by Nicky Smith | 1 Feb, 2018 | Main News Feed

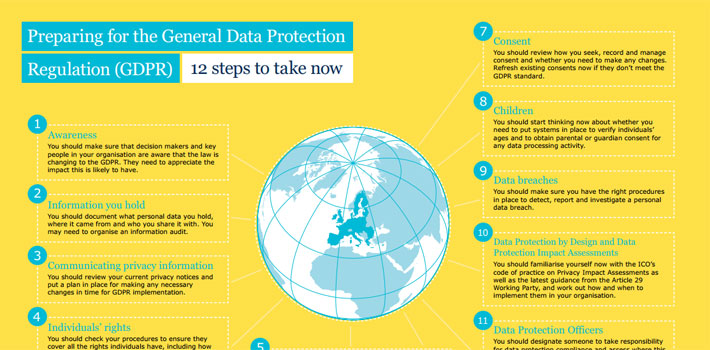

Like it or not, GDPR is going to impact all companies. As an example, consider the amount of personal data you hold on just your employees and LOSCs!

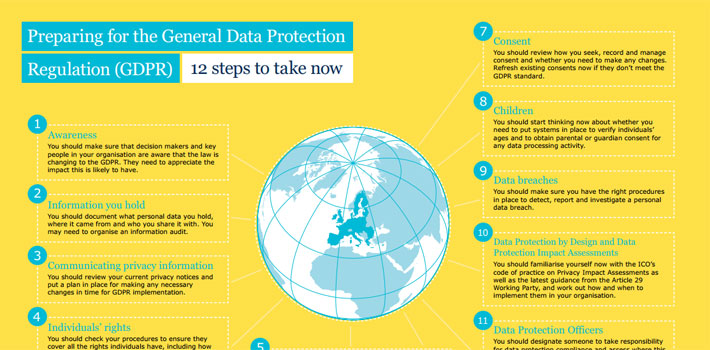

GDPR came into force in May 2016, with a two-year transition period becoming enforceable from 25 May 2018. The principles are very similar to EU Data Protection Directive, however, the GDPR contains a number of changes including:

- Enhanced documentation to be kept by data controllers

- Enhanced privacy notices

- More prescription rules on what constitutes consent

- Mandatory data breach notifications requirements

- Enhanced data subject rights

- New obligations on data processor

- Expanded territorial scope

- Appointment of Data Protection Officers

- Significant increase in the size of fines and penalties

What is covered by GDPR?

Both personal data and sensitive personal data are covered by GDPR. Personal data can be anything that allows a living person to be directly or indirectly identified. This may be a name, an address, or even an IP address. It includes automated personal data and can also encompass pseudonymised data if a person can be identified from it. Sensitive personal data encompasses genetic data, information about religious and political views.

Who enforces GDPR?

GDPR is governed by the Information Commissioners Office (ICO), which has the authority to enforce stiff fines for non-compliance. Before you panic, the ICO is not out to get you, and as long as you have shown due diligence if you fall foul of GDPR it will be understanding.

Who needs to be aware of GDPR in your company?

In the first instance, directors and senior managers need to be aware of GDPR and take steps to ensure that the company meets its obligations. This will then need to filter down to other members of your organisation to ensure they are following procedures.

What‘s next?

We would love to be able to give you a template/action plan to ensure you are compliant. However, how each company approaches GDPR will differ depending on the data the company processes and who has access. In the first instance, you will need to access where, and how, personal data you hold is being processed. This will dictate your action plan moving forward.

What is important is that you take action NOW!

Links

There is a huge amount of information out there relating to GDPR. Just a few of the links we have found useful can be found on the right.

by Nicky Smith | 30 Jan, 2018 | Main News Feed

During January, we welcomed four new companies to the FIS membership; Bournes of London Projects Ltd and Keylon Interiors Ltd are contractor members and we have two service providers – Endeavour Recruitment Services Limited and Chalkstring Limited.

We look forward to a long and successful relationship with our new and existing members going forward in 2018. A range of membership benefits, Special Interest Forums, events and publications are available in the FIS Membership Hub.

Look out for news from the President’s Lunch on 6 February!

by Nicky Smith | 22 Jan, 2018 | Main News Feed

Comments are invited on the final peer review of the Steel Construction Institute’s document Design and Installation of Light Steel External Wall Systems. All comments received will be collated and discussed at a meeting of the Steel Framed Systems forum in February/March 2018; please inform Dan Cook, FIS technical assistant, if you would like to attend: dancook@thefis.org

The document has already gone through two extensive reviews which can be read in ‘track changes’ here. If you would like to submit any comments they should be recorded here and returned to dancook@thefis.org no later than 19 February 2018.

The FIS Steel Framed System Forum can be found here.

If you have any questions please email joecilia@thefis.org

by Nicky Smith | 16 Jan, 2018 | Main News Feed

The main topics from January’s tax update include the news that The Chancellor of the Exchequer has announced that the first spring statement, where the government will respond to the forecast from the Office for Budget Responsibility (OBR), will be held on Tuesday 13 March.

If any business is unable to pay tax on time (because money due to the business has not been received) then HMRC must be contacted before the due date to ask for permission to pay late. HMRC will grant this if permission is sought BEFORE the due date.

Ahead of the reverse charge VAT – which will start in October 2019 – businesses should begin to focus on improving their cashflow control.

In 2017-18 Scottish taxpayers will pay the higher rate of tax (40%) when they earn £43,000 as opposed to £45,000 in the rest of the UK. HMRC is now trying to establish who Scottish taxpayers are and employers are asked to check and maintain a careful record of all changes of address for employees.

For more information, download the latest edition of the Joint Taxation Committee’s Newsline for January here.

by Nicky Smith | 16 Jan, 2018 | Main News Feed

The collapse of Carillion is a significant event for the UK construction sector and some FIS members will be affected. Our partnership with law firm Womble Bond Dickinson provides access to free legal advice. Members should download and complete this form to allow maximum benefit from the advice session.

Womble Bond Dickinson has created a dedicated page on their website ‘Carillion Liquidation – how will it affect me?’ for Employers/Developers and those in the supply chain.

FIS has actively supported the Ten Minute Rule Bill which seeks to amend the 1996 Construction Act and ensure that retentions within construction are held in a third party trust scheme. The bill will receive a second reading on 27 April. Evidence of retentions abuse will add support to this bill, so please email davidfrise@thefis.org if you have anything, all evidence will remain confidential.

by Nicky Smith | 10 Jan, 2018 | Main News Feed

Dame Judith Hackitt’s Interim Report, which was published during the week ending 23 December 2017, indicates that a major change to building regulations is coming soon. The new system for building regulations will be ‘output based’ meaning contractors and manufacturers will face tougher requirements to prove they have met the specification and regulations.

FIS believes this is quite clear and challenges industry to provide some of the solutions to compliance evidence and conformity itself; which we are already consulting with manufacturers suppliers and specialist contractors.

Our contributions to date are acknowledged in the report, through the umbrella organisations of the Construction Products Association and Build UK where we engage through the Industry Response Groups (IRG) as well as our direct contact with MHCLG where FIS will continue to submit its comments and contribute to the questions being raised. This is your chance to get your voice heard.

A formal response to the interim report will be submitted by the Construction Products Association on 17 January ahead of a summit meeting with Dame Judith Hackitt on 22 January. FIS will be finalising our comments to CPA by 16 January. Please ensure that we receive any comments by Monday 15 January to info@thefis.org using ‘Comments on the Dame Judith Hackitt Interim Report’ in the subject box.

A full copy of the report can be found by following this link: Independent report: Independent Review of Building Regulations and Fire Safety: interim report

by Nicky Smith | 10 Jan, 2018 | Main News Feed

We are now accepting entries for the 2018 Scottish Awards; nominations are also sought for Apprentice of the Year. The awards were introduced in 2016 to demonstrate the quality of work and the range of projects that are carried out in Scotland. Entry is open to all FIS contractor members for projects completed between 1 January 2017 and 31 December 2017 in the following categories:

Interior Fit-Out

Partial Fit-Out

Drywall Construction

Plasterwork (general and heritage)

Suspended Ceilings

Partitioning

Judges’ Award (for projects which do not fit into the above categories)

Apprentice of the Year (Apprentice must be undertaking their training in Scotland)

Entries to be submitted via the website here. The closing date for all entries is 28 February 2018.

by Nicky Smith | 8 Jan, 2018 | Main News Feed

FIS members are invited to attend the Construction Products Association meeting with the Ministry of Housing, Communities and Local Government to discuss the implications of Brexit on the future of the construction products regulation and standards. MHCLG is particularly interested to have face-to-face, roundtable discussions with SMEs.

Representatives from the Department for Business, Energy and Industrial Strategy (BEIS) and the Department for Exiting the EU (DExEU) will likely also be attending. The meeting, to include presentations and ‘workshop-style’ roundtable discussions, will take place on Wednesday 14 February, 9 am to 1 pm at The Building Centre, 26 Store Street, London WC1E 7BT. This represents an excellent opportunity for members to quiz government representatives on the future of the regulatory environment.

FIS members interested in attending should rsvp to mary.economidou@constructionproducts.org.uk copying in FIS technical director joecilia@thefis.org

by Nicky Smith | 3 Jan, 2018 | Main News Feed

Survey respondents indicated that house building remained a key engine of growth, with residential work expanding for the sixteenth consecutive month in December. In contrast, latest data indicated a moderate fall in commercial construction, thereby continuing the downward trend seen since July. Civil engineering work stabilised during the latest survey period, which ended a three-month period of decline.

Duncan Brock, Director of Customer Relationships at the Chartered Institute of Procurement & Supply, said: “The sector offered little in terms of comfort at the end of 2017, though the pace of new business picked up to its strongest level since May, and purchasing activity rose to its fastest rate in two years, supply chains were under increasing pressure from all sides. The housing sector was the strongest performer again and materials for residential building were in greater demand fuelling longer delivery times, shortages of key materials and sharper input cost rises.”

Download the full report here.

by Nicky Smith | 2 Jan, 2018 | Main News Feed

In the January edition of SpecFinish, Technical Director Joe Cilia looks at Standards and specifications within the finishes and interiors sector. Standards will appear as a measure of compliance in a PQQ.

In the January edition of SpecFinish, Technical Director Joe Cilia looks at Standards and specifications within the finishes and interiors sector. Standards will appear as a measure of compliance in a PQQ.

On page 16, we outline the ‘Fit-Out Futures’ initiative whereby FIS will be bringing the industry together to deliver a skills development programme.

Read more in the January edition of SpecFinish online via the Publications section of the website or the PDF version here.

by Nicky Smith | 21 Dec, 2017 | Main News Feed

UPDATE – Deadline for submissions has been extended to Tuesday 6 February, 5pm.

FIS Skills has launched the new sector-wide digital Training Needs Analysis (TNA) for 2018.

We urge all FIS members to complete the TNA and submit by 6 February 2018. Submissions will provide evidence for the FIS Skills whitepaper on the overall skills need and workforce sustainability of our sector. All those completing the TNA will automatically receive a digital copy.

The skills team will be able to make year-on-year comparisons from the previous TNA results. This sector engagement process will continue up to 2020.

The result also allows the skills team to accurately forecast the demand needs for skills and technical qualifications required to meet your contractual obligations over the next financial year. To ensure we meet our membership’s reported demand and engage our supply chain of approved training providers and partners to fill demand, your response is critical.

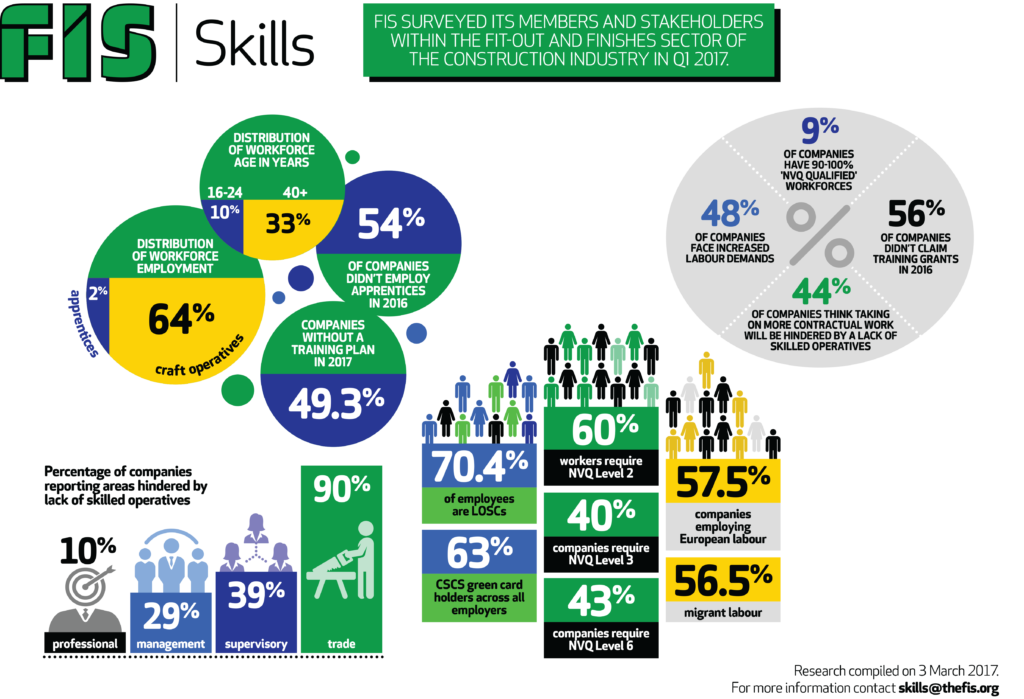

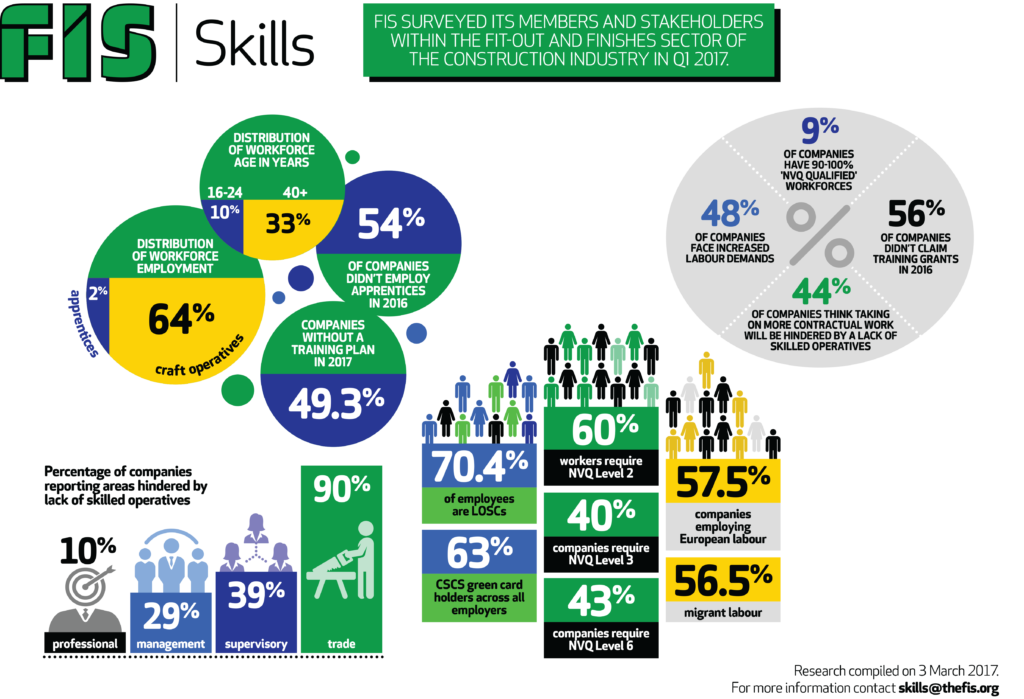

The infographic below highlights some of the key analysis findings of the TNA 2017.

General Information

• Ideally, this survey should be completed by the dedicated person in your organisation responsible for training and development planning, such as a training officer or human resources officer

• All responses for future forecasts should be accurate based on the date of return

• Your TNA returns will be held in confidence and in line with the FIS privacy and data protection policy

• The TNA has an inbuilt save function. You will be asked for your email address and a unique link will be sent to your address returning you to the last question you worked on

Should you require any assistance in completing any section(s) please contact the Project Manager Amanda Scott by email: amandascott@thefis.org where individual appointments can be booked. Amanda will be in touch with all members from 2 January onwards.

by Nicky Smith | 21 Dec, 2017 | Main News Feed

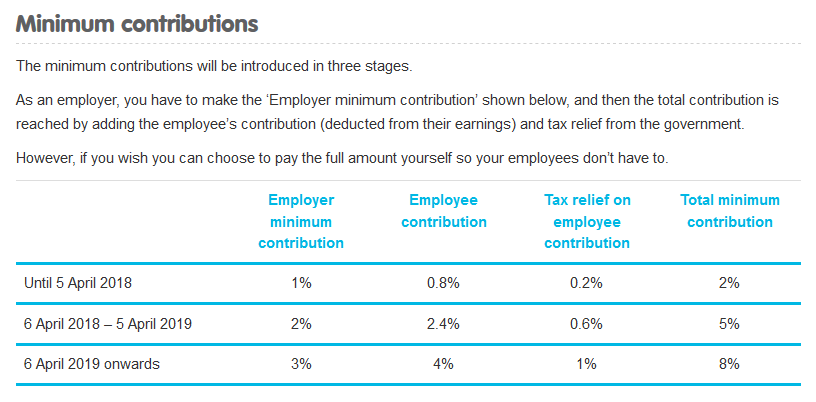

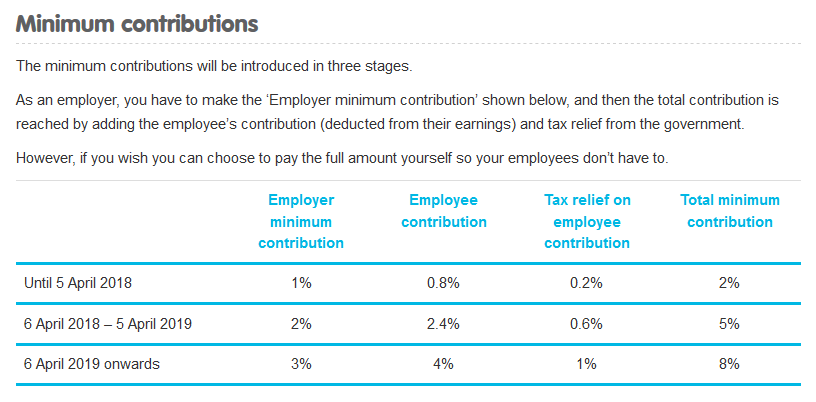

In line with the April 2018 change, The People’s Pension has confirmed that they will automatically increase the percentages for schemes that have been set up on the minimum contributions (1% employer, 1% employee and both based on ‘qualifying earnings’) and have just one worker group. This will ensure any communications sent to new members will comply with their increased minimum contributions.

If your scheme isn’t set up on the minimum contributions (eg different contribution rates, not based on qualifying earnings, with more than one worker group) then you will need to change the amounts manually in The People’s Pension Online Services. There will be more information available on how to make these changes in early 2018.

If your payroll software is assessing your workforce for you (and working out your contributions) you will need to speak to your payroll software provider to find out how they’ll make sure you remain compliant.

For more information, you can email your usual contact at The People’s Pension or the support team: support@bandce.co.uk

by Nicky Smith | 20 Dec, 2017 | Main News Feed

During December, we welcomed three new companies to the FIS membership. All three are Supplier Members: Bryson Products Ltd, Protektor UK Ltd and Tekfloor Limited.

We look forward to a long and successful relationship with our new and existing members going forward in 2018.

by Nicky Smith | 19 Dec, 2017 | Main News Feed

A consortium of more than 20 trade associations, including FIS, has written an open letter to the Daily Telegraph calling for an end to poor payment practices in construction.

“In the construction industry, clients and main contractors have traditionally withheld part of the payment owed to specialist contractors and builders for a period of time, ostensibly as security against defective work or risk of insolvency.

As trade associations and professional bodies representing many small- and medium-sized businesses, we want to highlight the following facts about this practice, known as cash retentions.

Some £10.5 billion of the overall construction sector turnover of £220 billion is held in retentions by clients and main contractors from small- and medium-sized businesses down the supply chain. An estimated £7.8 billion in retentions has been unpaid in the construction sector over the past three years, and in the same period, £700 million of retentions were lost due to upstream insolvencies.

Poor payment practices in construction affect productivity, innovation and investment, holding back the sector’s overall capacity to do business and invest in the workforce. Given that construction is a cornerstone of enterprise in Britain and fundamental to enhancing the country’s built environment, the problem of retentions cannot go on – it needs tackling as a priority.

There is, though, a simple way to reform the system. Regulations should specify that retentions must be held in a statutory retention deposit scheme (rather than in clients’ own bank accounts), an approach which is already being used successfully in Australia.

The Government consultation on retentions is still underway, but we believe that there is no longer any reason to stick with the status quo, or for this issue to be potentially kicked into the long grass again.

Reforming retentions would be a good way for the Government to show it is truly standing up for the interests of small- and medium-sized businesses, and is willing to put them at the forefront of plans for an industrial strategy and the expansion of the UK economy.”

The Daily Telegraph has published the letter online and also created a news story – Deposit protection scheme could provide boost for builders.

On behalf of the signatories, the letter will be shared with Business Secretary Greg Clark.

by Nicky Smith | 12 Dec, 2017 | Main News Feed

As part of the grant reform programme, CITB has now published a second set of training standards for your review. The standards for review and feedback forms can be found here. The consultation period will be open until 31 January 2018.

To help FIS get the best deal and right qualifications for our sector, we have a working group which you can join – contact Helen Yeulet via skills@thefis.org

CITB has recently concluded their consultation on the first set of training standards. The final versions are available to view online here.

by Nicky Smith | 12 Dec, 2017 | Main News Feed

The Department for Communities and Local Government (DCLG) published the first output from the Industry Response Group (IRG) on 11 December. It not only contains guidance for owners of high-rise buildings on what to do where the building is clad with Aluminium Cladding Material (ACM) but also provides guidance on compartmentation.

The Information Note is intended to assist building owners in assessing what measures they should consider taking to make their buildings safe. It contains a flowchart to guide building owners through the process of remediation and further information on the following:

-

- identifying and testing aluminium composite material (ACM) cladding systems

- checking broader fire safety of buildings

- progressing remedial works and maintenance

- durability and safety considerations if cladding has been removed

- professional advisors and where to find them

- building regulations and planning

- procurement of building work

The Industry Response Group consists of members from the Construction Industry Council, Build UK and the Construction Products Association; FIS is contributing to the CPA group.

by Nicky Smith | 12 Dec, 2017 | Main News Feed

The Government’s plans to tackle VAT fraud in the construction industry by introducing a domestic ‘reverse charge’ VAT scheme for construction services will come into effect on 1 October 2019. The HMRC Consultation Outcome was published on 1 December and there will be a technical consultation on draft legislation in spring 2018.

What does this mean in the supply chain?

As an example, the main contractor who owes a subcontractor £100 plus VAT £20 will only pay them £100 and will pay the VAT straight to HMRC. The subcontractor will, therefore, receive only 83% of the actual cash into their bank account. Although they won’t have to pay as much VAT to HMRC as they do now, there won’t be the funds swilling about to keep going in an hour of need. VAT owed to the Government is often used by firms to keep afloat.

It’s not just main contractors and major subcontractors who will be affected – everyone paying anyone else for work done who is not the end consumer of the service – a customer – will be required to reverse charge VAT.

The whole business of invoicing for work done and what VAT to show on an invoice, who determines the rate of VAT due on a supply and how we all communicate the rates to be used, will be up for grabs.

All accounting software used in the industry will have to change. In addition, we will all be ‘Making Tax Digital’ and getting our accounting packages to report quarterly at the same time.

It is going to be a difficult couple of years for the IT, tax and accountancy specialists in construction.

by Nicky Smith | 7 Dec, 2017 | Main News Feed, Transformation

Peter Aldous, a chartered surveyor before being elected to parliament in 2010, has tabled a private member’s bill to protect the millions of pounds of cash retentions withheld from construction SMEs. The Ten Minute Rule Bill will seek to amend the 1996 Construction Act and ensure that retentions within construction are held in a third party trust scheme. A key aim will be to help protect companies in the construction supply chain from insolvency and payment uncertainty. The Bill’s first Reading took place on 9 January 2018 and can be viewed via the link on the right.

Loading ...

Recent research commissioned by the Department for Business, Energy & Industrial Strategy (BEIS) has revealed that £7.8bn worth of retentions was outstanding over a three-year period. Peter Aldous said that he was concerned about the impact on SMEs: “I have been aware of retentions as an issue for a while, and with construction being a tough industry and uncertainty surrounding many aspects of the economy, small businesses need as much support as possible.” He added: “Over the past three years, £700m worth of retention payments to small businesses were lost due to the insolvency of a client, and if a small business suffers from an upstream insolvency of this kind, they are punished twice; firstly with the loss of work, and secondly with the loss of retention money. We, therefore, need action on this before more millions are lost. SMEs are the backbone of the UK economy, which is why they need support and protection. This bill is not about abolishing payment retentions; it is about making sure that people’s money is safe so that businesses can grow and invest in their future.”

Join the campaign – download the FIS letter template and write to your MP to request their support of the Retentions Trust Bill before the second reading which takes place on Friday 15 June.

by Nicky Smith | 4 Dec, 2017 | Main News Feed

Seven of the construction industry’s major trade bodies have set out what they believe to be the sector’s responsibilities and requirements in a post-Brexit labour market. The Association for Consultancy & Engineering, Build UK, Civil Engineering Contractors Association, Construction Products Association, Federation of Master Builders, Home Builders Federation and National Federation of Builders support the joint Construction Industry Brexit Manifesto.

The document sets out 12 key recommendations to the Government and industry on what it will need from a post-Brexit immigration system in order to be able to deliver the Government’s strategic objectives for new housing and infrastructure, including:

- The Government should embark upon a communications campaign that makes clear to EU workers currently residing in the UK that they will have no serious impediments to gaining settled status

- Industry bodies should continue to work with CITB to conduct a construction industry-wide census and other research that provides a clear evidence base regarding skills requirements and future training needs, now and in the longer term

- The Government should agree a transition period of at least two years as soon as possible during which time EU workers arriving in the UK should continue to have a path to settled status

- The construction sector should agree what it can realistically achieve in terms of increased training and recruitment of homegrown workers over the next five years based on the industry-wide census

Suzannah Nichol MBE, Chief Executive of Build UK, said: “Construction, like other major industry sectors, has substantial concerns over the impact of Brexit on its ability to recruit, train and retain talent. It is essential that industry works together to present the need for an effective partnership between Government and industry, enabling us to deliver the UK’s infrastructure, homes and communities.”

Prof. Noble Francis, Economics Director at the Construction Products Association, said: “Access to the right skills will be absolutely critical for the whole construction supply chain in the next few years if it is to help Government achieve its aims of building more affordable housing and improving the UK’s infrastructure, which will be vital for boosting UK productivity.”

John Slaughter, Director of External Affairs at the Home Builders Federation, said: “With the Budget having confirmed a target to deliver 300,000 homes a year by the mid-2020s, home builders will need to continue to bring more skilled people into the industry. Companies are building on their existing investment through the successful work of the CITB-supported Home Building Skills Partnership and are committed to doing even more, but to deliver the national social and economic necessity of an improved housing supply we will also continue to need access to foreign workers under a manageable migration system.”

by Nicky Smith | 4 Dec, 2017 | Main News Feed

In 2017, the President’s Lunch, Contractors’ Awards Lunch and Scottish Awards Lunch welcomed nominated charities to collect donations and proceeds from each of the prize draws totalling £8,498.

In February, representatives from the BounceBack charity attended the President’s Lunch to collect £2,726 raised in the prize draw. The first prize, sponsored by Metsec, was a Fortnum and Mason hamper. Second prize was an Amazon Kindle, sponsored by CCF. The third prize was a BB-8 Droid, jointly sponsored by Vela Training and approved training provider NowGetQualified.

The year’s biggest event, the Contractors’ Awards Lunch, raised a total of £4,640 for BounceBack; the auction of the ‘Ceiling Fixer’ sculpture (see photo above) went to Tapper Interiors with a very generous winning bid of £1,650. Representatives from BounceBack collected £2,990 in donations from attendees.

In October, we invited Hansel Fundraising to the Scottish Awards Lunch in Edinburgh. FIS members Brian Hendry Interiors, Scotwood Interiors and Veitchi Interiors donated prizes for the draw which raised a total of £1,132.

We will continue to support various charities in 2018; our first event is the President’s Lunch on Tuesday 6 February. If you haven’t done so already, book your tickets here.

Page 3 of 13«12345...10...>Last

In the January edition of SpecFinish, Technical Director Joe Cilia looks at Standards and specifications within the finishes and interiors sector. Standards will appear as a measure of compliance in a PQQ.

In the January edition of SpecFinish, Technical Director Joe Cilia looks at Standards and specifications within the finishes and interiors sector. Standards will appear as a measure of compliance in a PQQ.