An open letter on COVID-19 to the sector from the FIS President

Mike and I have been running Tapper Interiors now for 35 years, but this has, without doubt, been the toughest week yet – I am shell shocked.

The lack of clear guidance from Government has added to the pressure as we have desperately tried to follow advice and do the socially responsible thing, but increasingly mindful of the health and welfare of our people and their families. I think Iain summed it up well in the Telegraph yesterday when he said the ambiguity has made this feel like death by 1,000 cuts for businesses in our sector – that is certainly how I feel.

In the last 24 hours many more sites have closed, but not all – there seems to me to be little logic to this. Where safety concerns have been raised, we have seen instances where clients have reacted by threatening to impose onerous delay clauses.

I know FIS is feeding these concerns directly to Government (please send details in), but increasingly now working with members on individual cases and trying to support dialogue with clients and major contractors. The message from FIS is clear, if you cannot do it safely, don’t do it. If the necessary precautions are not being implemented on-site, concerns must be raised with client, but ultimately reported to the HSE via their whistleblowing service.

If you deem it unsafe to continue, refer to your contract and ensure that you provide the necessary notifications for delay or suspension – paper trails and communication are critical to protecting your business, but protecting our people is everything.

As a Director of Tapper Interiors, my first responsibility is to do what is reasonably practicable to protect the health, safety and welfare of employees (and other people who might be affected by our business). Get this wrong and beyond the human cost, what are the potential liabilities if we carry on regardless and people do get sick or worse?

I didn’t expect this mess when I agreed be FIS President, but I have never been more glad to be an FIS Member or proud of our organisation. They, guided by the Board and supported by our community have been a vital lifeline, helping to inform the decisions we as a business have had to make and even been that caring and supportive voice at the end of the phone. Together we are stronger.

Before this situation escalated, a theme of my Presidency was Rebuilding Construction and I want to leave you with some hope. As a sector we will pull through this and my hope is that it will present us with a new opportunity to rebuild.

I do believe a lack of clarity/understanding of our sector from our Government has intensified things, but we must also look to the contracts and behaviours and accept that the industry cannot and must not be allowed to continue in this way.

Stay safe and well, keep those in your care safe and see you on the other side!

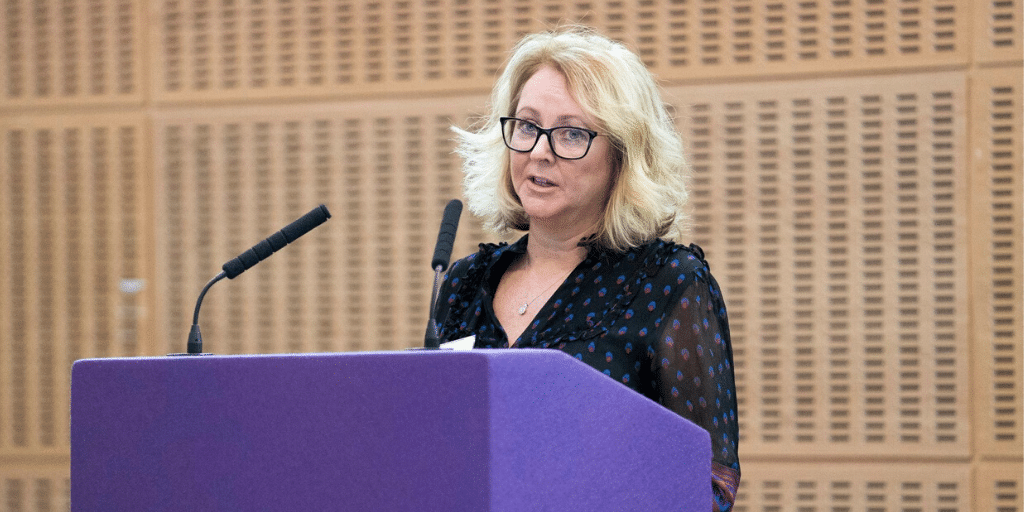

Helen

Helen Tapper

Business Operations Director, Tapper Interiors Limited

FIS President