“Whilst it is encouraging to see the rate of inflation coming down, this index does not necessarily reflect what individual contractors are experiencing on the ground. Whilst generic data is helpful, the index is broad and there are fairly large differences between the different material types and the headline may not align to the specific products specialists are procuring or deals they may be locked into.

“Beyond this it is important to remember that materials only typically reflect around 30-40% of the cost of construction and we have continued to see wage rate inflation trending high – the FIS Wage Rate and Productivity Survey published this week pointed to continued day rate inflation across all the key trades in our sector.

“The final cost to factor in, is that new regulation is putting pressure on all in the supply chain and the cost of compliance is impacting prelims.

“Looking ahead, the signs seem to be that the period of hyperinflation has passed, but this doesn’t mean real world prices are falling and we cannot be complacent. The full impact of recent events in the Middle East on energy and material prices remains unknown and just because work may be slowing down in some areas it does not necessarily follow that prices will drop.”

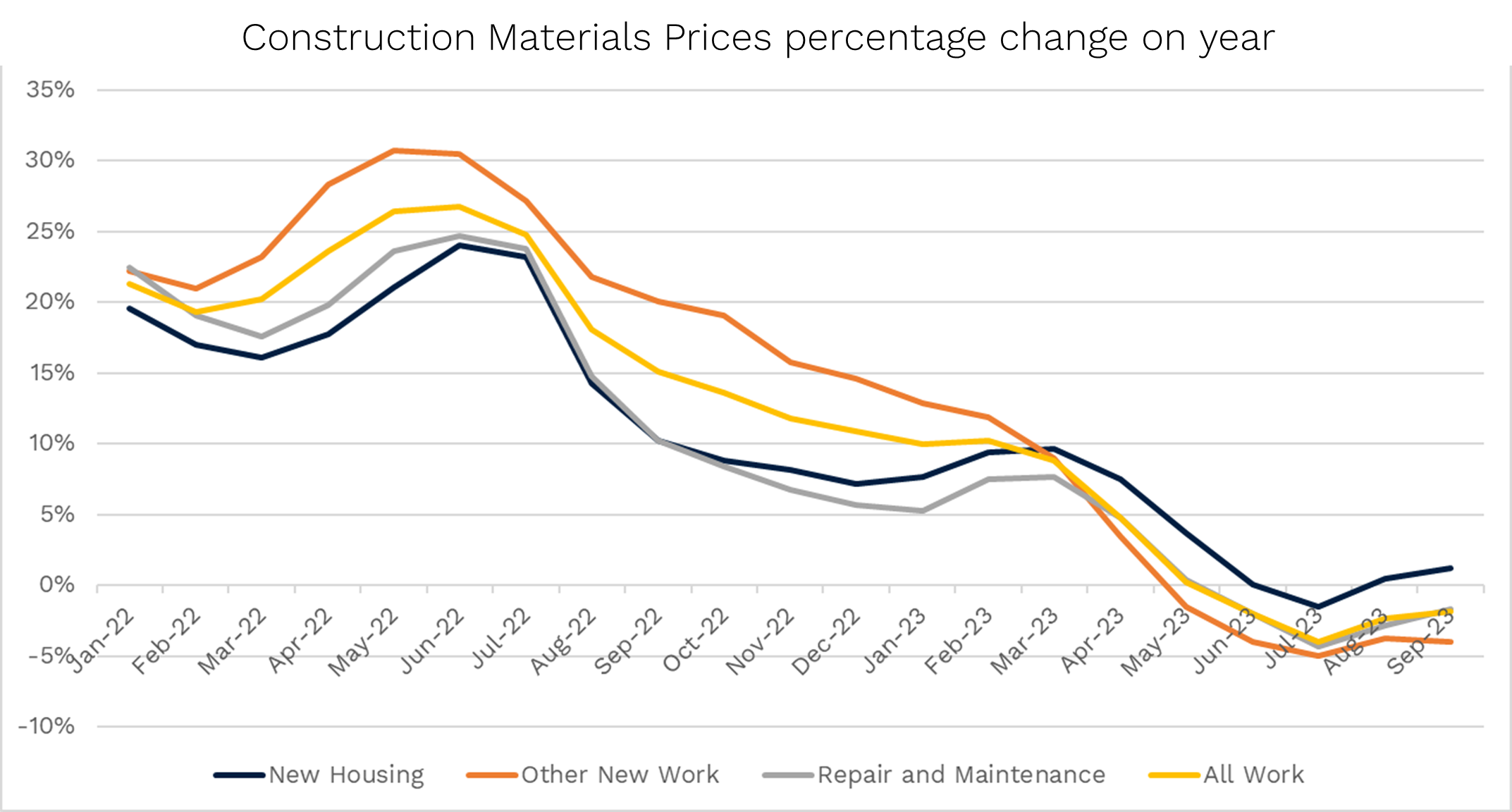

Source: Department for Business & Trade – Monthly Bulletin of Building Materials and Components, Table 1

To see the full report on material prices from BCIS click here

For access to the extensive range of market data available through FIS, click here.