by Iain McIlwee | 8 Dec, 2020 | Main News Feed

The Construction Leadership Council was created with a remit to drive improvement within the construction sector. Since its creation, it has worked to encourage collaboration to build a better industry, and to act as a bridge between the public and private sectors in pursuit of this objective. The challenge of responding to the Covid19 pandemic has emphasised the importance of this, and the necessity of creating a more robust and sustainable industry which can build back better as the UK enters the period of recovery. This is why the CLC, through its own members and also through its wider links with the industry, has collaborated and supported the combined efforts of the Cabinet Office and Infrastructure & Projects Authority, with input from across the public sector, to develop and publish the

Construction Playbook, and to endorse its aim of creating a more strategic relationship between Government and the construction sector.

Government Departments, other public bodies and the wider public sector represent key construction clients, investing in nationally significant infrastructure projects, capital programmes such as those in education and healthcare, projects that improve our cities and towns, and supporting the delivery of new homes. This spectrum of activity across the sector means the public sector has the potential to drive industry transformation, and how it approaches the development and delivery of construction can provide a powerful impetus for changes in industry practice and culture that extends beyond the projects it funds directly.

That is why the publication of the Construction Playbook is significant. It aims to embed a new approach to the procurement and delivery of construction projects and programmes, which is more collaborative, engages the whole supply chain, encourages investment in innovation and skills, and supports a more sustainable, resilient and profitable industry, capable of delivering higher-quality, safer and better performing built assets for its clients. It will create the foundation for a new approach to construction, where we can utilise digital and offsite manufacturing technologies to increase the capability of the industry, and accelerate the delivery of built assets.

It will also aim to deliver a better and fairer industry, with stronger and more open relationships between the industry and its clients, fewer disputes, and more equitable contractual terms, that ensure prompt and fair payment and a balanced allocation of risk, where these are managed by the organisation best placed to do so. Finally, it will help ensure that investment in construction projects creates the greatest economic, social and environmental value possible, and contributes to the delivery of strategic policy objectives such as our legal obligation to achieve net zero carbon by 2050 and levelling up across the UK.

These goals are our goals at the CLC. We share the Government’s desire to improve performance through new ways of working. But publishing the Playbook is just the first step in the process. For real change to happen, it is important that both Government and the industry embed the principles of the new approach, and invest in their capability to deliver this. The Government will be working to implement this across all central government Departments and public bodies, and mandating the adoption of this approach whilst recognising there is no-one-size-fits all approach to delivery. The CLC will work with organisations across the industry to ensure that this effort is matched, and that the public and private sectors can support each other in this shared endeavour.

Andy Mitchell

Co-Chair

Construction Leadership Council

by Iain McIlwee | 8 Dec, 2020 | Main News Feed

Brexit looms, a deal remains elusive and we continue to be inundated by messages from the Secretary of State and various government departments to, “get ready”, but there remain some real challenges and uncertainty. There are some practical things you can do, but “Get ready” may mean in some cases “brace yourself and be prepared to flex fast”. At FIS we have produced the Risk Assessment Toolkit and continue to run webinars on key issues (next is the 10th December at Midday). Here we look at three of the big issues impacting the Finishes and Interiors Sector.

ISSUE 1: People (The Points Based Immigration System)

The new points-based system means there is additional cost to bring workers in, even if you can get to the 70 points required, which is very difficult for most occupations in our sector.

The Home Office have not, in the opinion of FIS, adequately considered the COVID effect when applying the Points Based Immigration System. It is creating a real concern on three levels. Firstly many skilled workers have left the UK due to COVID and a combination of currency fluctuation and work at competitive rates in or near their home country means that they do not now intend to return. Across the sector we employ around 175,000 people, circa 40% of all workers are from the EU and according to the ONS the number of these workers available has declined by 40% to Q3 2020. The Home Office have not adequately taken this into account when appraising the shortage occupation list. Secondly they are relying on out-dated Standard Occupational Codes (2010 as opposed to 2020) with no granularity applied to the occupational areas included in “other” categories. As a consequence, trades such as ceiling fixing and drylining have been classified wrongly as semi-skilled. Finally the system fails to recognise and guidance is not forthcoming about workers employed through the Construction Industry Scheme (CIS), via agencies and through umbrellas, the tax system recognises the need for a contingent workforce in construction, the immigration system does not.

Whilst we had been reassured that the Points Based System was designed to be flexible, a recent meeting with the Home Office advised that no change is likely until 2022. We are optimistic that we can increase our trainee and apprenticeship programmes, BUT we need time to train (e.g. 18 months to train a dryliner). A drive to employment seems to be motivating Government, but this requires a radical rethink of procurement practices in construction. In the interim this leaves us with the potential of a shortfall in labour that could inflate rates, delay programmes and projects starts and could even make it difficult to fulfil existing contracts.

The solution must be to look at phasing the changes in over a longer period, allowing applications for pre-settled status to run into next year. We can then work with the Migration Advisory Committee to understand the impact and how we can progressively tighten the immigration process together, controlling flow of workers at the same time as improving the training infrastructure. The alternative is huge uncertainty and business failures damaging our ability to adapt as a sector. This will in turn impact the nations home building and infrastructure programmes and constrain the potential of construction for the UK economy.

FIS continues to lobby on behalf of our community here, but if you are impacted, we have prepared a template letter that you can use to contact your MP. To receive a copy of this template, simply email iainmcilwee@thefis.org

You can access a further details and advice on the Points Based Immigration System Here.

ISSUE 2: Product (Movement and Marking)

For many who already export or import products, change will largely mean a bit more admin, tariffs and communication to reassure your clients. If you are already trading internationally, then it should be relatively straightforward.

First time importers and exporters (i.e. those that have not previously purchased product or sold product from outside the EU) you will need to add some new processes, make sure they understand the product marking and consider tax implications and any tarriffs, but beyond a bit of bureaucracy it should be manageable. We have had questions raised as to whether UK Test Standards will still be applicable for export – realistically there should be no change if Building Regulations or Codes in the respective country are not altered to remove reference.

However, there is a big BUT….

If your products are currently subject to the Construction Products Regulation and rely on CE marking then it may not be so straightforward. Whilst there is a 12-month transition (to January 2022) before UKCA and UK NI marks become mandatory, as far as the EU is concerned all UK notified bodies lose their status to issue CE Marking Certificates from midnight on the 31st December 2020. Exporters need to be working now with their notified body (or notified test laboratories) about transfer of certificates to European Notified Bodies and validity of evidence for ongoing CE Marking if declaring using The Assessment and Verification of Constancy of Performance (AVCP) System Level 3 (e.g. Gypsum Products, Flooring and Internal and external wall and ceiling finishes) .

The impact goes beyond exporters, this EU Commission stance means than any Declaration of Performance (to support CE Marking) that relies on Engineered Technical Assessments (ETAs) from a UK Notified Body or where CE marking declarations is made using AVCP System Level 3 and where Tests have been conducted in a UK Notified Laboratory, will be invalidated from 1st January 2021. Government has confirmed that, if you cannot switch to an EU Notified body to continue CE Marking, you will be expected to start UKCA Marking with immediate effect from 1st January 2021.

Above applies to all supplying the GB market from 1st January 2021 (regardless of whether you are an importer, exporter or domestic manufacturer). UK Approved Bodies will be allowed to issue the UKCA mark from 1st January 2021, but the legal structure is not yet in place and concerns are mounting that it may not be in time. Time is running away to manage the associated logistics of stamping or labelling products, uploading and replacing declarations of performance and updating manuals/marketing literature and packaging.

A question therefore remains what to do if you cannot maintain your old CE certificate (due to the status of your notified body) and UK Approval Bodies are not ready to issue a UKCA certificate to allow the UK company to operate legally? Government Guidance on UKCA confirms that “in some cases you will need to apply the new UKCA marking to goods being sold in Great Britain immediately from 1 January 2021”. It is important to remember that the entity “placing the product” on the market will have responsibility here.

As well as what to put on the product when you make it, you must also consider stock and if you have manufactured for stock that has not yet been “placed on the market” or wish to supply into Northern Ireland (where UK Approved Bodies can play more of a role initially and support the issue of the UK NI mark). It is also vital to consider if your product is a system or an assembly (a set of discrete components), if the latter, you will need to consider the CE marking of each individual item.

BREXIT: CLC Guide to Conformity Marking of Construction Products

Brexit Update: Demystifying Product Marking post Brexit

ISSUE 3: Process (Possible Delays, Costs and Tarriffs)

There are growing concerns around delays at UK ports holding up crucial deliveries. This weekend the Builders Merchant Federation warned that the ports were becoming a “major issue” for its members with products that would normally take one week to clear, taking up to four.

Since September, the country’s biggest container port, Felixstowe, has been handling about 30% more goods than usual, with businesses rushing to replenish stock after the end of lockdowns and building stockpiles before the end of the Brexit transition period. As a consequence of hold-ups there have even been reports that loads destined for the UK being partially onloaded or dumped at European ports.

According to the BMF the high level of demand has prevented the building trade from stockpiling in the run-up to Brexit. Shortage areas mentioned include screws, timber, ironmongery, tiles, fixings and electrical products. A fear is that this could drive further inflation.

Clearly depending on your position in the supply chain, the impact will impact you in different ways, but one thing that is vital is that we must all check our contracts to ensure that any responsibility and impact of delays is not unfairly set as our responsibility.

You can access contractual advice via the FIS Brexit Toolkit here

Ongoing work

FIS will continue to represent your interests through the Construction Leadership Council and with the various Government Departments calling for flexibility and stronger guidance.

In the meantime, we encourage you to visit our Brexit Toolkit here

Our next Brexit Webinar takes place on 10th December at Midday

BREXIT: CLC Guide to Conformity Marking of Construction Products

Blog prepared by Iain McIlwee 8th December 2020, updated on the 10th December (correct to the best of our knowledge at the time of writing!).

by Iain McIlwee | 3 Dec, 2020 | Main News Feed

FIS has joined a powerful coalition construction bodies in calling for reverse charge VAT plans to be scrapped. In a letter signed by 44 bodies, the coalition points out that many SMEs in the supply chain are critical to delivering the Government’s ‘Build Build Build’ strategy. The introduction of Reverse Charge VAT will have a significant negative impact on the industry, substantially increasing the burden on business and restricting cash flow in what is already an extremely difficult economic climate.

As a result the changes will particularly impact SMEs that provide both services and materials. This is because they will have to pay VAT on the materials they purchase, including extremely costly elements such as steel, cladding and concrete, but will not be paid the VAT by their customer. For a significant number of companies this will be unsustainable and three case studies are set out are below.

FIS CEO, Iain McIlwee commented – “Whilst construction has powered through the COVID crisis, it has called on a deep reserve of determination and resilience, but we must not make the mistake of thinking all is well and Government can pile on more pressure. The next few months will be incredibly challenging for construction businesses as we try to manage the pipeline and programme issues that COVID has thrown up and confront the very concerning issues linked to the new immigration system and the potential labour shortage issues that this exacerbates as well as other potential inflationary pressure linked to Brexit. Many companies are simply battered and bruised and, with cash reserves depleted, facing further challenges from an unprecedented period of change – the Reverse Charge VAT could be the knock-out blow.”

Iain also expressed his gratitude to the working group that FMB have been chairing that has helped to keep this issue on the agenda and bring this coalition together to make a stand.

A full copy of the letter is available here – Joint letter to Rt Hon Rishi Sunak MP

The FIS Reverse Charge VAT toolkit is available here.

by Iain McIlwee | 30 Nov, 2020 | Building Safety Act, Main News Feed, Skills

Joe Cilia Technical Director FIS

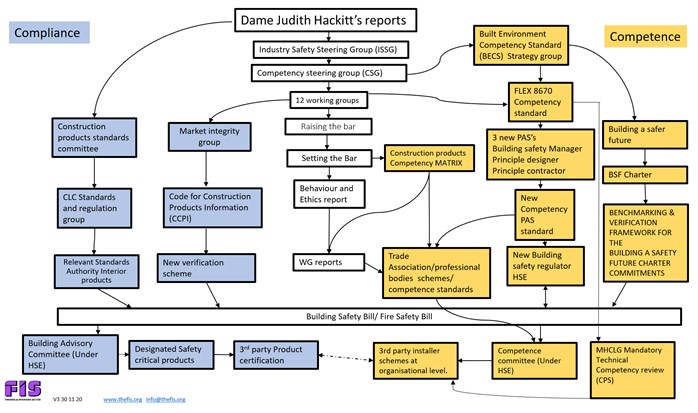

Dame Judith Hackett was clear in her interim report of Building Regulations and Fire Safety that there has been a lack of evidence of compliance and competency and even clearer that the industry needed to address this. So, what has happened since February 2018 and do we have a clear roadmap?

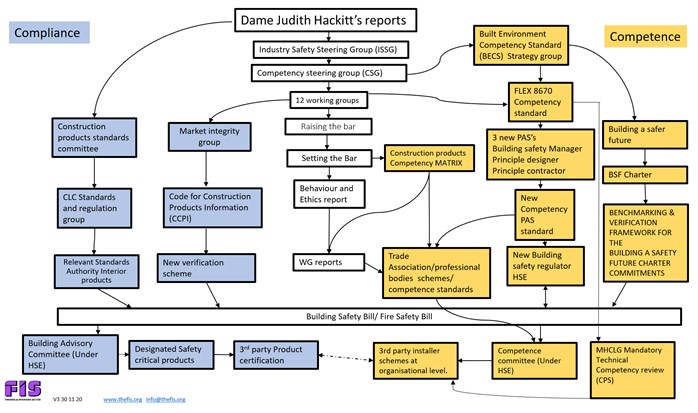

A complex problem has been broken up into its constituent parts and addressed by over a hundred organisations, including FIS dedicating cumulative thousands of hours to interrogate information and advice and propose on a better way of working. With work led by the Industry Response Group (IRG) and the Technical Expert Panel (TEP), the work of these groups and the draft Building safety Bill and Fire Safety Bill, are all coalescing to provide a clear direction of travel addressing the linked issues of Competency and Compliance.

To help structure our efforts and uncover how a number of new initiatives will lead to tangible changes to the way we market performance products, the words we use to describe them and the Skill, Attitude Knowledge and Experience needed to specify, purchase, supervise, install and maintain them; we have pulled together this new Map that starts to identify the initiatives are linked and give us an idea of where this will lead in the next year.

It’s about competency…

A Competency Steering Group was established to oversee the issue and twelve working groups were established to address the issue across the supply chain with one overarching group to coordinate the results and a Market Integrity Group (MIG) who would look specifically at how performance products were described and the performance verified.

The twelve working groups are:

- Overarching Competence Body (WG0)

- Engineers (WG1)

- Installers (WG2)

- Fire engineers (WG3)

- Fire risk assessors (WG4)

- Fire safety enforcing officers (WG5)

- Building standards professionals (WG6)

- Building designers, including architects (WG7)

- Building safety managers (WG8)

- Site supervisors (WG9)

- Project managers (WG10)

- Procurement professionals (WG11)

- Products competence (WG12)

The first output from the group is a document called Raising the Bar which was presented at a conference in October 2019 HERE

The report represents twelve months’ work by more than 150 organisations from across the construction, built environment, fire safety and owner/manager sectors, which have come together to improve the competence of those procuring, designing, constructing, inspecting, assessing, managing, and maintaining Higher Risk Residential Buildings (HRRBs). The work is in response to recommendations in the Independent Review of Building Regulations and Fire Safety, conducted by Dame Judith Hackitt.

Setting the Bar is the second and final report of the Competency Steering Group (CSG) and is an update of the Interim Report, Raising the Bar, published in August 2019.

Feeding into this report, for example, is the work I’ve been involved in from WG12 on Products Competence is the development of a Construction products Matrix, which will help manufacturers define the level of expected competence to specify, procure, supervise and install their products. Based on Skill, Knowledge and Experience it will help ensure the correct products are used alongside all products they interact with to create building systems.

The Built Environment competency standard group (BECS) The industry-led programme sponsored by MHCLG will deliver an overarching competence framework standard for everyone working on a building. This is intended to be used by key professions and trades including designers, contractors, fire risk assessors, building managers and others in specialist technical or corporate roles. The framework will provide a set of core principles of competence, including leading and managing safety, communicating safety, delivering safety, risk management, regulations & processes, building systems, ethics, and fire/life safety. The competence framework is being developed using an iterative and dynamic process, in line with our new flexible route to standardization, called BSI Flex.

BSI Flex 8670 v1.0 Built environment – Overarching framework for competence of individuals – Specification is designed to provide a framework for the development of three new PAS documents to describe the competency levels for the three new positions described in the (Draft) Building Safety Bill:

- Building Safety Manager

- Principle Designer

- Principle Contractor

The competency of these people will be overseen by the new Building Safety Regulator (HSE). There will also be an overarching publicly available Specification (PAS) that can be used by industry and trade bodies to develop competency schemes in a consistent way specific to their sector.

Building a safer future Charter In April 2020, the UK Government encouraged industry-wide commitment to sign-up to the Charter, in its response to the ‘Building a Safer Future’ consultation ‘A reformed building safety regulatory system’. In early 2020, the Considerate Constructors Scheme (CCS) was appointed to develop and manage the Charter and FIS is proud to be amongst the first signatories.

It’s about compliance…

Looking beyond competency to other elements of compliance, another new group formed is the Construction Products Standards Committee. This Committee will be comprised of technical experts and academics and it will advise the Secretary of State for Housing on whether voluntary industry standards for construction products should also become UK regulatory standards, a role currently undertaken by the European Commission. The Construction Products Standards Committee will also provide advice and recommendations on the conformity assessment process and product test standards. In particular the Construction Products Standards Committee will advise on:

- the assumptions and weaknesses within the current testing regime, including the effectiveness and accuracy of current tests;

- ways to improve the testing regime and new tests to address the weaknesses; and

- innovation in how construction products are tested.

Organisations, such as FIS will be feeding into this group (via the Construction Products Association), helping to deliver a new rigorous and proportionate process for proving compliance.

Alongside this work the Market Integrity Group (MIG) published their initial findings ahead of developing a Code for Construction Product Information (CCIP). The CCIP will provide a code for all construction product manufacturers (including distributors) to ensure that consistent terminology is used and performance claims are evidence based and have been signed off by the competent technical person in the organisation.

A new body (also formed under the auspices of the CCS) will provide a verification scheme for suppliers wishing to sign up to the code. Its clear that we are reaching a stage where the wind of change is coming and the framework for measuring competence and compliance is being constructed using new overarching legislation that will be built on rapidly over the next months and years.

It’s about collaboration…

In this Map I have attempted to show how these committees, working groups, legislative changes standards, documents, reports and bodies come together and how they will start to lead to a more compliant built environment in the months and years ahead. An encouraging start has been the spirit of collaboration across the sector, bringing us into contact with new individuals, organisation and perspectives on some age-old problems.

I am sure this map will evolve, but as the structures start to settle and the next stage of this huge change begins, if you see anything missing or want to discuss how it all fits together, please don’t hesitate to get in touch.

You can download a copy of the Competence and Compliance landscape map here

About Joe

Joe is the Technical Director at FIS which represents the Finishes and Interior Sector, he is responsible for Standards guides and legislation, environmental and sustainability issues. Joe works closely with BSI where he chairs a mirror group and a major review of the drylining standard.

He Co-Chaired the production of Fire-stopping of service penetrations – best practice in design and installation and has been pivotal in developing the FIS Product Process People (PPP) Quality Management Framework.

Joe is the immediate past Chair of the Construction products Association Technical committee and represents the finishes and interior sector on the CPA Technical panel as part of the MHCLG Industry Response Group to the Grenfell inquiry alongside Build UK and CIC.

Contact details

joecilia@thefis.org

by Iain McIlwee | 26 Nov, 2020 | Main News Feed

MHCLG today published updated copies of Approved Document B (Fire Safety) Vols 1 & 2: 2019 incorporating the 2020 amendment covering sprinklers, wayfinding signage and a correction to the boundaries information.

The amendments do not apply where a building notice or an initial notice has been given to or full plans deposited with a local authority and either the building work to which it relates has started before 26 November 2020 or is started before 29 January 2021.

There are three main changes/additions to AD B Vols 1 & 2:

Sprinklers

- Paragraph 7.4 Vol 1 has been amended to reduce the trigger height for sprinklers in blocks of flats from 30m to 11m.

- Table B4 Vols 1 & 2 (Minimum periods of fire resistance) has been updated to include a new category height of buildings up to 11m

Wayfinding signage

- Vol 1 now includes new paragraphs 15.13 to 15.16 providing guidance on signs to assist the fire service identify each floor and flat in a block of flats 11m or more in height

- The new signage will be found:

- On the landings of every protected stairway

- In every protected lobby or corridor into which a firefighting lift opens

- Guidance id provided on the minimum letter height, wording, style and positioning/legibility of the signs.

Boundaries

- A correction to an error which appeared in the 2019 edition of AD B

- Vol 1 (paragraph 11.5) and Vol 2 (paragraph 13.5) have been amended to include purpose group,2 (Residential – Institutional/Other) for application of a ‘notional boundary’ between two buildings on the same site.

To view these updated documents please click here

by Iain McIlwee | 26 Nov, 2020 | Main News Feed

Welcome to the 2020 FIS ‘Virtual’ AGM and conference. This is certainly a novel format and I very much hope one of a kind.

2020 has been a year of nightmare scenarios. When I addressed you last year none of us could have predicted the sinister turn that life would take. My business plans, just like yours, are in the bin and I have had to re-evaluate my aspirations for the future.

It was amongst this mayhem that the value of the FIS really crystallised. The whole team ‘stepped up’, took on the challenge and in a matter of weeks produced the Covid-19 Hub. This provided guidance on the maze of procedures that left us confused and anxious. It provided the Risk Management Toolkit and the H&S Taskforce, a group that sprang up overnight and supported by members, provided crucial guidance on site procedures.

There were daily mailshots, twice weekly webinars and most importantly of all, a friendly voice at the end of the phone when you needed moral support and one that could carry our concerns into the wider industry and economic debate – straight to the Construction Leadership Council, Civil Servants and Ministers.

The board also did their bit with weekly meetings and offers of support to members who needed it, I have never been prouder to be a part of that team. I have also never been prouder to be part of our industry, which has demonstrated incredible resilience, whether building Nightingale hospitals or simply holding our end up in keeping at least some of the economic lights switched on.

I know what it’s like to be a small business owner, swimming in a sea of regulations. I know what it’s like to not be able to afford expensive consultants or accountants to give me regulatory or financial advice. I know what it’s like to sometimes make decisions that I don’t feel qualified to make and bear the responsibility for that. Here’s an amazing statistic for you, nearly 60% of our contractor members turn over less than £5m and in fact only 17% turnover more than £10m and we never forget that statistic. You, like me, need the advice, technical guidance and moral support more than anyone and once again FIS membership pays dividends. It is these companies that we are targeting our new Business Risk Management Tool that is now available to download from our website.

As well as helping with the day to day, FIS keeps an eye on our future. The Building Safety Bill will have enormous repercussions for our sector. In response Joe Cilia has collaborated with other leading bodies to produce the guide to ‘Firestopping of Service Penetrations’, a guide that gets to the heart of safety issues in our sector. Another well received publication was the ‘Safe Ingress of Plasterboard’, essential for the prevention of Musculoskeletal disorders so prevalent in our sector.

The training team, hit badly by the withdrawal of CITB funding, has under new leadership in George Swann been working to find ways to continue resourcing the leading work that we have been delivering through the Fit-Out Futures program and set a more standard framework for competence through our sector. Again vital work.

So we move into the formal part of the day today, the AGM, I hope you have felt the benefit of being part of this amazing community. At the heart of this, Jane Knight, our Operations Director, who last week celebrated 30 years at the FIS. This is quite a landmark, congratulations Jane and thank-you for your immense contribution to FIS.

What will 2021 look like. That is our focus for today, building a phoenix from the flames of a pandemic. In January we have Brexit and the repercussions for labour shortages and product certification, The Building Safety Bill, Reverse Charge VAT and that’s just the first quarter. Our headline topics cover some of the biggest issues and discuss how we foster healthy relationships in our supply chain, replace mistrust and combat with cooperation and collaboration and give our sector the best chance of succeeding, with of course the FIS backing us up. Because above all else,

IT’S ABOUT COMMUNITY… TOGETHER WE ARE STRONGER.

Members can read the minutes of the 2020 Annual General Meeting here.

by Iain McIlwee | 26 Nov, 2020 | Main News Feed

New data from the FIS indicates that 30% of members are already experiencing labour shortages and 62.5% are concerned for what the New Year brings. FIS is hosting a workshop on 1st December at Midday with experts to review and advise on how members need to prepare for the new points based system.

In a recent survey FIS asked members a number of key questions around the new points based system. Concerns are amplified in the larger specialist employers, where 40% were currently experiencing shortages and 74% believe the new system will have a negative impact on their business. Other interesting data revealed that respondents relied on labour gangs/agencies for an average 11% of the workforce, this again rises for the larger businesses.

FIS CEO, Iain McIlwee stated “The figures presented by Noble Francis at our AGM show that we have already seen an exodus of EU workers and this snap survey has not allayed our concern that we could be facing a real challenge in the New Year. Clearly the difficulty is that these are unprecedented times and making sense of any data is difficult. Will COVID restriction soften and ease travel concerns? How hard will Brexit be? What will the impact on currency be here and across Europe? How will this impact rates here and abroad and how attractive will that make UK versus other possible work locations?

We need a crystal ball to know for certain what people, who do not necessarily have deep roots in the UK, might decide to do. But, when we need the UK to be primed to Build Build Build, the Government have taken an unnecessarily hard line on construction workers, which could come back to bite us by shortening labour supply, impacting programme and driving wage inflation. More of a staged approach would be better for industry, particularly given the huge dent in training and recruitment activities we have seen in 2020 due to COVID.”

FIS is attending a roundtable on the 4th December with the Home Office and colleagues across construction. We are still gathering information to feed in, if you wish to feed your views in, please contact iainmcilwee@thefis.org or phone 07792 959481 or you can still add you results to the final survey here.

by Iain McIlwee | 24 Nov, 2020 | Main News Feed

The Finishes and Interiors Sector (FIS) has launched a new Business Risk Management Tool to support contractors and help them adopt a structured approach to understanding risk and reducing uncertainty.

Launched at the FIS Virtual AGM and Conference on the 24 November, the Business Risk Management Tool identifies over 120 common risk areas for contractors against the categories including Business Management, Contractual, Financial, Quality, H&S and Procurement, providing a mechanism to score and rank risk and advice on mitigation and management.

A risk management matrix ranks risk in term of probability of an event occurring and the severity of the impact should the event occur. It can be used to identify and prioritise activity so that a contractor can then make informed business decisions and improve their resilience.

In her AGM speech, FIS President and Operations Director at Tapper Interiors, Helen Tapper stated: “I know what it’s like to not be able to afford expensive consultants or accountants to give me regulatory or financial advice. I know what it’s like to sometimes make decisions that I don’t feel qualified to make and bear the responsibility for that. Here’s an amazing statistic for you, nearly 60% of our contractor members turn over less than £5m and in fact only 17% turnover more than £10m and we never forget that statistic. You, like me, need the advice, technical guidance and moral support more than anyone and once again FIS membership pays dividends. It is these companies that we are targeting our new Business Risk Management Tool that is now available to download from our website.”

Commenting on the launch of the risk management tool, FIS CEO Iain McIlwee said: “We have learned in the past few years that basic risk management in construction needs to improve. Beyond the obvious, the worst thing for any business is getting smacked in the side of the head by something they didn’t see coming on a busy Tuesday afternoon. Our hope is that this risk management tool at least helps protect people from the unknown unknowns. It is built on the collective wisdom of our community and a tried and tested framework. It isn’t a static thing and we can develop and evolve it as we help members front up to daily problems in the 21st Century. We don’t have to learn from our mistakes, we can communicate and collaborate and learn as a community from each other – this way the sector gets better”.

The Risk Management Tool is available to download free for members of the FIS community here – FIS Business Risk Management Tool.

by Iain McIlwee | 20 Nov, 2020 | Main News Feed

The Government has added further guidance on the closure of non‐essential businesses. The list now includes showrooms for products used in homes, including bathrooms, kitchens and glazing, which should be closed to the public, including where they are located as distinct sections within hardware stores and builders’ merchants. Delivery and click and collect services may continue to be offered. Each business should assess whether they are required to close having considered the regulations as well as the guidance, and Build UK has made the point that changing guidance midway through a lockdown is unhelpful and will have a major impact on businesses and their supply chains.

The updated guidance does not affect construction sites, manufacturers, storage and distribution facilities, or builders’ merchants without showrooms. Tradespeople may also continue to work in people’s homes following the the Safer Working guidance.

You can access the FIS COVID-19 hub here

by Iain McIlwee | 20 Nov, 2020 | Main News Feed

Following a discussion with Sharon Miller of Scottish Government, she has advised that Scottish Government has issued further guidance for Level 4 restrictions on construction work in homes. The guidance states:

Tradespeople should only go into a house in a level 4 area to carry out or deliver essential work or services, for example:

to carry out utility (electricity, gas, water, telephone, broadband) safety checks, repairs, maintenance and installations

- to carry out repairs and maintenance that would otherwise threaten the household’s health and safety

- to deliver goods or shopping

- to deliver, install or repair key household furniture and appliances such as washing machines, fridges and cookers

- to support a home move, for example furniture removal

When working in someone’s house tradespeople should stay 2 metres apart from the people who live there, wear a face covering and follow good hand and respiratory hygiene.

Visit the FIS COVID-19 hub for the latest updates and information

by Iain McIlwee | 17 Nov, 2020 | Main News Feed

The Secretary of State has written to a number of sectors with the top asks that businesses within those respective sectors should take, as part of their preparation for EU transition. These letters have been issued through Companies House. I attach the construction letter which has started to permeate through the sector.

The full text is provided below:

Urgent message from the Business Secretary

Are you ready for new rules for business with the EU?

There is just over a month to go until the end of the transition period and there will be new rules to follow from 1 January 2021 onwards. As Business Secretary, I urge you to ACT NOW to avoid your business operations being interrupted when the transition period ends.

As a business in the construction sector, you can find out what you need to do by going to gov.uk/construction-2021. The top actions you can take now to prepare are:

- Check the new rules on importing and exporting goods between the EU and Great Britain from 1 January 2021. Different rules will apply in Northern Ireland.

Your business could face delays, disruption or administrative costs if you do not comply with new customs procedures from 1 January 2021.

- Use GOV.UK to identify changes affecting manufactured goods, such as new marking requirements or approvals needed, to ensure your business is ready to sell them in the UK and EU.

You may not be able to sell your goods in the UK and the EU from January 2021.

- If you are planning to recruit from overseas from 1 January 2021, you will need to register as a licensed visa sponsor.

You may not be able to legally hire people from outside the UK if you do not have a licence. New employees from outside the UK will also need to meet new job, salary and language requirements. Irish citizens and those eligible under the EU Settlement Scheme are not affected.

- If you are moving goods into, out of, or through Northern Ireland, check the latest guidance.

At the end of the transition period, the Northern Ireland Protocol comes into force. There will be special provisions which only apply in Northern Ireland so if you move goods into, out of, or through Northern Ireland make sure you check the latest guidance at: gov.uk/northern-ireland-trade

THE CHANGES CAN TAKE LONGER THAN YOU THINK, SO START TODAY

The Government is providing a range of support, including webinars to walk you through the changes. These are available to watch on demand at: gov.uk / transition-webinars. You should also check with your suppliers and customers that they are taking action.

These are challenging times, but the transition period is ending on 31 December 2020 and there will be NO EXTENSION . Unless you take action, there is a risk your business operations will be interrupted. The Government will be there to help you to take advantage of the many new opportunities that being an independent trading nation will bring.

Yours sincerely,

The Rt Hon Alok Sharma MP

Secretary of State for Business, Energy & Industrial Strategy

The transition website can be accessed here

You can access the FIS Brexit Toolkit here

by Iain McIlwee | 17 Nov, 2020 | Main News Feed

The Government has added further guidance on the closure of non-essential businesses to include showrooms open to the public for products used in homes, including bathrooms, kitchens and glazing.

The updated guidance does not affect construction sites, manufacturers, storage & distribution facilities or builders merchants without showrooms.

We are fully aware that changing guidance midway through a lockdown, particularly after clarification was sought on this specific issue, is not helpful and have specifically requested that this does not happen in future.

The full guidance is here and key points from the guidance which may be useful are:

- It is for each business to assess whether they are a business required to close having considered the guidance and Regulations.

- Hardware stores and builders merchants (such as tools, timber, paint, plumbing and glass) can remain open. Where these stores contain showrooms in distinct sections, the showroom area should be closed to the public.

- Showrooms for products used in homes, including bathrooms, kitchens and glazing should be closed to the public.

- All businesses may continue to offer delivery and click and collect services (where items are pre-ordered and collected without entering the premises). People can also leave home to collect or return orders from these businesses.

- Premises are not closed to staff or other authorised personnel needed to maintain them, secure them, or to prepare them to reopen.

- Tradespersons who need to visit other people’s homes for their work can continue to do so and should follow the safer working guidance.

For all your COVID updates, visit the FIS COVID-19 Hub

by Iain McIlwee | 16 Nov, 2020 | Main News Feed

New guidance has been published on declarations required if you bring or receive goods into Great Britain or Northern Ireland after 31st December 2020.

Bringing goods into Great Britain

From Northern Ireland

For most goods no declarations will need to be made. Guidance on this will be published at a later date.

Check if you need to make a declaration when the goods leave Northern Ireland.

From the EU

Check if the goods are controlled.

For controlled goods a declaration will need to be made when the goods arrive.

If the goods are not controlled find out the rules for declaring goods brought in from the EU from 1 January 2021.

From outside the EU

For all goods:

- an entry summary (safety and security) declaration must be submitted before the goods arrive

- a declaration will need to be made when the goods arrive

Bringing goods into Northern Ireland

From Great Britain

For all goods:

- an entry summary (safety and security) declaration must be submitted before the goods arrive

- a declaration will need to be made when the goods arrive

From the EU

Declarations are not needed for any goods.

From outside the EU

For all goods:

- an entry summary (safety and security) declaration must be submitted before the goods arrive

- a declaration will need to be made when the goods arrive

Moving goods through Great Britain and Northern Ireland

Common Transit may affect the declarations that need to be made.

Tariffs on goods

Guidance about any tariffs on goods moving between the UK and EU will be published at a later date.

This advice is taken from the Government website Brexit Transition

FIS is trying to consolidate and prioritise information via the FIS Brexit Hub. To access the FIS Brexit Hub click here.

by Iain McIlwee | 13 Nov, 2020 | Main News Feed

The latest phase of the Grenfell inquiry has seen the material supply and specification process under close scrutiny. The suppliers faced claims of “clever marketing” being used to exploit confusion within the regulatory framework and mask product shortcomings to mislead specifications

The three main companies in focus were Arconic, which made the cladding panels, and Celotex and Kingspan, which made the insulation used.

A particularly concerning revelation raised was that Kingspan’s have now confirmed that tests, carried out in 2005, and again in 2014, were “not representative of the K15 product that had been sold”. Kingspan have been heavily criticised through the Inquiry and subsequently through the National Media that, despite requests through the Inquiry made in 2019 to withdraw the test certification for the K15 product used in Grenfell, the company have only formally informed fire engineers in recent weeks that its test certification for the K15 product used at Grenfell should be withdrawn.

Arconic were also accused of having manipulated testing. In this case the accusation was that they had tested a riveted panel, rather than the cassette panel used on Grenfell – to gain a higher ‘class B’ fire rating than the ‘class E’ the cassette was rated. Internal emails from Celotex disclosed to the Inquiry also appeared to confirm that the product should not be used behind most cladding panels because it would burn.

Fingers of blame through the Inquiry and statements saw the manufacturers turning on one another with the intense competition between Kingspan and Celotex being used to drive the sales teams. The product manager for Celotex was tasked to lead a rebrand and development of a Celotex insulation product range that would enable the firm to compete against Kingspan in the market for high-rise buildings was a 23 year old Business Studies Graduate. Concerns were levelled at individuals about whether they understood the scope of the product with the Sales Manager at Celotex admitting at the time he did not realise that he did not appreciate “at the time” that the greater depth of insulation required for the Grenfell project moved outside the scope of the Celotex test evidence.

As a result of these findings, the Inquiry has been asked to give consideration to whether an urgent recommendation should be made to the government before the end of the inquiry’s second phase to review the premise of its building safety programme.

Full transcripts of the Grenfell Inquiry Hearings are available here.

The excellent BBC Sounds Summaries of the Grenfell Inquiry are available here.

Details of the FIS PPP (Product Process People) Quality Framework are available here

by Iain McIlwee | 13 Nov, 2020 | Main News Feed

Urgent update for members using European Technical assessments

FIS is working with colleagues from across the sector, via the Construction Leadership Council (CLC) Product Standards and Regulatory Alignment Group, to formulate a clear position on matters pertaining to Brexit. One area we have been discussing and has raised a particular concern has been CE marking using European Technical Assessments (ETA’s), specifically how they can be applied to products sold in the European Union when we exit the EU on January 1 2021.

Contrary to what the European Organisation for Technical Assessment (EOTA) has been stating for some time, the European Commission has ‘decreed’ that ETAs originating from UK TABs will not be valid in the EU after 31/12/20. These ETAs are to be removed from the EOTA website on 1/1/21. This means, as it currently stands, manufacturers using Technical Assessment Bodies (TAB’s) in the UK will no longer be able to CE mark products when placing them on the market in the European Union and Northern Ireland from January 1 2021.

EOTA is raising their concerns about this approach with the Commission and at the same time the issue has been raised in the UK with the Department of Business Energy and Industrial Strategy (BEIS). At this stage it is unlikely that we will get a clear response or any movement until there is clarity on the details of any deal with the EU .

It is important to note that in the reverse scenario there is a transitional year agreed i.e. manufacturers using TAB’s based in the European Union will be able to continue CE marking products and selling these into the UK, but will have to use a UK TAB in order to apply a UKCA mark by the end of December 2021.

If you are currently CE marking products based on an ETA, it is advised that you contact the TAB that you are currently working with to check that they are aware and have a process in place for supporting you in transitioning Assessments to an appropriate authority, if necessary.

We are still trying to understand if this will have an impact if you are currently placing your product on the UK market using a CE Mark.

HMRC urges traders to act now to prepare for 1 January 2021

With 53 days to go until the end of the transition period, HMRC has written to VAT-registered traders who trade with the EU, to encourage them to act now in order to avoid business disruption. The Border Operating Model and tax rules will come into effect at the end of the transition period regardless of whether or not a Free Trade Agreement is negotiated.

To continue trading with Europe from 1 January 2021, businesses should take some key actions:

- Appoint a specialist to deal with import and export declarations. This is important regardless of the amount or value of trade your business does with Europe. Most businesses use a third party such as a freight forwarder or fast parcel operator to deal with this, and do not do their customs declarations themselves.

- Check to see if you will be able to delay your declarations or duty payments.

- Register for the free-to-use Trader Support Service if you plan on moving goods into Northern Ireland from 1 January 2021.

- For more help and advice on preparing for the end of the transition period, please visit www.gov.uk/transition

Selling goods into the EU (including Ireland) post Brexit

From 16th July 2021 UK manufacturers will need to appoint an authorised representative base in the EU or EEA if selling products without using an importer or a fulfilment service provider e.g. if you sell online and ship directly to the end user.

This information is set out in Regulation (EU) 2019/1020 on market surveillance and compliance of products which amends the CPR and Regulation (EC) No 765/2008. Article 4(1) of Regulation (EU) 2019/1020 states that products subject to the legislation referred to in Article 4(5) can only be placed on the market if there is a person established within the Union who is responsible for the regulatory compliance tasks set out in Article 4(3).

Article 4(2) of the Regulation requires the authorised representative must have their name, registered trade name or trademark and contact details indicated on the product or its packaging, the parcel or accompanying documentation.

Below is an extract of Article 4 from Regulation (EU) 2019/1020. A copy of the full Regulation can be viewed here.

CHAPTER II

TASKS OF ECONOMIC OPERATORS

Article 4

Tasks of economic operators regarding products subject to certain Union harmonisation legislation

Notwithstanding any obligations set out in applicable Union harmonisation legislation, a product subject to legislation referred to in paragraph 5 may be placed on the market only if there is an economic operator established in the Union who is responsible for the tasks set out in paragraph 3 in respect of that product.

For the purposes of this Article, the economic operator referred to in paragraph 1 means any of the following:

(a) a manufacturer established in the Union;

(b) an importer, where the manufacturer is not established in the Union;

(c) an authorised representative who has a written mandate from the manufacturer designating the authorised representative to perform the tasks set out in paragraph 3 on the manufacturer’s behalf;

(d) a fulfilment service provider established in the Union with respect to the products it handles, where no other economic operator as mentioned in points (a), (b) and (c) is established in the Union.

Without prejudice to any obligations of economic operators under the applicable Union harmonisation legislation, the economic operator referred to in paragraph 1 shall perform the following tasks:

(a) if the Union harmonisation legislation applicable to the product provides for an EU declaration of conformity or declaration of performance and technical documentation, verifying that the EU declaration of conformity or declaration of performance and technical documentation have been drawn up, keeping the declaration of conformity or declaration of performance at the disposal of market surveillance authorities for the period required by that legislation and ensuring that the technical documentation can be made available to those authorities upon request;

(b) further to a reasoned request from a market surveillance authority, providing that authority with all information and documentation necessary to demonstrate the conformity of the product in a language which can be easily understood by that authority;

(c) when having reason to believe that a product in question presents a risk, informing the market surveillance authorities thereof;

(d) cooperating with the market surveillance authorities, including following a reasoned request making sure that the immediate, necessary, corrective action is taken to remedy any case of non-compliance with the requirements set out in Union harmonisation legislation applicable to the product in question, or, if that is not possible, to mitigate the risks presented by that product, when required to do so by the market surveillance authorities or on its own initiative, where the economic operator referred to in paragraph 1 considers or has reason to believe that the product in question presents a risk.

Without prejudice to the respective obligations of economic operators under the applicable Union harmonisation legislation, the name, registered trade name or registered trade mark, and contact details, including the postal address, of the economic operator referred to in paragraph 1 shall be indicated on the product or on its packaging, the parcel or an accompanying document.

This Article only applies in relation to products that are subject to Regulations (EU) No 305/2011 (34), (EU) 2016/425 (35)and (EU) 2016/426 (36) of the European Parliament and of the Council, and Directives 2000/14/EC (37), 2006/42/EC (38), 2009/48/EC (39), 2009/125/EC (40), 2011/65/EU (41), 2013/29/EU (42), 2013/53/EU (43), 2014/29/EU (44), 2014/30/EU (45), 2014/31/EU (46), 2014/32/EU (47), 2014/34/EU (48), 2014/35/EU (49), 2014/53/EU (50) and 2014/68/EU (51) of the European Parliament and of the Council.

Visit the FIS Brexit Toolkit for latest updates and guidance

by Iain McIlwee | 5 Nov, 2020 | Insurance, Main News Feed

Workers across the United Kingdom will benefit from increased support with a five-month extension of the furlough scheme into Spring 2021, the Chancellor announced today, 5 November.

The Coronavirus Job Retention Scheme (CJRS) will now run until the end of March with employees receiving 80% of their current salary for hours not worked.

Similarly, support for millions more workers through the Self-Employment Income Support Scheme (SEISS) will be increased, with the third grant covering November to January calculated at 80% of average trading profits, up to a maximum of £7,500.

The Chancellor of the Exchequer Rishi Sunak said:

I’ve always said I would do whatever it takes to protect jobs and livelihoods across the UK – and that has meant adapting our support as the path of the virus has changed.

It’s clear the economic effects are much longer lasting for businesses than the duration of any restrictions, which is why we have decided to go further with our support.

Extending furlough and increasing our support for the self-employed will protect millions of jobs and give people and businesses the certainty they need over what will be a difficult winter.

The Chancellor also announced today an increase in the upfront guarantee of funding for the devolved administrations from £14 billion to £16 billion. This uplift will continue to support workers, business and individuals in Scotland, Wales and Northern Ireland.

The furlough scheme was initially extended until 2 December. But the government is now going further so that support can be put in place for long enough to help businesses recover and get back on their feet – as well as giving them the certainty they need in coming months. Evidence from the first lockdown showed that the economic effects are much longer lasting for businesses than the duration of restrictions.

There are currently no employer contribution to wages for hours not worked. Employers will only be asked to cover National Insurance and employer pension contributions for hours not worked. For an average claim, this accounts for just 5% of total employment costs or £70 per employee per month. The CJRS extension will be reviewed in January to examine whether the economic circumstances are improving enough for employers to be asked to increase contributions.

Throughout the pandemic, the government has acted with speed to protect lives and safeguard jobs with an unprecedented £200 billion support package. The furlough scheme has protected over nine million jobs across the UK, and self-employed people have already received over £13 billion in support. This is in addition to billions of pounds in tax deferrals and grants for businesses.

On top of this, the government has announced:

- cash grants of up to £3,000 per month for businesses which are closed worth more than £1 billion every month

- £1.1 billion is being given to Local Authorities, distributed on the basis of £20 per head, for one-off payments to enable them to support businesses more broadly

- plans to extend existing government-backed loan schemes and the Future Fund to the end of January, and an ability to top-up Bounce Back Loans

- an extension to the mortgage payment holiday for homeowners

- up to £500 million of funding for councils to support the local public health response.

The full speech from the Chancellor is available here.

Visit the FIS COVID-19 Hub here.

by Iain McIlwee | 1 Nov, 2020 | Insurance, Main News Feed

The PM has announced that, in line with the new National Lockdown announced on the 31st October, Furlough arrangements through the Coronavirus Job Retention Scheme will be extended “until December”. Under the extended scheme, workers in any part of the UK who will be paid at least 80% of their salary up to £2,500 a month. The flexibility of the current CJRS will be retained to allow employees to continue to work where they can.

Employers small or large, charitable or non-profit are eligible and because more businesses will need to close, they will now be asked to pay just National Insurance and Pensions contributions for their staff during the month of November – making this more generous than support currently on offer.

The proposed Job Support Scheme will not be introduced until after Coronavirus Job Retention Scheme ends.

Access the FIS COVID-19 Hub here.

by Iain McIlwee | 31 Oct, 2020 | Main News Feed

The Prime Minister today, 31st October, announced that from Thursday the country would return to National Lockdown in England for a period of 4 weeks. The lockdown rules announced are less strict than those announced earlier in the year, but will see restrictions in place on non-essential travel and parts of retail and many hospitality and leisure businesses being forced to close. However, in his speech the Prime Minister confirmed that the Construction and Manufacturing Sector would not be expected to stop working. He also announced that the Furlough scheme would be extended into December, the Government will once more put in the full 80% of salary (up to the maximum of £2,500), with the employer only covering pension and national insurance contributions..

Lockdown plans will be set before Parliament this week with the intention of commencement on Thursday.

Commenting on the lockdown FIS CEO, Iain McIlwee stated “This is clearly a blow to National morale and will impact the economic recovery that we had started to see, however, at least the Prime Minister name checked construction and manufacturing so we have clarity as a sector about how to proceed and will not return to the uncertainty and chaos that the industry experienced at the outset of the first lockdown.”

You can access resources in the FIS COVID-19 H&S Hub to support social distancing at work and the FIS COVID-19 Hub should you require letters of authorisation to support hotel stays or travel requirements related to construction activities.

A full transcript of the Prime Minister’s speech and accompanying slides are available here.

Devolved Nations

Scotland now has five COVID protection levels in place, ranging from ‘Level 0 ‐ Nearly Normal’ to ‘Level 4 ‐ Lockdown’, and you can check the level for an area by entering the postcode.

Wales is under its own ‘firebreak’ lockdown until Monday 9 November 00:01am. Under this “firebreak” that was implemented from Friday 23 October:

- Construction and manufacturing can continue, provided employers take all reasonable measures to mitigate the spread of coronavirus. This includes builders’ merchants, which can remain open.

- In a last minute change to the guidance, work in people’s homes can continue, as long as both the worker and household members have no symptoms of coronavirus. If a member of the household is self‐isolating, works are not recommended except to repair faults posing a direct safety risk.

- All accommodation providers are required to close, unless they are providing ‘specific services’ at the request of the Welsh Government or a local authority. This includes providing emergency accommodation for key workers, which include those responsible for the construction or maintenance of public service buildings.

Northern Ireland In Northern Ireland, a tighter lockdown has been implemented for four weeks, increasing restrictions on travel and gatherings. Again construction sites are allowed to continue to operate in compliance with social-distancing measures. Border counties in the south such as Donegal, Monaghan and Cavan have seen their level of restrictions increase, meaning only essential workers should go to work; construction has been deemed as ‘essential’ and will be allowed to continue. These restrictions are in place until Friday 13 November.

by Iain McIlwee | 23 Oct, 2020 | Main News Feed

The Construction Leadership Council has published guidance on the movement of goods and materials into and between GB and NI in respect of the expiration of the transition period with the European Union at the end of the year.

The guidance offers an overview of the new customs regime, specific information concerning the trade of goods and materials between Great Britain and Northern Ireland as well as between Northern Ireland and the Republic of Ireland. The guide also includes an introduction to the new UK Global Tariff, touches on the interplay between movement of goods and materials and standards and alignment (which will be covered in a separate CLC publication), information on preparedness of the border as well information on shortage materials and other useful resources.

The guidance has been issued by the Movement of Goods and Materials Workstream (Product Availability Group) of the CLC BREXIT Working Group and comprises the third publication in a suite of business readiness advice that the group intends to publish ahead of 31 December 2020.

Access the guidance here.

by Iain McIlwee | 23 Oct, 2020 | Main News Feed

In just 71 days there will be guaranteed changes to doing business and there are many actions you can take now to prepare.

Regardless of whether we reach a trade agreement with the EU, from 1 January there will definitely be changes to:

- the way businesses import and export goods

- the process for hiring people from the EU

- the way businesses provide services in EU markets

This week the government is launching a major public information campaign to help firms prepare and keep business moving. It has one simple message: Time is running out, so you need to act now.

Support is available, including sector-specific webinars to walk you through the changes. If you missed our webinars for the Services and Investment, Retail, Automotive, Materials and Metals, Electronics Machinery and Consumer Goods sectors, they are available to watch on demand now.

As Business Secretary I encourage you to:

- Check what actions you need to take by visiting uk/transition.

- Sign up for updates.

- Attend government webinars for additional support, sign up here.

Unless you take action, there is a risk your business operations will be interrupted. You should also check with your suppliers and customers that they are taking action.

I know these are challenging times, but the transition period is ending on 1 January and there will be no extension. It is vital your business prepares for our new relationship with the EU, outside of the single market and customs union. The Government will be there to support and help you to take advantage of the many new opportunities that being an independent trading nation will bring.

Yours sincerely,

Rt Hon Alok Sharma MP

Secretary of State for Business, Energy and Industrial Strategy

Yours sincerely,

Rt Hon Alok Sharma MP

Secretary of State for Business, Energy and Industrial Strategy

Additional Brexit Updates from the Department of Business Energy and Industrial Strategy

The updated Border Operating Model provides further detail on how the GB-EU border will work and the actions that traders, hauliers and passengers need to take. These steps will be needed regardless of whether we reach a trade agreement with the EU. The updated GB-EU Border Operating Model:

- Maps out the intended locations of inland border infrastructure. The sites will provide the necessary additional capacity to carry out checks on freight.

- Announces that passports will be required for entry into the UK from October 2021 as the Government phases out the use of EU, EEA and Swiss national identity cards as a valid travel document for entry to the UK.

- Confirms that a Kent Access Permit will be mandatory for HGVs using the short strait channel crossings in Kent. The easy-to-use ‘Check an HGV’ service will allow hauliers to check if they have the correct customs documentation and obtain a Kent Access Permit. A preview demo of the Check and HGV service is available now.

Government launches plans to keep trade flowing after 1 January 2021: The government has announced a series of measures to help keep trade flowing by minimising the risk of disruption at the end of the transition period.

Exporters: sign up for the EU dual-use OGEL: Check now whether your business will need to register for the Open General Export Licence (OGEL), for export of dual-use items to EU member states from 1 January 2021. A full listing of sectors covered, and how to register for the licence with the Export Control Joint Unit is contained in this Notice to Exporters.

HMRC has written to VAT-registered businesses highlighting actions they need to take to prepare for new processes for moving goods between Great Britain and the EU from 1 January 2021.

Page 10 of 15« First«...89101112...>Last