by Clair Mooney | 2 May, 2023 | Market data

Yesterday, the Bank of England implemented the 12th consecutive rise in interest rates to attempt to deal with “sticky” inflation. In more positive news the Bank also upgraded growth forecasts and lowered forecasts for unemployment.

According to the CPA, construction output is forecast to fall from a record-high level and contract by 6.4% in 2023 according to the CPA’s Spring Forecasts. This is a downgrade from a fall of 4.7% expected in the Winter, driven primarily by sharp falls in the two largest construction sectors – private new housing and private housing repair, maintenance and improvement (rm&i) – together with recent government announcements of delays to major infrastructure projects.

Private housing new build, and private housing rm&i account for around 40% of total construction output and are forecast to be the sectors in which demand is most affected by a macroeconomic backdrop of falling household incomes and higher interest rates. In infrastructure, the third-largest sector, growth is expected but has been downgraded from the Winter Forecasts owing to government delaying HS2 work at Euston station and work on major road schemes. A wider recovery in economic growth in 2024 is expected to boost demand for both new build housing and rm&i activity and total construction output is forecast to return to growth, rising by 1.1%.

Private housing is the sector forecast to experience the sharpest contraction in 2023, with a 17.0% fall in output in 2023. Following the government’s disastrous Mini Budget last Autumn which directly led to interest rates rising to a 14-year high, the resulting higher mortgage rates combined with broader cost of living increases and falling real incomes led to a significant weakening in homebuyer sentiment and a sharp drop in demand heading into this year. Continued pressure on household budgets and the absence of stimulus for homebuying in the Budget, particularly first-time buyers, means that demand from a key segment of the market will remain subdued. The forecast assumes a pickup beginning in the traditional Spring selling season with mortgage interest rates settling at current levels – lower than at the end of 2022 but still significantly higher than 12 months ago and the ultra-low rates of the last decade. However, a gradual improvement in demand will need to be maintained throughout the Summer and beyond to shore up house builder confidence to start new developments and drive the recovery in building activity in 2024.

Private housing rm&i is similarly exposed to the fall in real incomes but is also experiencing slower demand. This is due to the fading impact of the one-off boost to activity during and immediately after the pandemic, when increased working from home, a ‘race for space’, and accumulated savings and housing wealth saw households investing in large improvements projects. A drop in planning applications in the second half of 2022 and the return of competing spending decisions such as overseas holidays point to a reduced pipeline of improvements work and discretionary r&m projects for this year. As a result, output is forecast to fall 9.0% in 2023, which is partly offset by strong activity on energy efficiency retrofit and solar/PV work, before a broader economic recovery that drives output growth of 2.0% in 2024.

In infrastructure, forecast growth rates have been downgraded in the Spring Forecasts to 0.7% for 2023 and 1.2% for 2024, from 2.4% and 2.5% respectively in Winter. Activity on regulated frameworks in water & sewerage, road and rail provides sizeable activity, but growth in the sector tends to be driven by large projects, most recently by HS2, the Thames Tideway Tunnel and Hinkley Point C. Nonetheless, in the space of six months the UK government has gone from announcing it would bring forward 138 infrastructure projects to start by the end of this year to cancelling this and delaying HS2 Phase 2a and Euston station, the Lower Thames Crossing and other roads projects by two years in an attempt to reduce government spending near-term. HS2 Phase 2a is beyond the scope of the forecasts and previous forecasts had factored in delays and cost overruns on current phases, but the pause of work at Euston, for which preparatory work had begun, will adversely affect activity during the forecast period.

CPA Head of Construction Research Rebecca Larkin:

“Despite the improvement in the outlook for the UK economy compared to six months ago, the headwinds of falling real incomes and interest rate rises remain. For construction, the most acute effects of this will be felt in the two largest sectors of activity and those that are most exposed to a slowdown in discretionary household spending: private housing and private housing rm&i. The sharp falls that are forecast for housing in 2023 mean that overall, a construction recession will be unavoidable. However, it is important to emphasise that the starting point is a record-high level of activity and the 6.4% contraction expected is smaller than during the construction recessions of 2008/09, 2012 and 2020.

“In previous years, infrastructure activity has helped cushion falls elsewhere, but recent government announcements delaying HS2 work at Euston station and on major roads schemes including the Lower Thames Crossing have weakened the near-term growth prospects for the third-largest sector of construction. Unlike the relatively fast bounce back that is expected in housing in 2024, the prospect of delays leading to even greater cost overruns on large infrastructure projects poses a risk to longer-term activity. This shines a light on the government’s decision to keep capital spending budgets unchanged in cash terms from 2024/25.”

FIS CEO Iain McIlwee added:

“Interest rates rising is seldom good news for construction, particularly new build commercial and private house building, impacting the viability of investment. This change has, however been factored in to the CPA work and whilst there remain some areas of concern, there are more positive indicators in the house building arena and commercial refurbishment and conversion of industrial and commercial to residential (both strong areas for FIS members) have been isolated as a strong performing areas of the sector. Inflation remains a challenge and the level of insolvencies is a worry, but the mists seem to be clearing and the medium to long term prospects for the construction sector remain strong”.

by Clair Mooney | 28 Apr, 2023 | Market data

The Construction Products Association’s latest State of Trade Survey for 2023 Q1 highlighted the continued mix of fortunes in the construction product manufacturing industry. For a third consecutive quarter a fall in sales for heavy side producers contrasted with continued growth for manufacturers on the light side. Forward-looking sales expectations improved, however, but the strength of demand in construction remains the key concern for sales over the next 12 months.

The CPA State of Trade Survey reports the results of the Association’s quarterly survey of construction products manufacturers, providing a timely assessment of current and expected conditions in the sector.

by Oscar Venus | 13 Apr, 2023 | Main News Feed, Market data

BSI have published their 2023 version of the Little book of BIM.

This is a quick reference guide for the standards, definitions and terms commonly used in describing BIM and its related processes, as well as training and qualification pathways for all levels. The guide can be used by organisations across the supply chain.

You can download a copy here.

by Clair Mooney | 21 Feb, 2023 | Market data

The Construction Products Association’s latest State of Trade Survey for 2022 Q4 revealed a quarter of mixed fortunes for the construction product manufacturing industry. Performance was split between a decline in sales for heavy-side producers and continued growth for manufacturers on the light side. Furthermore, manufacturers expect these dynamics to persist in 2023, with new build starts affected by economic uncertainty but refurbishment and activity for energy-efficient retrofit continuing apace.

In 2022 Q4, 20% of heavy-side manufacturers reported that sales of construction products declined, marking a second consecutive quarter of decline. In contrast, 27% of light-side manufacturers reported that product sales rose, which extended a run of growth to ten straight quarters.

In the Q4 survey, demand was viewed as the key constraint on manufacturers’ activity going forward. On balance, one-third of heavy-side firms, whose products tend to feed into the earlier stages of construction, anticipated a decrease in sales over the next 12 months, with two-thirds citing demand as their key concern. On the light side, a balance of 8% of firms anticipated a rise in sales during 2023.

Rebecca Larkin, CPA Head of Construction Research said: “It was a mixed bag for construction product manufacturers at the end of last year, with demand in some areas of construction knocked by renewed economic uncertainty following the Truss government’s Mini Budget, as well as early signs that historically high inflation was stalling household spending and business investment decisions. This primarily affected heavy side manufacturers, who experienced a fall in sales for products that are typically used at the earlier stages of construction as demand and confidence weakened for new build project starts. Sales growth continued for light side manufacturers in Q4, however, and is likely to have been buoyed by areas of construction that are still experiencing strong activity, namely offices refurbishments and energy-efficient retrofit such as insulation measures.”

Key survey findings include:

- A balance of 20% of heavy-side firms reported that construction products sales fell in Q4 compared with Q3, marking a second straight quarter of falling sales

- 27% of light side firms reported product sales rose, the tenth quarter of growth

- One-third of heavy-side manufacturers anticipated a decrease in sales over the next 12 months; 8% of light-side firms anticipated a rise in sales

- Fuel, energy and raw materials costs rose for all heavy-side manufacturers

- Overall costs are expected to increase over the next year according to balances of 69% on the heavy side and 62% on the light side, the lowest balances since mid-2020

Overall, the Q4 survey highlights the varied demand by the construction sector and adds to the signs pointing to a slowdown in activity across new build or sectors that are driven by consumer or business confidence, which will be partially offset by high levels of activity on commercial refurbishment and energy efficiency improvements.

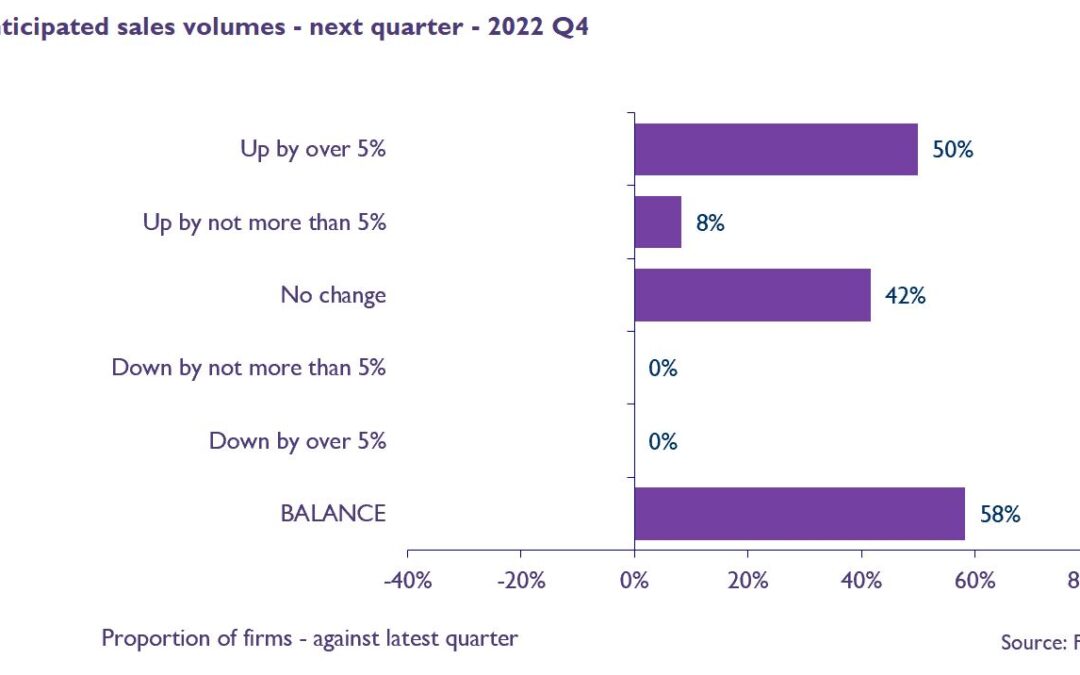

by Iain McIlwee | 7 Feb, 2023 | Market data

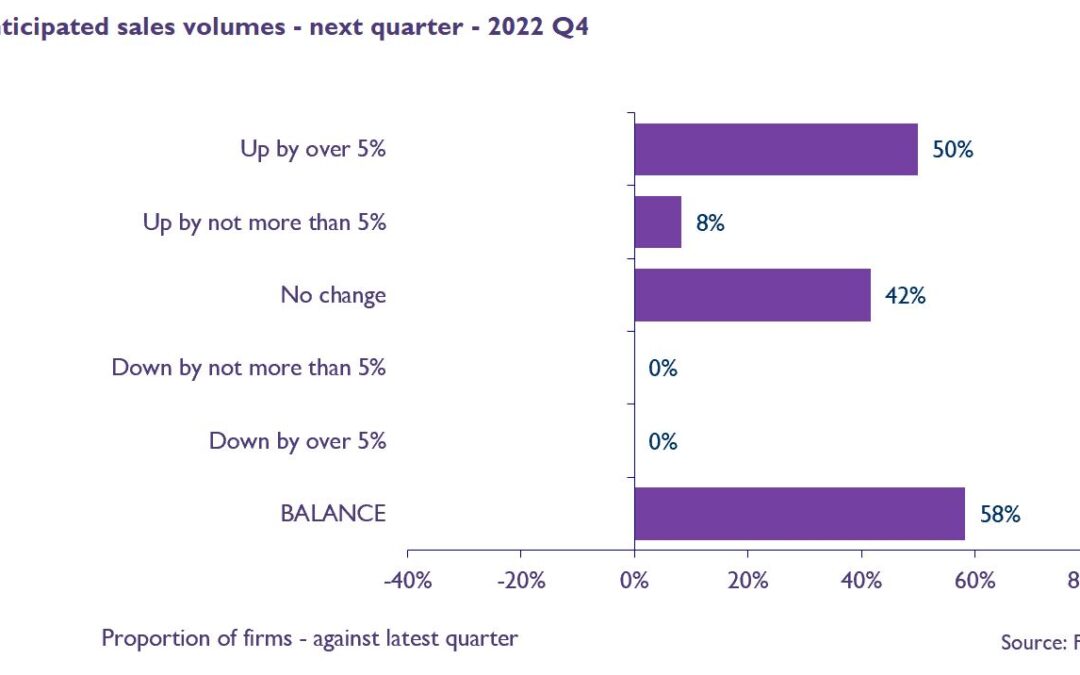

According the the latest FIS State of Trade Survey, the finishes and interiors finished 2022 relatively strongly with a net balance of 42% experienced growth in sales (against 17% in Q3) and 50% of those responding to the FIS State of Trade Survey reporting sales volumes increasing by over 5% (up from 33% reporting the same in Q3).

Looking ahead to 2023, again the picture for sales is more positive than in Q3 with those predicting growth swinging from just 20% to 75%. There is, however, an acceptance that some projects will slip and not all will turn into boots on the ground and the overall impact on anticipated workload is that there is a slight downward trend with just 33% predicting growth (versus 45% in Q3).

The majority anticipate static market conditions for the year ahead, with a small swing in terms of those predicting a decline (up to 26% from 25% last quarter) resulting in a net balance predicting growth of 9%. This is slightly less optimistic than in Q4 2021 when a net balance of 18% were predicting an increase in workloads.

You can read the full findings, including an update on inflation and investment in the FIS State of Trade Survey Q4 2022 here.

FIS data is absorbed into the wider CPA State of Trade Survey – you can see the full results and findings here.

by Clair Mooney | 1 Feb, 2023 | Market data

The construction industry is expected to endure a recession this year after two strong years for the industry. According to the Construction Products Association’s Winter Forecasts, construction output is expected to fall by 4.7% in 2023 before recovering slowly in 2024 with growth of just 0.6%.

The construction industry is not immune to the impacts of a wider UK economic recession, rising interest rates and inflation. Private housing new build, the largest construction sector, and private housing repair, maintenance, and improvement (rm&i), the third largest sector, are forecast to be the worst affected sectors this year. Falls in activity in these areas are expected to be partially offset by continued growth in infrastructure, the second largest sector, which is already at historic high levels of activity. Even here, however, there are growing concerns over the impacts of double-digit construction cost inflation. Given financial constraints for government, this means that we are likely to see the value of activity expected previously but not the volume.

Private housing is forecast to be the sector most affected by the downturn and fortunes for the sector over the next 12-18 months are likely to go one of two ways. The main forecast anticipates a soft landing for the housing market, which involves a sharp decline in demand during 2022 Q4 and 2023 Q1 before a recovery in demand this Spring. Even still, private housing output in 2023 is forecast to experience an 11.0% fall as housebuilders focus on completing existing developments rather than starting new sites. This fall is primarily due to rising mortgage rates, falling real wages and poor consumer confidence. Plus, there is now a less friendly government policy environment for housebuilders, given the end of Help to Buy, the Residential Property Developer Tax and the Building Safety Levy. The largest impact of the decline in demand is likely to be on property transactions, which are anticipated to fall in 2023 by around 20% whilst house prices are anticipated to decline by 8% -10%. After two consecutive years of double-digit growth, house prices will return to levels seen around a year ago. However, if demand doesn’t recover from Spring as mortgage rates continue to fall, private housing could fall even further, as is outlined in the CPA’s Lower Scenario.

Private housing rm&i output was driven to historic high levels in 2021 due to increased working from home and a ‘race for space’. With falling real wages, poor consumer confidence and double-digit construction cost inflation, many homeowners were quick to start delaying smaller, discretionary improvements work and output has been falling since March 2022. Larger improvements work, however, continued last year as households had pencilled in the finance for it at the start of 2022. Given further expected falls in real wages and increases in mortgage payments for many households this year, a further decline in private housing rm&i output of 9.0% is forecast in 2023. This will focus on a fall in larger improvements activity, before slow growth of 1.0% in 2024 as activity recovers in line with the wider UK economy. Unsurprisingly, however, one area of private housing rm&i that continues to remain strong is energy-efficiency retrofit; given homeowner concerns over energy prices, insulation and solar panel installations activity is currently buoyant.

Infrastructure continues to go from strength to strength, reaching historic high levels in 2022 as it benefitted from multi-billion pound projects such as HS2, the Thames Tideway Tunnel and Hinkley Point C as well as long-term frameworks activity in sub-sectors such as rail, roads and energy. Going forward, further growth in infrastructure output is expected but it is likely to be slower than in previous years due to cost inflation and financial constraints. The Chancellor stated clearly in the Autumn Statement that capital expenditure would be maintained in cash terms. In the near-term, this is likely to mean that current central government projects go overbudget given double-digit construction cost inflation. Also, there will be hesitancy from the public sector signing up to new projects due to uncertainty over costs spiralling further. In addition, financially constrained councils are likely to cut spending on new projects to cover the rising costs of essential repairs and maintenance. In the medium-term, projects towards the end of the government’s Spending Review are expected to be pushed back into the next review period due to budgetary constraints. After 4.9% growth in 2022, infrastructure output is forecast to rise by 2.4% in 2023 and 2.5% in 2024.

CPA Economics Director Noble Francis: “The construction industry has enjoyed a buoyant two years since the first national lockdown largely shuttered the industry back in Spring 2020 and activity still remains high for the moment. Overall, however, construction output is forecast to fall by 4.7% this year. It is worth keeping in mind the broader context that this is not 2008 and the decline is nowhere near the fall in output that occurred in the last recession. Looking back 15 years ago, construction output fell by 15.3% over two years during the global financial crisis.”

“Private housing and private housing rm&i, two of the three largest construction sectors, are highly dependent on the wider UK economy, interest rates, real wages and consumer confidence. So, as the UK economy falls into recession, interest rates rise, real wages fall and consumer confidence remains poor, construction output will fall sharply in these sectors. These falls will be partially offset by continued growth in infrastructure but that means that it is more important than ever that government maintains its commitments to meeting its own targets by investing in levelling up, its infrastructure pipeline and transitioning to Net Zero.”