by Clair Mooney | Dec 22, 2022 | Main News Feed, Material Shortages

Construction Product Availability: 21 December 2022

Statement from John Newcomb, CEO of the Builders Merchants Federation and Peter Caplehorn, CEO of the Construction Products Association, co-chairs of the Construction Leadership Council’s Product Availability working group.

Overall product availability is good and returning to pre-Covid levels, while some bricks, blocks, plasterboard and roofing products are occasionally still subject to disruption or allocation. Despite this, lead times for these products are now far lower than earlier in the year.

The availability of gas boilers and other products containing semi-conductors and electrical components remains the most problematic in terms of supply, as sub-component manufacturers operating in a highly competitive global market continue to experience restricted supply. In addition, the electro-technical sector has highlighted a new area of concern regarding the supply of solar and environmental products, with difficulty identifying those coming from Chinese manufacturers with the proper accreditation. This is a growing product area with increasing demand, so the UK construction industry is challenged to ensure such products are of the proper standard and quality.

Timber availability is good with further reductions in prices due to the large amount of stock already in the UK and reduced shipping costs. The one issue for timber centres on birch plywood which, due to sanctions, cannot be legally sourced from Russia. With limited supplies available from Latvia and Finland, we advise speaking to plywood suppliers regarding alternatives.

Shipping lead times from the Far East are improving, though China is now experiencing rising Covid rates following the relaxation of their lockdown regulations which may lead to more bottlenecks. However, with a surplus of containers in China and container rates generally down by 80% from their peak, this is a great improvement.

Price inflation for products has slightly moderated across the board this month, but looking ahead, rising energy and wage costs are expected to put significant upward pressure on prices in the New Year. In particular, manufacturers of energy-intensive products (such as bricks, cement, glass, insulation and plasterboard) warn that although many have been able to hedge energy costs through Q1 of 2023, energy prices in Q2 and Q3 are expected to be considerably above historical (pre-Ukraine war) levels without further Government support. Several plaster, plasterboard and insulation manufacturers have notified there will be double-digit inflationary increases in the New Year.

Against this, a gradual slowing of demand for construction products across most sub-sectors over the last three months of 2022 has helped ease the pressures on product supply. Most industry forecasts project further declines in demand in 2023 although some sub-sectors will fare better than others. With less strain on the supply chain, general product availability should have an opportunity to recover further.

For all the work FIS is doing around inflation and availability, including recommended contractual terms click here

by Clair Mooney | Nov 24, 2022 | Main News Feed, Material Shortages

Construction Product Availability: 23 November 2022

Statement from John Newcomb, CEO of the Builders Merchants Federation and Peter Caplehorn, CEO of the Construction Products Association, co-chairs of the Construction Leadership Council’s Product Availability working group

Product supply continues to improve, with the availability of building materials and products overall now at its best since pre-pandemic levels last seen at the end of 2019.

The restricted supply of semi-conductors, however, continues to challenge manufacturers of electro-technical products and gas boilers, though stock volumes are recovering. With current demand in the UK still outstripping supply, coupled with ongoing capacity and logistics issues in Asia, extended delivery times are likely to remain until the middle of 2023 and inflationary pressures will persist for these products.

There is a plentiful supply of timber in the UK and prices have reduced for popular groups such as CLS; however, log prices in Europe and North America are still strong and production is being reduced to reflect demand in the UK and Europe This could lead to gaps in the supply chain if demand rises suddenly but should not be a major issue if demand continues at current levels.

As mentioned in previous statements, birch plywood – currently a sanctioned good from Russia – is in short supply and some sectors will need to look at alternatives. Birch plywood can be legally sourced from Finland and Latvia but users should request full due diligence. Any imports of birch or birch furniture products from China and Vietnam will be manufactured from wood from Russia, which cannot be legally sold in the UK.

Inflationary pressures rather than availability present the main challenges for energy intensive products such as glass, concrete, cement, PIR, plasterboard and bricks. A warm autumn has helped reduce demand for gas but going into colder winter months prices may rise again. It is also unclear what financial relief from government will be available to energy intensive manufacturers in the spring when the current scheme is due to finish.

In his Autumn Statement, the Chancellor of the Exchequer announced a package of tax rises and spending cuts intended to stabilise the economy and lay the foundation for growth. Nonetheless, the near-term outlook will be challenging. While large-scale infrastructure projects will continue and larger housebuilders are currently maintaining volumes, we are already seeing a slight decline in starts by smaller housebuilders and a steady erosion of work in the home improvement sector as homebuyers and customers feel the pressure of rising living costs and interest rates.

We are also seeing a sustained, high level of construction firm insolvencies, particularly amongst SME builders and specialist contractors. This is in part the result of firms that became vulnerable during the pandemic now being wound up due to pandemic support being withdrawn. Other insolvencies are linked to economic uncertainty and the difficulty of reconciling fixed priced contracts with price inflation and reduced cash flow. Collaborative risk sharing will be key to preserving industry resilience and capacity moving forward.

For all the work FIS is doing around inflation and availability, including recommended contractual terms click here

by Clair Mooney | Oct 19, 2022 | Main News Feed, Material Shortages

Construction Product Availability: 17 October 2022

Statement from John Newcomb, CEO of the Builders Merchants Federation and Peter Caplehorn, CEO of the Construction Products Association, co-chairs of the Construction Leadership Council’s Product Availability working group

As we move into the fourth quarter of 2022, all regions are reporting the best product availability in two years, both in the range and volume of products available and delivery/lead times.

Availability of bricks has significantly improved and deliveries of aircrete blocks are being managed. Aircrete block manufacturers report strong sales of foundation blocks. Historically this leads to increased sales of above ground blocks 4-6 weeks later. This year there is less correlation, and the increased below ground activity is likely due to builders seeking to get new starts registered before changes in Part L regulations next June.

While longer delivery times for gas boilers remain and early ordering is recommended, availability is more positive than for some months.

The situation is somewhat different for electro-technical products which continue to be affected by the restricted supply of semi-conductors. Now, with rising interest in products related to energy saving, renewable energy production, storage and heating, there are further concerns over both availability and price escalation for electrotechnical products that may impact both the construction and facilities management sectors.

Although many construction sectors remain resilient and infrastructure and housebuilding activity has remained strong, there are early signs of softening in demand. This is most clearly seen in the home improvement sector where the rising cost of living and increased costs of finance are denting consumer confidence, but also in a reduction in the number of large commercial construction contracts being placed.

Softening demand has led overall product price inflation to moderate slightly, dropping from 25% to around 17%. Nonetheless, concerns remain over inflation tied to energy costs for manufacturers, despite the Energy Bill Relief Scheme announced by government last month and the fact that many manufacturers have already hedged energy costs. The concerns are greatest for energy intensive products such as bricks, blocks, glass, steel, cement and ceramics that have already seen sustained price increases during 2022. Some suppliers have already announced further increases from January.

Timber prices have fallen and there is plenty of stock on the ground, especially standard softwood sizes. There are, however, gaps in speciality markets such as birch plywood, which is affected by sanctions against goods from Russia. Anyone sourcing birch plywood should request full due diligence documentation to ensure it is legally sourced from Finland and Latvia. We are aware of cheap birch plywood coming from China and Vietnam, where there are no birch forests, and is likely sourced from Russia. Russian birch logs processed elsewhere cannot be legally sold in the UK.

Availability is not an issue for steel but rising rebar prices may be, again due to increased energy costs throughout Europe. This has led to importing products from more unusual markets including Egypt, which may be of lesser quality. The EU has also banned the import of semi-finished steel product from Russia, which may affect the availability of some steel products, particularly steel plate.

We note that shipping and logistics costs, capacity constraints and delays remain problematic but appear to be easing, though this is still very volatile depending on the products, countries and mode of transport involved. For example, in general container shipping prices from Asia to the UK have dropped over 50% since January and punctuality has improved. That said, the consensus amongst industry analysts is that high oil prices, strained global infrastructure, labour issues, Covid shutdowns in China and the war in Ukraine will cause logistics-related problems to persist and costs to remain elevated for the foreseeable future.

For all the work FIS is doing around inflation and availability, including recommended contractual terms click here

by Iain McIlwee | Oct 2, 2022 | Material Shortages

It is still clearly early days into the chaos in the financial markets following the Chancellor’s ‘Mini Budget’. The CPA Summer forecasts certainly didn’t have banks stopping lending for mortgages (40% of all mortgage products had been withdrawn as of Thursday morning) or the Bank of England having to do £65 billion of Quantitative Easing otherwise all pension providers becoming insolvent on our list of key risks. However, there are some impacts for UK construction that we can identify.

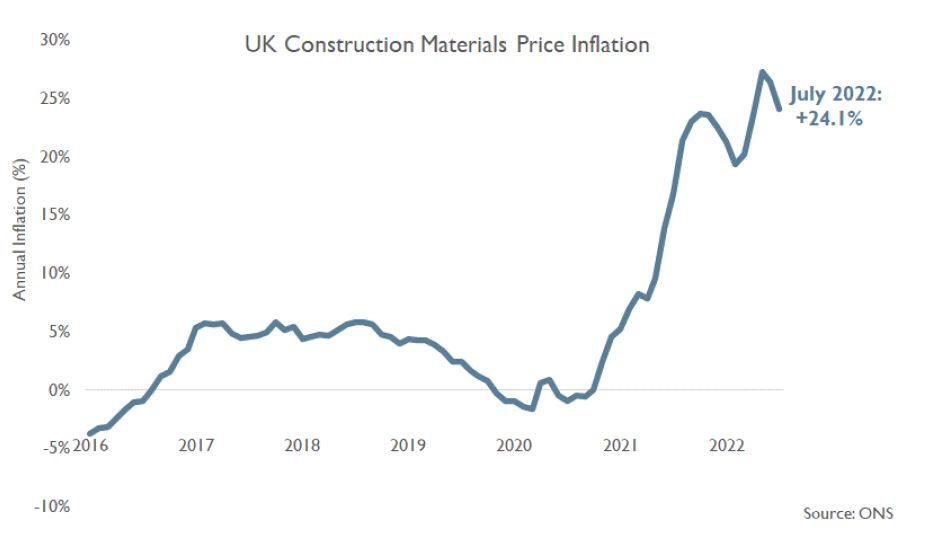

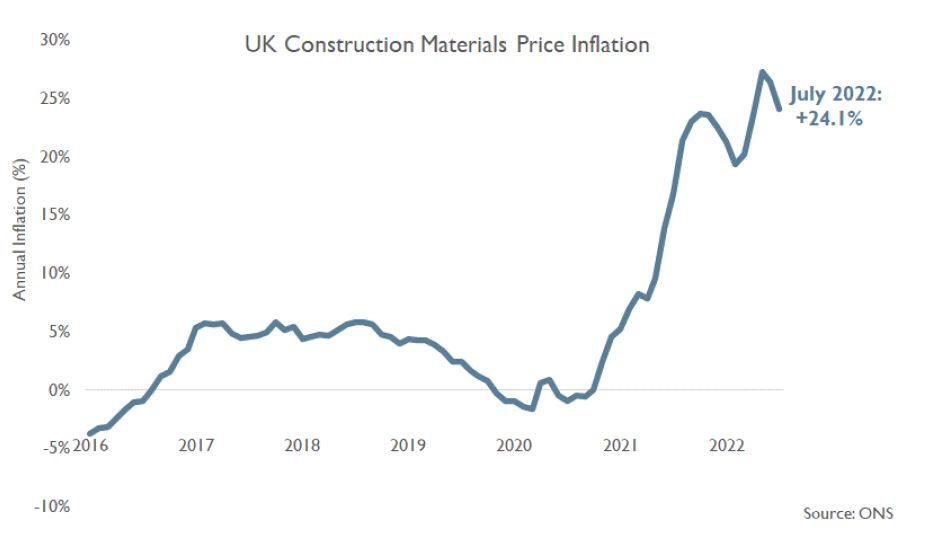

The depreciation in Sterling will lead to further increases in construction materials inflation. It’s worth keeping in mind that construction materials prices in July 2022 were already 24% higher than a year earlier and 46% higher than in January 2020, pre-pandemic. Sterling has depreciated 12% against the Dollar since the end of July. This will exacerbate cost inflation as depreciations in Sterling increase the price of imports.

FIS Members can read the full report CPA – Impacts of Recent Market Chaos on UK Housing and Construction here

by Iain McIlwee | Sep 14, 2022 | Material Shortages

Statement from John Newcomb, CEO of the Builders Merchants Federation and Peter Caplehorn, CEO of the Construction Products Association, co-chairs of the Construction Leadership Council’s Product Availability working group

A slight slowing of the market over the summer holiday months has resulted in product availability broadly improving. Some issues remain, with extended lead times continuing for aircrete blocks, bricks, gas boilers and various items containing semi-conductors and other electronics.

Price inflation remains the biggest issue for the entire industry and further significant increases in inflation are anticipated due to energy, raw material and labour cost rises.

We also note that although the UK Government’s recent announcement of a six-month energy price cap for business users will help manufacturers here to some degree, the risks around supply and cost of energy threaten manufacturing throughout the EU. While EU policy-makers wrestle with their own solutions, the possibility of factory shutdowns on the continent may lead to shortages of products, materials and components exported to the UK.

The root cause of the problem affecting smart meters, electrics, white goods and gas boilers is set to continue into 2023 as sub-component manufacturers struggle to secure supplies of semi-conductors and electronic components in a highly competitive market. Electrical component shortages are similarly affecting manufacturers in the wider electrical sector, likely to lead to reduced availability and increased prices.

Lead times for most roof tiles are improving. Separately, we are concerned to hear increasing reports of ungraded and poor battens being stamped as standard. Contractors are warned to ensure that correct battens are being used.

High demand for bricks, particularly for new housing, continued over the summer and led to reduced stock levels. This pattern is expected to continue in September, but manufacturers are delivering to agreed schedules with customers. Energy price hikes present a further challenge to both domestic and imported bricks, although Government support may ameliorate this issue for UK manufacturers. Aircrete supply has been compounded by a production issue at one of a major manufacturer’s sites, which meant deliveries were reduced in August.

Uncertainty around energy supply in Europe could also impact raw materials for paints and coatings, which are already affected by raw material shortages. Medium-term, there is a need to amend the UK REACH registration process to ensure chemical registration is not made so difficult and expensive that UK manufacturing loses access to key substances for products.

Overall steel supply has improved, but the EU has completely filled their quotas from non-EU countries, including the UK. Heavy sections cannot be transported from the UK mainland to Northern Ireland without incurring tariffs.

Rising energy costs are likely to affect timber prices as we move into Q4 and Q1 2023. There are good stocks on the ground of both structural softwood and wood based panels, but stocks at ports are much lower and buyers will need to consider forward purchases to ensure the specifications they require are available through to year end and into 2023. Price pressure eased considerably over the summer but log prices remain firm as demand for pulp and paper, pallets and fuel wood is currently very strong throughout Europe. With energy costs rising, forward replacement prices for structural softwood are unlikely to be at current UK levels.

The effect of high inflation and softening demand has seen shipping output and punctuality improve, and costs for some key UK routes down by a third since the beginning of the year. It is too early to gauge the impact on the construction sector of industrial action at Felixstowe, but we know that some businesses are suffering logistical headaches and added costs owing to re-directed deliveries. This Group will also monitor the two-week strike planned for 19 September at Liverpool’s port, Britain’s fourth largest.

Finally, we are saddened to note that the year to June recorded the highest annual level of insolvencies amongst UK construction firms since the financial crisis over 10 years ago, despite strong demand throughout the first half of the year. The key risk going forward, given the substantive rise in insolvencies, is to what extent sharp cost rises and slowing demand over the next six months will exacerbate the rise in insolvencies.

For all the work FIS is doing around inflation and availability, including recommended contractual terms click here

by Iain McIlwee | Jul 28, 2022 | Market data, Material Shortages

The market has remained bouyant in Q2 2022 with 54% of respondents reporting growth – this is a similar number to reporting same in Q1 2022, but with the vast majority now seeing sales growth in excess of 5%. This is positive, but there has also been an upturn in the number of companies reporting declines of over 5%, up from 15 to 21%, underpinning that the market remains volitile.

The annualised picture also shows that, in terms of volume, the market has been pretty strong, with just 7% of businesses indicating that workload has actually decreased by over 5%. Again anticipated sales are, on the whole, optimistic, with a 67% (down from 75% in the last survey) anticipating growth in sales and 59% reporting an increase in workload in the year ahead (down from 62%).

The key risks to the sector are identified as:

- A prolonged war in Ukraine leads to material availability issues and continued inflation

- Inflation impacts viability of planned and future projects

- Inflation drives aggressive tendering – squeezes margin and impacts viability of businesses, particularly where fixed term prices are imposed unsympathetically.

- Inward Investment becomes less attractive as companies consider the impact of potential future sanctions in the UK.

- More ethical scrutiny of investors starts to impact sources of inward investment.

- Prolongued Labour Shortages constrain growth

- Retrospective elements of the Building Safety Bill create a blame culture that in turn leads to higher business failure rates and availability of insurance

FIS State of Trade Survey Q2 2022