by Clair Mooney | May 27, 2022 | Health and Safety

Every week, workers in the construction industry develop serious lung diseases that can have a devastating impact on them and their families. During June, HSE will be carrying out a health inspection initiative focusing on the respiratory risks to construction workers from exposure to dust. The initiative aims to support industry by

raising awareness of health issues in relation to dust exposure to improve the long-term health of those working in construction. It is part of HSE’s wider-phased, strategic plan developed to improve health within the construction industry.

Rights and responsibilities when working on a construction site

Employers: Regardless of the size of your business, you have a legal responsibility to protect workers’ health.

Plan jobs to eliminate the risks from dust where you can. Otherwise, use measures to control dust and minimise the risk.

Construction workers: Don’t gamble with your future health by taking unnecessary risks today. Talk to your employer about the risks from dust and how to avoid them.

by Clair Mooney | May 26, 2022 | Skills

The Levy Order 2022 has now been approved by Government, which means the CITB Levy returns to its pre‐pandemic rates of 0.35% for PAYE and 1.25% for Net CIS. CITB has confirmed it will be issuing Levy Assessment Notices in June and the last date for employers to submit their completed 2021 Levy Return is Sunday 22 May.

by Clair Mooney | May 26, 2022 | Skills

CITB has published its Business Plan 2022/23 setting out how it will invest over £233 million to support the industry to address its skills challenges. The plan is focussed on three key areas: responding to the skills demand, developing the capacity and capability of training provision, and addressing future skills needs.

This comes at the same time as the CITB Levy rates are announced to be returning to pre-pandemic levels. The Levy Order 2022 has been approved by Government, which means the CITB Levy rates will revert to 0.35% for PAYE and 1.25% for Net CIS.

FIS Chief Executive Iain McIlwee said:

“Whilst the FIS membership voted against concensus, the wider vote didn’t follow and the organisation now has the statutory support it needs to continue to collect the levy. It is important from here that we work with CITB to ensure, not that we all get our money back, but that our investment in levy is returned in spades to help us to address the profound skills and labour shortages that we have and that we address the challenges that are making recruitment a struggle. The three core pillars in here around attracting and retaining people, focussing on the capacity and capability of training provision and looking at the wider areas of construction management are all fundamental to success for the sector and so FIS will be working with CITB to translate these for our sector and ensure our members are aware of and able to access all the support available in an efficient and that it is better targeted to support the needs of the flexible workforce that is construction. One thing we learned from our recent recruitment interventions is that there is a lot of support out there, some of it excellent, but that we are not consistently using it as a community.”

This plan heralds a new era for CITB, not only through its simplified look and feel, but for how they will approach their role in supporting the construction industry to address the skills challenges it faces. First it addresses the skills demand at a local level by putting training infrastructure in place to meet the changing needs of industry. Second, it explores where the greatest value for the Construction Industry Levy will be placed. And third, it examines where CITB can pull the levers to transformation, so that training is directed at meeting short and long-term industry challenges.

by Clair Mooney | May 26, 2022 | Main News Feed

ISG is the latest FIS member to adopt the Common Assessment Standard for its pre‐qualification (PQ) requirements.

ISG’s Head of Supply Chain Rob Scriven commented that “removing the burden of administration and eliminating inefficient practices is a win for us all”. ISG joins a growing list of organisations using the Common Assessment Standard, and members of the supply chain can now obtain just one certification from any of the four Recognised Assessment Bodies ‐ Achilles, CHAS, Constructionline and CQMS ‐ in order to tender for work with them.

The Common Assessment Standard has two levels of certification ‐ desktop and site‐based ‐ and companies should apply for the appropriate level depending on their trade, size and the requirements of their clients.

FIS CEO Iain McIlwee stated: “It is encouraging to see members getting behind the CAS. We talk about waste in construction all the time, but at the heart of our industry there is a pointless duplication of effort built around competing PQQ processes. Pre-qualification in principle should save us time and efforts to standardise and adopt a common approach are to be applauded”.

What this means for FIS Specialist Sub contractors:

When working for ISG they will not be specifying a specific PQQ process you will be able to use any of the four recognised CAS assessment tools in order to qualify for work.

FIS ran a webinar on the benefits of the Common Assessment Standard in February 2022

Linked news: May 2022

Common Assessment Standard updated to reflect UK sanctions list

by Clair Mooney | May 25, 2022 | Main News Feed

The CICV is calling on the Scottish Government to intervene and help address concerns raised by Scottish construction businesses over the introduction of the new UK Conformity Assessed (UKCA) mark.

The unique alliance’s Post-Brexit and Trade Group has written to Business Minister Ivan McKee (pictured above) requesting assistance as CICV businesses grapple with new UKCA conformity assessment and certification arrangements that replace CE Marking after 31 December this year.

The UK Government is introducing a new “UK Conformity Assessed” mark for goods placed on the market in Great Britain from 1 January 2023. Ministers seek new powers to end the recognition of CE Marking in favour of UKCA Marking in the recently passed Building Safety Act.

CICV has highlighted the deep frustration among manufacturers and importers that there is at present no route to accept historic test data and reports from EU Notified Bodies for use in complying with UKCA Marking.

This poses a particular problem, it says, for goods in relation to the Assessment and Verification of Performance (AVCP) System 3. If manufacturers and distributors want to continue selling their goods in Great Britain, they have to be re-tested and certified by an accredited UK Approved Body.

The CICV is concerned at the lack of progress between the UK Government and individual companies, trade associations and certification and testing bodies to prepare properly.

It argues that there is insufficient testing capacity and capability for manufacturers to have their goods assessed and certified for the British market, using UK-based Approved Bodies, by the end of this calendar year.

The letter says: “There are simply not enough approved companies or qualified people to conduct the huge number of assessments and certifications required to gain UKCA Marking in time.

“For example: there are no UK Approved Bodies able to test:

- insulation: most types of pipe insulation and duct insulation;

- trench heating: most types for residential, commercial & municipal buildings;

- renders: several types of synthetic renders and render-based brick slips;

- glass: several types of coated and laminated glass inc. mirrors;

- plastic pipes: several types of thermoplastic pipes for underground drainage.

“For other goods, there are scant few UK Approved Bodies available:

- radiators: only one approved company whose entire annual capacity is fully booked;

- fire doors: only two approved companies for smoke leakage tests;

- sealants: only one approved company – most tests take up to 3 months to allow for curing.”

The CICV says that with continued uncertainty about as-yet-unknown future regulations, large capital costs for SMEs to invest in more or new equipment and facilities and next-to-no time available to find and train specialist staff, there is little appetite for businesses to take the plunge.

The letter says: “Whitehall has told businesses to prepare for the end of CE Marking on 31 December 2022. Legislation is required but the Department for Levelling Up, Housing and Communities (DLUHC) cannot give a firm date for this.

“The risk is that faced with ongoing difficulties – like higher raw material, energy, labour and transport costs and other inflationary pressures – businesses do not bother, hoping somebody will come up with answers in time.”

It continues: “CICV says the situation is fast becoming serious for British manufacturers who are already spending hundreds of thousands of pounds on testing to both UK and EU standards. With eight months to go, there are too many unresolved questions about post-2023 arrangements.

“The preferred solution is for ministers to pause now that the Building Safety Act is on the statute book and take heed of what industry is telling them. The CICV view is that deferring the 31 December 2022 date is obvious and necessary and UK ministers should move quickly to say so and dispel uncertainty.

“Drafting the statutory instruments to bring in new provisions is critical and must be done correctly to avoid unintended consequences that harm British businesses. It is sensible and pragmatic to delay the secondary legislation to allow business to prepare properly.

“If the situation described is not resolved (and soon), the logical conclusion is that goods cannot be sold after 1 January – and construction, housebuilding and property RMI will slow down or stop.”

The letter concludes with the CICV asking the Scottish Government to recognise the concerns expressed and to see if there is scope within devolved powers to assist. “Any representations you can make to the UK Government on our behalf would be gratefully appreciated”, it adds.

Alan Wilson, MD of SELECT, the representative trade body of Scotland’s electro-mechanical sector, and who chairs the CICV, said: “With this submission to Mr McKee we are hopeful that that the Scottish Government can bring its influence to bear on this matter and allay the well-founded fears of CICV members.”

by Clair Mooney | May 23, 2022 | Main News Feed

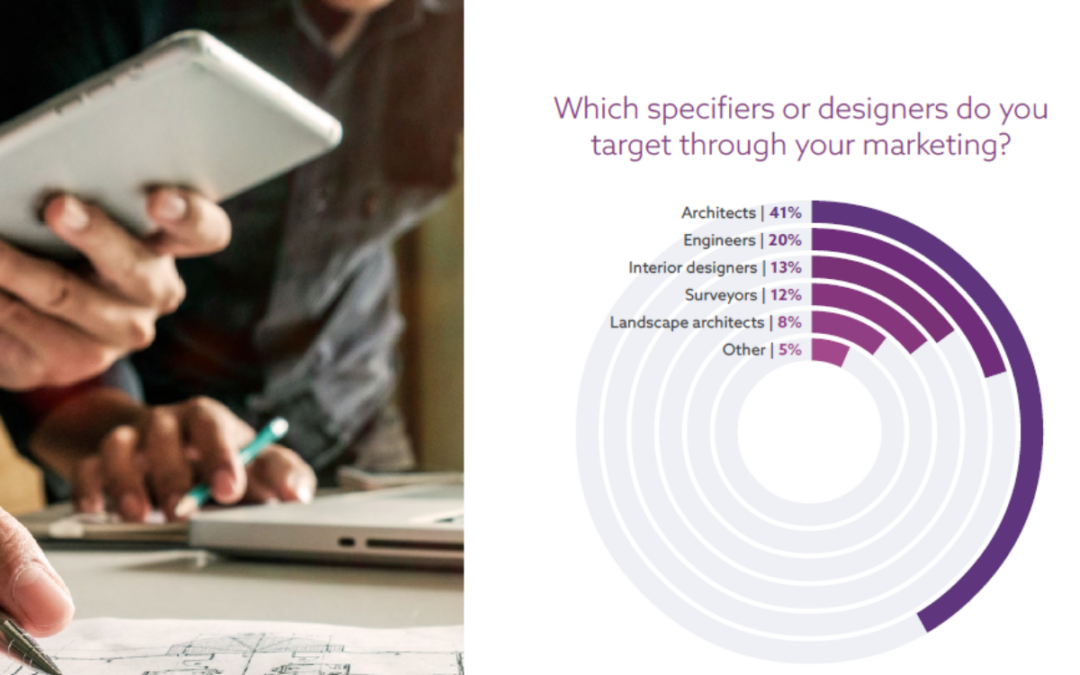

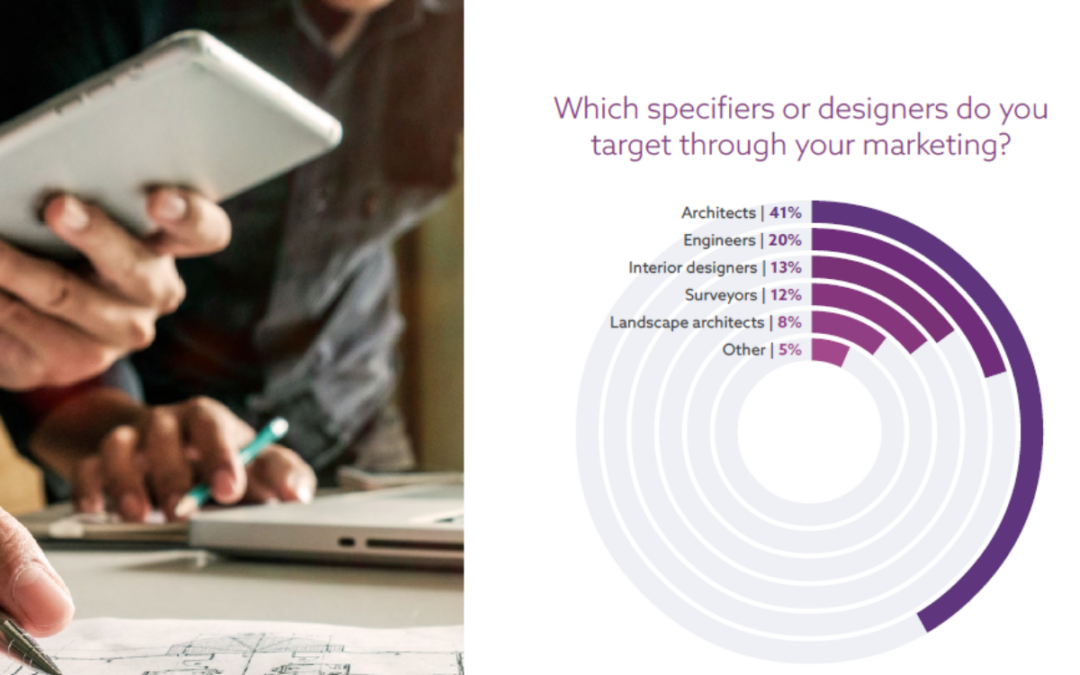

In this landmark marketing report, NBS and Glenigan deliver the results of their first joint marketing survey, the ‘Construction Manufacturers’ Marketing Index’.

The report covers:

- Trends for using particular channels or tools

- Differences in approach within the industry and how it compares with other industries

- Experiences and methods used by different companies

- Marketing budgets – and how they are being applied across marketing channels

It also contains people’s perceptions of marketing in construction, and what the future marketing landscape could look like for the industry.

FIS Chief Executive Iain McIlwee said:

“It is ever more interesting to compare how communication is developing. Design and specification continues to evolve almost as fast as the channels and methods open to reach them – it isn’t getting any easier to target information in the right format in order to win and protect specifications. It is great to be collaborating with Glennigans, NBS and other leading trade bodies to deepen our understanding and help better target resources of our members”.

This report is incredibly valuable to those supplying products to the construction industry: a way of benchmarking your marketing against others and, perhaps, learning something new that you can apply in the year ahead.

by Clair Mooney | May 20, 2022 | Membership

FIS has a suite of Specifiers Guide, and earlier this month we published the fourth in our series focussing on Partitioning. You can access this guide, along with others covering Ceilings and Absorbers, Drylining and SFS here. Two of these guides have now gained RIBA CPD accreditation, and we will be putting the others forward for accreditation in the coming months.

These guides work well when they are included in proposals and project plans to demonstrate how to best approach a project. They are also good differentiators when in competition with a non-member, and are an excellent introduction to new members of the team and any trainees and apprentices.

But our offering doesn’t stop there. We also have a dedicated Knowledge Hub packed full of resources for our sector. Our easy-to-use online library contains a wide variety of material, covering contractual and legal, technical guidance and quality standards, drawn from a broad range of sources. The Knowledge Hub is constantly expanding, with up-to-date and topical material added on a regular basis.

In addition a member of our in-house technical team is only a phone call away to offer support to help you navigate the complexity of contracting and supplying products to the sector.

by Clair Mooney | May 20, 2022 | Building Safety Act

The Grenfell Tower Inquiry in the Phase 1 report noted that “Fire doors play an essential role in preventing or inhibiting the spread of smoke and toxic gases and in preserving the effective compartmentation of buildings.” The Inquiry noted that the fire doors in Grenfell Tower did not, through damage and/or disrepair, act in the way that they should so that they prevent smoke and gases from spreading. The Inquiry recommended (Recommendations 33.29 (a) and (b)) that the owner and manager of every residential building containing separate dwellings carry out an urgent inspection of all fire doors to ensure compliance with current legislative standards and that regular (no less than every three months) checks be carried out to ensure all fire doors are fitted with an effective self-closing device which is in working order. In addition, the Inquiry recommended (Recommendation 33.30) that all those who have responsibility for the condition of the entrance doors to individual flats in high-rise residential buildings (with unsafe cladding) be required by law to ensure these doors comply with current standards.

Prior to the Fire Safety Act 2021, flat entrance doors in multi-occupied residential buildings may not have been routinely considered as part of the fire risk assessment process. The Fire Safety Act 2021 has removed the legal ambiguity and confirms that flat entrance doors are in scope of the Fire Safety Order.

The Fire Safety (England) Regulations 2022 will make it a legal requirement from 23 January 2023 for responsible persons for all multi-occupied residential buildings in England with storeys over 11 metres in height to:

- Undertake quarterly checks of all fire doors (including self-closing devices) in the common parts; and,

- Undertake – on a best endeavour basis – annual checks of all flat entrance doors (including self-closing devices) that lead onto a building’s common parts.

The regulations will also require responsible persons to provide to residents of all multi-occupied residential buildings with two or more sets of domestic premises (that have common parts) information on the importance of fire doors to a building’s fire safety.

by Clair Mooney | May 19, 2022 | Skills

The recent FIS regional events identified the challenge of retaining people in apprenticeships and training to the point of successful completion, it is estimated approximately 30% of those who start construction apprenticeships do not complete. There are a number of reasons for this, but key is ensuring that we have the management processes and support mechanisms in place to support young people in our businesses. It is widely acknowledged that organisations that have dedicated coaches and mentors experience higher retention rates across all levels of the workforce, but this isn’t easy to implement and there hasn’t been enough support and training to help.

The Strategic Development Network (SDN), a team of leading specialists in apprenticeships, technical education and workforce development has been working with Government and Industry Bodies to address this concern. SDN are hosting a one hour webinar on the role of the line manager and mentor on the 31 May. The focus will be on hosting young people in the workplace who are engaged on government backed schemes that prepare them for work, T-Levels and Traineeships, potentially the finishes and interiors sectors future workforce.

Here are the details:

The role of the line manager and mentor – hosting young people in the workplace – 31 May 2022, 2-3pm

In this 1-hour webinar, SDN will cover:

- The role of line managers throughout the placement

- Creating a mentoring culture and identifying suitable mentors

- Setting up an effective mentoring scheme – supporting young people to succeed in the workplace

- Staff development – mentoring, coaching and interpersonal skills

- Case study insights from those already offering industry placements

- The government support available to help you

There is no charge for this session. You can register your place here

FIS look forward to seeing you online.

by Clair Mooney | May 19, 2022 | Building Safety Act

Building Safety – First stage complete in journey towards fully competent installer workforce

The construction and built environment sector must maintain momentum to ensure the competence of installation organisations and employees as a key report highlights ‘red flags’ amid wider progress on Building Safety.

A report has been published setting out the current state of competence arrangements for those installing products and systems in buildings. Prepared by members of Working Group 2, which was set up as part of the post-Grenfell Competence Steering Group, volunteers from Working Group 2 have worked with six pilot installer sectors – Dry Lining, Domestic Plumbing and Heating, Fire Detection and Alarms, Fire Stopping Specialist, Rainscreen Cladding, and Roofing – to benchmark existing competence arrangements.

This Pilot – Phase One stage sets a baseline to identify shortfalls and considers the changes needed to create competence frameworks that comply with the recommendations of Setting the Bar. In 2020, Setting the Bar outlined how industry must improve the competence of those procuring, designing, constructing, inspecting, assessing, managing, installing and maintaining higher risk residential buildings.

The report recognises that good practice exists in each of the six sectors that allows them to demonstrate elements of competence. Yet there are elements of each sectors’ arrangements that the working group has red rated, showing that significant work is required to meet the requirements of Setting the Bar.

Each sector will now move to develop sector-specific competence frameworks that play to existing strengths and close off any red flag issues raised in the report. This process – which will also develop a timeline and implementation plan for each sector – is expected to take six to nine months.

The report also calls on other installer sectors to begin their own competence journey now, offering guidance to help them do so which Working Group 2 has developed during the pilots.

Iain McIlwee, FIS Chief Executive who was a participant in the Dry Lining pilot, said:

“FIS has taken an active role in this work and will continue to work with our members and the wider sector to ensure that competency is understood, the support mechanisms needed to deliver a competent workforce are in place and that we are able to track, manage and reward competence effectively. We have championed and led the Dry Lining work because it is an important part of most building operations, it is a labour intensive process and frankly has been hugely undervalued in the construction process. This work is the building block, a fresh start not only to delivering a better competency framework, but helping to raise the profile and change expectations about the vital work that dry liners do. We do not underestimate the enormity of this task given the current socioeconomic backdrop, but do recognise that it is essential work that we must take on together.”

Mark Reynolds, Sponsor for the CLC’s People and Skills Network, said:

“Publication of Working Group 2’s latest report marks an important milestone in progress towards improved standards of installer competence in the built environment. The CLC will continue to do all we can to assist with the pilots and I would urge other installer sectors now to embark on their own competence journeys, drawing on the resources which Working Group 2 has provided.”

Nick Jarman, Chair of Working Group 2, said:

“There has been much collaboration since the formation of Working Group 2, focussed on how we can learn from the lessons of the past and forge a new pathway of improvement for the future with the objective of providing a safer built environment overall. I would like to thank sector representatives and my Working Group 2 colleagues for getting the pilot process to the point this report can be published. Working Group 2 looks forward to further engagement and collaboration with the wider installer sector to continue progress on this crucial workstream.”

by Clair Mooney | May 16, 2022 | Building Safety Act

After receiving Royal Assent on 28 April 2022 the Building Safety Bill is now available for scrutiny.

FIS will continue to look at how the Bill will impact our community and will keep members up-to-date with developments. We have prepared an initial summary of the key implications that you can access here.

FIS is committed to supporting our members with compliance and ensuring the Bill supports a better safety and a more collaborative approach to procurement.

by Clair Mooney | May 13, 2022 | Sustainability

Net Zero is rapidly becoming a high priority and therefore the FIS Sustainability Group has put together a series of papers to help FIS members understand more about the net zero agenda and its relevance to the finishes and interior sector. These papers provide members with an overview of:

- How to measure the whole life carbon impacts of products and projects using a life cycle assessment (LCA) approach

- What net zero means at project and organisational levels and approaches to measuring the carbon footprint of an organisation

- An action plan for the sector to start getting a better understanding of the performances of FIS members

These papers provide an overview of the most commonly used jargon in relation to the topic, how to measure, what the drivers are and references to other relevant information.

They are freely available to FIS members at https://www.thefis.org/knowledge-hub/sustainablility/sustainability-related-to-your-activities/net-zero/

by Clair Mooney | May 13, 2022 | Main News Feed

The FIS Contractors Awards showcase the very best of our industry and after months of project visits, we are excited to announce that our judges have determined their shortlist.

To see who made the shortlist click here

The FIS Contractors Awards aim to promote and encourage high levels of craftsmanship in the finishes and interiors sector. The standard of entries into this year’s Contractors Awards was extremely high, so congratulations to all companies that entered.

The winners in each category, along with the the architect or interior designer of the winning project, will be announced in front of a packed audience at the FIS Awards Lunch on 9 June at the Royal Lancaster Hotel in London. The event is now sold-out, so if you would like to attend but haven’t yet booked, get in touch with clairmooney@thefis.org and we will add you to the waiting list.

by Clair Mooney | May 12, 2022 | Building Safety Act, Technical

Developers in Scotland will be banned from using combustible cladding on high‐rise buildings from 1 June, following the introduction of new building standards legislation. Since 2005, new cladding systems on high‐rise blocks of flats have either had to use non‐combustible materials or pass a large‐scale fire test. However, the new legislation removes the option of the fire test, prohibiting such materials from being used on domestic and other high‐risk buildings above 11 metres. The highest risk metal composite cladding material will be banned from all new buildings whatever their height, with replacement cladding also required to meet the new standards.

FIS has reviewed the proposals and note that Cavity Trays that caused some disruption in England and Wales are in the list of exemptions and consistent with the work we did with Scottish Government on buildings greater than 18 m.

Scottish Procurement Policy Note (SPPN) 02/2022 will also be introduced from 1 June, which sets out how public sector bodies are to embed prompt payment performance in the supply chain through procurement processes. Suppliers will have to pay 95% of valid invoices on time, or provide an improvement plan, otherwise they will not be selected to bid.

by Clair Mooney | May 12, 2022 | Main News Feed

Due to the unprecedented situation in Ukraine, which has led to a growing list of sanctions against Russia and Belarus, Build UK will be adding a new question to the Common Assessment Standard to enable the construction supply chain to demonstrate that it is not dealing with any companies or individuals subject to the UK Sanctions List. Version 3.1 will be published on 1 July and suppliers will be required to answer the new question when they next go through the certification process for the Common Assessment Standard.

We are continuing to roll out the Common Assessment Standard across the industry and our new infographic shows how it is improving efficiency and reducing cost in the pre‐qualification (PQ) process.

by Clair Mooney | May 12, 2022 | Main News Feed, Material Shortages

Statement from John Newcomb, CEO of the Builders Merchants Federation and Peter Caplehorn, CEO of the Construction Products Association, co-chairs of the Construction Leadership Council’s Product Availability working group

With the Product Availability Group having met only three weeks ago, there has been little change in respect of overall product supply since our last report, although the conflict in Ukraine is likely to affect some timber supplies later in the year. There is a good supply of most products and materials but, as previously reported, ongoing challenges continue to affect bricks, aircrete blocks, concrete products, PIR insulation products and gas boilers all of which are on long lead times.

Most wood products, including structural timber, are fully stocked. While structural softwood will remain fully available, the availability of some other product groups, whose use is concentrated in the joinery, shopfitting and finishing sectors rather than housing, is less certain given their greater reliance on raw material supplies from Russia and Belarus. The most critical is Birch plywood, which will become increasing scarce as summer progresses as outside of Russia there is only limited production from Europe, principally Finland. If the UK market is offered Birch Plywood for later in the year from the Far East, it will be based on Russian Birch logs and will be illegal to import.

Although Siberian Larch cladding will disappear from the market eventually, there are plenty of alternative cladding sources. Similarly, there are alternatives to Russian redwood and whitewood used principally in joinery and shopfitting, although these are generally more expensive.

Some PAG members reported initial signs of a slowing market. These reports are corroborated by recent published data from Glenigan, pointing to a slowdown in starts on site during the three months to April 2022. These data points suggest that inflationary pressures are starting to influence client decisions in some sectors, continuing the trend seen with softening retail sales over the last few months.

Most regions are still reporting strong demand on the trade side, particularly from larger housebuilders and for infrastructure projects including road building. SME contractors, however, are concerned that local authorities may delay regeneration projects until they can achieve more price certainty through the procurement process. We have also heard of delayed start dates for specialist trades at the end of the product building cycle, that may indicate projects continuing at a slower pace, which may impact both productivity and cash flow.

Price inflation remains a critical issue. We have previously reported the impact of rising energy, fuel and raw material costs on product price, and the latest data published by BEIS shows that annual material price inflation increased to over 24% in March for a basket of materials. With further restrictions on Russian gas and oil imports across Europe we expect that energy price movements will continue to be unpredictable. Some merchants and producers have also reported impacts on the availability of products caused by the outbreak of Covid in China and the restrictions imposed in response to this, which is affecting manufacturing and shipping from Shanghai. Wage inflation is a further concern within the supply chain, with pay rises necessary to secure labour.

Those pay raises have helped to somewhat ameliorate the shortage of HGV drivers, with reports of a record number of HGV drivers taking their tests and estimates that the driver shortfall has reduced from 100,000 at its peak to 65,000.

Despite this, the high costs and risks around haulage and shipping persist; we note reports that some European lorry manufacturers are not taking orders either because backlogs were problematic or pricing of input materials for new vehicles was proving too uncertain. This may put greater pressure on companies to maximise the efficiency of their fleet and keep vehicles for longer than anticipated. Construction product manufacturers and distributors are amongst the largest users of the UK’s road network.

In regards to global shipping, the price of moving a container from the Far East to Europe has dropped as much as 25% from its high at the start of the year, but many forecasters believe that the elevated costs and volatile delivery schedules caused by the container crisis will nonetheless carry on to mid-2023.

The conflict in Ukraine continues to affect certain product areas, as detailed in our last two reports (21 April and 28 March). We are undertaking a horizon scanning exercise to determine the likely extent of disruption particularly in relation to clay, ceramics, electrical products, and raw materials for steel and other production, as well as impact on energy costs.

by Clair Mooney | May 12, 2022 | Main News Feed

The Covid-related relaxation to the rules on claiming expenses for working from home has now been abolished. What this means is that if your employees *can* work from home if they choose but you have not *required* them to work from home, they can no longer claim home office expenses (they should check their 2022-23 notice of coding).

There is a clear statement from HMRC that “You cannot claim tax relief if you choose to work from home” which you can find here and there is a “check your status” tool employees can complete for themselves here.

May is a busy month of deadlines which members are encouraged to factor into their planning.

- 19 May If you are not paying electronically, this is the deadline for PAYE/NICs/CIS/Student Loan for the month ended 5/5 and for CIS returns. These payments need to clear HMRC’s bank account by 22 May.

- 31 May deadline for employees to have received P60s from their employers.

- 31 May Companies House should have received 31/8/2021 private company accounts and 31/11/2021 accounts for plcs.

- 31 May CT self-assessment returns for companies with accounting periods to 31 May 2021.

This issue of Newsline, exclusively available to FIS members, also includes as update on when a non-construction business can be “deemed” to be within CIS, avoidance schemes and National Insurance Contributions. Read the latest issue here.

by Clair Mooney | May 5, 2022 | Technical

FIS has launched a technical guidance note, Guarding with frameless glass partitioning to help specifiers, designers, manufacturers and specialist contractors fully understand the unique challenges of utilising full height frameless glazed partitions as a barrier.

The new FIS technical note was produced by the FIS on behalf of its members and peer reviewed by the wider community in response to ongoing feedback on the specific overlap between this product category and it’s intended use which is not well described or prescribed by standards or regulations. The document also gives examples of how to harmonise the approach to performance across devolved nations where the guidance that exists can vary.

Commenting on the need for guidance Peter Long of Optima Systems said:

“We need to be advocating the same degree of risk management in guarding as we do with fire. Both areas of construction are protecting risks to life, so both should have the same levels of attention to safe design.”

This supports the need to consider this product to be a clear example of a safety critical product.

Referenced and associated FIS publications:

The unintentional designer

Spontaneous breakages of toughened glass

FIS acoustic verification scheme

Best practice guide for installing partitions

These guides work well when they are included in proposals and project plans to demonstrate how to best approach a project. They are also good differentiators when someone is in competition with non-members, and are an excellent introduction to new members of the team and any trainees and apprentices.

The guidance note is freely accessible to FIS members and to specifiers on request. Visit the Technical Guidance section on the webiste at https://www.thefis.org/knowledge-hub/technical/fis-technical-notes-industry-alerts/

by Clair Mooney | May 4, 2022 | Main News Feed

In its latest quarterly forecast, the Construction Products Association (CPA) sees a dramatic slowing in growth, with uncertainty ahead as global issues start to affect the UK market.

In previous years, the predicted 2.8% growth in construction output anticipated by the CPA team would be cause for celebration. However, while a robust figure, this is a sharp revision down from the 4.3% growth forecast just three months ago.

Demand remains strong across the industry in Q2, and the current project pipeline suggests that this will support activity levels until at least 2022 Q3. The downward revision to the growth forecast stems from concern around a host of price pressures arising from both local and global issues.

Prior to the conflict in Ukraine, UK construction was already facing labour and product availability issues and the impact of reverse charge VAT and IR35. Rising energy costs were driving near-record price increases in construction products and the continued conflict is exacerbating this issue.

The impact of these pressures, and of more general rising costs, on demand will vary considerably by sector. Across the board the picture is one of positive market conditions in the short term with anticipation of tougher times ahead.

In private housing repair, maintenance and improvement, the stellar performer post the initial Covid-19 lockdowns, SMEs report that demand remains high, but this is the sector arguably most exposed to current price inflation, falls in consumer confidence and pressures on household incomes. Overall, output is expected to fall by 3% in 2022 and 4% next year from current all-time highs.

Private housing, the largest construction sector, remains strong, with housebuilders reporting resilient demand. Longer term, there must be questions over consumer confidence but output in this sector is forecast to rise by 1% in both 2022 and 2023. This contrasts with the 3% per year growth forecast three months ago.

The fastest growth is expected in the industrial sector, in which output is forecast to rise by 9.8% in 2022 and 9.3% in 2023, due to a strong pipeline of warehouse projects, resulting from a long-term shift towards online shopping.

Infrastructure, traditionally less affected by immediate economic conditions, remains positive. Large projects such as HS2, Thames Tideway and Hinkley Point C combined with the five-year spending plans in Page 2 of 3 regulated sectors such as rail, road and power generation point to a forecasted growth of 8.8% in 2022 and 4.6% in 2023.

On the supply side, the main immediate impact of the war in Ukraine for construction products will be the knock-on from rising energy prices and commodity shortages. Soaring energy costs will have to be passed on and lead to sharp rises in the cost of energy-intensive products. This will affect both imported products such as aluminium and steel and locally sourced products such as bricks and cement.

Contractors are likely to feel the pressure first, particularly those working to fixed-price contracts. For future projects, contractors will be forced to re-price, add fluctuation costs and introduce risk-sharing arrangements to deal with the uncertainty over potential cost inflation.

Noble Francis, CPA Economics Director, offered this summary of the latest figures:

“The major challenge is creeping uncertainty. The immediate picture is one of resilient demand and healthy pipelines. Longer term, the current inflationary pressures, if sustained, will have an increasingly depressing impact, while the continuation, or potential escalation, of conflict in Europe presents an existential risk.

“Specialist sub-contractors are feeling the effects first, particularly those working to fixed-price contracts. For future projects, contractors will be forced to re-price, add fluctuation clauses and introduce risk[1]sharing arrangement to deal with the uncertainty over potential cost inflation.”

by Clair Mooney | May 3, 2022 | Main News Feed

The Construction Industry Collective Voice (CICV) has reassured clients that ongoing price rises for projects are caused by global events not “profiteering” – and says any increases only reflect the spiralling costs that are affecting the whole construction industry.

Clients have voiced concerns at the increasing costs of construction work, but the body insists this is due only to ongoing global events sparking a rise in fuel costs and shortages of raw materials and labour.

Iain McIlwee, FIS Chief Executive said:

“The war in Ukraine, energy price hikes, impact of Brexit and fallout from COVID-19 have all created a ‘perfect storm’ just as there is a surge in demand, with price increases being imposed on the industry as a result.

Construction professionals are increasingly being forced to shoulder these ongoing rises, particularly when it comes materials, and are having no option but to pass these increases on to clients. But it is not profiteering – it is a necessity for these businesses to survive.”

The CICV’s Post-Brexit & Trade sub-group this week discussed the higher costs for raw materials, energy, labour and transport being faced by construction businesses of all sizes in Scotland, with particular focus on inflationary pressures for SMEs caused by external factors.

Iain added:

“This is a really challenging time for all in the construction supply chain with costs rising, often at short notice. The critical thing now is that we work together as a supply chain.

Too often in construction we have contracted down all risks, but we are now in a position where fixed prices could undermine the resilience of contractors or suppliers and we need to adopt a more collaborative approach and consider how fluctuations clauses can be deployed and any risks fairly shared so as not to undermine the quality or viability of a project or businesses.”

The CICV says as well as the negative impact of political, military and health issues, the withdrawal of red diesel in April has also led to higher costs for construction firms.

Chris Cassley, Policy Manager at CICV member the Construction Plant-hire Association (CPA), said:

“The UK Government’s environmental strategy with the removal of red diesel for construction plant has undoubtedly contributed to the current financial impact on industry, and despite representations to government departments, has proceeded regardless.

“The rise in energy and material prices, together with supply chain pressures and higher inflationary figures, has led to a tipping-balance for suppliers and customers alike, and in many instances resulted in necessary price increases. These increases are very likely to be passed back up to the client and for government projects, it will be the taxpayer who will ultimately have to pay.”

Another warning came from Andrew Richards, Strategic Director of Safedem and a member of the Construction Scotland Industry Leadership Group, (representing SMEs and the supply chain) which is working in tandem with CICV to support the industry. Mr Richards said:

“The knock-on effects caused by the global events of the past two years looks like they will continue for the immediate future, so clients should consider fluctuations and rises in construction costs as part of ‘the new normal’ and shouldn’t expect prices to fall any time soon.

“Construction professionals are equally concerned about the uncertainty that surrounds the marketplace and are only passing on cost increases through necessity, not greed.”

The Post-Brexit & Trade panel is one of 12 sub-groups run by the CICV, covering a range of issues ranging from health and safety and skills to the supply chain and project bank accounts.

The collective was rebranded from the Construction Industry Coronavirus (CICV) Forum at the start of 2022 to reflect its widened remit, which now covers all areas of construction.

Since its creation in March 2020, the CICV has drawn on the collective expertise of its members to maintain a steady supply of information and practical advice to the sector as well as carrying out surveys, hosting webinars and making appeals to government ministers.