Commenting on Today’s Budget, FIS CEO, Iain McIlwee stated:

Who’d have thought twelve months ago, the first Budget after leaving the EU would have no mention of Brexit! Against the backdrop of COVID and uncertainty that still surrounds it did start to provide a vision for Building our Future Economy.

A Recovery built on investment is absolutely the right approach.

When we look to investment in people, the doubling of incentives to support businesses taking on apprenticeships is welcome, but it does not fully reflect the value that business delivers through apprentice schemes. It would have been good to hear this go further and guarantee that the Apprenticeship Levy is ringfenced and adapted to support further investment in the infrastructure needed to deliver quality apprenticeships. The focus on additional support for traineeships is also encouraging and we will be looking to ensure this is targeted at creating jobs in our sector. It is crucial that we pull out all of the stops to support businesses here as the immigration policy has the potential to hamstrung parts of economy if we do not effectively support the huge scaling up in training that is required to offset.

Extending and adapting the stamp duty holidays should ensure that the recovery in the housebuilding sector does not come to a hard stop and combined with mortgage guarantees supports continued investment.

It was encouraging for our sector to hear that the Chancellor used construction as the exemplar for investment in describing the new Super Deduction Scheme. This scheme, which goes beyond full expensing and allows businesses to reduce their tax bill by 130% of the cost, sounds like a really positive move and we look forward to fully understanding the scope and type of investment that can be supported. Announcements around this, carrying back business losses and the re-emphasis of the importance of R&D Tax credits help, with the time lag soften the blow of what on the surface are fairly steep increases in corporation tax.

The National Infrastructure Bank and focus on Regional Growth and Free Port areas again should encourage investment and reconfirms that Government is committed to investing in vital infrastructure.

It was also good to hear the intrinsic link being made between economic and environmental development, signified most clearly by incorporating environmental sustainability and the transition to net zero within the remit of the Bank of England.

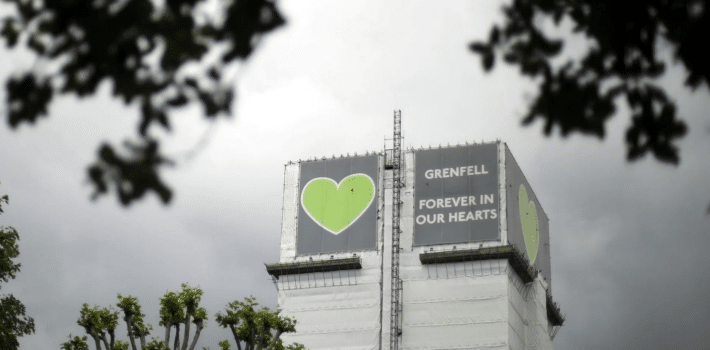

My one real disappointment is that the Budget was silent on Building Safety Aspects and we still seem to be floundering around this issue that is very much at the core of how we look after people within our society, but it was also a shame that we did not get recognition of the cash impact of Reverse Charge VAT, an extension to the deferral scheme would have helped many businesses keep their head above water. It is a shame too that, given the extended period of lockdown the Chancellor did not extend the interest free period on some of the loan packages (e.g. CBILS) that have supported businesses through this difficult period.

Full Budget Report: BUDGET 2021 PROTECTING THE JOBS AND LIVELIHOODS OF THE BRITISH PEOPLE

FIS Members: Read the CPA Response to the Spring Budget 2021 here

Transcript of the Chancellor’s speech below:

Coronavirus what was originally thought to be a temporary disruption to our way of life has fundamentally altered it. People are still being told to stay in their homes, businesses have been ordered to close. 1000s of people are in hospital much has changed. The one thing has stayed the same.

I said, I would do what it takes. I have done. And we have announced over 280, billion pounds of support. Protecting jobs, keeping businesses afloat, helping families get by.

Despite this unprecedented response.

Since March over 700,000 people have lost their jobs.

Our economy has shrunk by 10%, the largest fall in over 300 years. Our borrowing is the highest it has been outside of wartime.

It’s going to take this country. And the whole world. A long time to recover from this extraordinary economic situation.

But we will recover.

This budget to protect the jobs and livelihoods of the British people.

First, we will continue doing whatever it takes to support the British people and businesses through this moment of crisis. Second, once we are on the way to recovery. We will need to begin fixing the public finances. And I want to be honest today about our plans to do that. And third, in today’s budget. We begin the work of building our future economy.

Madam Deputy Speaker. Today’s forecasts show that our response to coronavirus is working. The Prime Minister last week set out our cautious irreversible roadmap to ease restrictions. Whilst protecting the British people.

The NHS deserving of immense praise has had extraordinary success in vaccinating more than 20 million people across the United Kingdom, and combined with our economic response. One of the most comprehensive and generous in the world. This means the office for budget responsibility on now forecasting in there was a swifter and more sustained recovery, and they expected in November.

The OBO now expect the economy to return to its pre COVID level by the middle of next year six months earlier than previously thought.

That means growth is faster. Unemployment lower wages higher investment higher household incomes higher.

But while our prospects are now stronger coronavirus has done, and is still doing profound damage.

And today’s forecasts made clear repairing the long term damage will take time to VR still expect this in five years time, because of coronavirus our economy will be 3% smaller than it would have been.

Before I share the detail of the OBL forecasts. Let me thank Richard Hughes, and his team for their work.

It will be our forecast that our economy will grow this year by 4% by 7.3% in 2022, then 1.7 1.6 and 1.7% in the last three years of the forecast.

And the OPR have said that our interventions to support jobs have worked in July last year, they expected, unemployment, to peak at 11.9%. Today, because of our interventions. They forecast, a much lower peak six and a half percent.

That means, 1.8, million fewer people are expected to be out of work than previously thought.

Every job lost, is a tragedy, which is why protecting creating and supporting jobs remains my highest priority.

So, madam Deputy Speaker let me turn straight away to the first part of this budgets plan to protect the jobs and livelihoods of the British people through the remaining phase of this crisis.

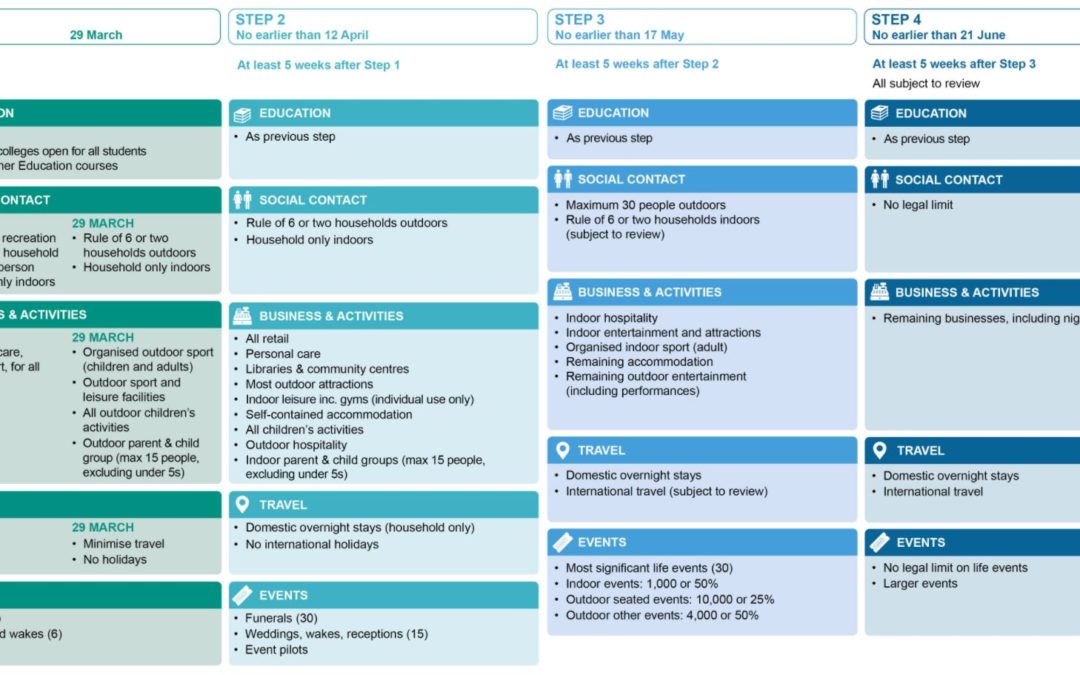

First, the furneaux scheme will be extended until the end of September for employees, there will be no change to the terms, they will continue to receive 80% of their salary for hours not work until the scheme, and as businesses reopen, we will ask them to contribute alongside the taxpayer to the cost of paying their employees.

Nothing will change until July, when we will ask for a small contribution of just 10% and 20%. In August, and September.

The government is proud of the furlough. One of the most generous schemes in the world, effectively protecting millions of people’s jobs.

Second, support for the self employed, will also continue until September, with a fourth grant covering the period February to April, and a fifth and final grant from May onwards. The fourth grant will provide three months of support at 80% of average trading profits for the fifth grant, people will continue to receive grants worth three months of average profits with the system, open for claims from late July.

But as the economy reopens over the summer, it is fair to target our support towards those most affected by the pandemic. So people whose turnover has fallen by 30%. We’ll continue to receive the full 80% grant.

People whose turnover has fallen by less than 30% will therefore have less need of taxpayer support, and will receive a 30% grant.

And I can also announce a major improvement in access to the self employed scheme.

When the scheme was launched the newly self employed. Couldn’t quantify because they hadn’t filed, the 1920 tax return. But as the tax return deadline has now passed. I can announce today that provided they filed a tax return by midnight last night. over 600,000, more people, many of whom became self employed last year, can now claim the fourth and fifth grants.

Over the course of this crisis. We will have spent 33 billion pounds, supporting the self employed. One of the most generous programmes for self employed people anywhere in the world.

We’re also extending our support for the lowest paid, and most vulnerable to support low income households. The Universal Credit uplift of 20 pounds a week will continue for a further six months, well beyond the end of this national lockdown. We’ll provide working tax credit payments, with equivalent support for the next six months. And because of the way that system works operationally, we will need to do so with a one off payment of 500 pounds. And over the course of this year, as the economy begins to recover. We are shifting our resources and focus towards getting people into decent well paid jobs, we reaffirm our commitment to end low pay, increasing the national living wage to eight pounds 91 from April, an annual pay rise of almost 350 pounds for someone working full time on the national living wage.

And my Right Honourable friends. The Education Secretary and the Work and Pensions secretary of taking action to give people the skills they need to get jobs or get better jobs, the restart programme, supporting over a million long term unemployed people, the number of work coaches, double the kickstart scheme funding high quality jobs for over a quarter of a million young people, the Prime Minister lifetime skills guaranteed giving every adult the opportunity for a fully funded level three qualification. And we bought businesses to hire new apprentices. So we’re paying them more to do it. Today, I am doubling the incentive payments we get businesses to 3000 pounds. That’s all new apprentice hires of any age, alongside investing 126 million pounds of new money to triple the number of traineeships, we’re taking what works to get people into jobs, and making it better.

Madam Deputy Speaker. One of the hidden tragedies of lockdown has been the increase in domestic abuse. So I’m announcing today, an extra 19 million pounds on top of the 120 5 million pounds, we announced that the spending review for domestic violence programmes to reduce the risk of reoffending, and to pilot a network of rest bike rooms to provide specialist support for vulnerable homeless women to recognise the sacrifices made by so many women and men in the armed forces community and providing an additional 10 million pounds to support veterans with mental health needs.

And on current plans. The funding to support survivors of the thalidomide scandal runs out in 2023.

They deserve better than to have constant uncertainty about the future costs of their care. So not only will I extend this funding with an initial down payment of around 40 million pounds. I am today announcing a lifetime commitment, guaranteeing funding forever. And let me thank the thalidomide trust, and the Honourable Member for North Dorset for their leadership on this important issue, as well as supporting people’s jobs incomes, the lowest paid and most vulnerable. This budget, also protects businesses. We’ve been providing businesses with direct cash grants, through the recent restrictions. These grants come to an end. In March, I can announce today that we will provide a new restart grant. In April, to help businesses reopen and get going again, non essential retail businesses will open first, so they will receive grants of up to 6000 pounds per premises, hospitality and leisure businesses, including personal care and gyms will open later or be more impacted by restrictions when they do, so we’ll give them grants of up to 18,000, pounds. That’s 5. billion pounds of new grants, on top of the 20 billion pounds we’ve already provided, taking our direct total cash support to business to 25 billion pounds. And I pay tribute to my Right Honourable friend the member for ronzi in Southampton north, the highlighting the particular needs of the personal care sector.

And with my Right Honourable friend the culture Secretary were making available, 700, million pounds to support our incredible art, culture, and sporting institutions, as they reopened. Back in the UK and Ireland’s joint 2013 World Cup, launching a new approach to apprenticeships in the creative industries and extending our 500 million pound film and TV production restart scheme.

Even with the new restart grants. Some businesses will also need loans to see them through as the bounce back low and see those programmes come to an end, we’re introducing a new recovering loan scheme to take their place. Businesses of any size can apply for loans from 25,000 pounds, up to 10 million pounds through to the end of this year, and the government will provide the guarantees and lenders of 80%.

Last year, we provided an unprecedented 100% business rates holiday in England for all eligible businesses in the retail hospitality and leisure sectors attack worth 10 billion pounds.

This year, we’ll continue with a 100% business rates holiday for the first three months of the year. In other words, through to the end of June, for the remaining nine months of the year, business rates will still be discounted by two thirds, up to a value of 2 million pounds to close businesses with a lower cap, than those who have been able to stay open a 6 billion pound tax cut for business.

One of the hardest hit sectors has been Hospitality and Tourism 150,000 businesses that employ over 2.4 million people need our support to protect those jobs. I can confirm that the 5% reduced rate of VAT will be extended for six months to the 30th of September.

And even then, we won’t go straight back to the 20% rate will have an interim rate of 12 and a half percent for another six months, not returning to the standard rate, until April of next year.

In total, we’re cutting back next year by almost 5 billion pounds.

Madam Deputy Speaker, the housing sector supports over half a million jobs, the carton stamp duty I announced last summer, has helped hundreds of 1000s of people buy a home and supported the economy at a critical time, but due to the sheer volume of transactions we’re seeing many new purchases won’t complete in time for the end of March. So I can announce today. The 500,000 pound nil rate band will not end on the 31st of March, it will end on the 30th of June, then, to smooth the transition back to normal. The nil rate band will be 250,000 pounds, double its standard level, until the end of September, and we will only return to the usual level of 125,000 pounds from October. The first.

Even with the stamp duty cut. There is still a significant barrier to people getting on the housing ladder. The cost of a deposit. So I’m announcing today, a new policy to stand behind homebuyers a mortgage guarantee lenders who provide mortgages to homebuyers who could only afford a 5% deposit or benefit from a government guarantee on those mortgages. And I’m pleased to say that several of the country’s largest lenders, including Lloyds NatWest Santander Barclays and HSBC will be offering these 95% mortgages, for next month. And I know more, including Virgin Money will follow shortly after a policy that gets people who can can’t afford a big deposit the chance to buy their own home. As the Prime Minister has said, we want to turn generation rent into generation by.

So, madam Deputy Speaker, the further extended to September, self employed crops, extended to September, Universal Credit extended to September, more money to tackle domestic violence, bigger incentives to hire apprentices higher grants to struggling businesses, extra funds for culture, arts and sport, new loan schemes to finance businesses kickstart restart a lifetime skills guarantee business rate cut VAT cut stamp duty cut, and a new mortgage guaranty, the first part of a budget that protects the jobs and livelihoods of the British people.

And Madam Deputy Speaker. As you can see, we’re going long, extending our support well beyond the end of the roadmap to accommodate, even the most cautious view about the time, it might take to exit the restriction.

Let me summarise, for the house. The scale of our total fiscal response to coronavirus at this budget, we are announcing an additional 65 billion pounds of measures over this year and next to support the economy in response to coronavirus, taking into account the significant support announced at the spending review. This means our total COVID support package this year in next is 352. billion pounds. And once you include the measures announced that spring budget last year including the step change in capital investment. Total fiscal support from this government over this year and next amounts to 407 billion pounds coronavirus has caught one of the largest, most comprehensive and sustained economic shocks. This country has ever faced. And by any objective analysis. This government has delivered, one of the largest, most comprehensive and sustained responses. This country has ever seen.

So, madam Deputy Speaker.

We’re using the full measure of our fiscal firepower to protect the jobs, and livelihoods of the British people, but the damage done by coronavirus combined with a level of support unimaginable only 12 months ago has created challenges for our public finances.

The ob RS fiscal forecasts show that this year. We have borrowed a record amount. 355. billion pounds. That’s 17% of our national income, the highest level of borrowing since World War Two.

Next year, as we continue our unprecedented response to this crisis.

10.3% of GDP and amount so large, it has been one rival in recent history. This year, without corrective action borrowing would continue at very high levels, leaving underlying debt rising indefinitely.

Instead, because of the steps, I am taking today. Borrowing falls to four and a half percent of GDP in 2223 3.5%, in 2324, then 2.9 and 2.8%. In the following two years. And while underlying debt rises from 88.8% of GDP this year to 93.8% next year. It then peaks at 97.1% in 2324. Before stabilising and falling slightly to 97% and 96.8%. In the final two years of the forecast.

Let me explain why this matters.

The amount we’ve borrowed is comparable only with the amount we borrowed during the two world wars.

It’s going to be the work of many governments, over many decades to pay it back.

Just as it would be irresponsible to withdraw support too soon. It would also be irresponsible to allow our future borrowing and debt to rise unchecked.

When crises come. We need to be able to act. And we need the fiscal freedom to act of freedom that you only have, if you start with public finances in a good and strong place.

The only reason we have been able to respond as boldly as we have the COVID is because 10 years of conservative governments painstakingly rebuild our fiscal resilience.

When the next crisis comes, we need to be able to act again.

And while our borrowing costs are affordable right now. Interest rates and inflation may not stay low forever.

And just a one percentage point increase in both would now cost us over 25 billion pounds. And as we have seen in the markets. Over the last few weeks, sovereign bond yields can rise sharply.

This budget is not the time to set detailed fiscal rules with precise targets and dates to achieve that by. I don’t believe that would be sensible. But I do want to be honest about what I need. I sustainable public finances and how I plan to achieve our fiscal decisions are guided by three principles. First, while it is right to help people and businesses through an acute crisis like this one in normal times, the state should not be borrowing to pay for everyday public spending.

Second. Over the medium term, we cannot allow our debt to keep rising and given how high, our debt now is we need to pay close attention to its affordability.

And third, it is sensible to take advantage of lower interest rates to invest in capital projects that can drive our future growth.

So the question is, how we achieve that, how we balance the extraordinary support we are providing to the economy right now with the need to begin the work of fixing our public finances.

I have an always will be honest with the country about the challenges we face. So I’m announcing today, two measures to begin that work. Let me take each intern.

Madam Deputy Speaker, our response to coronavirus has been fair with the poorest households benefiting the most from our interventions. And our approach to fixing the public finances, will be fair to asking more of those people and businesses who could afford to contribute and protecting those who cannot.

So this government is not going to raise the rates of income tax, National Insurance, or VAT instead. Our first step is to freeze palatable tax thresholds. We’ve nearly doubled the income tax personal allowance over the last decade, making it the most generous of any g 20 country. We will, of course, deliver our promise to increase it again next year to 12,570 pounds. But we will then keep it at this more generous level, until April, 2026, the higher rate threshold will similarly be increased next year to 50,000 pounds 270, and will then also remain at that level for the same period. Nobody’s take home pay will be less than it is now. As a result of this policy. But I want to be clear, with all members that this policy does remove the incremental benefit created have thresholds continued to increase with inflation. We are not hiding it. I am here, explaining it to the house, and it is in the budget document in black and white.

It is a tax policy that is progressive and fair.

And I will also maintain at their current levels, until April 2026, the inheritance tax thresholds, the pensions lifetime allowance. The annual exempt amount and capital gains tax and for two years from April 2020 to the VAT registration threshold, which at 85,000 pounds will remain more than twice as generous as the EU, and OECD averages. We’ll also tackle fraud and our COVID schemes, with 100 million pounds to set up a new HMRC task force of around 1000 investigators, as well as new measures and new investment in HMRC to clamp down on tax avoidance, and evasion, the full details are set out in the red book.

Madam Deputy Speaker.

The government is providing businesses with over 100 billion pounds of support to get through this pandemic. So it is fair and necessary to ask them to contribute to our recovery.

So the second step, I am taking today is that in 2023, the rate of corporation tax paid on company profits will increase to 25%.

Even after this change, the United Kingdom will still have the lowest corporation tax rate in the g7 lower than the United States, Canada, Italy, Japan, Germany and France were also introducing some crucial protections. First, this new higher rate won’t take effect until April 2023, well after the point when the OPR expect the economy to have recovered.

And even then, because Corporation taxes, only charged on company profits. Any struggling business will, by definition, be unaffected.

Second, I’m protecting small businesses with profits of 50,000 pounds or less by creating a small profit rate maintained at the current rate of 19%. This means around 70% of companies, 1.4 million businesses will be completely affected.

And third, we will introduce a taper above 50,000. So the only businesses with profits of a quarter of a million pounds, or greater will be taxed at the full 25% rate. That means only 10% of companies will pay the full higher rate. So yes, it’s a tax rise on company profits, but only on the larger, more profitable companies, and only in two years time, and I wanted to announce this now, because I think for business certainty matters.

For the next two years. I’m also making the tax treatment of losses significantly more generous by allowing businesses to carry back losses of up to 2, million pounds, three years, providing a significant cash flow benefit. This means companies can now claim additional tax refunds of up to 760,000 pounds. And because of the current 8% Bank surcharge the implied overall tax rate for banks would be too high. So we will review the surcharge to make sure the combined rate of tax on the UK banking sector doesn’t increase significantly from its current level, and to make sure this important industry remains internationally competitive.

Madam Deputy Speaker.

These are significant decisions to have taken decisions, no Chancellor wants to make.

I recognise, they might not be popular. But they are honest.

And let’s consider the alternatives.

The first is to do nothing to leave our deficit problem and treated, our debt problem for someone else in the future to deal with that has never been the way of a conservative government and nor do I believe it can be the way of a responsible Chancellor.

Another alternative would be to try and find all the savings we need from public spending.

But when we said at the last election that we were the party of public services people believed us, and they will write to believe us. And when we said we’d be the party that invest in new infrastructure, they will write to believe that to the only other alternative would be to increase the rates of tax on working people, but I don’t believe that would be right, either.

So while I believe our approach. While bold is compatible with our duty as a fiscally responsible and business friendly government. This is the right choice and I’m confident it will command public assent. I have one final announcement on business tax, with the lowest corporation tax in the g7, and a new small profits rate. The UK will have a pro business tax regime.

But we need to do even more, to encourage businesses to invest, right now, business investment creates jobs lifts growth spurs innovation drive productivity. For decades, we’ve lagged behind our international peers. right now. While many businesses are struggling, others have been able to build up significant cash reserves. We need to unlock that investment, we need an investment led recovery. So today, I can announce the super deduction for the next two years, when companies invest. They can reduce their tax bill, not just by proportion of the cost of that investment as they do now, or even by 100% of their costs. The so called full expensing that some have called for with the super deduction. They can now reduce their tax bill by 130% of the cost.

Let me give the house, an example, under the existing rules a construction firm buying 10 million pounds of new equipment could reduce their taxable income in the year they invest by just 2.6 million pounds with the super deduction. They can now reduce it by 13 million pounds. We’ve never tried this before, in our country. The OPR have said it will boost business investment by 10% around 20 billion pounds more per year. It makes up and meets our tax regimes the business investment truly world leading lifting us from 30th in the OECD to first and and worth 25 billion pounds during the two years that is in place. This will be the biggest business tax cut in modern British history. Bold unprecedented action to get companies investing, creating jobs and driving our economic recovery.

Madam Deputy Speaker. Let me now turn to duties.

This is a tough time for hospitality. So I can confirm that the planned increases in duties for spirits like scotch whiskey wine cider and beer will all be cancelled. All alcohol duty is frozen for the second year in a row, only the third time in two decades. And right now, to keep the cost of living low. I’m not prepared to increase the cost of a tank of fuel. So the plant, increasing fuel duty is also cancelled.

Madam Deputy Speaker.

This budget protects the jobs and livelihoods of the British people. This budget is honest about the challenges facing our public finances and how we will begin to fix them.

And this budget does one other thing. It lays the foundation of our future economy. The third part of our plan.

If we want a better future economy. We have to make it happen. We have to do things that have never been done before. The world is not going to be any less competitive, after coronavirus. So it’s not enough to have some genuine desire to grow the economy. we need a real commitment to green growth is not enough to have some general desire to increase productivity, we need a real commitment to give every business large or small, the opportunity to grow, innovate and succeed. It’s not enough to have a genuine desire to create jobs, we need a real commitment to create jobs where people are and change the economic geography of this country. And we can’t strengthen our domestic economy without remaining a global outward looking nation.

This future economy won’t be created in any one budget. But today we lay the foundations.

Madam Deputy Speaker, our future economy needs investment in green industries across the United Kingdom, so I can announce today, the first ever UK infrastructure bank, located in Leeds, the bank will invest across the UK in public and private projects to finance the green Industrial Revolution, beginning this spring, it will have an initial capitalization of 12. billion pounds, and we expect it to support at least 40 billion pounds of total investment in infrastructure. And I know my Right Honourable friend the member for Pudsey will particularly welcome the location of this new institution offshore wind is an innovative industry where the UK already has a global competitive advantage. So we’re funding New Port infrastructure to build the next generation of offshore wind projects in Teesside and Humberside, and in November I amounts we will launch a world leading sovereign green bond. Today we’re going further announcing a new retail savings product to give all UK savers the chance to support green projects, as my white friend the member for northeast Bedfordshire has campaigned for. We’ve also asked him for a first to establish a new group to position the city, as the global leader for voluntary high quality carbon offset markets and underpinning. All of this will be an updated monetary policy we met for the Bank of England. It reaffirmed that 2% target, but now it will also reflect the importance of environmental sustainability and the transition to net zero. Madam Deputy Speaker, our future economy will also address our productivity problem and support small business. Too often smaller firms don’t have the time or resources to acquire the extra skills and training they need to be more efficient, more digital, and more productive. Thanks to be the business. We have made a good start, and supporting these firms. Today, the business secretary and I are going further with a new set of UK wide schemes, help to grow, but help to grow management will help 10s of 1000s of small and medium sized businesses get world class management training. 1000s of business schools across the UK, will offer a new executive development programme with mentoring and peer learning and government will contribute 90% of the cost of real commitment. To learn more, make more and earn more. Second, help to grow digital with the pandemic. Many businesses have moved online. This has been a challenge, but we want to turn it into an opportunity. We’re going to help small businesses develop digital skills by giving them free expert training and a 50% discount on new productivity enhancing software worth up to 5000 pounds each both programmes will commence by the autumn. And I urge interested businesses to register today on gov.uk, forward slash help to grow a real commitment to help over 100,000 businesses become more innovative more competitive and more profitable.

Madam Deputy Speaker a future economy requires us to be at the forefront of the next scientific and technological revolutions, becoming a scientific superpower is something we can be. I don’t think that’s you breadstick or unrealistic, our incredible vaccination programme has showed the world what this country is capable of. So I’m providing an extra 1.6 billion pounds today to continue the rollout, and improve our future preparedness. And I want to make the UK, the best place in the world for high growth, innovative companies. So I’m launching to wide ranging consultations today, to make sure our research and development tax reliefs, and our enterprise management incentives are internationally competitive. And my wife honourable friend the Home Secretary knows that a scientific superpower needs scientific superstars. So together we’re announcing ambitious visa reforms aimed at highly skilled migrants, including a new unsponsored points based visa to attract the best and most promising international talent in science research and tech new improved visa processes for scale up and entrepreneurs and radically simplified bureaucracy, for high skilled visa applications. Now, as well as support for innovation and access to talent, high growth firms need access to capital. To do that, we’re taking steps to give the pensions industry more flexibility to unlock billions of pounds from pension funds into innovative new ventures, launching a new future fund breakthrough to help fill the scale up funding gap and changing the rules to encourage more countries more companies to list here. Let me thank the Lord Hill for leading this landmark review. The FCA will be consulting on his proposals, very shortly.

to local leaders like the brilliant there for the West Midlands, and the St. Louis are making the case for investment in their area. We’re also creating 150 million pound fund to help communities across the UK, take ownership of pubs theatres shops or local sports clubs at lots of risk of loss, putting more power in the hands of local people. And I’m launching the first round of the levelling of fun today, inviting applications from local areas across the United Kingdom. And I was grateful to my wife and I were friends the transport secretary, and the community secretary for their support on this crucial initiative.

Madam Deputy Speaker.

I have one final announcement that exemplifies the future economy of policy on a scale. We’ve never done before, a policy to bring investment trade, and most importantly job right across this country to replace the industries of the past with green innovative fast growing new businesses to encourage free trade and reinforce our position as an outward looking trading nation open to the world of policy, we can now only pursue now that we are out of the European Union Freeport Freeport, our special economic zones with different rules, to make it easier and cheaper to do business, they’re well established internationally. We’re taking a unique approach, and our free port will have similar planning to allow businesses to build infrastructure funding to improve transport needs cheaper customs with favourable tariffs VAT or duties and lower taxes, with tax breaks to encourage construction private investment and job creation, an unprecedented economic boost across the United Kingdom. Free ports will be a truly UK wide policy, and we will work constructively with the Scottish Welsh and Northern Irish administration. Today, I can announce the eight free port locations in England.

East Midlands Airport Felixstowe and heritage Humber Liverpool City region Plymouth Solon Thames, and Teesside pay to new freeports in eight English regions, unlocking billions of pounds of private sector investment, generating trade and jobs, up and down the country. I commend members from across the house for the campaigning, but in particular. The Honourable Members for red car Cleethorpes and great Grimsby, as well as inspiring local leaders like Ben houchin de mer for tees Valley.

Madam Deputy Speaker. This take just one of those places Teesside. In the past, it was known for its success in industries like steel. Now, when I look to the future of T side. I see old industrial sites being used to capture and store carbon vaccines, being manufactured offshore wind turbines, creating clean energy for the rest of the country, all located within a free port, with a treasury just down the road, and the UK infrastructure bank only an hour away.

I see innovative fast growing businesses, hiring local people into decent well paid green jobs. I see people designing manufacturing and exporting incredible new products and services. I see people putting down roots in places they are proud to call home. I see a people optimistic and ambitious for their future that madam Deputy Speaker is the future economy of this country.

And so, whilst this last year has been a test, unlike any other. That which we are, we are, the fundamentals of our character as a people have not changed. Still determined. Still generous still fair. That’s what got us through the last year. It’s what will guide us through the next decade and beyond. This time last year, we set out to deliver on the promises we made to the British people.

But the most important promise was implicit, and in truth is made by every government, irrespective of their politics, and that is to do what must be done when the danger is imminent, and when no one else can.

Today, we set out a plan to protect the jobs, and livelihoods of the British people. But the promises that underpin that plan remain unchanged from those, we pledged ourselves to 12, long months ago.

To unite and lead to level up to create a world class education system to keep our streets safe to keep our NHS strong to support the most vulnerable to reform and improve public services to grow the economy to spread prosperity to extend the awesome power of opportunity to all corners of the United Kingdom, and yes, to be honest and fair in all factory do. Madam Deputy Speaker, an important moment is upon us a moment of challenge and of change of difficulties Yes, but of possibilities to. This is a budget that meets that moment, and I commend it to the house.