by Clair Mooney | Jan 25, 2021 | Building Safety Act, Market data

FIS Members are invited to take part in an industry-wide consultation into a new proposed Code for Construction Product Information (CCPI), to gather the views on the Code before it is formally launched later this year.

The Code has been developed by the CPA’s Marketing Integrity Group (MIG) with input from FIS, which was tasked with responding to the issues raised in Dame Judith Hackitt’s report ‘Building A Safer Future’, and the credibility challenge facing our industry following the Grenfell Tower fire. The report confirmed radical change was needed for construction products, particularly in the areas of testing, information and marketing.

The Code, made up of 11 clauses, aims to set the benchmark for how product information is presented and marketed by manufacturers. A new microsite dedicated to this consultation – www.buildingsafely.co.uk – explains the background, and includes a specially written report on the new Code. It’s presented in an easy-to-read, digestible format for the industry to review and respond.

The MIG’s work tackles shortcomings in ‘Product Information’ identified in Chapter 7 of the ‘Building A Safer Future’ report. Its work represents two years of open debate and discussion, and of engagement with various parts of the supply chain. It follows detailed analysis of the Call For Evidence survey in 2019, which attracted over 500 responses from across the industry. The survey confirmed that for product and performance information to be trusted, it must be Clear, Accurate, Up-to-date, Accessible and Unambiguous. These five points are the acid tests that now stand behind the 11 Clauses in the new Code.

The MIG is driving a wide-reaching consultation to give manufacturers, specifiers and users of information an opportunity to comment on the new Code, the implementation of its 11 Clauses, and its ongoing management and policing. The consultation is being carried out independently by industry specialists, MRA Research.

CPA Chief Executive Peter Caplehorn comments: “The importance of this new Code and consultation process will be obvious to all those working in the built environment post-Grenfell. It is our responsibility as an industry to regain public trust and credibility in what we do, and to demonstrate that technical competence can be trusted. I believe the Code represents both a determined attempt on behalf of manufacturers to correct disingenuous marketing practices and a proactive and collaborative effort to address the issues highlighted in Dame Judith Hackitt’s Report.

“The first industry consultation in 2019 was key in establishing the way forward. We are now encouraging all FIS Members to have their say once more before the Code is launched. CPA are reaching out to every organisation across the construction supply chain, whether that be manufacturers, specifiers, suppliers, distributors, contractors or installers. They hope businesses and individuals will embrace the opportunity to be involved, and recognise the urgency of change that is needed for our industry to ensure safe buildings.”

MIG Chair Adam Turk adds: “Following Grenfell, our industry reputation has been damaged. This Code is an opportunity to demonstrate our commitment to setting a level playing field for all construction product manufacturers to ensure that information they provide passes the five acid tests. In particular, that users of our products can once again rely upon the information given to them, to build the great buildings and infrastructure in which we live, work and play.”

We think this is one of the biggest changes in the way that manufacturers describe their products and demonstrate their commitment to Clear, Accurate, Up-to-date, Accessible and Unambiguous information, and we see this as a mark of quality that all members will want to be associated with.

Download the Code for Construction Products Information at www.buildingsafely.co.uk and register to have your say. The consultation will open on 1st February and run until 31 March.

FIS will be holding a webinar on Friday 5 February to expand on this introduction and discuss any questions that you may have before submitting your response. To register please follow this link https://www.eventbrite.co.uk/e/consultation-on-new-code-for-construction-product-information-tickets-138263563039

by Clair Mooney | Jan 21, 2021 | Market data, Membership

Increases in contract awards in the North West, East of England and the South West.

Contract awards in the commercial sector valued £7.3bn, 4% lower than 2019’s £7.6bn. The number of projects fell by 17% to 1,100 from 1,400. This is broadly consistent with preceding years and continues the long negative trend in the sector.

The sector experienced a major shock this year with a huge increase in home working leaving offices unoccupied and retail stores shuttered for much of the year resulting in a surge in online purchases by consumers.

FIS members can access the full report here.

Total number of contract awards decrease by 16% in 2020 and values fall by 5%.

Construction output increased by 2% in November, bringing the in-month value above pre-Covid levels for the first time. This was achieved through strong infrastructure activity, as well as repair & maintenance activity across all sectors. Private housing was also strong in November and continued its upward trajectory since the summer.

However aggregate output for 2020 remained significantly down on 2019. Housing has taken the largest hit, at 20% below last year’s levels – public housing especially is down, by 28%. The industrial and commercial sectors are 18% and 17% lower respectively. The sectors least impacted are infrastructure (-3%), RMI (-5%) and public non-housing (-7%).

by Clair Mooney | Jan 20, 2021 | Market data

Construction bouncing back despite W-shaped recession and recovery

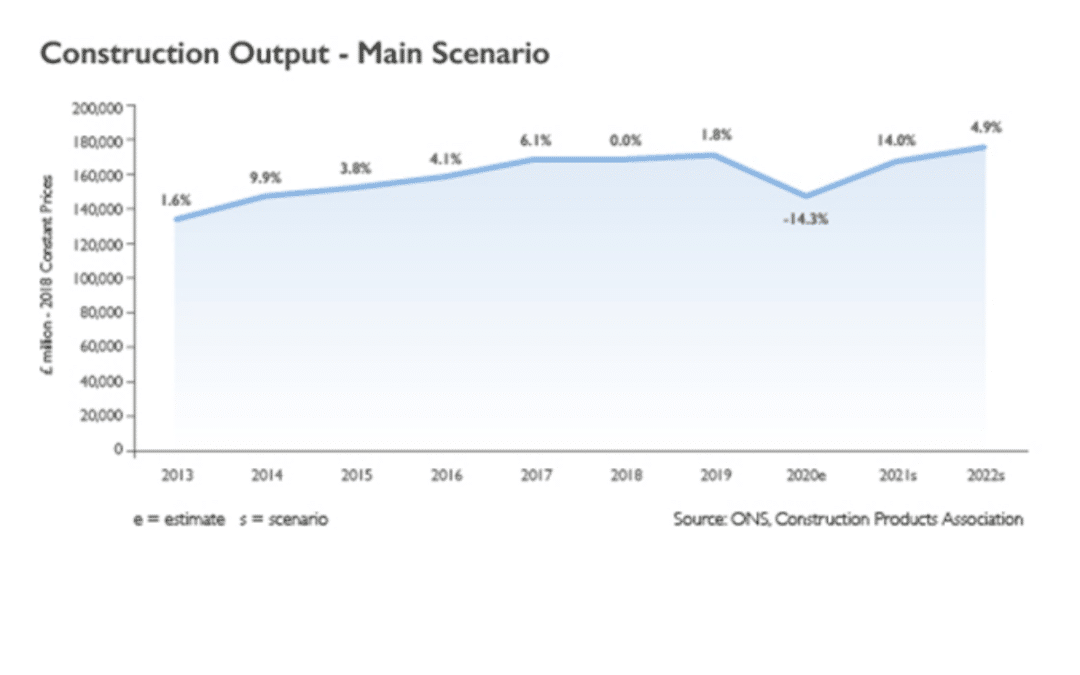

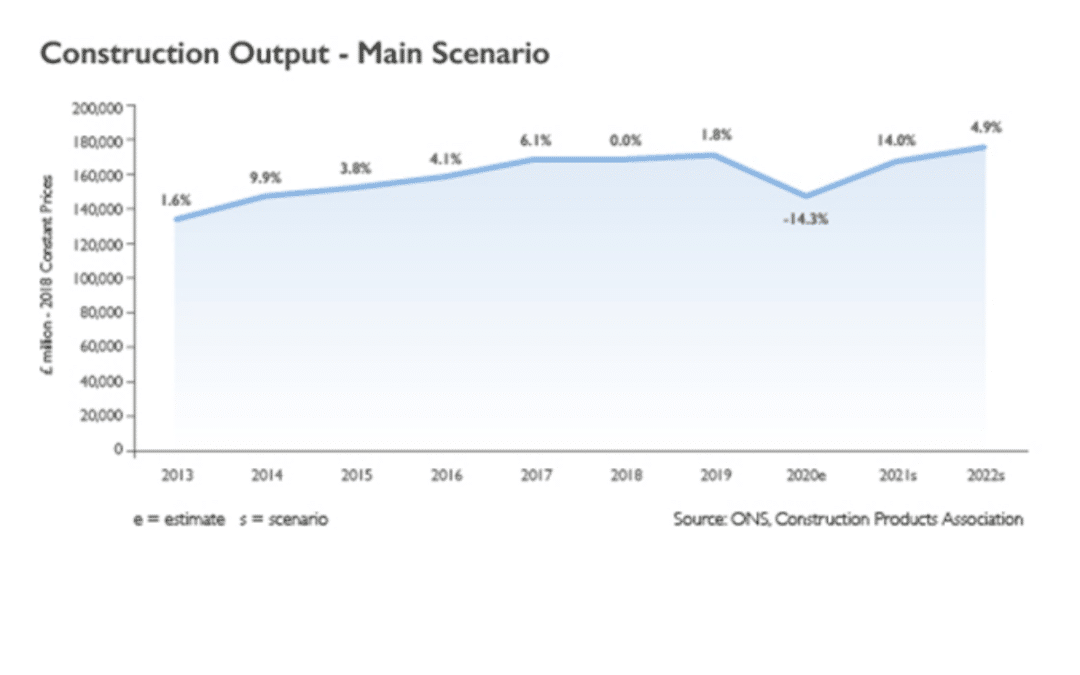

The CPA’s latest Construction Industry Scenarios sees a ‘W’-shaped economic recession and recovery as its main assumption, with construction output expected to rise 14% in 2021 and 4.9% in 2022. This takes into account the new lockdown restrictions over winter 2020/21 before a sustained recovery from 2021 Q2 as vaccines are rolled out and the services-based economy can reopen again. While some sectors of construction are dependent on consumer and business confidence returning, construction activity has largely been able to bounce back quicker than the overall economy.

With government making it clear that the construction and manufacturing sectors should continue to operate despite Covid-19 restrictions, output has been able to rise and recover relatively rapidly. The 14.0% rise in 2021 follows an estimated contraction of 14.3% overall in 2020 caused by the sharp fall in the first half of last year. It should be noted, however, that output is only expected to recover to pre-Covid levels in 2022. There is also the risk that once the furlough and self-employment support schemes end in April, there may be a sharp rise in unemployment that could potentially dampen this recovery.

The CPA’s Scenarios show that private housing was one of the quickest sectors to recover in 2020, with mortgage lending and property transactions above pre-Covid levels at the end of the year. Pent up demand as well as the government’s stamp duty holiday and the end of the first phase of Help to Buy largely drove the recovery in this sector. Demand for private housing is expected to moderate in 2021 after these policies end on 31 March and then subsequently pick up once again in line with the economic recovery throughout late 2021 and 2022.

A slower recovery has been seen in the commercial sector, with store closures and low rent collection in retail and leisure as well as the shift to working from home causing uncertainty for the offices sub-sector. Recovery in 2021 and 2022 is further constrained by the long-term shift to e-commerce in retail, which is likely to have been accelerated by consumers switching to online purchasing during the pandemic. The ongoing question of whether the shift to homeworking will continue after the vaccines are rolled out will be crucial to determining demand for offices space.

Homeworking has on the other hand had a positive impact on the private housing RM&I sector, with households investing accumulated savings from lower daily expenditure back into homes. Although the trajectory for future demand is dependent on labour market conditions as job support schemes end in April, the extension of the government’s Green Homes Grant may help to boost activity. For public housing, a backlog of cladding work is expected to drive activity in RM&I in 2021 and 2022 as the Building Safety Programme moves beyond the removal of Aluminium Composite Material.

Commenting on the Winter Scenarios, the CPA’s Economics Director, Noble Francis, said: “The spectre of a ‘No Deal’ Brexit that would have badly affected the UK economy and construction in the short term has been avoided but questions over the long term impact of Covid-19 on the structure of the economy still remain. This continues to leave questions about the fortunes of certain construction sectors. This is most notable in the commercial sector, where there is still lots of uncertainty about the future of retail and office space. It will be crucial to observe how businesses change their operations as the vaccine is rolled out in the coming months and to what extent there is a ‘return to the office’.

“While the fortunes of some sectors have been tied to Covid restrictions and associated business and consumer confidence in the wider economy, infrastructure has largely escaped such uncertainty. Projects have been able to effectively enact safe operating procedures given the sector’s large construction sites that have fewer different trades mixing than in most sectors. As such, infrastructure has been least-affected by Covid restrictions and output is expected to lift the whole industry over 2021 and 2022. Main works on HS2, Europe’s largest construction project, along with offshore wind and nuclear projects are expected to be the main drivers of activity.”