CITB has today published a new construction industry forecast in which it states that Government investment is needed to support skills in the coming year to prevent a generation of talent being lost.

The CITB Construction Skills Network (CSN) report for 2021-25 outlines three scenarios for how the construction sector might recover from the current recession.

Under the best-case scenario, UK Gross Domestic Product (GDP) would return to pre-Covid-19 levels in 2022, whereas it is likely to be 2025 or later for the mid-case or worst-case. The forecast fall in construction employment varies between 10% and 14% of the workforce, or 286,000-372,000 sector workers. The numbers employed will only approach pre-Covid levels from 2025 onwards.

Action is essential to ensure that this loss of skilled workers does not hold industry back from delivering on its pipeline of work, meeting the governments ambitions for infrastructure, new homes and zero carbon or modernising to boost productivity.

CITB is working with industry to make it easier for people to join construction, to place people who have lost their jobs, to help learners complete their apprenticeships and to carry out essential training and retraining.

The report makes four key recommendations for Government to build on this. These are:

- Protect and retain as much of construction’s existing talent as possible

- Make construction a priority sector in the new National Skills Fund

- Reform the Apprenticeship Levy so that more money can be spent on smaller companies in the supply chain

- Help get more college students into construction jobs and apprenticeships

FIS Skills and Training Lead George Swann said: “The coronavirus pandemic has led to the economy taking a severe hit, with many sectors struggling. This Construction Skills Network, Industry Outlook provides three economic recovery scenarios for the construction industry, categorised as base, mid and worst cases. Each case predicts a steady rise in workforce numbers, which means employer investment in recruitment selection and induction then training and qualifying individuals. FIS can help not only with recruitment and training activities, but in identifying, sourcing and securing funding finishes and interiors employers are eligible for. If you need any information, advice or guidance, please give FIS a call”.

Steve Radley, CITB Policy Director, said: “This forecast shows that a recovery will be slower than previously hoped but that construction will grow and create more jobs over the next five years. This will create skills challenges and it is vital that CITB, industry and government work together to meet them.

“CITB is investing levy funds to make it easier for people to join construction, to place people who have lost their jobs, to help learners complete their apprenticeships and to carry out essential training and retraining.

“Government can play a key role and providing certainty on its infrastructure pipeline, working with industry to help more college students into construction jobs and apprenticeship and prioritising construction in the new National Skills Fund to help it recruit and train fresh talent. It should also look at reforming the Apprenticeship Levy to allow employers to pass on unspent vouchers in bulk.”

CSN’s annual average sub-sector growth rates over the next five years see public housing in the strongest position (8.2%), while private housing (7.8%) and infrastructure (5.5%) are also expected to grow strongly and be key drivers for recovery.

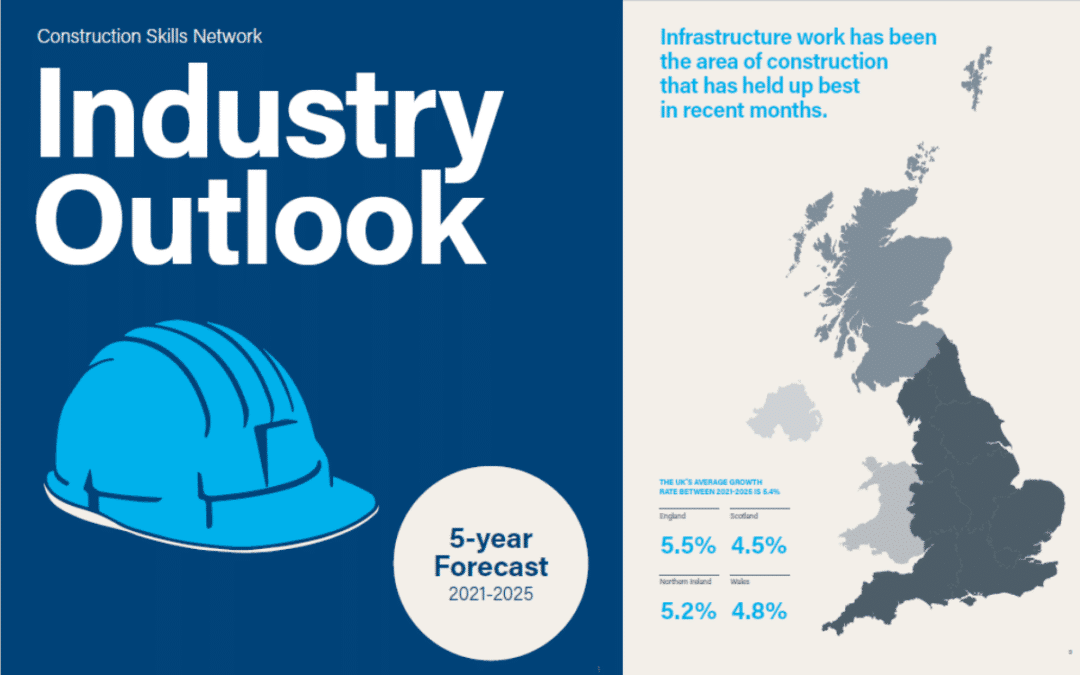

Growth is expected to be evenly spread across all nations, with a UK average rate for 2021-2025 at 5.4%, England at 5.5%, Northern Ireland at 5.2%, Wales at 4.8%, and Scotland at 4.5%.

In the short term, 2021-2022, limited recruitment of new entrants and apprenticeship starts is expected, with a rise in unemployment but demand for skilled workers in infrastructure. In 2023-2025 recruitment of new entrants and apprenticeships should pick up with increased demand for training from employers.