Falling demand hits construction product manufacturers’ sales

In 2023 Q4, a balance of 63% of heavy side manufacturers reported that sales of construction products decreased, marking the sixth consecutive quarter of decline and the weakest performance since 2020 Q2, at the height of the pandemic. Alongside this, 40% of light side manufacturers also reported a fall in product sales. This was the second quarterly decline but, equally, the lowest balance recorded since activity was paused during the early pandemic restrictions.

Looking to the next 12 months, demand was cited by 71% of heavy side manufacturers and 80% of light side manufacturers as the factor most likely to constrain growth during 2024. Consequently, 11% of heavy side manufacturers and 15% of light side manufacturers anticipated a fall in sales over this year.

The backdrop for costs was shown to be more favourable, however, with manufacturers reporting a continued easing in cost inflation. Price pressures were lower for raw materials, fuel and energy, which had all been major contributors to inflation over the last couple of years. Nevertheless, manufacturers reported continued upward pressure from wages & salaries.

Rebecca Larkin, CPA Head of Construction Research said: “Manufacturers had a challenging end to 2023 and there appears little to rally expectations for growth this year. Falls in new construction orders since the end of 2022 have now begun to filter through into lower construction activity, particularly in housing, commercial offices and warehouses and factories in the industrial sector. With flatlining GDP growth, a step-change in interest rates and build costs, and emerging risks around delays and cost rises related to the Red Sea shipping disruptions, it should come as no surprise that demand was flagged as the key concern for construction product manufacturing activity in 2024.”

Key survey findings include:

- A balance of 63% of heavy side firms and 40% of light side firms reported that construction products sales fell in 2023 Q4 compared with Q3

- This was the sixth straight quarter of decline for the heavy side and second for the light side

- 11% of heavy side manufacturers and 15% of light side manufacturers anticipated a fall in sales over the next 12 months

- 71% heavy side manufacturers and 80% of light side manufacturers cited ‘demand’ as the key concern for sales over the next 12 months

- Cost balances continued to moderate but wages & salaries were the strongest cost pressures for both heavy side and light side manufacturers

CPA State of Trade Survey Q4 2023: declining demand impacts sales of construction product manufacturers

The recent publication of the CPA’s State of Trade Survey Q4 2023 revealed a continued decrease in construction product sales for manufacturers in the previous year. This marks the sixth consecutive quarter of decline for heavy side manufacturers and the second decrease for those on the light side. Looking ahead, manufacturers predict a further decline in sales over the next 12 months, expressing worries about the anticipated weak demand in 2024.

CPI Inflation and Core CPI Inflation for January 2023 have shown moderate increases

The CPA’s weekly Economic and Construction Update provides an insightful summary of the latest economic and construction trends in the UK.

The CPA’s weekly Economic and Construction Update offers a comprehensive overview of the current economic and construction trends in the UK, including key indicators like CPI inflation, core CPI inflation, UK construction average weekly earnings, UK construction insolvencies, UK house price index, and the UK residential market survey. This resource is valuable for individuals keen on the UK construction sector, with a user-friendly contents page for easy navigation to specific sections of interest.

In the latest report, it is evident that CPI Inflation and Core CPI Inflation for January 2023 have shown moderate increases, reflecting the current economic climate. The ONS Construction Output data for December 2023 indicates steady growth in the sector, with promising signs for future developments. Additionally, the ONS Construction New Orders for Q4 of 2023 demonstrate a positive outlook for upcoming projects within the construction industry.

Moreover, the ONS UK Construction Employment figures for the same period reveal stable employment rates, highlighting the industry’s resilience and ability to provide job opportunities. On another note, the Insolvency Service UK Construction Insolvencies data for December 2023 shows a decrease in insolvencies, indicating a more robust financial landscape for construction companies.

Lastly, the ONS UK House Price Index for December 2023 presents an overview of the housing market, showcasing trends and fluctuations in property prices. Overall, the comprehensive update provides valuable insights into various aspects of the construction and housing sectors, offering a glimpse into the current state of the UK economy.

FIS Wage Rate Survey points to ongoing inflation and contractual pressures

The survey also explored some of the concerns that are currently being experienced related to risk dumping through the supply chain.

Commenting on the data FIS CEO Iain McIlwee stated:

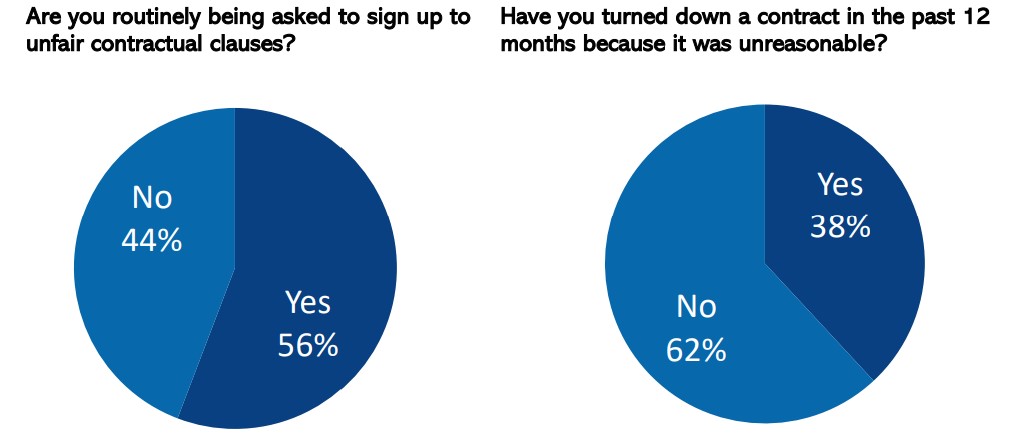

“The numbers clearly shows that the supply chain continues to be hit by inflationary pressures. Some of the contractual issues are also a worry, close to 60% of our specialist members are being asked to sign unfair contracts. Encouragingly there is evidence here that the Responsible No is being exercised, but the numbers are still out of balance. There is also evidence that design, programme and compliance risk are increased with over 70% stating that they routinely being asked to take more risk in terms of Design and close to 90% stating the same for programme. These numbers are not surprising, but they are concerning, especially against the backdrop of rising cost and more limited insurance cover available“.

In 2024 FIS launched the Responsible No Campaign to help bring attention to the pressures that specialists are under and the indiscriminate risk dumping that is evident in parts of the supply chain.

IF you wish to participate in future wage rate surveys, please contact the FIS on info@thefis.org and we will make sure you recieve appropriate updates.

FIS State of Trade Survey Q1 2024: Inflation continues, contractual battles persist but hope on the horizon

FIS Q1 2024 State of Trade Survey

FIS State of Trade Survey Q1 2024 highlights that inflation has slowed, but prices continue to rise due to raw materials and wages.

Workloads reported by FIS members in the final quarter of 2023 were mixed. Whilst a balance of 9% experienced growth, close to a quarter reported no changes quarter-on-quarter and the difference between those growing by over 5% and declining by over 5% was marginal.

Looking to the next quarter (Q1 2024) the expectation for most is more positive with 30% anticipating growth of over 5%, but this is balanced by 34% expecting their market to level out and 23% expecting the market to tighten and a further.

Members can dowload a full copy of the FIS State of Trade Survey Q1 2024 here

Alignment with wider industry forecasts

FIS data is gathered with the support of the COnstruction Products Association, who this week published the Construction Products Association’s Winter Forecasts.. Construction output is forecast to fall by 2.1% this year due to falls in private housing new build and repair, maintenance and improvement (rm&i) – the two largest construction sectors. The CPA forecasts that construction output will rise by 2.0% in 2025 in line with falling interest rates and a general economic recovery, which, in turn, could ease challenges in the housing and rm&i sectors. Recent disruptions in the Red Sea, however, have been identified as a key risk to the forecasts, potentially leading to supply issues such as delays and accelerating cost inflation.

Private housing – the largest construction sector – suffered a double-digit fall last year after a spike in mortgage rates hit housing market demand. Consequently, many house builders have reported a fall of around 25-35% in demand, in addition to the regulatory issues that smaller house builders continue to face in particular around planning, as well as water and nutrient neutrality. The lagged effect of higher mortgage rates is likely to continue to weigh upon property transactions this year with private housing output expected to fall by a further 4.0%. Looking to next year, a gradual fall in interest rates should boost demand with private housing output expected to rise by 4.0%. This doesn’t imply a speedy recovery however, as interest and mortgage rates are not expected to return to the record lows seen as recently as 2021 anytime soon. The lack of a government policy stimulus to help overcome high deposit and mortgage payment requirements, also means the recent peaks in housebuilding from 2022 are unlikely to be seen again until at least the end of the decade.

Private housing rm&i is the second-largest construction sector and activity continues to be on a general downward trend. The rising cost of living has hit discretionary household improvements spending. In addition, fewer property transactions last year led to a decline in refurbishment activity from new homeowners who typically make cosmetic improvements within the first 6-9 months of moving in. Smaller project work is likely to continue to remain flat in the first half of this year as household spending remains tight, whilst the continued fall in property transactions in the first half of this year is likely to hit larger project work for the remainder of 2024. This is likely to be partially offset though by strong activity on energy-efficiency retrofit such as insulation and solar photovoltaic work. Overall, private housing rm&i output is expected to fall by 4.0% in 2024 before growth of 3.0% in 2025.

In infrastructure, which is the third-largest construction sector, activity remains strong down on the ground. Work continues apace on HS2 Phase One despite the most recent cost increases, as well as on Hinkley Point C and the Thames Tideway Tunnel. Frameworks activity in the regulated sectors of roads, rail, water and electricity provides sustained levels of activity in the infrastructure sector too. Concerns remain, however, over pauses and delays to National Highways projects, as well as increasing uncertainty on the deliverability of plans in the water sector to deal with water quality issues through increased capital expenditure. Furthermore, at a local level, councils continue to face financial constraints and despite government announcing £8.3 billion of funding for potholes, resurfacing and roads projects to 2034, there is little evidence to suggest that this will lead to any uplift over the forecast period. As a result, overall, infrastructure output is expected to fall by 0.5% in 2024, a third successive marginal fall in output, before rising by 1.2% in 2025.

Commenting on the Winter Forecasts, CPA Economics Director, Noble Francis said: “The bad weather at the start of January has already affected the construction industry but there is still lots of time for a catch up in activity when the weather improves. The bigger problems for the industry are the hits to activity last year in its two largest sectors – private housing and private housing rm&i. These are likely to continue into 2024. Even with expected falls in interest and mortgage rates in the second half of this year, rates are likely to remain relatively high and so demand in the housing market, house building sector and rm&i sector is likely to remain subdued overall.

“Given the importance of housing to the UK economy, it was disappointing that the Chancellor’s Autumn Statement last year had little to help the beleaguered sector. It is critical that we see measures to help boost house building and homeownership from government in the upcoming Spring Budget. Furthermore, government should do more on infrastructure delivery given that the sector is set for its third consecutive fall in output. This is despite announcements from government on new projects to compensate for the cancelling of the Northern leg of HS2.”