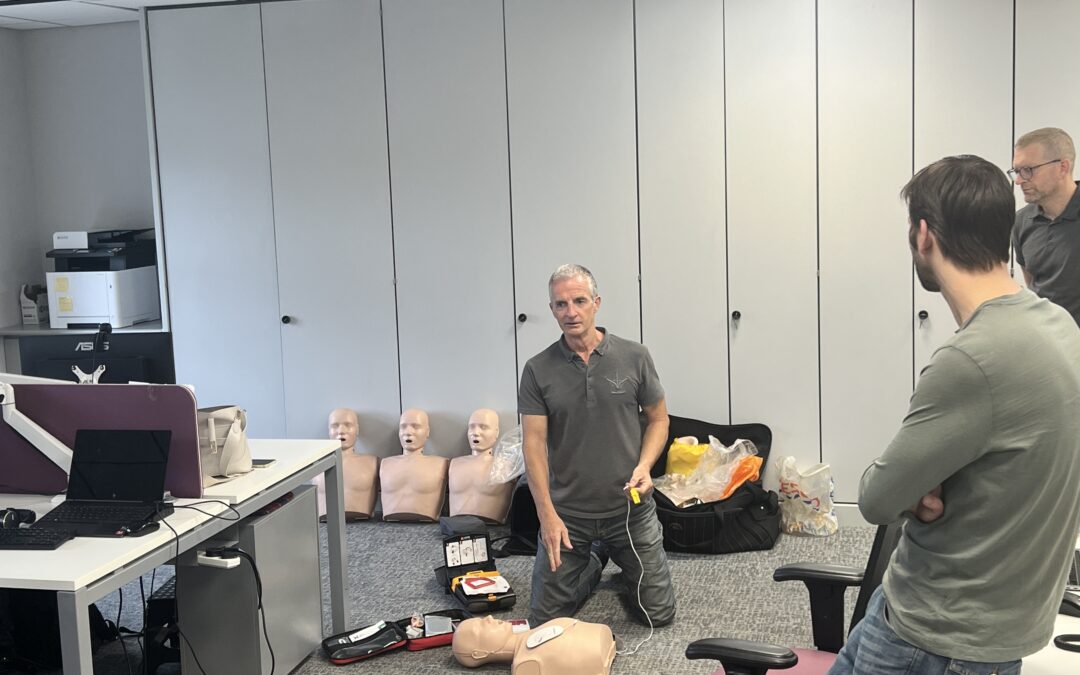

In readiness for Restart a Heart Day, the FIS (Finishes & Interiors Sector) team undertook Basic Life Saving training to understand what to do when faced with an emergency situation. Here, Hermione Neale, FIS Marketing Apprentice, highlights what the team learnt and how early defibrillation can save lives.

In this article, I will cover the effectiveness of defibs, the action to take in an emergency, what CPR (Cardiopulmonary Resuscitation) is, The Circuit and how to access defibrillators, storage of defibrillators, number of first aiders, statistics and Cardiac Awareness week.

Giving people a chance

Statistics show that using a defibrillator within the first minute can have a survival rate as high as 90%, however every minute that passes after this, the survival rate drops by 10%. This proves the effectiveness of defibrillators and how much of a difference they can make in saving lives. With manual compressions the survival rate is between 5-10%, with 1 in 10 people surviving resuscitation.

CPR (Cardiopulmonary Resuscitation) is rescue breaths and compressions in an attempt to bring back the patient’s heartbeat and breathing. CPR (Cardiopulmonary Resuscitation) is different for adults, children over a year and infants under a year. A defibrillator is a device used to restore a regular heartbeat by an electric current.

In the case of an emergency check your surroundings for danger, begin compressions, call 999, call for a defibrillator, turn on the defibrillator, cut off clothing covering chest, place pads as shown, follow defibrillators verbal instructions, if there are signs of responsiveness place them in the recovery position and monitor.

Finding a Defib

The Circuit is the national defibrillator network that is used by the 14 ambulance services across the UK. This allows ambulance services to locate the nearest defibrillator upon arrival of a cardiac arrest. These defibrillators are connected to each of the 14 ambulance services and there are an estimated 90,000 defibrillators currently in the UK. Through calling 999, the operator can tell you where the nearest defibrillator is and then what the code to access it is.

Defibrillators should be stored in a case to protect it from damage and the recommended temperature range is between 0 to 50 degrees. The AED needs to be kept within this temperature range due to the adhesive gel on the pads melting and not sticking to the patient properly, therefore preventing the electrical shock from getting to the heart. In the winter months the defibrillator should be stored in a heated outdoor cabinet. Defibrillators should be checked every day including the batteries to ensure that the defibrillator is ready for use.

It could be you

Every year in Britain, 30,000 people have cardiac arrests outside of a hospital and statistics show that 1 in 10 patients survive due to lack of education and training. 72% of cardiac arrests happen at home and 15% happen at a workplace. Half of out of hospital cardiac arrests are witnessed by a bystander and 7 out of 10 attempt CPR (Cardiopulmonary Resuscitation). However, public defibrillator use is reported at being used less than 1 in 10. The average ambulance response time is 6.9 minutes, which means by the time a call is made and the wait time for the ambulance, the patients survival rate from defibrillation will have dropped by 70%. In 2018, 59% of the public were trained in CPR (Cardiopulmonary Resuscitation) training, however only 19% knew how to use an AED, which means that the chance of cardiac arrest patients has a significantly lower chance of survival.

In a workplace with 25 employees, the minimum legal requirement is one appointed first aider.

This information and statistics show how important informative first aid is to the survival rate of cardiac arrests. It is important for employers to take the time to train their employees and ensure they all have awareness surrounding cardiac arrests, the signs and how to use a defibrillator.

Restart a Heart Day

Restart A Heart Day took place on the 16 October. The Day helps raise awareness of cardiac arrests. This program encourages confidence in CPR (Cardiopulmonary Resuscitation) practice and allowing them to learn lifesaving skills. The focus for this year’s Restart A Heart Day was to aid equal access to defibrillators, which will increase the chance of survival rates. This is now an internationally celebrated day.