by Iain McIlwee | 25 Jun, 2020 | Main News Feed

The Construction Products Regulation lays down EU-wide rules for marketing construction products. The European Commission has opened a formal review to includes:

- addressing the issues identified in the 2019 evaluation

- improving how the single market for construction products functions.

The aim is to unlock the sector’s growth and jobs potential, promote environmental goals as part of the Green Deal and Circular Economy Action Plan, and possibly promote product safety.

While the UK is currently in the Transition Period which ends on 31st December 2020, we are obliged to follow EU legislation being passed. Even after the end of the Transition Period, the UK will more than likely continue to use the CPR as the governing legislation for the placing of construction products on the UK and EU markets. It should also be remembered that this consultation is against a backdrop that MHCLG made clear its intention to review the current test and evidence methodology for construction products, possibly using a parallel system to the Construction Products Regulation, but independent and UK limited through the Construction Products Standards Committee.

As it stands, FIS will be responding to this consultation through the Construction Products Association and Construction Products Europe.

To support an informed consultation, The European Commission has issued invitations to two online Q&A sessions on:

A summary of concerns with the current iteration of the Construction Products Regulations are provided below:

Summary of the current CPR problem areas

This document provides an overview of the numerous problems surrounding the CPR and hopefully sheds some light on the issues concerned. It does not cover possible solutions at this stage.

- The current CPR acquis

By the CPR acquis we mean published and cited hENs, cited European Assessment Documents (EADs) and delegated and implemented acts published in the OJEU.

Within these documents, formal contradictions to the CPR exist and, therefore, they do not meet the current legal framework. According to the numerous European Court of Justice (ECJ) rulings e.g. James Elliott case, the European Commission is responsible for the correct content of the hENs.

The CPR acquis should be in line with the CPR itself (both the current Regulation and any future revision). The current CPR acquis must continue to be available as the basis for the European single market for construction products. Withdrawing most of the hENs is not viable as it would destroy the existing single market.

2. Backlog of blocked standards

According to the Commission, the vast majority of revised and newly developed hENs have been refused citation because they “formally contradict the CPR or they do not comply with the respective Mandate”. Behind this is the series of rulings by the ECJ making the Commission legally responsible for the content of hENs. This has brought to a standstill the technical progression of standard writing.

It is a necessity that the CPR acquis adapts to enable technical progression of hENs under the existing CPR and any future revision of the Regulation. It is imperative that the existing backlog of citations be successfully overcome ASAP, while still ensuring the hENS remain in line with the CPR.

- Adaptation to technical and regulatory progress

Although a hEN may be regarded as being exhaustive today, as national and European regulations adapt to meet market demands, gaps could well appear in the future. Thus, a procedure is required to adapt hENs to accommodate technical and regulatory progress without creating new barriers to trade. These changes to regulatory requirements need to be covered by harmonised technical specifications in a reasonably short time frame.

- Exhaustiveness and gaps in hENs

Member States have complained that the essential characteristics within a hEN do not always exist enabling compliance with national provisions. Current ECJ rulings prohibit Member States plugging these gaps with supplementary national provisions as this would be against the basic presumption of exhaustiveness.

Member States and the Commission expect hENs to contain all the relevant essential characteristics so that no gaps exist. Similarly, industry expects the hENs to have all the necessary information for the single market to function without any additional national requirements.

- Empowerment of the Commission for correcting errors in harmonised technical specifications.

CEN has been criticised by the Commission for submitting hENs for citation which do not meet the requirements of the respective Mandate or that they contradict the CPR. The Commission goes on to state that it does not have the power to correct such errors and, therefore, the backlog of standards for citation continues to rise.

It is imperative that hENs comply with their respective Mandate/Standardisation Request and the principles of the CPR. Practical procedures must be developed to correct these identified errors, however, the Commission wants to be able to act by itself and not depend on CEN.

While CEN/TCs do not deliberately submit standards that are not compliant with the mandate or the CPR, the remedy for this problem should entail complete and detailed Mandates/Standisation Requests as well as having binding criteria and corresponding guidance for the drafting of hENs.

- Product compliance with National requirements

The CE marking and DoP are not directly linked to the requirements in a certain Member State which gives rise to complaints from industry professionals about the difficulties they have to assess whether they can install a specific CE marked construction product in a building of a specific Member State.

Users of CE marked construction products expect clear and simple information enabling them to decide whether the declared performance complies with the general requirements for its use in a certain country.

With future CE/DoP information becoming available in a structured digital format it is possible to develop compliance tools to automatically compare this information with national requirements in different Member States.

- Implementation of BRCW7+

Basic requirements for construction works (BRCW) are defined in Annex I of the CPR. There are three BRCWs which contain life-cycle / environmental impact / sustainability relevant requirements: BRCWs 3, 6 and 7. Collectively these are known as BRCW7+.

There is an increasing need for the inclusion of life cycle information with harmonised technical specifications. However, BRCW7+ has not yet been implemented in Mandates/Standardisation Requests so harmonised life cycle product information remains non-harmonised.

The alignment of EN 15804 with the PEF methodology has not yet been taken by the Commission as the final decision about assessment according to EN 15804 Amendment 2 and its integration into the CPR or whether PEF construction products need to be developed for this purpose.

- Transitional arrangements

The Commission has estimated that it will take up to 10 years to revise the CPR and to adjust the CPR acquis. This is far too lengthy a period.

During this period it requires that technical progress continues and, therefore, it must be possible to revise/adapt hENs in the meantime.

The current backlog in the citation of hENS must be remedied ASAP so that they can be used under the current CPR.

- Market surveillance

As currently operated by National Authorities, this is not satisfactory. The resources needed are not available, consequently there is insufficient coordination between individual, national market surveillance authorities etc.

Market surveillance is required to work as an incentive to fulfil legal obligations and to act as a tool to protect the market from inadequate practices. The process needs to focus on the non-conformity of products rather than undertaking formal document checks.

- Avoidance of double regulation

There are still issues on the overlap between the CPR and other legislation which must be avoided as they cause the utmost confusion in the market place for manufacturers trying to comply with legislation.

- EOTA

The criteria for the activities of EOTA and the national Technical Assessment Bodies (TABs) are not clear and transparent enough. Currently, EOTA can produce an EAD without a corresponding Mandate from the Commission thus throwing doubt on whether the current activities of EOTA/TABs are still in accordance with the original intention.

A clear separation of the standardisation process and the work of EOTA is required and needs to consider both legal and technical issues.

- Information in DoP and CE marking

Duplication of information appearing in the DoP and the CE marking is an unnecessary obstacle which requires a remedy. With the future implementation of BRCW 3 and 7 the amount of information to be included will become impossible to include in the CE mark.

It must be possible to affix the legally required CE marking (including BRCW 3 and 7 information) to a construction product to ensure a link is provided to the relevant information in a digital format.

- Introduction of product inherent properties

Some in industry see the need to include product properties which are independent from the products intended use in addition to the current building related essential characteristics. These should not be linked to the performance of the product across the lifetime of the construction works.

These independent properties need to be assessed on a case by case basis and where possible integrated into Standardisation Requests when their declaration in the CPR framework is necessary to protect individuals and the environment.

To assist debate and start to gather consensus, Construction Products Europe have prepared a draft reply to the consultation, which can be viewed here if anyone members have differing views email joecilia@thefis.org and we will feed these into the CPA and consider a separate response accordingly. Please feed any information by the close of the first week of August 2020 to enable us to make appropriate representations.

by Iain McIlwee | 25 Jun, 2020 | Main News Feed

- No Levy payments before September and then, up to 12 months to pay

- Next year’s Levy bills to be delayed and 50% cut proposed

- Skills Stability Plan protects apprenticeships, Grants Scheme and employer funding

- Consensus will not take place this year to allow focus on recovery

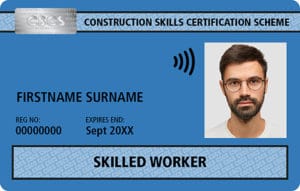

CITB has today announced its plan to help employers recover from the impact of Coronavirus, including a substantial reduction in Levy bills.

The Skills Stability Plan 2020-21 protects apprenticeships and provides direct funding to employers to adopt new ways of working needed in the wake of Covid-19.

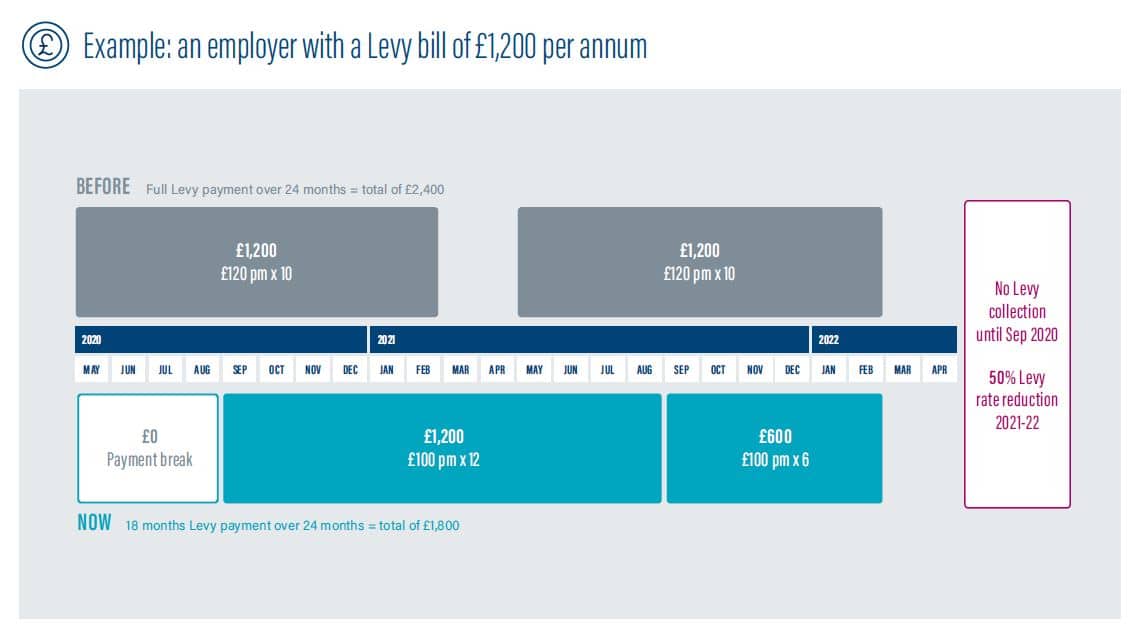

Employers will continue to have a payment holiday on the Levy until September and then up to a full year to pay the 2020/21 levy. In addition, CITB will propose a 50% discount on the 2021/22 Levy rate. This means employers will pay 18 months’ Levy out of 24, making an overall saving of 25% across two years, providing help when it is most needed.

An employer with an average annual levy bill of £1,200 would normally pay £2,400 over 2020-22. Instead, they will pay nothing from April to August this year and then take advantage of spreading the costs – £100 per month up to February 2022, paying £1,800 overall.

These changes will see CITB’s forecast Levy income drop by £166m across two financial years. Despite this large drop in income, the Skills Stability Plan will protect apprenticeships, direct funding to employers and the Grants Scheme. CITB is also cutting costs and using its reserves to support employers’ skills needs.

CITB will work with other industry partners to support workers who have lost their jobs or seen their apprenticeship disrupted,matching them with a new employer, including through exploring a talent retention scheme. This will build on the support already provided to help appprentices complete their programmes through up-front grant payments to current year 2 and 3 apprentices, training materials being made available online and support from Apprenticeship Officers to allow learning to continue remotely.

The plan has also prioritised direct funding for employers through the Skills and Training Funds, with £8m earmarked for small and micro businesses, £3.5m for medium-sized businesses, with a £3m Leadership and Management Fund for large firms. This will help employers train to adapt to the new working environment and update the skills of their workforce.

CITB Chief Executive Sarah Beale said: “This represents a radical plan of action that balances the need for a reduction in the Levy at this time, alongside vital investment in the skills needed by employers now and in the future.

“It is the result of hundreds of conversations with employers across the length and breadth of Britain and I’m confident it meets the sector’s immediate needs. We are committed to making the Levy work hard to protect apprenticeships and support hard-pressed employers as they equip themselves for the challenges and opportunities ahead.”

CITB will now seek the views of industry employers and federations about the development of a new strategic plan, covering 2021-23, with the plan expected to be published in September.

Sarah Beale continued: “We have spoken to employers and federations and most have suggested that they want us to focus full-time on helping the industry meet the challenges posed by COVID. We have confirmed with the Department for Education that we will not run the usual Consensus process and instead we will speak to employers and industry groups to seek their views on our plans for next year.

“We will continue to be responsive and collaborative, working closely with the sector and Government to return the industry to growth. We will listen to industry and respond to its priorities and give every employer the confidence that we wish to understand and learn from their concerns and ambitions.”

Mark Reynolds, Mace Group Chief Executive and Skills Workstream Lead at the Construction Leadership Council (CLC), said: “Our industry has come together to develop an effective plan to come back from the effects of Covid-19, as detailed in the CLC’s Roadmap to Recovery document. CITB’s Skills Stability Plan builds on this work and clearly outlines how they will play their part in delivering the skills we need. We very much support efforts made by the CITB to substantially reduce the Levy. It is right that Consensus is delayed so we can work together to make sure that our recovery, still in its early stages, is as strong as possible.”

About CITB

CITB supports the skills needs of construction across England, Scotland and Wales. It attracts talent to the construction sector so employers have an adequate recruitment pool, and encourages employers of all sizes to access the skills and training necessary to grow their businesses.

Details of expected Levy bill process – what will be billed when for payment when

The 2019 Levy Assessment that was due to be sent to employers in April 2020 will now be sent to employers in August 2020. For employers opting to pay this bill by Direct Debits, the payments will run for up to 12 months from September 2020 to August 2021.

The 2020 Levy Assessment will be deferred for six months and sent to employers in August 2021.The rates proposed for this assessment will be half the value that would ordinarily have been applied – so if the agreed Levy rates remain at 0.35% for PAYE and 1.25% for Net paid sub-contractors then these will halved so only half of the assessment will be levied. Employers opting to pay by Direct Debits will pay this assessment in up to six monthly instalments between September 2021 and February 2022. The final rate

CITB Skills Stability Plan 2020-21