FIS Chief Executive Iain McIlwee will be speaking at the Conflict Avoidance Conference on 2 October in London. Iain will be discussing the Conflict Avoidance Pledge including the tools required to avoid and manage emerging disputes.

Speakers include Sir John Armitt, Chair of the National Infrastructure Commission, Tim Tapper, Director of Contract Services at Turner and Townsend, Sue Barrett Head of Contracts & Procurement at Houses of Parliament Restoration & Renewal and FIS CEO Iain McIlwee.

Commenting on his contribution on one of the panels, FIS CEO Iain McIlwee said:

“I will be using data from the Reading Report and the ongoing research and dialogue Finishes and Interiors Sector has with our community to make the case that better buildings need better contracting. Better Safety and Sustainability are for many locked away by irresponsible contractual appointments and punitive combative behaviours. If you want to unlock better mental health in construction, better occupational health, genuine net zero deliverables, a collaborative approach to building safety and the strategic planning that underpins investment in the skills and technology needed to improve productivity, then we do need to start here. If you disagree, come along and tell us why, if you agree support the Pledge, come along and share ideas and if you aren’t sure get yourself along and listen to the debate”.

Places at the conference are limited, so please book early to avoid disappointment – you can secure your place here.

Should you sign the Conflict Avoidance Pledge? Find out why FIS is supporting it here.

See more news likes this

The Conflict Avoidance Process (CAP) gets a new lease of life

A recent flurry of organisations have signed the Conflict Avoidance Pledge and FIS is proud that our members are front and centre in this. The new momentum coincides with a new Chair of the Conflict Avoidance Coalition who many members will recognise, Len Bunton, one...

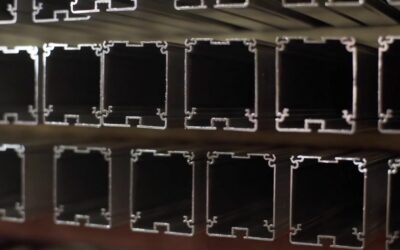

FIS Expresses Disappointment over Russian Aluminium still available in the UK

Last week European Aluminium, an association representing the European aluminium sector, issued a hard-hitting statement to the European Parliament, calling on them to address the ongoing exclusion of major aluminium product categories from its sanctions regime on...

FIS is General Election Ready

With the General Election called for the 4th July, FIS wasn't caught on the hop - we have already set down our core manifesto A Blueprint for Better Construction looking at how policy can support better procurement and contracting and help to improve investment in...