by Oscar Venus | 12 Jan, 2024 | Market data

The CLC has released a statement on Reporting on Payment Practices and Performance (Amendment) Regulations 2024

On Wednesday 10 January the Department for Business and Trade (DBT) laid the Reporting on Payment Practices and Performance (Amendment) Regulations 2024.

These Regulations amend existing regulations, which impose a requirement on large companies and limited liability partnerships (LLPs) to publish certain information twice per financial year about their practices, policies and performance in relation to paying suppliers. These Regulations extend the Principal Regulations and the LLP Regulations beyond their current sunset date of 6 April 2024 to 6 April 2031 and require additional information to be reported by qualifying companies and LLPs. This includes requirements for qualifying companies to publish information on the value of payments made within a qualifying period and information on payments that were not paid under qualifying contracts. The Regulations can be found here.

The Government response to the public consultation on the amendments to the Payment Practices and Performances Regulations 2017 was published alongside the Autumn Statement 2023, and confirmed the introduction of a requirement for qualifying businesses that are parties to construction contracts to report on their retention payment policy and key statistics in relation to retentions.

Legislation for the new retention reporting requirements is expected to be laid before Parliament in 2024. It is anticipated that qualifying business will commence data collation and include in their payment practices and performance reports during 2025.

FIS CEO Iain McIlwee added:

“It is great to see the changes that were announced in the Autumn are being carried into law, but a bit disappointing that we have to wait until 2025 before we start to see the benefit. This is an area where FIS has long been calling for reform and has repeatedly highlighted the limitations with current reporting requirements that mask some serious underlying problems. The new requirements will provide a more realistic measure of late payment of construction invoices and highlight problems related to retention and disputed invoices.

This is a positive step, but better measurement is not in itself change. As we head to the next General Election we will continue to lobby for reform of payment certification and retentions in construction and I am hopeful that the data that will start to come through will support our calls for change. New Zealand recently legislated for retentions to be held in trust and the EU are bringing forward far tougher late payment regulations. In the UK we are way behind on this and the supply chain is, as a consequence, getting even harder hit by the current levels of insolvency.”

by Oscar Venus | 11 Jan, 2024 | Market data

The new R&D tax credit scheme, slated for launch in April 2024, has been closely followed by investors in construction innovation. The government has increased the tax credit from 1 April 2023 to 20% of qualifying expenditure, which is an excellent incentive to boost construction productivity. However, there were initial concerns that the text implied a restriction in claiming the tax credit in cases where the R&D stemmed from sub-contracting, which would have been disastrous for many SMEs and large businesses in the construction sector.

Following close engagement with the government, the Construction Leadership Council (CLC) is pleased to report that specific positive references to subcontracting and the construction industry have been included in the Autumn Statement, with the aim of preserving current eligibility for the tax credit. The CLC, however, had valid concerns regarding the draft wording of the legislation released in the Draft Finance Bill 2023-24, which could still pose problems for the construction industry, where R&D activities had been “contemplated” further up the chain. The CLC is committed to ensuring that the R&D tax credit remains available to all firms in the construction supply chain that initiate their own R&D activities. HMT and HMRC have confirmed their willingness to work with the CLC and other industry professionals to ensure that the guidance is clear and that the final legislation reflects the position in the Autumn Statement. Real-world examples and case studies, including those from the construction industry, will be included in the guidance note, which should be available by early 2025.

Miranda Chamberlain, Group Head of Tax at Mace Group, shared these important updates.

by Iain McIlwee | 14 Dec, 2023 | Market data

To help monitor wage rate inflation (and other contractual issues), FIS launched in 2021 The FIS Wage Rate Index. The aim of this work is to support contract negotiations and to help track the impact of labour shortage on the cost breakdown of projects.

The survey is conducted every six months and FIS is asking all contractor members to take part. Data is published as a price index to allow for regional rate variations and all company specific data is managed in the strictest of confidence. The survey covers core trade roles, labourers, apprentices and construction and site managers.

THE DETAILED RESULTS OF THE SURVEY WILL BE MADE AVAILABLE EXCLUSIVELY TO CONTRIBUTORS.

You can complete the survey via the link here. The survey will close early in the New Year. If you cannot complete, please share the link with the person in your business who can.

Your support is, as ever, appreciated.

by Oscar Venus | 4 Dec, 2023 | Market data

According to surveys conducted throughout the construction supply chain, the sector experienced a decline in activity during Q3 of 2023. Heavy side and light side manufacturers experienced sales declines, while chartered surveyors saw their workloads decrease. Small and medium-sized contractors, as well as civil engineering contractors, also saw their net workload balances weaken. The surveys revealed that forward-looking questions all pointed to a deteriorating backdrop for the next year. Concerns over demand strength, tighter financial constraints due to raised interest rates, and a decrease in new enquiries – including in sectors that had previously driven construction activity – were all noted. Additionally, construction costs continued to rise, outpacing increases in tender prices and reducing profit margins.

The CPA’s Construction Trade Survey brings together results from surveys of building contractors, specialist contractors, civil contractors and product manufacturers. It provides a pan-industry assessment of current and expected conditions.

Members can access the Trade Survey here

by Iain McIlwee | 8 Nov, 2023 | Market data, Material Shortages

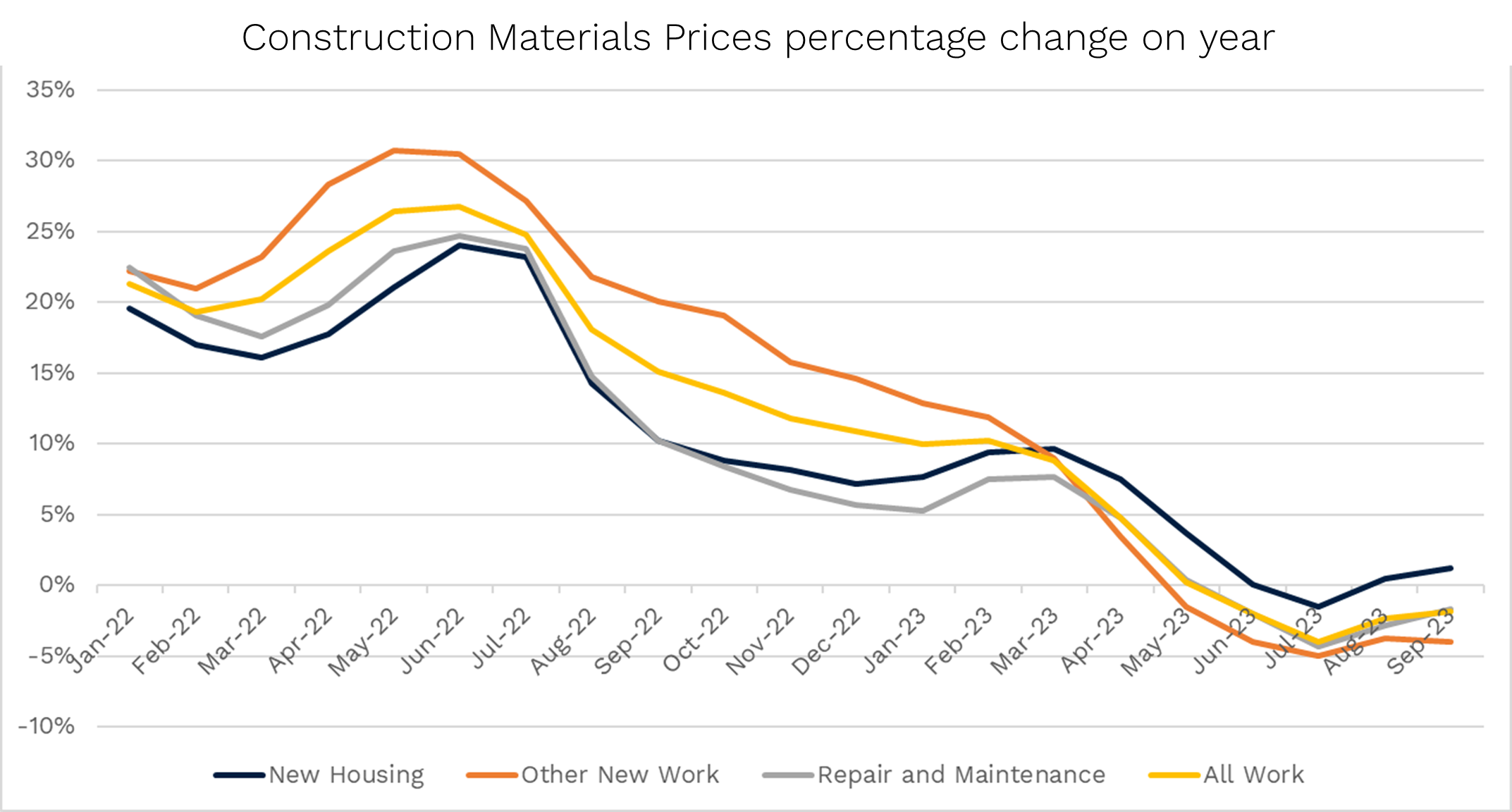

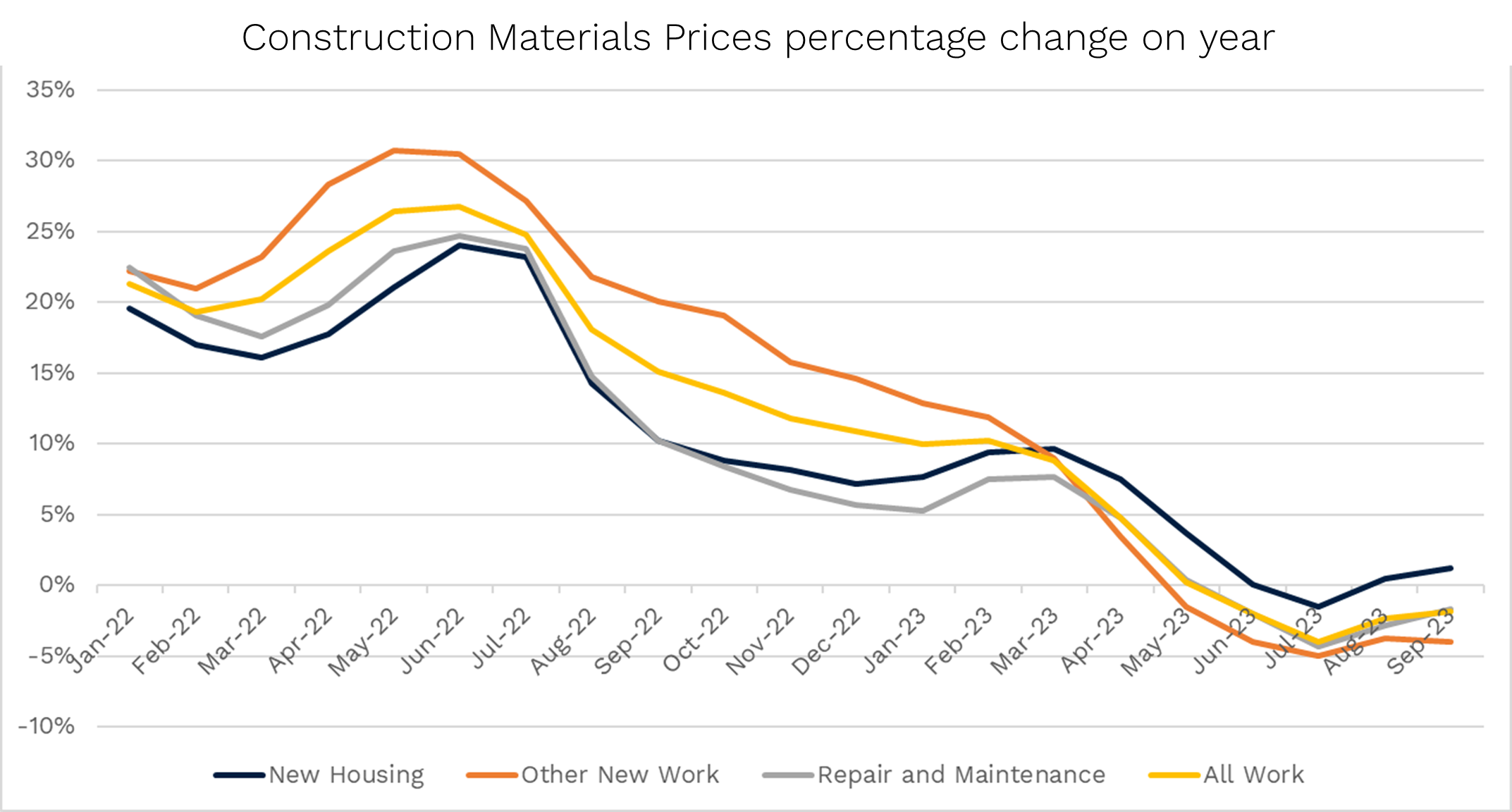

Commenting on the data FIS CEO, Iain McIlwee stated:

“Whilst it is encouraging to see the rate of inflation coming down, this index does not necessarily reflect what individual contractors are experiencing on the ground. Whilst generic data is helpful, the index is broad and there are fairly large differences between the different material types and the headline may not align to the specific products specialists are procuring or deals they may be locked into.

“Beyond this it is important to remember that materials only typically reflect around 30-40% of the cost of construction and we have continued to see wage rate inflation trending high – the FIS Wage Rate and Productivity Survey published this week pointed to continued day rate inflation across all the key trades in our sector.

“The final cost to factor in, is that new regulation is putting pressure on all in the supply chain and the cost of compliance is impacting prelims.

“Looking ahead, the signs seem to be that the period of hyperinflation has passed, but this doesn’t mean real world prices are falling and we cannot be complacent. The full impact of recent events in the Middle East on energy and material prices remains unknown and just because work may be slowing down in some areas it does not necessarily follow that prices will drop.”

Source: Department for Business & Trade – Monthly Bulletin of Building Materials and Components, Table 1

If you are interested in participating in the FIS Wage Rate Survey and receiving a copy of the data, email iainmcilwee@thefis.org (data goes back to 2020, but is only available to contributing companies).

by Clair Mooney | 18 Sep, 2023 | Market data

The ‘Regional Construction Hotspots in Great Britain 2023’ report from Barbour ABI and the CPA provides a regional analysis of construction contract awards to signal near-term trends in construction that aren’t always reflected in data at a national level. By analysing the value of contracts awarded last year in local authority regions across the residential, infrastructure and commercial sectors, the report identifies ‘hotspots’ and ‘coldspots’ as pockets of growth or contraction over the next 6-24 months. The report is available now to members, which can be access here.