Specialist insurance advice for FIS Members

To help manage risk and provide additional support to members on insurance matters, FIS has partnered with specialist insurance consultants Construction Shield and AWL Homeproof Ltd.

This service enables members to test the effectiveness of existing cover and secure an alternative quote. It also opens-up exclusive access to specialist insurance products at highly competitive prices. Members will be supported with Professional Indemnity, Contractors All Risk, Commercial Combined Business Insurance, Directors and Officers Insurance, Motor, Performance Bonds and a range of other relevant specialist insurance products.

Members can also speak to AWL Homeproof if they wish to talk about standalone building control advice.

To obtain a quote:

Call: 0121 726 5130

Call Construction Shield at least six weeks prior to your renewal date. They will ask you to provide the schedule from last year’s policy and any details that may have changed or evolved in your business. Construction Shield and AWL Homeproof will aim to secure the best possible price for you.

To obtain a quote:

Call: 0121 726 5130

Call Construction Shield at least six weeks prior to your renewal date. They will ask you to provide the schedule from last year’s policy and any details that may have changed or evolved in your business. Construction Shield and AWL Homeproof will aim to secure the best possible price for you.

To help keep costs as low as possible, FIS has waived entitlement to any introductory commission – this will be rebated back to the individual member. The result is FIS members receive a dedicated pricing structure which isn’t available on the open market.

Frequently asked questions...

I’m happy with my current broker. Do I need to move all my insurances to this company?

No, you can remain with the broker of your choice. However, the only way to access the dedicated FIS products and below market pricing is through Construction Shield and AWL Homeproof. So, if you want to test the market with an alternative offer, give them a call.

Can I retain existing cover but switch broker?

Yes, Constructon Shield and AWL Homeproof can take over existing open market insurance if there are policies that you wish to retain.

Will my claims data be shared with the rest of the membership or anyone else?

No. No one’s information will be shared publicly with anyone. However, as more members utilise the dedicated FIS insurance products, the collective sector specific claims information will begin to paint a picture of the needs of its members. Construction Shield and AWL Homeproof can then collate this information for FIS to help us understand what we need to focus on to further improve risk management for members. Similarly, Construction Shield and AWL Homeproof can then use the collective data to work with dedicated underwriters and insurers to build even more bespoke and meaningful policies for members with sector specific insurance innovations, pushing for further pricing reductions across all product areas.

Who is Construction Shield?

Construction Shield is dedicated to supporting construction professionals, having been formed to address frustrations arising from the current and historic insurance providers.

Its unique selling point is it can operate as a ‘one stop shop’ for all construction-related risks, whatever the trade and circumstance, including warranties as well as general insurance. Other brokers or insurance businesses are usually generalists and offer ‘off the peg’ commercial insurance policies that are designed for all trades and industries, rather than trade specific policies within various subsectors of construction.

Whilst Construction Shield is a broker operating across the UK and can search the whole of market for general commercial insurances, it has sourced exclusive products for FIS Members which are underwritten by specialist insurers. This supports competitive pricing and offers better terms to the membership. These products are only available through Construction Shield and not available on the open market.

Who is AWL Homeproof Ltd?

AWL Homeproof is the sister company of Construction Shield and is dedicated to working with Construction Professionals who require specialist Insurance Backed Guarantees, Bonds and Latent Defect Insurance for developments. The company has operated in this sector for many years from its offices in Yorkshire and is known for offering exceptional service. Further to offering insurance products, AWL Homeproof operates a surveying and building control service, meaning all insurance and inspections are conducted in a single visit by one professional, saving clients time, effort and money to offer a best-in-class service.

Members can also speak to AWL Homeproof if they wish to talk about standalone building control advice.

How is this different to my Insurance Broker?

Construction Shield and AWL Homeproof specialise in construction related insurances and have dedicated products suited to member trades. They are working closely with FIS to better understand the risk exposure of businesses in the sector. Unlike other insurance products on the open market that cater for generic construction risks and therefore get covers and pricing in a generic way, these products are tailored for individual FIS members and priced on a below market premium basis as a scheme. They will operate through a transparent, co-operative relationship with FIS designed to support the community.

To help keep costs as low as possible, FIS has waived entitlement to any introductory commission – this will be rebated back to the individual member.

The result is FIS members receive a dedicated pricing structure which isn’t available on the open market. No one member should be turned away, as this is looked at on a collective basis. If any business has struggled to gain cover and get a fair price, this should be of particular interest to them.

Why is this happening?

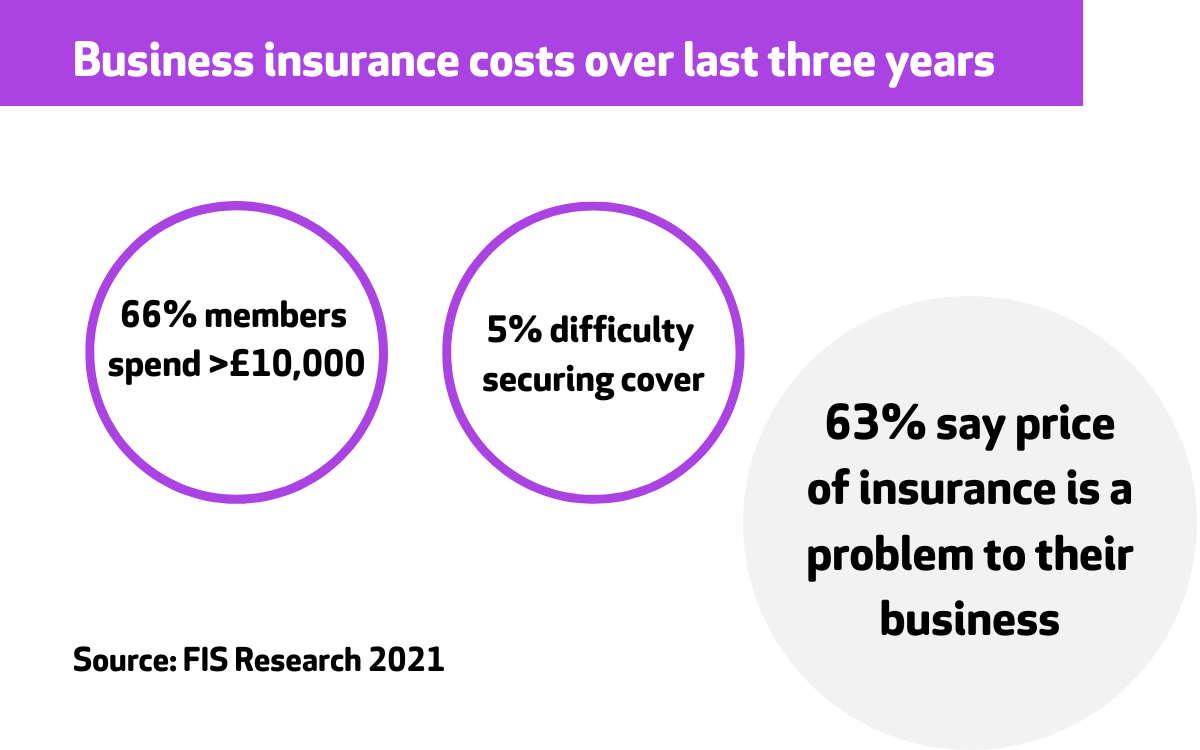

FIS is focussed on compliance and improved risk management in the finishes and interiors sector. In the past couple of years Members have increasingly raised concerns related to rising insurance premiums, reduced cover, onerous endorsements and at times the inability to gain access to the correct cover.

The aim of this new service is to leverage the collective power of our membership to create greater awareness of the risks faced in our sectors and enable meaningful research and development to be carried out driven from claims and risk data for our members.

This new partnership will support the development of a deeper understanding of claims, how risk is being assessed and to develop different and more progressive relationship with the insurance sector, one that offers a truly bespoke service whilst also allowing for greater access to insurance products at improved pricing structures.