will continue to have a payment holiday on the Levy until September and then up to a full year to pay the 2020/21 levy. In addition, CITB will propose a 50% discount on the 2021/22 Levy rate. This means employers will pay 18 months’ Levy out of 24, making an overall saving of 25% across two years, providing help when it is most needed.

An employer with an average annual levy bill of £1,200 would normally pay £2,400 over 2020-22. Instead, they will pay nothing from April to August this year and then take advantage of spreading the costs – £100 per month up to February 2022, paying £1,800 overall.

These changes will see CITB’s forecast Levy income drop by £166m across two financial years. Despite this large drop in income, the Skills Stability Plan will protect apprenticeships, direct funding to employers and the Grants Scheme. CITB is also cutting costs and using its reserves to support employers’ skills needs.

CITB will work with other industry partners to support workers who have lost their jobs or seen their apprenticeship disrupted,matching them with a new employer, including through exploring a talent retention scheme. This will build on the support already provided to help appprentices complete their programmes through up-front grant payments to current year 2 and 3 apprentices, training materials being made available online and support from Apprenticeship Officers to allow learning to continue remotely.

The plan has also prioritised direct funding for employers through the Skills and Training Funds, with £8m earmarked for small and micro businesses, £3.5m for medium-sized businesses, with a £3m Leadership and Management Fund for large firms. This will help employers train to adapt to the new working environment and update the skills of their workforce.

CITB Chief Executive Sarah Beale said: “This represents a radical plan of action that balances the need for a reduction in the Levy at this time, alongside vital investment in the skills needed by employers now and in the future.

“It is the result of hundreds of conversations with employers across the length and breadth of Britain and I’m confident it meets the sector’s immediate needs. We are committed to making the Levy work hard to protect apprenticeships and support hard-pressed employers as they equip themselves for the challenges and opportunities ahead.”

CITB will now seek the views of industry employers and federations about the development of a new strategic plan, covering 2021-23, with the plan expected to be published in September.

Sarah Beale continued: “We have spoken to employers and federations and most have suggested that they want us to focus full-time on helping the industry meet the challenges posed by COVID. We have confirmed with the Department for Education that we will not run the usual Consensus process and instead we will speak to employers and industry groups to seek their views on our plans for next year.

“We will continue to be responsive and collaborative, working closely with the sector and Government to return the industry to growth. We will listen to industry and respond to its priorities and give every employer the confidence that we wish to understand and learn from their concerns and ambitions.”

Mark Reynolds, Mace Group Chief Executive and Skills Workstream Lead at the Construction Leadership Council (CLC), said: “Our industry has come together to develop an effective plan to come back from the effects of Covid-19, as detailed in the CLC’s Roadmap to Recovery document. CITB’s Skills Stability Plan builds on this work and clearly outlines how they will play their part in delivering the skills we need. We very much support efforts made by the CITB to substantially reduce the Levy. It is right that Consensus is delayed so we can work together to make sure that our recovery, still in its early stages, is as strong as possible.”

About CITB

CITB supports the skills needs of construction across England, Scotland and Wales. It attracts talent to the construction sector so employers have an adequate recruitment pool, and encourages employers of all sizes to access the skills and training necessary to grow their businesses.

Details of expected Levy bill process – what will be billed when for payment when

The 2019 Levy Assessment that was due to be sent to employers in April 2020 will now be sent to employers in August 2020. For employers opting to pay this bill by Direct Debits, the payments will run for up to 12 months from September 2020 to August 2021.

The 2020 Levy Assessment will be deferred for six months and sent to employers in August 2021.The rates proposed for this assessment will be half the value that would ordinarily have been applied – so if the agreed Levy rates remain at 0.35% for PAYE and 1.25% for Net paid sub-contractors then these will halved so only half of the assessment will be levied. Employers opting to pay by Direct Debits will pay this assessment in up to six monthly instalments between September 2021 and February 2022. The final rate

CITB Skills Stability Plan 2020-21

by Iain McIlwee | Jun 24, 2020 | Main News Feed

The Scottish economy is now in its deepest recession in living memory, according to the latest Economic Commentary by the Fraser of Allander Institute at the University of Strathclyde.

The Institute points out that whilst the depth of the collapse in GDP is largely artificial and entirely due to the lockdown, what matters is how quickly activity bounces back once the restrictions are lifted.

All signs are however, that there will be some scarring and it will take some time before the economy recovers to a ‘new normal’.

The outlook for the next few months looks hugely challenging. The unprecedented government support has provided an invaluable safety net –

■ Around £10 billion of funding support for the Scottish economy through additional resources for the Scottish Government and various business support schemes. Equivalent to over 5% of GDP.

■ Over 750,000 employees furloughed & self-employed workers supported via the Coronavirus Job Retention and Self-employment Income Support Schemes.

Considering the complexity of restart, supply chain disconnects, lower demand and dwindled corporate cash reserves the expectation is that there will be a spike in closures and job losses in the next few weeks and months as firms look ahead to the rolling back of government support later in the year.

The Commentary considers a range of scenarios from a more optimistic scenario where confidence builds momentum, through to a more pessimistic scenario which includes a second wave of infection.

In the optimistic scenario, the economy is projected to take until the end of 2021, at the earliest, to fully recover lost output. In the pessimistic scenario, it could be 2024 before a ‘new normal’ is reached.

The Institute also points out that even when the economy returns to growth, the underlying structure of Scotland’s business base will be altered forever.

You can read the full report here

by Iain McIlwee | Jun 23, 2020 | Main News Feed

The Prime Minister Boris Johnson has today announced that (in England) the two-metre social distancing rule will be replaced with “one-metre plus” guidance from the 4th July. In another step towards “normality”, the “one-metre plus” approach will mean that people can be one metre away from each other as long as other measures are put in place to limit the transmission of the virus, such as “wearing face coverings, installing screens and facing away from other people”. Mr Johnson reiterated in his speech to the house that people should still say two metres apart from others where possible.

In his speech Mr Johnson advised the House that Government have now ordered over 2.2 billion items of protective equipment from UK based manufacturers, many of whose production lines have been called into being to serve this new demand. He also announced that new guidance will be published on how businesses can reduce the risk by taking certain steps to protect workers and customers. “These include, for instance, avoiding face-to-face seating by changing office layouts, reducing the number of people in enclosed spaces, improving ventilation, using protective screens and face coverings, closing non-essential social spaces, providing hand sanitiser and changing shift patterns so that staff work in set teams. And of course, we already mandate face coverings on public transport. Whilst the experts cannot give a precise assessment of how much the risk is reduced, they judge these mitigations would make “1 metre plus” broadly equivalent to the risk at 2 metres if those mitigations are fully implemented.”

The Prime Minister reflected on the importance of this announcement to the hospitality sector and plans to re-open large sections on the 4th July stating – “I know this rule effectively makes life impossible for large parts of our economy, even without other restrictions. For example, it prevents all but a fraction of our hospitality industry from operating.” He has committed to publishing findings of the expert review in the Commons Library this week.

Responding to the announcement FIS CEO Iain McIlwee said: “This measure is less targeted at construction and more at the fact that From July 4, the hospitality sector will start to re-open. That said, we now need to review our own guidance – with only 12% of our members able to operate profitably under the existing Site Operating Procedures, this announcement could have a huge impact on productivity and be a vital lifeline. I think it is important to echo what the Prime Minister said in his speech – where it is possible to keep 2 metres apart people should. The sector has reacted well to adapting processes to enable maintaining safe working distances, and not withstanding productivity, we also know that behaviours are one of our biggest challenges. We need to continue re-enforcing the importance of safe working distances – evidence tells us that the risk will increase the closer we get and we need to continue to do all we can to protect our people and prevent any transmission of the virus”.

In the speech the Prime Minister also reminded that the administrations in Scotland, Wales and Northern Ireland hold responsibility for their own lockdown restrictions and they will respond to the united view of the Chief Medical Officers at their own pace, based on their own judgement.

Responding to the statement the Construction Leadership Council commented:

“The Government is reviewing its ‘Safer Working’ guidance in light of this. Consequently, the Construction Leadership Council (CLC) will review its own guidance (including the Site & Branch Operating Procedures) and update it to reflect the new requirements.”

You can read the full speech here.

Details of current H&S Guidance including PPE from FIS is available in our H&S COVID Toolkit Here including detailed guidance on PPE and our Task Assessment Tool.

by Iain McIlwee | Jun 18, 2020 | Main News Feed

A £230 million Return to Work package has been unveiled to help stimulate Scotland’s economy following the coronavirus (COVID-19) pandemic.

The initiative covers construction, low carbon projects, digitisation and business support and will provide a flow of work for businesses and support jobs. It is funded by the reallocation of underspends from schemes interrupted by COVID-19.

New projects featured in the package include:

- £51 million for business support, including boosting high growth companies

- £78 million for construction, including £40 million for regeneration projects and £20 million for roads maintenance

- £66 million to kick-start our green recovery, including £7 million to equip buses for physical distancing and the return to work

- £35.5 million for digitisation, including justice and education services

Finance Secretary Kate Forbes announced the package today as she opened a Scottish Parliament debate on the financial implications of COVID-19. She also sought Parliament’s support for the Scottish Government’s call to be granted additional financial powers to manage the crisis.

Ms Forbes said:

“The impact of COVID-19 has been enormous on both businesses and individuals and the Scottish Government has so far spent more than £4 billion tackling its effects.

“We are also taking steps to accelerate our economic recovery and this package ensures that we can make immediate use of money which, because of the pandemic, might otherwise not have been spent this year.

“I do not underestimate the challenges we face but I also see opportunities. It is important we take this chance to reshape our economy in a way that works for everyone and promotes long-term growth, not just quick fixes.

“This £230 million delivers investment across Scotland and will boost the green recovery, speed up digitisation and bolster construction, supporting hundreds of jobs.

“The Return to Work package is part of a process to harness Scotland’s talent and resources and build a modern economy that is robust, fair and sustainable. But it is only a start. Larger programmes will follow and I will continue pressing the UK Government both for new financial powers and greater certainty over funding.

“These additional powers are now absolutely essential – without them Scotland will be planning for recovery with one hand tied behind our back.”

by Iain McIlwee | Jun 18, 2020 | Main News Feed

In Scotland today the First Minister has confirmed a gradual introduction of Phase 2 of the National route map for easing COVID-19 restrictions, which means the Construction Sector can move to Phase 3 of the Construction Restart Model from Monday 22nd June.

Phase 3: Steady state operation (where physical distancing can be maintained)

In this phase, the site complement will have reached a steady state level and, depending upon the site parameters, evidence suggest that this could mean that only 30% to 40% of the original workforce are able to be accommodated, due to physical distancing criteria.

As in Phase 1, due to the shortage of medical style PPE supply, only work that can be carried out within physical distancing parameters or with physical barriers will be carried out. Progress throughout Phase 3 will be subject to monitoring and supervision by site management, with any data/evidence gathered (such as site Covid-19 related absences) being used to inform continual review of management practices and arrangements to ensure safe working and physical distancing.

In a subsequent briefing from The Minister for Local Government, Housing and Planning, Kevin Stewart, to members of the CICV Forum (attended by FIS CEO, Iain McIlwee), the Minister expressed his gratitude to the construction sector for their patience and support in providing evidence to support this transition. He emphasised that the plan was centred on small steps taken slowly and carefully – it does not mean a return to normal and that strict adherence to the 2m working rule is essential. He applauded the level of collaboration in the sector, which he recognised was unprecedented. The Minister also highlighted the opportunity to benefit from the £230 million Return to Work Package, launched this week, £78 million of which has been earmarked for construction. He concluded his update by emphasising the importance of the construction sector to the Scottish economy and to ensure that if any difficulties are occurring in the way Public Bodies are managing contracts and not meeting the requirements of CPN 4: Managing Disputes and Cashflow then this should be reported to officials.

Full details of the phased plan are available here.

It has also been confirmed that face coverings will become mandatory on public transport from Monday 22 June. Further details can be found here.

by Iain McIlwee | Jun 17, 2020 | Main News Feed

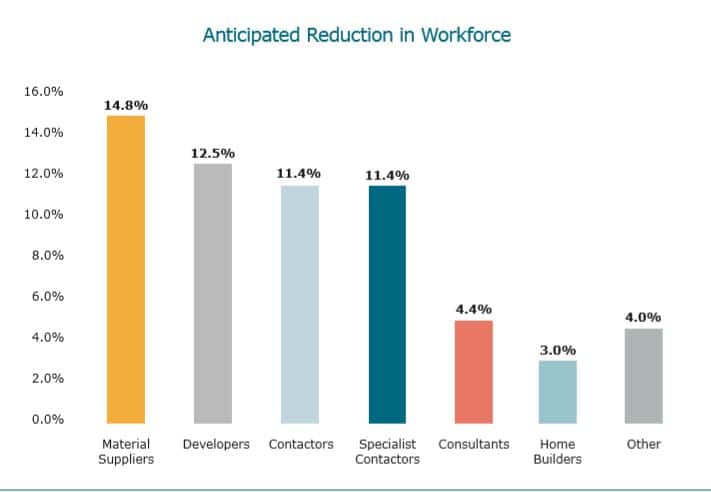

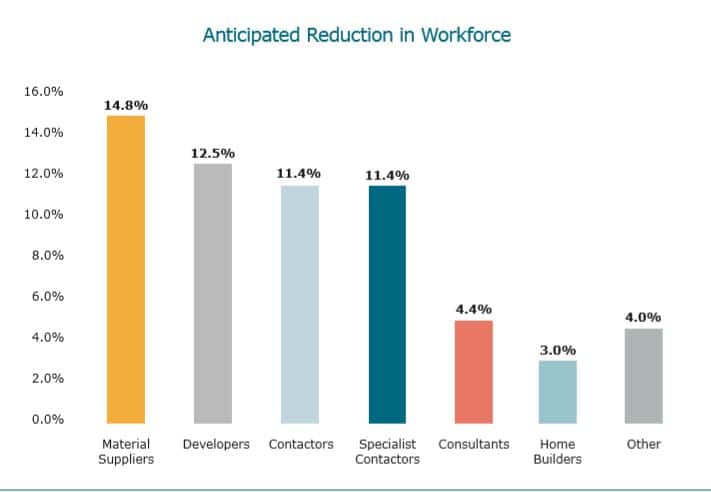

Retaining Talent in Construction reveals an anticipated reduction of 9.9% in the construction workforce by September. In the longer term, 43% of respondents expect to make redundancies, with up to 20% of their workforce being affected. 6.7% of apprentices are likely to lose their jobs by September, and 60% of respondents are looking to take on fewer apprentices at the next intake.

The cross-industry ‘People Survey’ was carried out by Build UK on behalf of the Construction Leadership Council (CLC) at the start of June 2020 to provide a snapshot of how a reduced workload post coronavirus (COVID-19) may affect the construction workforce.

In the wake of recent cuts announced by Travis Perkins, the report reinforces the need to look to targeted support for construction businesses, stimulus for construction works and a supply chain focus on extending the benefit of pipeline through to all employers in the supply chain, through earlier engagement and better planning.

Speaking on the launch of the report FIS CEO, Iain McIlwee commented: “The numbers give us a feel for what the future could look like if key issues related to support for apprentices, encouragement to retain, incentives to build and better planning of the pipeline aren’t addressed. We talk about the new normal, but numbers like this are a stark reminder of how tough it will be for many if swift action is not taken to support the industry. Just to put it in to context, 20% of the construction workforce is around a quarter of a million people! We need to look to Government for stimulus, but better and earlier planning and procurement is in our hands – as well as improving confidence and preventing decisions based on short term survival, it will also lead to better quality and support much needed investment in automation, digital and off-site solutions”.

You can read the full report Retaining Talent in Construction here

by Iain McIlwee | Jun 16, 2020 | Main News Feed

The procurement pipeline includes over 340 procurement contracts across 269 projects, programmes and other investments. It also sets out a projection of infrastructure procurement over the next year of up to £37 billion.

The procurement pipeline is made up of work packages, projects and programmes that are planned to go out to market for procurement throughout the 2020/21 financial year. rojects where contracts have already been awarded or where funding has already been drawn down will not be included in the procurement pipeline. Projects in the early stages of development are also not included in the procurement pipeline for 2020/21.

The Pipeline aims to provide confidence and certainty to the market during the COVID-19 pandemic – and as such is a key part of the CLC’s ‘Road to Recovery’ .

Andy Mitchell, Co-Chair of the CLC said:

“The Construction Sector is facing an unprecedented challenge as a result of COVID-19. As the largest single client of economic and social infrastructure, a strong and clear pipeline of work from Government is vital to generating confidence and certainty.

I am therefore delighted that the Government has today responded to one of the proposals in the CLC Industry Recovery Plan and look forward to working with Government to deliver these projects over the months and years to come”.

Projects Relevent to the Finishes and Interiors Sector

Within the IPA there are a little over £1.4 billion investment in schools, £2.2 bn new Housing & Regeneration Projects, £1.2 bn investment in prisons and over £100m on cultural and heritage works. The department of Works and Pensions is responsible for £115m of fit-out work across the UK. The full list of projects is available here.

Iain McIlwee, CEO of the FIS responded. “Pipeline and confidence are key to a swift recovery in construction. For me though the benefit of publishing this is limited if it is not matched with a procurement drive that supports early supply chain engagement. We have to remember that the bulk of jobs are in the specialist fields and we need to extend this foresight into the supply chain to support real investment in skills and process improvement. Earlier engagement has the added benefit of ensuring specialist knowledge is available to iron out any design wrinkles and practical issues are addressed in planning rather than on site. Whilst more complex, it we need to try to find a similar process to monitor larger private investments and housing to ensure construction is optimised and ready to meet demand”.

You can view the National Infrastructure and Construction Procurement Pipeline 2020/21 here

For private sector pipeline, you can track projects, FIS works with Barbour ABI who publish a monthly report of key regional contract awards, members can download this report here.

by Iain McIlwee | Jun 13, 2020 | Main News Feed

The Government has updated its guidance on the Coronavirus Job Retention Scheme, which confirms how the scheme will change from 1 July 2020 to provide for ‘flexible furloughing’:

- Employers can only furlough an employee who has previously been furloughed prior to 30 June. The exception is employees returning from statutory maternity and paternity leave, provided that their employer has previously furloughed other employees

- Employers can bring furloughed employees back to work for any amount of time and on any work pattern while still claiming grant for the hours not worked. Flexible furlough agreements must be for a minimum of one week, and employees can enter into a flexible furlough agreement more than once

- Employers must confirm in writing with employees and keep records of how many hours employees work and the number of hours they are furloughed

- If an employee is flexible furloughed over two different calendar months, a separate claim must be submitted for each month

- From 1 August, employers will have to contribute towards the cost of furloughed employees’ wages.

When making a claim, employers will need to provide the number of hours an employee would have usually worked as well as the number of hours they actually worked, and the Coronavirus Job Retention Scheme calculator has been updated to assist in working out claim amounts for flexible furloughing.

The first time you will be able to make claims for days in July will be 1 July, you cannot claim for periods in July before this point.

31 July is the last day that you can submit claims for periods ending on or before 30 June.

Visit the FIS Employment Law Toolkit here

by Iain McIlwee | Jun 12, 2020 | Main News Feed

From next Monday (15 June) face coverings will be mandatory on public transport in England to help reduce the risk of transmission of coronavirus when social distancing is not always possible. A face covering is a simple cloth that covers your nose and mouth, and the Government has published guidance on How to wear and make a cloth face covering. Anyone using public transport who does not wear a face covering could receive a fine.

Wherever possible, people should continue to work from home and avoid public transport, and the Government has published Safer travel guidance for passengers. Transport for London (TfL) is encouraging passengers who must travel to consider walking or cycling as part of their journey, or getting off a stop or two early to reduce numbers on Tubes and buses.

Next Monday will also see Thames Clippers resuming services for passengers on a temporary timetable. Services will run between 6:00am and 9:00pm on weekdays and between 9:30am and 7:30pm on weekends, with park and ride available from the O2 for £8 per day for Thames Clippers customers. All passengers will be required to maintain social distancing, wear a face covering and pay by contactless, and the on‐board café will reopen for takeaway service only.

Travel and Accommodation

To help contractors working away from home find local accommodation: Build UK has temporarily repurposed its Open Doors website. There are now 340 providers listed offering 22,000 beds.

An Essential Workers letter has been prepared to support the booking process. This can be downloaded here.

by Iain McIlwee | Jun 11, 2020 | Main News Feed

In the case of a suspected case of COVID-19

Many business owners will in the coming weeks be confronted with a worker who is displaying symptoms of COVID-19. Soldiering on is not an option and we must continue to re-enforce at every opportunity that an individual should not go to the workplace if they:

- are unwell with coronavirus symptoms

- are told to self-isolate by a government test and trace service, because they’ve been in close contact with someone who’s testing positive

- need to self-isolate because someone in their household has symptoms

If they’re already at work and displaying symptoms, swift action and leadership is essential and they should be advised:

- immediately to go home

- avoid touching anything, and wash their hands regularly

- cough or sneeze into a tissue and put it in a bin, or if they do not have tissues, cough and sneeze into the crook of their elbow

- use a separate bathroom from others, if possible

- avoid using public transport to travel home, if possible

- The worker should be advised to arrange a test as soon as practicable

The workplace does not necessarily have to close and the Government has produced cleaning advice.

Remember this is likely to cause anxiety for the person in question, so it is important to be supportive and sensitive to this.

How to manage colleagues who have been in close proximity

You need to act quickly to minimize the risk of the disease spreading. You will need to ask the worker who in the business they have been in “close contact” with within the prior two weeks (closer than 2m for longer than 15 mins).

Workers will be required to isolate if they:

- have coronavirus symptoms and are awaiting a test result

- have tested positive for coronavirus

- are a member of the same household as someone who has symptoms or has tested positive for coronavirus

- have been in close recent contact with someone who has tested positive and received a notification to self-isolate from NHS test and trace.

If they are working in a “bubble” then you may decide to limit the risk of further spread to ask the entire bubble to self-isolate whilst clarity is sought. Further guidance on how to manage this situation moving forward is included in the section on Testing and Tracing.

You need to be mindful of the need to respect confidentiality and that you should not reveal the potentially effected worker’s identity.

When else might a member or staff be required to self-isolate?

If a government ‘test and trace’ service tells someone they’ve been in close recent contact with someone who has tested positive, they must self-isolate for 14 days. If they develop symptoms, everyone else in their household must self-isolate for 14 days.

If someone lives in a household and is the first to have symptoms, they must self-isolate for 7 days. Everyone else in their household must self-isolate for 14 days.

If during this time your are tested and the result is negative, the individual and other household members no longer need to self-isolate.

What if a staff member is reluctant to be tested?

An implied term within an employment contract is that an employee has a duty to obey lawful and reasonable instructions given the employer.

Whilst there is no formal case law to confirm this, in the case of COVID-19, both the employer and employee also have a duty to safeguard the health and safety of co-workers. As a consequence unreasonable refusal to take a test could be deemed to constitute a breach of their employment contract and be followed up as a disciplinary action.

In lieu of a test, any employee displaying symptoms should follow instructions to self isolate.

In the case of a subcontractor, you would need to refer to the terms of your contract. It is advisable to remind them on the potential implication of their actions on colleagues who may have been exposed.

Information on Testing and Tracing

Details of the government test and trace services are available here:

We are advised at the time of writing (11th June) that testing can take up to 48 hours to arrange, but results are typically available within 12 hours.

Anyone who tests are positive will be contacted by the NHS test and trace service or local public health teams via a text, email or by phone. They will be asked for the contact details of anyone they’ve been in close proximity to and about places they have visited. Anyone considered at risk of catching the virus will then be contacted and told to self-isolate for 14 days whether they have symptoms or not. The rest of their household does not have to self-isolate unless someone in the house becomes ill.

Testing and tracing is a public health measure, intended to inhibit the spread of the virus as the country slowly comes out of lockdown. It could potentially reveal hotspots where the infection rate is higher and the government has said this information could lead to ‘local lockdowns’ to tackle flare-ups in towns, schools or workplaces.

An NHS Covid-19 contact-tracing app is currently being trialled that will also (anonymously) alert users when they have been in close contact with someone identified as having been infected by the virus.

Supporting staff who need to self-isolate

If someone needs to self-isolate, it’s good practice for employers to:

Depending on someone’s circumstances, they might have to self-isolate more than once during the coronavirus pandemic. Employers should support them in the same way each time.

In these situations, the employer should again look to see whether there are any options for working from home. If this is not possible, it is advisable, in the case of an employee, to treat as a suspension and pay the employee as normal.

Supporting employers with a workplace outbreak

If multiple cases of coronavirus appear in a workplace, an outbreak control team from either the local authority or Public Health England will, if necessary, be assigned to help the employer manage the outbreak. Employers should seek advice from their local authority in the first instance.

How does Statutory Sick Pay (SSP) Work

Employees in self-isolation are entitled to Statutory Sick Pay for every day they are in isolation, as long as they meet the eligibility conditions. Information for employers on reclaiming Statutory Sick Pay is available here.

The FIS is seeking clarification on whether SSP can be claimed if an employee is suspended due to contact as a cautionary measure, but is not displaying symptoms. Currently the criteria on the HMRC website states:

You must keep the following records for 3 years after the date you receive the payment for your claim:

- the dates the employee was off sick

- which of those dates were qualifying days

- the reason they said they were off work – if they had symptoms, someone they lived with had symptoms or they were shielding

- the employee’s National Insurance number

You can choose how you keep records of your employees’ sickness absence. HMRC may need to see these records if there’s a dispute over payment of SSP.

If the worker is self-employed and hence not eligible for SSP through the “employer” and are advised to self-isolate, they would be eligible to make a claim for Universal Credit (UC) or new style Employment and Support Allowance. More information on how to claim is available here.

RIDDOR reporting of COVID-19

You should only make a report under RIDDOR when when it is confirmed that a worker has been diagnosed as having COVID-19 attributed to an occupational exposure to coronavirus. This should be reported as a case of disease. It is recommended that you contact the HSE to advise of your particular circumstances to ensue that it falls under the RIDDOR requirements.

You can access the FIS COVID H&S Toolkit here

You can access the FIS COVID Employment Toolkit here

If you have any questions not answered in this article, please send them in to info@thefis.org or call our helpline on 0121 707 0077.

by Iain McIlwee | Jun 11, 2020 | Main News Feed

The First Minister has announced today that the construction sector will be now be allowed to move to Phase 2 in its restart plan from today provided that businesses follow guidance on the safety and welfare of the workforce and the public. This will include work carried out in domestic properties. This announcement is in line with the industry-agreed six-step phased model for the return of the construction sector:

- Phase 0: Planning

- Phase 1: Covid-19 Pre-start Site prep

- Phase 2: ‘Soft start’ to site works (only where physical distancing can be maintained)

This phase begins when the site preparations are complete and when it is safe to do so in line with public health advice. It will consist of a progressive return of a proportion of the original workforce to ensure that extended inductions, including site tours to explain the new arrangements for hygiene and physical distancing, are able to be carried out.

The health and safety of the workforce is of paramount interest to the sector and there will be a phased return of a proportion of the workforce, brought back in “batches” to allow a high supervisor to worker ratio. This will allow extended inductions and site tours to familiarise the workforce with the new arrangements and allow time for those to become “the new normal.”

As explained above, the number of workers able to return will depend upon the space available on site (both external areas and floorplates, if a building) and the welfare facilities that have been provided. Contractors will have to adjust their site facilities and work planning to ensure that physical distancing requirements are able to be met at each stage. During this phase, due to the shortage of medical style PPE supply, only work that can be carried out within physical distancing parameters or using protective barriers, will be carried out. Risk assessment approaches will still be used to control the hazard of Covid-19 but if this shows that close working is still required and that protective barriers would be ineffective, that work will not be carried out until supplies of medical style PPE are restored to normal. This means that some tasks will not be able to be carried out, although the industry will make strenuous efforts to develop innovative ways of completing critical tasks, working within the new parameters.

- Phase 3: Steady state operation (only where physical distancing can be maintained)

- Phase 4: Steady state operation (where physical distancing can be maintained and/or with PPE use)

- Phase 5: Increasing density/productivity with experience

The latest announcement, moving to Phase 2 of the plan provides an opportunity for businesses to return to site work on a “soft-start” basis. It also allows businesses to undertake all forms of work in domestic properties.

Full details of the phased plan are available here.

Further details to support H&S are provided in the FIS H&S Toolkit Here. This includes specific site operating procedures for Scotland and excellent additional advice developed through the CICV Forum and the FIS COVID 19 H&S Task Group. FIS has also developed a Restart Risk Management Checklist for members here which has also been updated today in line with new advice available on what to do if a worker exhibits symptoms of COVID-19.

by Iain McIlwee | Jun 10, 2020 | Main News Feed

With companies beginning a phased return to work, the wide-ranging questionnaire addresses multiple issues which have not gone away during the pandemic and suggests that the sector cannot realistically go back to the way it was.

The consultation is the latest in a series of initiatives from the Forum, which has been at the forefront of information dissemination to the sector throughout the COVID-19 crisis, and which has become for many enterprises the first port of call for clarity of advice.

Forum chair and SELECT Managing Director Alan Wilson, said: ”All too often we are told that a body or organisation is the ‘voice’ of a sector but to be the voice, first of all you must listen to what members are saying.

“Being the ‘ears of the industry’ is a concept often sadly forgotten and this piece of work aims do just that – listening to what the industry wants before suggesting options for change.”

Led by Consultant Len Bunton, the consultation was compiled with the input of four leading quantity surveying firms, as well as Ian Honeyman, Commercial Director of the Scottish Building Federation, and Ken Lewandowski, former local chairman of Clydesdale Bank.

Mr Bunton said that, for everyone involved in construction, the ultimate objective for the post-pandemic future must be an industry which is not only fair and transparent but allows contractors and the supply chain to operate profitable businesses.

He said: “The questions in the consultation will be put to the many trade and professional bodies in the Forum, as well as their members. The aim is to focus on the step changes which are necessary, the main problems and the potential solutions.

“We want to look at the endemic problems of low tendering, no margins and the lack of regard for competency and experience. Serious cashflow and payment issues, poor quality and health and safety probelems are also consistent concerns for the industry.

“We also need to consult with public and private sector clients who are the lifeblood of the industry, as their investment creates employment for the construction sector in Scotland.”

Mr Bunton added: “The consultation makes the point that the CICV Forum, which was quickly and efficiently assembled to deal with the ongoing effects of the shutdown, has demonstrated the desirability of disparate parties coming together to work for the mutual benefit of the sector.”

The Forum, made up of trade associations (including FIS), professional services bodies, companies and individuals, stepped into the fray immediately in March with advice on how to operate safely while carrying out emergency or essential work.

It has since been drawing on the collective expertise of its members to maintain a steady supply of information and practical advice to the sector as well as carrying out surveys, producing animations and posters, hosting webinars and speaking regularly with Government ministers.

- The consultation was initially issued to members of the Forum only. If you would like to submit your thoughts about the future of the Scottish construction sector, please download the questionnaire here and send initially to iainmcilwee@thefis.org by 19 June to enable collation of responses.

by Iain McIlwee | Jun 5, 2020 | Main News Feed

As of last week, the Scottish Government has allowed the construction sector to start work on preparing its sites for a safe return to work – Phase 1 on the industry Re-Start Plan (see information here) – and that industry has been asked to “consult with government to ensure it is safe to do so in line with public health advice” before starting Phase 2 on that plan – the” Soft Start” return to work.

To provide confidence that Phase 2 can begin evidence of the advance preparation of sites, in line with the new Site Operating Guidance and their own (or sector specific) procedures (see details in the FIS COVID-19 H&S Toolkit), it is critical now that industry share material through the Construction Leadership Forum in Scotland. Evidence shared with the Construction Leadership Forum will help them and, more importantly, government, gain confidence that the industry is preparing to start work safely.

Examples of the potential activities being sought, dependent upon the nature of the site, could include:

- Installing new, or expanding existing, site welfare and toilet facilities

- Installing hand washing/sanitiser stations

- Alterations to form “one way” systems

- Installation of Covid-19 signage

- Marking 2m distancing on access routes throughout the site

- Re-modelling office and meeting rooms for physical distancing

- Cleaning of all site facilities and the workspace

- “Road testing” all new systems prior to supply chain returning to site

The “evidence” that could include photographs, videos, written reports (examples of RAMS), site plan changes management plans, completed checklists and customer testimonials. The Construction Leadership Forum will be seeking sample evidence across a wide range of project types and situations.

Any information should be sent initially to CICV Forum member and FIS CEO iainmcilwee@thefie.org who will arrange for it to sent to the Construction Leadership Forum to collate and provide as evidence. Additionally, in the spirit of collaboration, if you are inclined to share more broadly as evidence of good practice through the Construction Leadership Forum members and/or included on the FIS Community H&S Best Practice Gallery please let us know when you submit the information.

Visit the FIS H&S COVID-19 Toolkit Here

Page 12 of 13« First«...910111213>